Okuma (TSE:6103): Assessing Valuation as Market Sentiment Shifts

Reviewed by Kshitija Bhandaru

Okuma (TSE:6103) shares have been moving under the radar despite some changes that might catch investors’ attention. With a steady stream of earnings and operational growth, Okuma’s recent share price dips and recoveries are not linked to any single headline event. For long-term watchers, these moves could signal an evolving market view of risk and return around this factory automation specialist.

Looking back, Okuma’s share price has drifted lower over the past month, dropping around 2%, and is down roughly 5% over the past 3 months. Yet, the stock is up 11% for the year and has achieved more than 51% growth over 3 years, signaling persistent underlying momentum and resilience despite recent pullbacks. Annual revenue and net income are still growing, which may help explain ongoing investor interest.

With momentum simmering and expectations shifting, is Okuma positioned for a genuine bargain at today’s price or has the market already accounted for its future growth potential?

Price-to-Earnings of 24.6x: Is it justified?

Okuma trades at a price-to-earnings (PE) ratio of 24.6 times, which is noticeably higher than the average for its industry peers and the broader Japanese Machinery sector. This multiple serves as a key measure of how the market values the company's current and future earnings capacity. This is especially important for mature industrial outfits like Okuma, where growth prospects and steady profitability drive investor sentiment.

A higher PE ratio compared to both the peer average (16.4x) and industry average (13.7x) suggests that the market expects stronger growth or superior returns from Okuma versus its competitors. However, without matching earnings acceleration or robust profit margins, this premium may be difficult to justify in the long term.

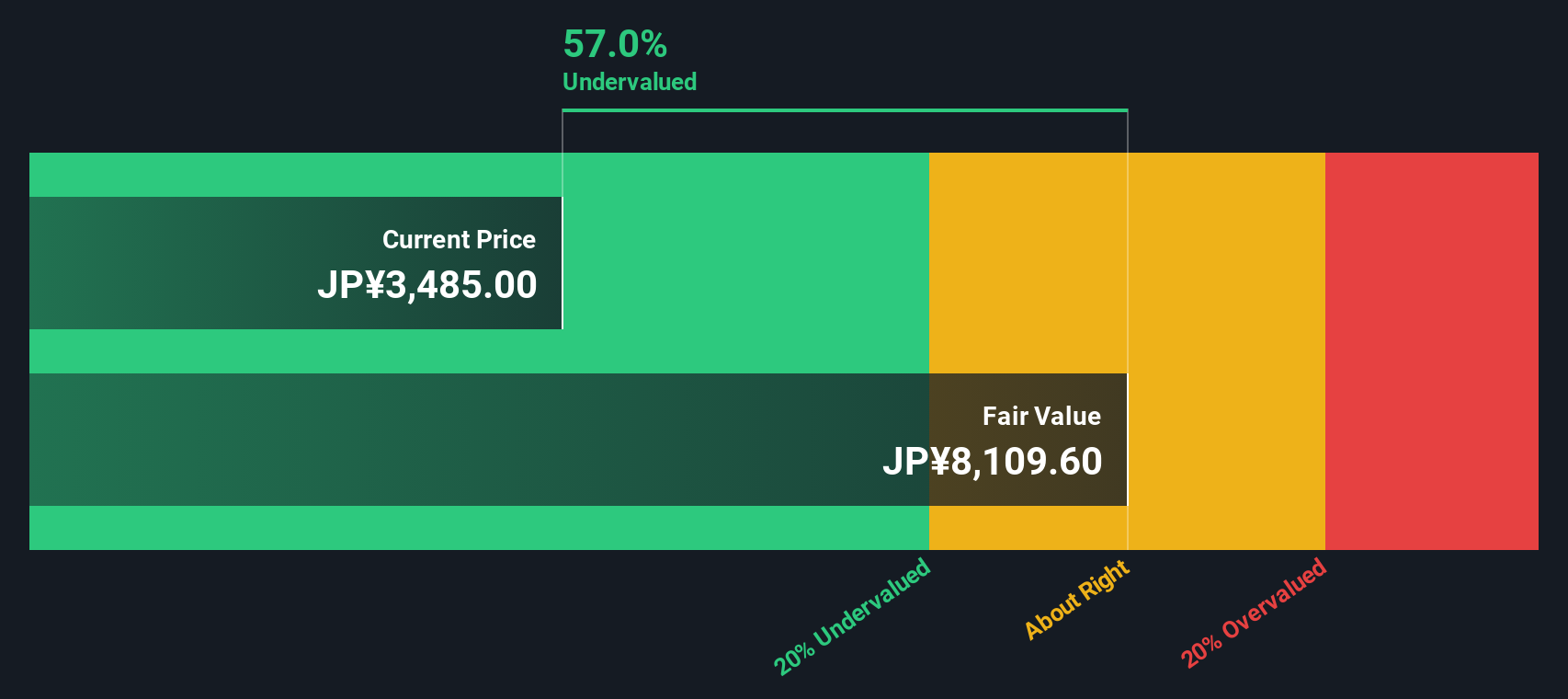

Result: Fair Value of ¥8,279.57 (UNDERVALUED)

See our latest analysis for Okuma.However, risks such as slowing revenue growth or unexpected margin pressure could quickly change the market's sentiment for Okuma going forward.

Find out about the key risks to this Okuma narrative.Another View: Discounted Cash Flow Perspective

Taking a step back from market multiples, our DCF model offers a different perspective and currently signals that Okuma is undervalued. Could the market be missing something? Is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Okuma Narrative

If you want to dig deeper or believe there is another story behind the numbers, it is easy to conduct your own analysis and shape a narrative in just a few minutes. Do it your way

A great starting point for your Okuma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to broaden your portfolio? Smart investors seize unique opportunities. Don’t let choice stocks slip away while others uncover new growth stories with powerful tools.

- Uncover emerging companies with big growth potential by checking out penny stocks with strong financials, making waves behind the scenes.

- Tap into high-yield opportunities and fortify your passive income stream through dividend stocks with yields > 3%, featuring market-leading payouts.

- Spot hidden value in the market by tracking undervalued stocks based on cash flows, which could be primed for a strong rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6103

Okuma

Manufactures and sells machine tools in Japan, the United States, Europe, and Asia/Pacific.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives