- Japan

- /

- Electrical

- /

- TSE:5803

Fujikura Ltd.'s (TSE:5803) P/E Is Still On The Mark Following 27% Share Price Bounce

Despite an already strong run, Fujikura Ltd. (TSE:5803) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days were the cherry on top of the stock's 516% gain in the last year, which is nothing short of spectacular.

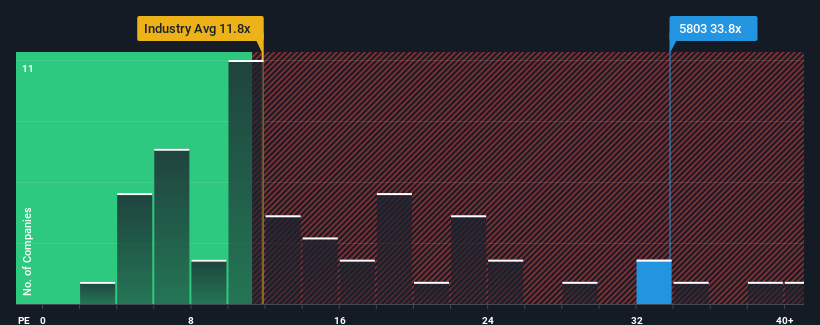

Since its price has surged higher, Fujikura may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 33.8x, since almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Fujikura certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Fujikura

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Fujikura's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 59%. The latest three year period has also seen an excellent 392% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 23% each year during the coming three years according to the ten analysts following the company. With the market only predicted to deliver 11% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Fujikura's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Fujikura's P/E

Shares in Fujikura have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Fujikura maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Fujikura that we have uncovered.

If you're unsure about the strength of Fujikura's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5803

Fujikura

Engages in telecommunication and power systems, electronic, and automotive products businesses in Japan, the rest of Asia, North America, Europe, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives