- Taiwan

- /

- Entertainment

- /

- TPEX:5478

Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate rising U.S. Treasury yields and mixed economic signals, investors are closely watching how these factors influence stock performance. With the S&P 500 Index recently experiencing a decline after weeks of gains, dividend stocks may offer a more stable income stream amid market volatility. In such conditions, selecting stocks with consistent dividend payouts can be an effective strategy for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.55% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2016 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Soft-World International (TPEX:5478)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Soft-World International Corporation develops, operates, and distributes games in Taiwan and China, with a market cap of NT$20.45 billion.

Operations: Soft-World International Corporation's revenue is primarily derived from its segments, with Neweb Technologies Co., Ltd. contributing NT$1.39 billion, Soft-World and Soft-World (Hong Kong) generating NT$3.10 billion, Yifan bringing in NT$890.52 million, Chinese Gamer Int. accounting for NT$415.97 million, and Xinganxian and Zhifandi adding NT$430.14 million.

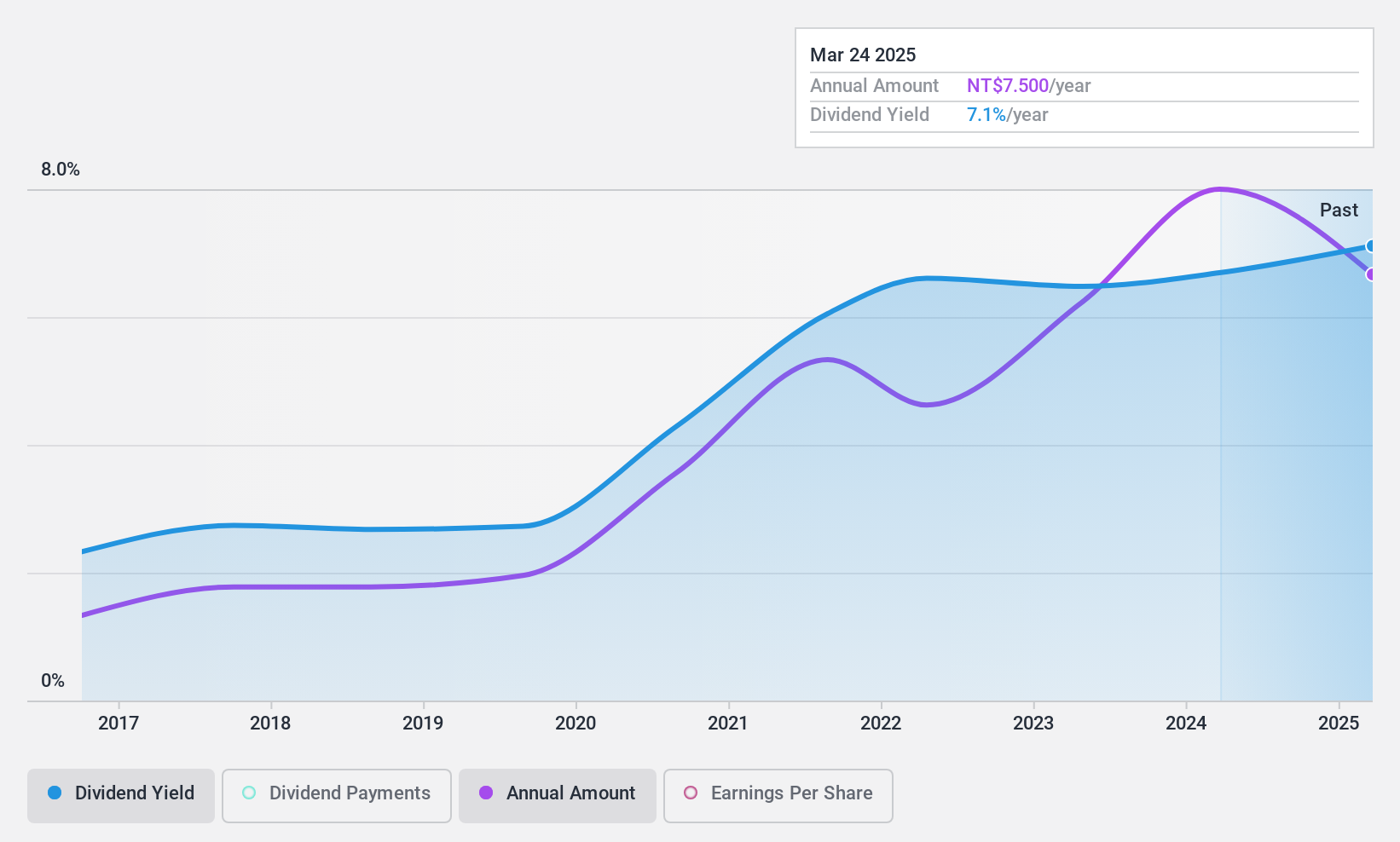

Dividend Yield: 6.6%

Soft-World International's dividend yield of 6.57% ranks in the top 25% of TW market payers, yet it is not well-covered by earnings, with a high payout ratio of 115.8%. While cash flows sufficiently cover dividends with a cash payout ratio of 56%, dividend reliability remains an issue due to historical volatility and lack of consistent growth. Recent earnings improvements may provide some stability, but past shareholder dilution and fluctuating payouts warrant caution for dividend-focused investors.

- Unlock comprehensive insights into our analysis of Soft-World International stock in this dividend report.

- Our valuation report unveils the possibility Soft-World International's shares may be trading at a discount.

Nippon Electric Glass (TSE:5214)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Electric Glass Co., Ltd. manufactures and sells specialty glass products and glass making machinery across Japan, China, South Korea, the United States, Europe, and other international markets with a market cap of ¥2.86 trillion.

Operations: Nippon Electric Glass Co., Ltd. generates its revenue primarily from the manufacturing and sale of specialty glass products and glass making machinery across various international markets, including Japan, China, South Korea, the United States, and Europe.

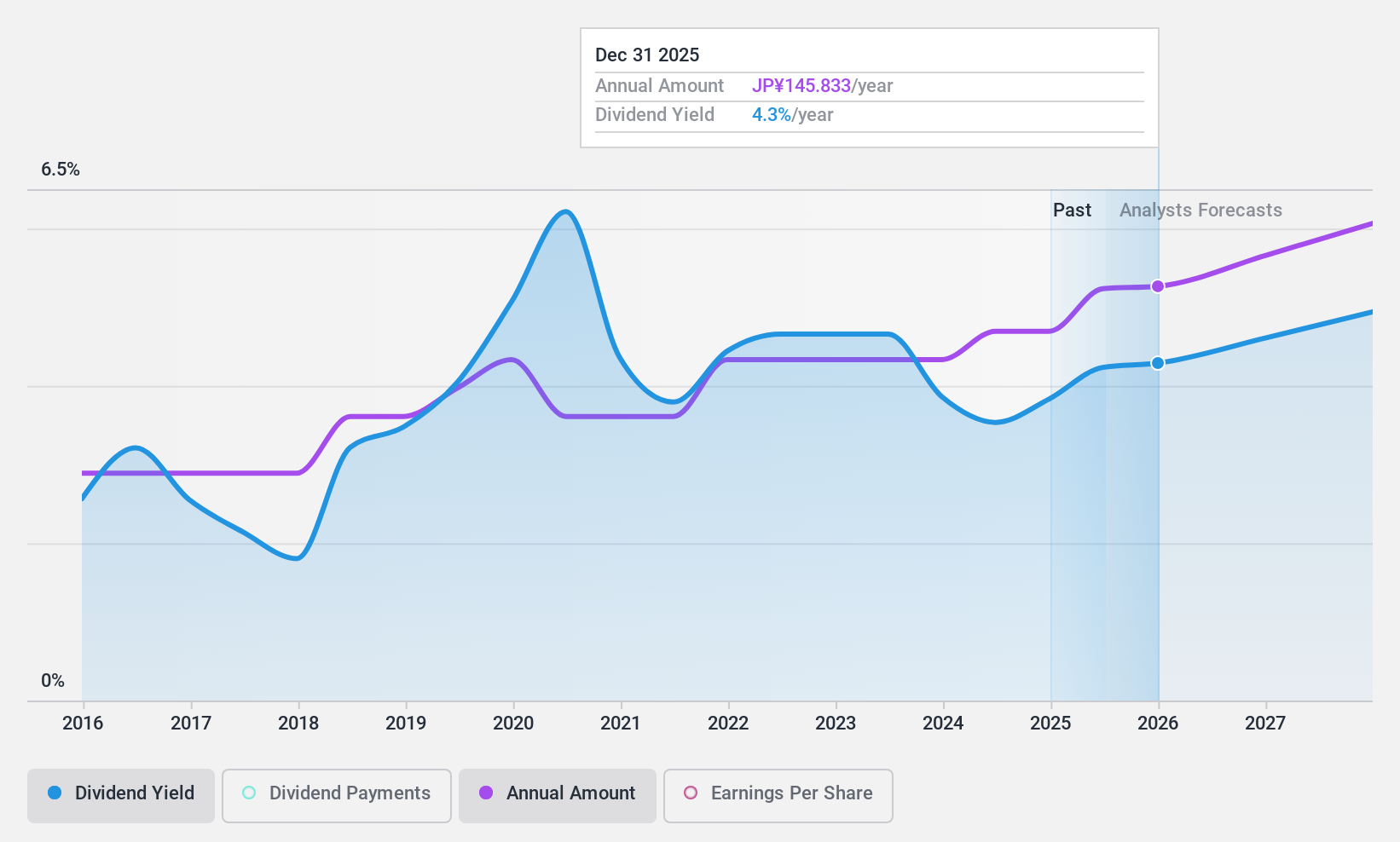

Dividend Yield: 3.7%

Nippon Electric Glass's dividend yield is slightly below the top 25% of JP market payers, yet its dividends are covered by both earnings and cash flows with payout ratios of 84% and 81.7%, respectively. Despite recent dividend increases, historical volatility and unreliability in payouts pose concerns for stability. The company has completed a significant share buyback for ¥9.99 billion, potentially enhancing shareholder value amidst a forecasted decline in earnings over the next three years.

- Click here and access our complete dividend analysis report to understand the dynamics of Nippon Electric Glass.

- In light of our recent valuation report, it seems possible that Nippon Electric Glass is trading behind its estimated value.

Koike Sanso KogyoLtd (TSE:6137)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koike Sanso Kogyo Co., Ltd. is engaged in the development, manufacturing, and sale of gases, welding and cutting machines and systems for industries processing steel plates, aluminum, and stainless steel both in Japan and internationally, with a market cap of ¥24.88 billion.

Operations: Koike Sanso Kogyo Co., Ltd. generates revenue from its segments as follows: Machinery ¥22.73 billion, High-Pressure Gas ¥20.18 billion, and Welding Equipment ¥8.29 billion.

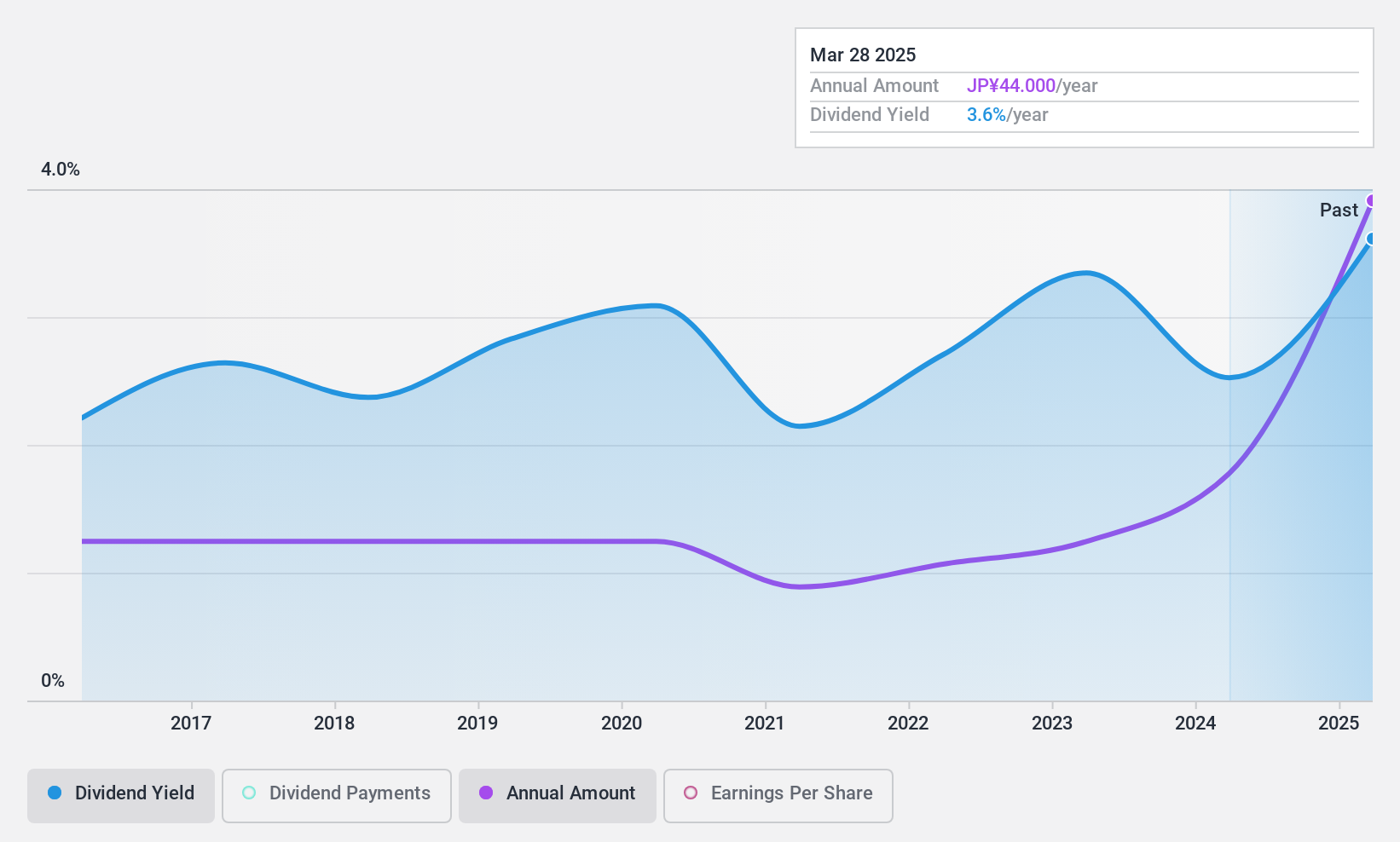

Dividend Yield: 3.3%

Koike Sanso Kogyo's dividend yield of 3.3% is below the top 25% in Japan, but its payout ratios of 26% for earnings and 27.1% for cash flows indicate strong coverage. Despite a history of volatility and unreliability in dividends over the past decade, recent earnings growth of 54% suggests potential improvement. The addition to the S&P Global BMI Index may enhance visibility, though share price remains volatile recently.

- Click to explore a detailed breakdown of our findings in Koike Sanso KogyoLtd's dividend report.

- Upon reviewing our latest valuation report, Koike Sanso KogyoLtd's share price might be too pessimistic.

Taking Advantage

- Unlock our comprehensive list of 2016 Top Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5478

Soft-World International

Develops, operates, and distributes games in Taiwan and China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives