- Thailand

- /

- Real Estate

- /

- SET:AP

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and concerns over consumer spending, global markets experienced volatility, with major U.S. indexes ending lower despite early gains. Amidst this uncertainty, investors often turn to dividend stocks for their potential to provide steady income and portfolio stability. In the current climate of fluctuating market sentiment, selecting dividend stocks that demonstrate strong fundamentals and consistent payout histories can be a prudent approach to enhancing your investment portfolio.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.73% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.10% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

AP (Thailand) (SET:AP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AP (Thailand) Public Company Limited, with a market cap of THB26.90 billion, operates in the real estate development sector in Thailand through its subsidiaries.

Operations: AP (Thailand) Public Company Limited generates revenue primarily from its Low-Rise Segment with THB32.09 billion and High-Rise Segment with THB3.46 billion.

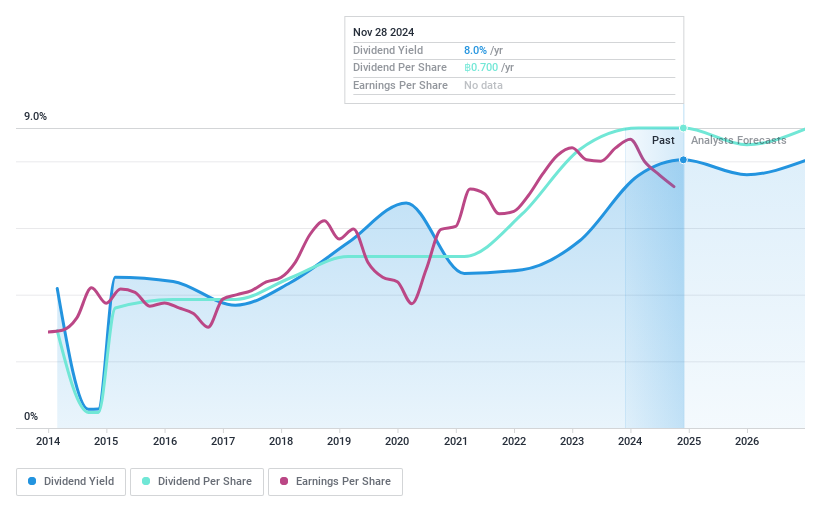

Dividend Yield: 8.2%

AP (Thailand) offers a compelling dividend yield of 8.19%, placing it in the top 25% of Thai market payers. Despite its attractive yield, the dividend's sustainability is questionable due to a high cash payout ratio of 234.4%, indicating dividends are not well covered by free cash flows. The company's earnings growth forecast at 5.65% per year and a low P/E ratio of 5.3x suggest potential value, yet past dividend volatility raises concerns about reliability for income-focused investors. Recent fixed-income offerings totaling THB 500 million may impact financial flexibility moving forward.

- Delve into the full analysis dividend report here for a deeper understanding of AP (Thailand).

- Insights from our recent valuation report point to the potential undervaluation of AP (Thailand) shares in the market.

Sinoma International EngineeringLtd (SHSE:600970)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinoma International Engineering Co., Ltd operates in engineering, equipment manufacturing, and supply both in China and internationally, with a market cap of CN¥25.89 billion.

Operations: Sinoma International Engineering Co., Ltd generates revenue primarily from its heavy construction segment, totaling CN¥46.02 billion.

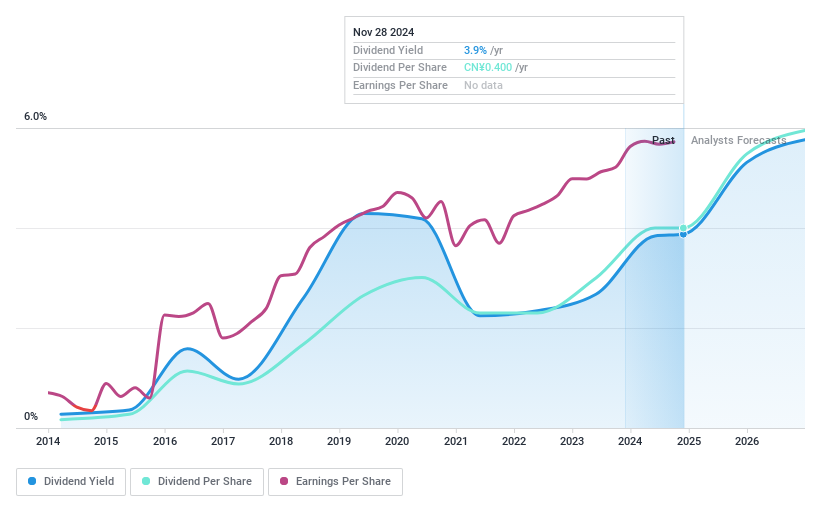

Dividend Yield: 4.1%

Sinoma International Engineering Ltd. offers a dividend yield of 4.08%, ranking in the top 25% of the Chinese market, with dividends well-covered by earnings and cash flows, as indicated by payout ratios of 35.1% and 41.8%, respectively. Despite trading at a significant discount to its fair value, its dividend history is marked by volatility over the past decade, raising concerns about reliability for income investors seeking stable returns amidst forecasted earnings growth of 12.56% annually.

- Take a closer look at Sinoma International EngineeringLtd's potential here in our dividend report.

- Our valuation report unveils the possibility Sinoma International EngineeringLtd's shares may be trading at a discount.

OSG (TSE:6136)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OSG Corporation, with a market cap of ¥148.48 billion, manufactures and sells cutting tools across Japan, the Americas, Europe, Africa, and Asia.

Operations: OSG Corporation generates revenue from several regions, including ¥74.31 billion from Japan, ¥37.78 billion from Asia, ¥35.86 billion from the Americas, and ¥37.02 billion from Europe and Africa.

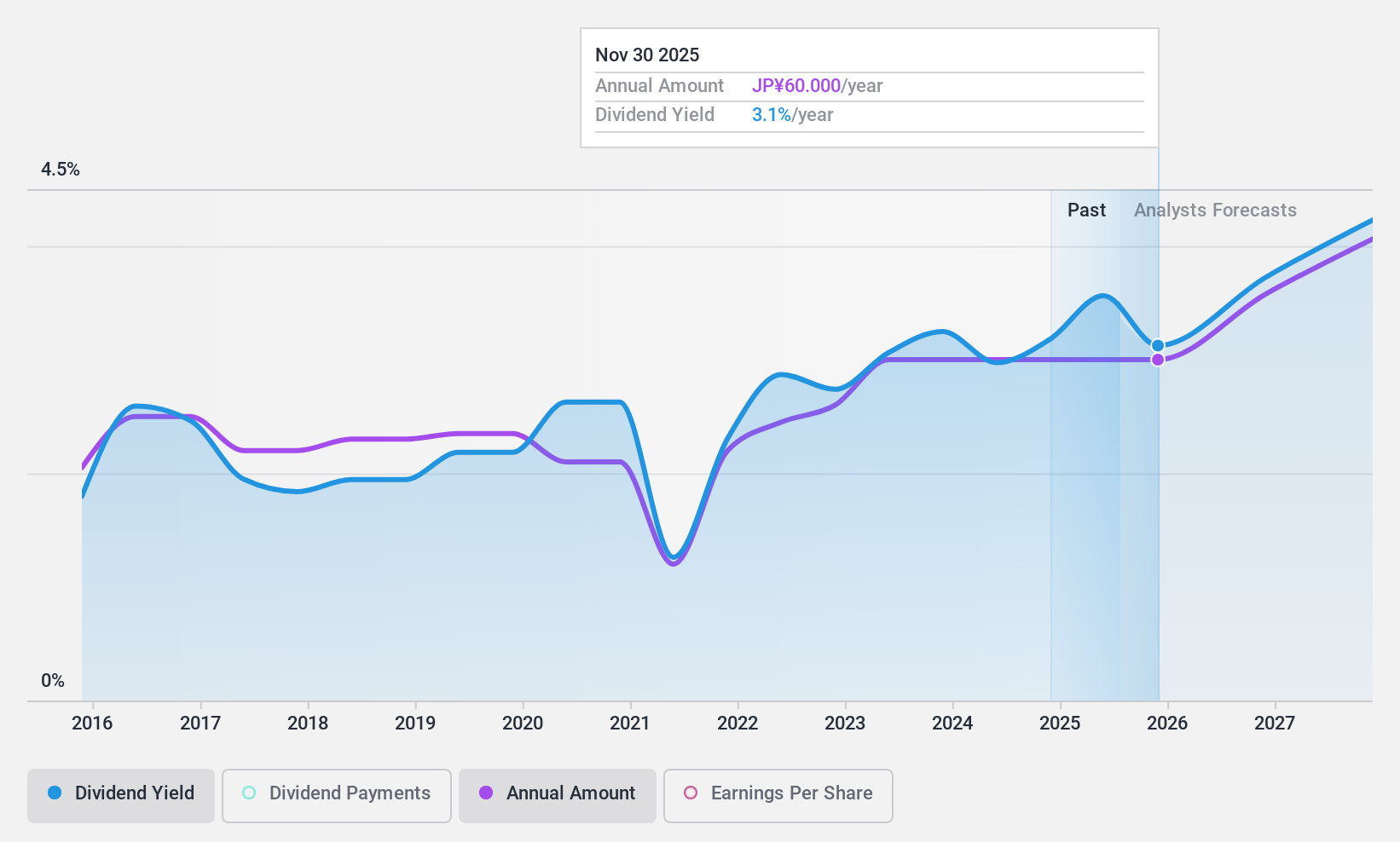

Dividend Yield: 3.4%

OSG Corporation's dividends are covered by earnings and cash flows, with payout ratios of 40.3% and 41.2%, respectively, indicating sustainability despite a volatile dividend history over the past decade. The company trades at a significant discount to its fair value but offers a lower-than-top-tier dividend yield of 3.43%. Recent announcements include expected dividends of JPY 28 per share for the second quarter and JPY 32 per share for year-end 2025, alongside positive earnings forecasts.

- Click here to discover the nuances of OSG with our detailed analytical dividend report.

- The analysis detailed in our OSG valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Explore the 2013 names from our Top Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:AP

AP (Thailand)

Engages in the real estate development business in Thailand.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives