- China

- /

- Electric Utilities

- /

- SHSE:600101

Spotlighting Undiscovered Gems with Potential in December 2024

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, highlighted by fluctuating consumer confidence and manufacturing data, small-cap stocks have shown resilience with indices like the Russell 2000 posting notable year-to-date gains. In this environment, identifying undiscovered gems requires focusing on companies that demonstrate strong fundamentals and adaptability amid changing economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Sichuan Mingxing Electric Power (SHSE:600101)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Mingxing Electric Power Co., Ltd. operates in the electric power industry and has a market capitalization of CN¥5.03 billion.

Operations: The company generates revenue primarily from its electric power operations, with a market capitalization of CN¥5.03 billion.

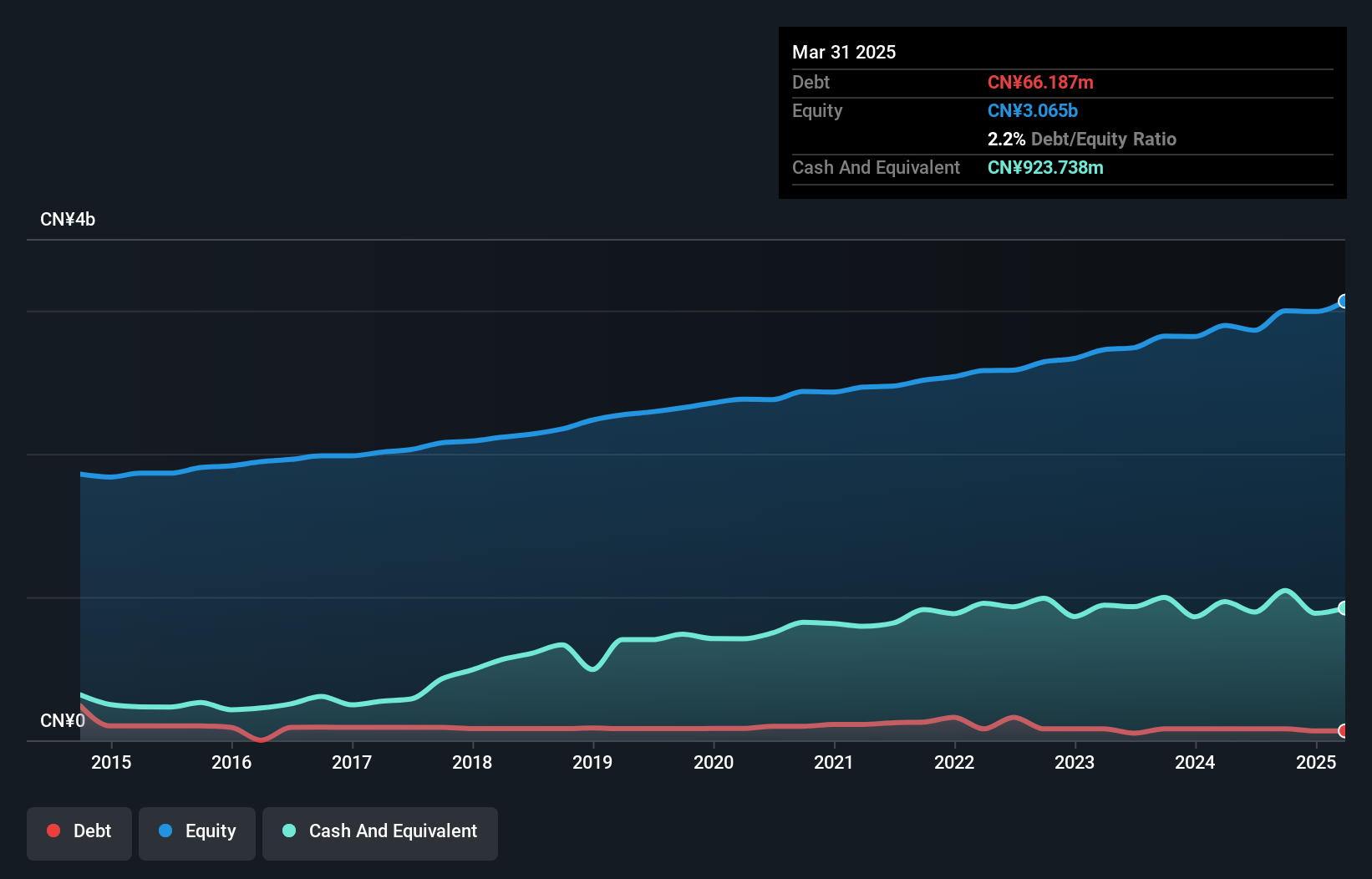

Sichuan Mingxing Electric Power, a smaller player in the electric utilities sector, has shown promising financial health with earnings growing 20% annually over the past five years. The company reported sales of CNY 2.13 billion for nine months ending September 2024, up from CNY 2.01 billion last year, and net income increased to CNY 223.81 million from CNY 184.31 million. With a price-to-earnings ratio of 23x below the CN market average of 36x and reduced debt-to-equity ratio from 3.5 to 2.7 over five years, it seems well-positioned for continued profitability despite not outpacing industry growth recently at just under industry levels at around nearly12%.

Maruzen (TSE:5982)

Simply Wall St Value Rating: ★★★★★★

Overview: Maruzen Co., Ltd. specializes in the manufacture and sale of commercial kitchen equipment, with a market cap of ¥54.93 billion.

Operations: Maruzen generates revenue primarily from the manufacture and sale of commercial kitchen equipment. The company has a market cap of ¥54.93 billion, reflecting its financial standing in the industry.

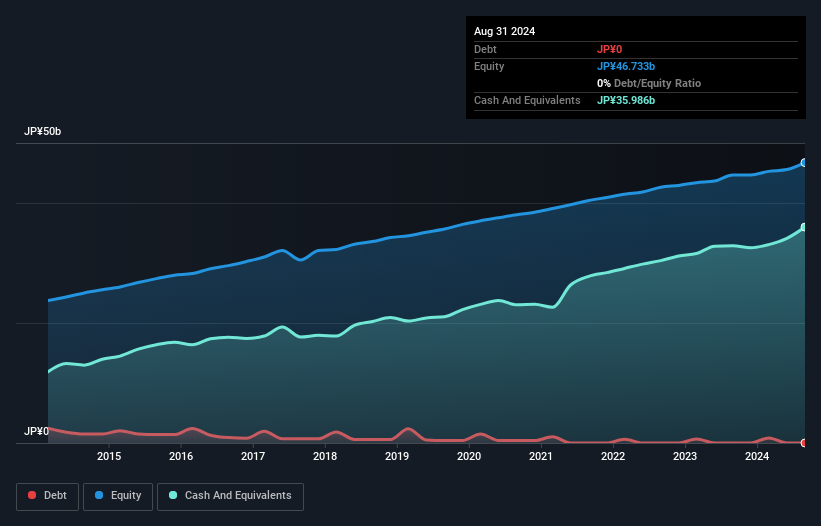

Maruzen, a small company in the machinery sector, has shown impressive growth with earnings surging by 44% over the past year, outpacing the industry average of 1.4%. Currently trading at 73% below its estimated fair value, it presents an intriguing opportunity for investors. The firm is debt-free now compared to five years ago when its debt-to-equity ratio was 1.1%, which likely enhances its financial stability and flexibility. With high-quality earnings and positive free cash flow, Maruzen seems well-positioned to capitalize on future growth prospects within its industry context.

- Delve into the full analysis health report here for a deeper understanding of Maruzen.

Assess Maruzen's past performance with our detailed historical performance reports.

Denyo (TSE:6517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Denyo Co., Ltd. is involved in the development, manufacturing, and sale of engine-driven generators, welders, and air compressors across Japan, the United States, Asia, and Europe with a market capitalization of ¥61.68 billion.

Operations: Denyo Co., Ltd. generates revenue primarily from Japan (¥54.33 billion) and the United States (¥19.88 billion), with additional contributions from Asia and Europe. The company's financial performance is influenced by its operations across these regions, with significant revenue streams derived from its core products like engine-driven generators, welders, and air compressors.

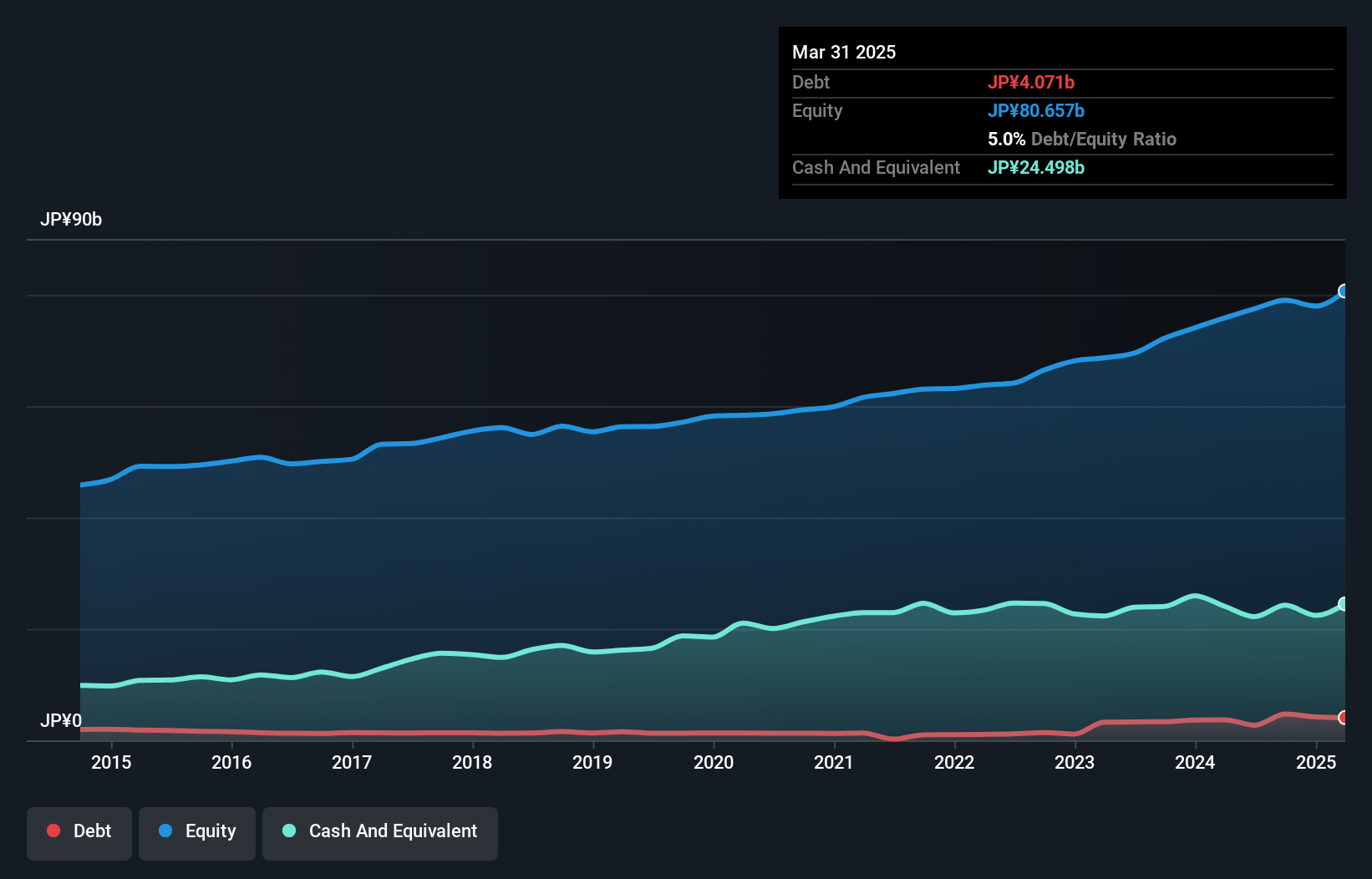

Denyo, a smaller player in the electrical industry, has been making waves with its impressive 30.7% earnings growth over the past year, outpacing the sector's 11.6%. Despite an increase in its debt to equity ratio from 2.3% to 6% over five years, Denyo's financial health remains robust as it holds more cash than total debt and earns more interest than it pays. The company is trading at a significant discount of approximately 51.7% below estimated fair value and recently announced a share buyback program worth ¥600 million alongside increasing its dividend to JPY 30 per share from JPY 24 last year.

- Click here to discover the nuances of Denyo with our detailed analytical health report.

Examine Denyo's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Discover the full array of 4626 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600101

Sichuan Mingxing Electric Power

Sichuan Mingxing Electric Power Co., Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives