Exploring December 2024's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and mixed economic indicators, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming against larger indices like the S&P 500. Amidst this backdrop of fluctuating market sentiment and economic signals, investors might find opportunities in lesser-known companies that offer unique growth potential or niche market positions. In this context, identifying undiscovered gems involves looking for stocks with strong fundamentals and innovative strategies that can thrive even when broader market conditions are uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Pluk Phak Praw Rak Mae (SET:OKJ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pluk Phak Praw Rak Mae Public Company Limited is engaged in the cultivation of organic vegetables and fruits in Thailand, with a market capitalization of THB9.01 billion.

Operations: Pluk Phak Praw Rak Mae derives its revenue primarily from the restaurant business, generating THB2.25 billion. The company focuses on organic produce cultivation to support its restaurant operations.

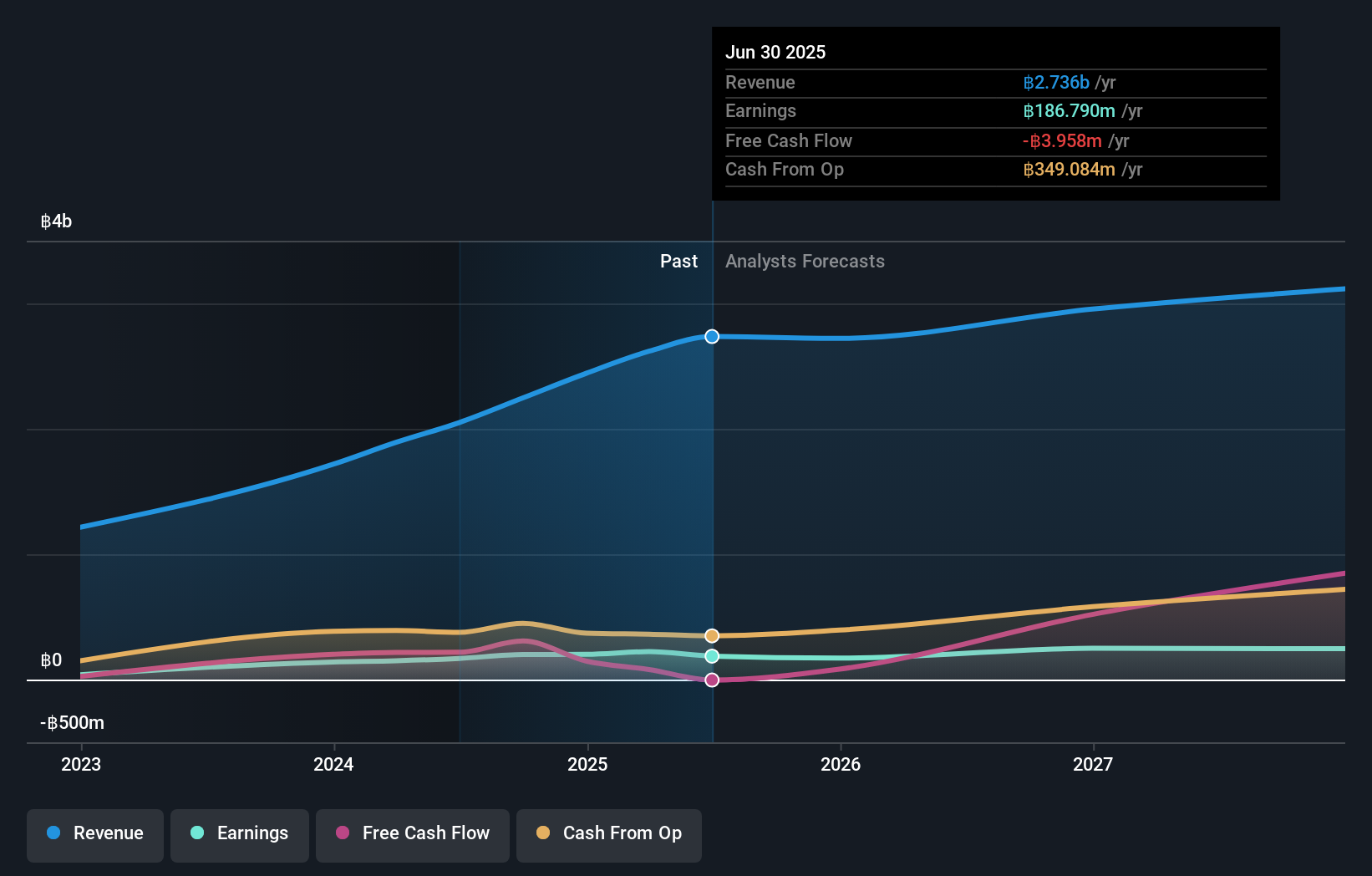

Pluk Phak Praw Rak Mae, a relatively small player in the food industry, recently completed an IPO raising THB 1.07 billion with shares priced at THB 6.7 each. The company shows promising growth potential, with earnings rising by 73% over the past year and outperforming the industry average of 34%. Its financial health is solid as interest payments are well-covered by EBIT at a ratio of 12.7x, indicating strong operational efficiency. Despite recent share price volatility, it trades at a substantial discount of about 52% below estimated fair value, suggesting room for appreciation if market conditions stabilize.

- Delve into the full analysis health report here for a deeper understanding of Pluk Phak Praw Rak Mae.

Learn about Pluk Phak Praw Rak Mae's historical performance.

Premium Water HoldingsInc (TSE:2588)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Premium Water Holdings Inc. is engaged in the production and delivery of mineral water under the Premium Water brand in Japan, with a market capitalization of ¥93.34 billion.

Operations: Premium Water Holdings Inc. generates its revenue primarily from the production and delivery of mineral water in Japan. The company has a market capitalization of ¥93.34 billion, reflecting its position in the industry.

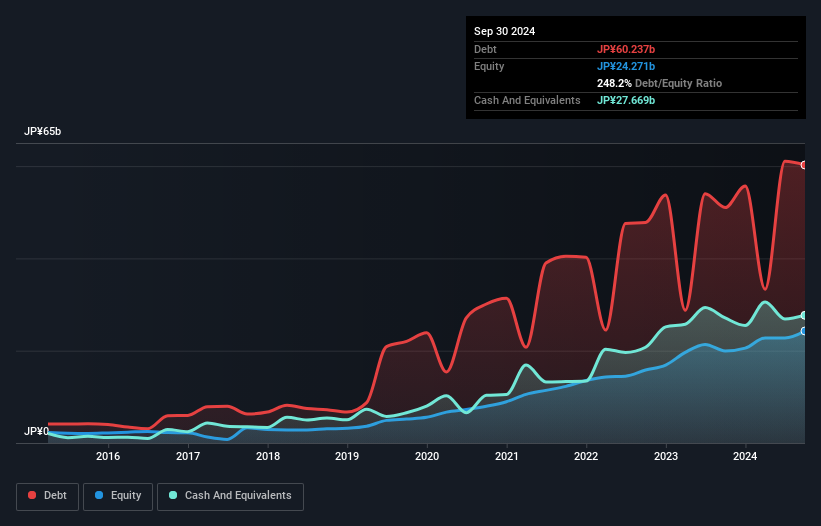

Premium Water Holdings, Inc. has been making waves with its robust financial performance and strategic moves. Over the last five years, earnings have surged 28% annually, showcasing high-quality earnings despite a high net debt to equity ratio of 134%. The company recently reduced its debt to equity from 423% to 248%, indicating improved financial health. Interest payments are comfortably covered by EBIT at a rate of 12 times, reflecting strong operational efficiency. Recent buybacks totaling ¥484 million for 166,700 shares suggest confidence in future prospects. Additionally, the firm announced a ¥75 billion sustainable bond offering and increased dividends to ¥45 per share for Q2.

Noritake (TSE:5331)

Simply Wall St Value Rating: ★★★★★★

Overview: Noritake Co., Limited, along with its subsidiaries, offers a range of industrial, ceramic and material, engineering, and tabletop products both in Japan and internationally, with a market cap of ¥108.51 billion.

Operations: The company generates revenue through its industrial, ceramic and material, engineering, and tabletop segments. A significant portion of costs is related to production and operational expenses associated with these diverse product lines. The net profit margin has shown variability over recent periods.

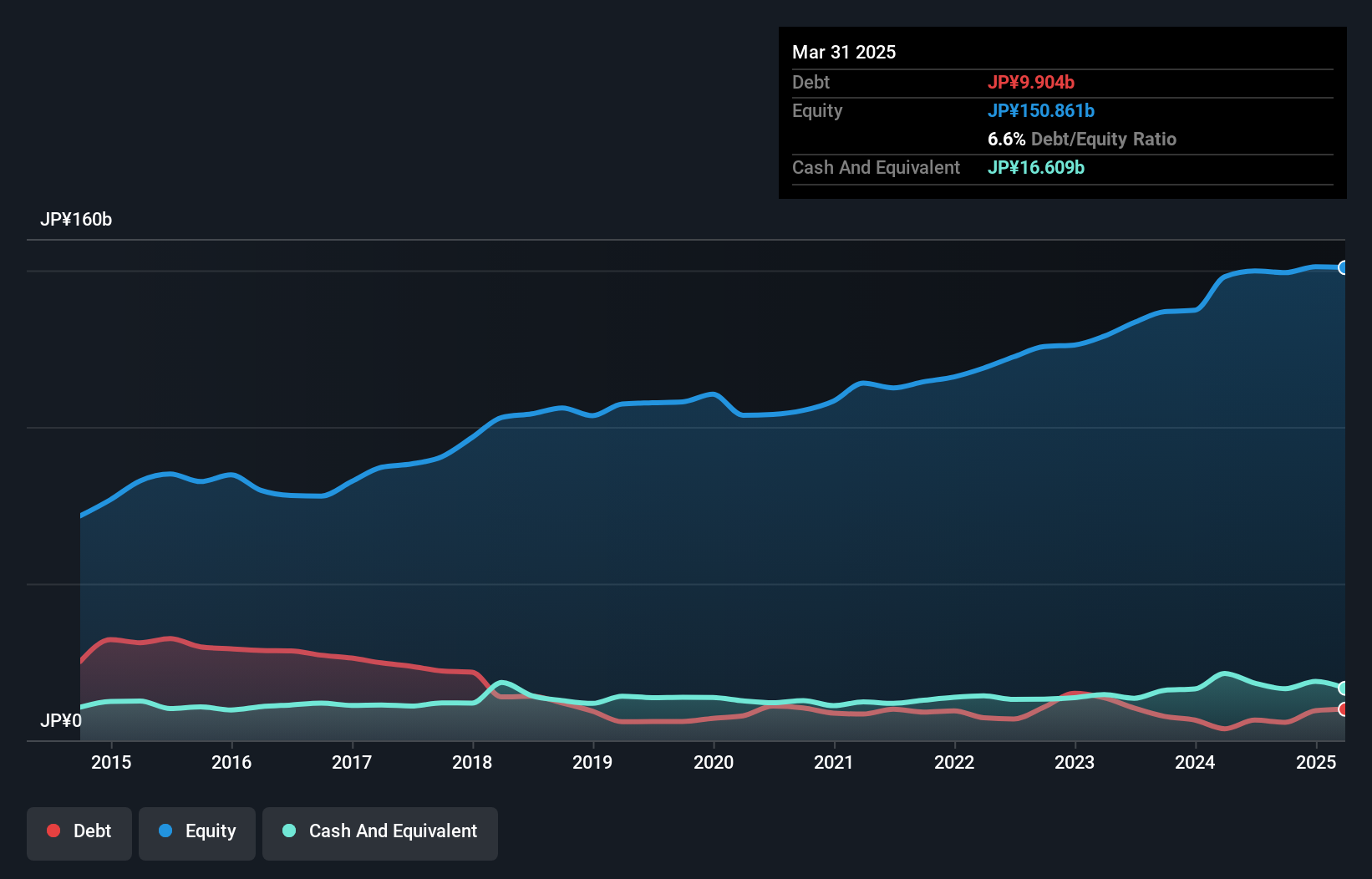

With earnings growth of 10.3% over the past year, Noritake is outpacing the Machinery industry, which grew by just 0.8%. Trading at an impressive 57.5% below its estimated fair value, this company shows potential for value investors. Over the last five years, its debt-to-equity ratio has improved from 5.6 to 3.8, reflecting better financial health and stability in managing liabilities. Additionally, Noritake's recent share repurchase of 196,900 shares for ¥750 million highlights a commitment to enhancing shareholder value through strategic buybacks in late 2024.

- Navigate through the intricacies of Noritake with our comprehensive health report here.

Understand Noritake's track record by examining our Past report.

Key Takeaways

- Get an in-depth perspective on all 4502 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noritake might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5331

Noritake

Noritake Co., Limited with its subsidiaries, provides industrial, ceramic and material, engineering, and tabletop products in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives