Assessing OSG (TSE:6136) Valuation Following Fresh Financial Forecasts for FY November 2025

Reviewed by Kshitija Bhandaru

OSG (TSE:6136) has released fresh financial forecasts for its fiscal year ending November 2025. The company projects net sales of JPY 160,000 million and net income attributable to parent owners of JPY 14,500 million. Investors often watch these updates closely.

See our latest analysis for OSG.

OSG shares have made a strong run this year, with a 1-month share price return of 9.37% and a surge of 22.91% year-to-date. This reflects renewed optimism after the latest earnings outlook. Over the past twelve months, total shareholder return reached an impressive 28.03%. This shows that momentum has clearly picked up as investors price in growth potential and management’s confident guidance.

If you’re interested in what’s catching attention across the market lately, now’s an ideal time to broaden your horizons and discover fast growing stocks with high insider ownership

The key question now is whether OSG’s impressive run still leaves room for upside, or if the stock’s recent gains mean investors are already factoring in all of the company’s projected growth. Is there still a true buying opportunity, or is everything priced in?

Price-to-Earnings of 13.9x: Is it justified?

OSG trades at a price-to-earnings (P/E) ratio of 13.9x, placing it above the average of comparable peers. With the latest share price at ¥2,253, investors are paying a premium versus similar companies.

The P/E ratio reveals how much investors are willing to pay for each yen of current earnings. In sectors like Machinery, where growth prospects can be cyclical, this metric highlights market expectations for a company’s future profit streams.

In OSG’s case, the premium multiple signals significant optimism despite its most recent annual earnings decline. However, when compared to the broader sector, OSG’s P/E of 13.9x is above both the peer group average of 12x and the Japan Machinery industry average of 13.3x. According to our analysis, a fair P/E for OSG based on its profile is closer to 13x. This suggests its current valuation leaves little room for disappointment if growth targets slip.

Explore the SWS fair ratio for OSG

Result: Price-to-Earnings of 13.9x (OVERVALUED)

However, factors such as slower-than-expected revenue growth or a disappointing earnings season could quickly challenge today’s optimistic valuation and shift investor sentiment.

Find out about the key risks to this OSG narrative.

Another View: What Does Discounted Cash Flow Say?

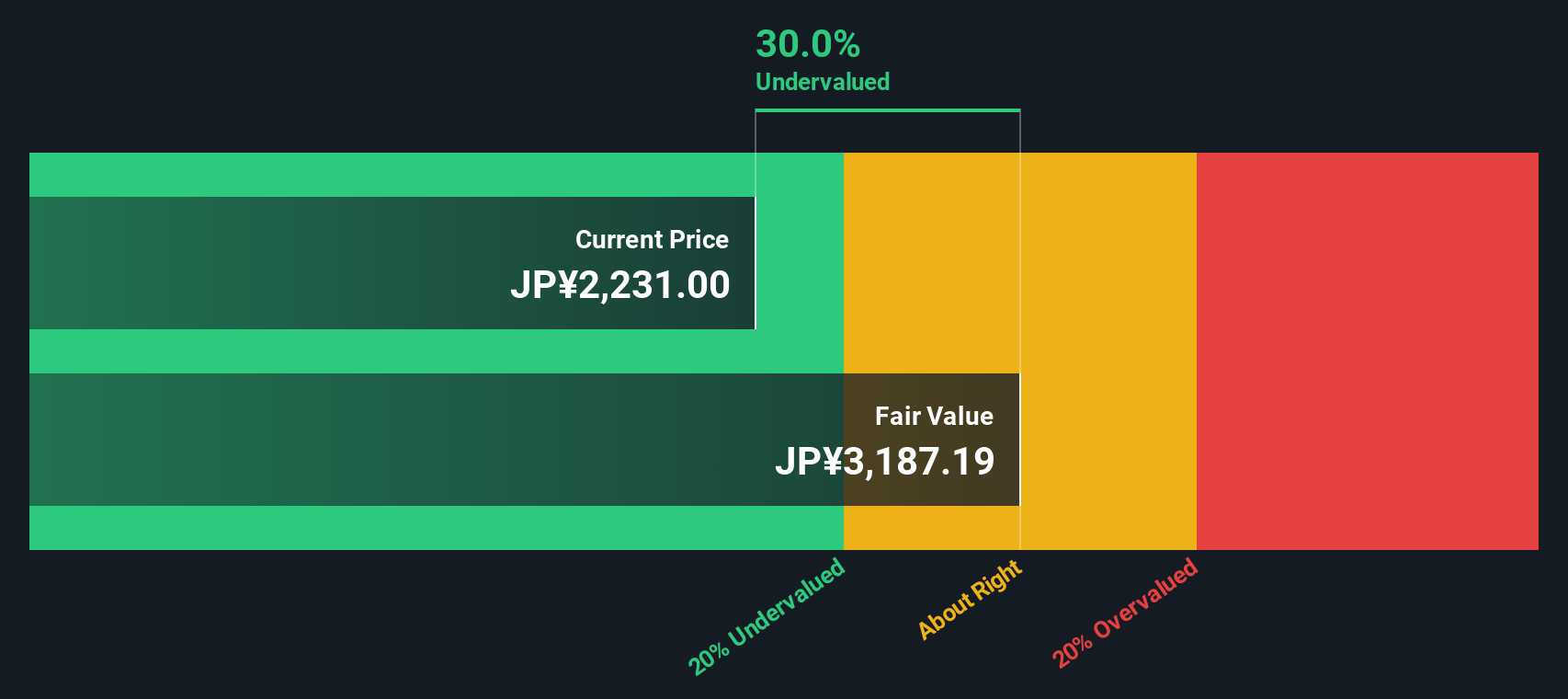

While multiples suggest OSG may be overvalued compared to peers, our DCF model offers a sharp contrast. According to this analysis, the stock is currently trading 28.4% below its estimated fair value. Could the market be underestimating OSG’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OSG for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OSG Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own view of OSG in just a few minutes. Do it your way

A great starting point for your OSG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Serious about wealth-building? Make sure you check out what’s next in high-growth sectors and unique opportunities before others catch on. Opportunity does not wait for the crowd.

- Capture potential in future tech by reviewing these 24 AI penny stocks for companies transforming industries with artificial intelligence and automation at their core.

- Secure steady income as you assess these 18 dividend stocks with yields > 3% known for attractive yields above 3%, perfect for balancing growth and reliability.

- Take a bold step toward tomorrow by checking out these 79 cryptocurrency and blockchain stocks making waves in digital assets and revolutionizing finance with new blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6136

OSG

Manufactures and sells precision machinery tools in Japan, the Americas, Europe, Africa, and Asia.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives