- Taiwan

- /

- Auto Components

- /

- TPEX:4570

3 Dividend Stocks To Consider With Up To 5.6% Yield

Reviewed by Simply Wall St

As global markets navigate a mix of moderate gains and economic uncertainties, with U.S. consumer confidence and manufacturing data showing declines, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In an environment where market volatility persists, selecting dividend stocks with attractive yields can offer both income stability and the potential for capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 1942 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

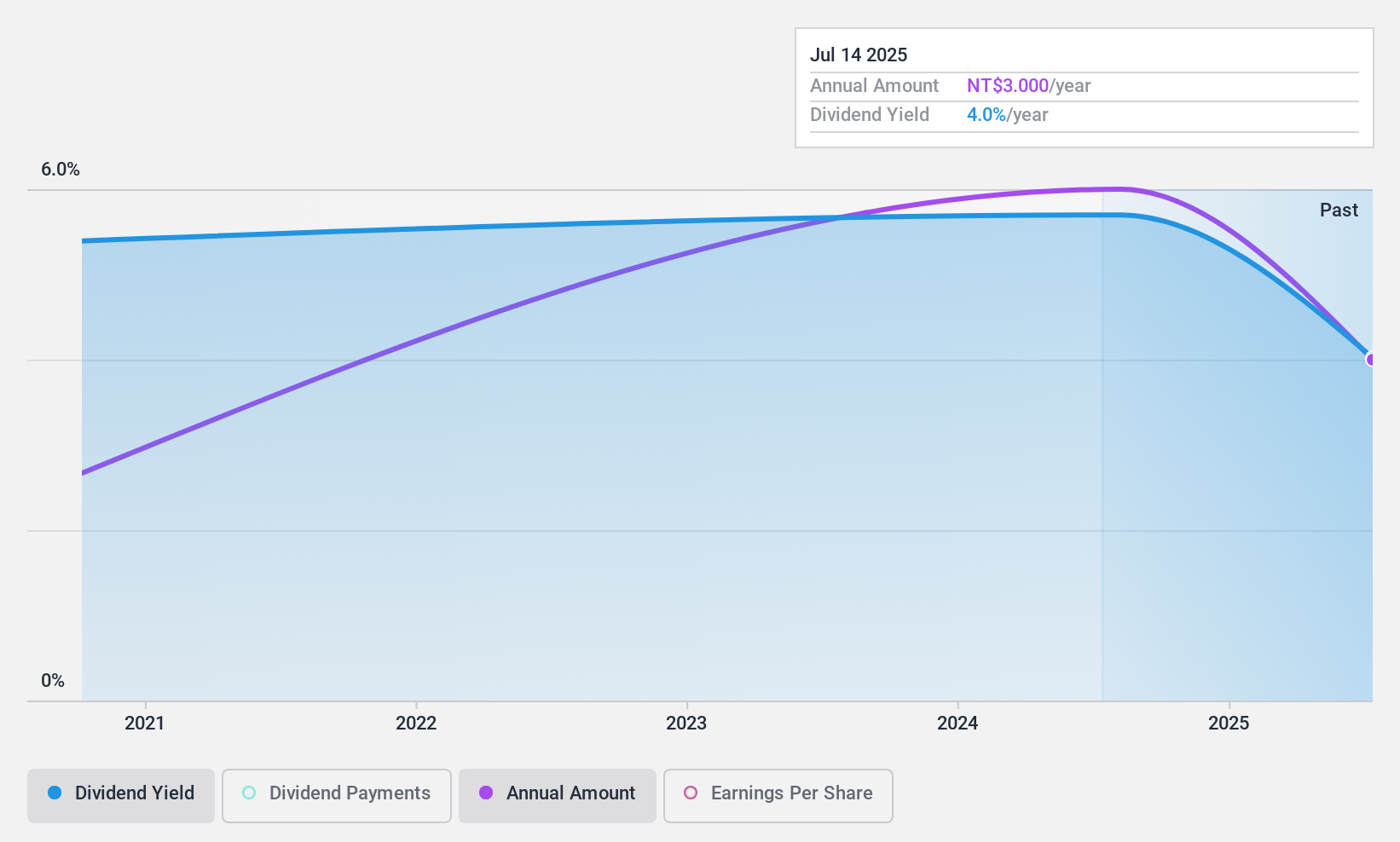

Jason (TPEX:4570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jason Co., Ltd. manufactures and sells steering and suspension products in Taiwan, with a market cap of NT$3.48 billion.

Operations: Jason Co., Ltd.'s revenue is primarily derived from its FAST and Jielun segment, contributing NT$1.07 billion, and the Jason and Checheng segment, which adds NT$2.01 billion.

Dividend Yield: 5.7%

Jason's dividend payments have grown over the past five years, with coverage supported by a payout ratio of 63.8% from earnings and 52.4% from cash flows, indicating sustainability. Although dividends have been stable and reliable, the company has a relatively short history of less than ten years in paying them. Trading at 30.8% below its estimated fair value, Jason offers a yield of 5.68%, ranking it in the top quartile within its market segment for dividends.

- Take a closer look at Jason's potential here in our dividend report.

- The analysis detailed in our Jason valuation report hints at an deflated share price compared to its estimated value.

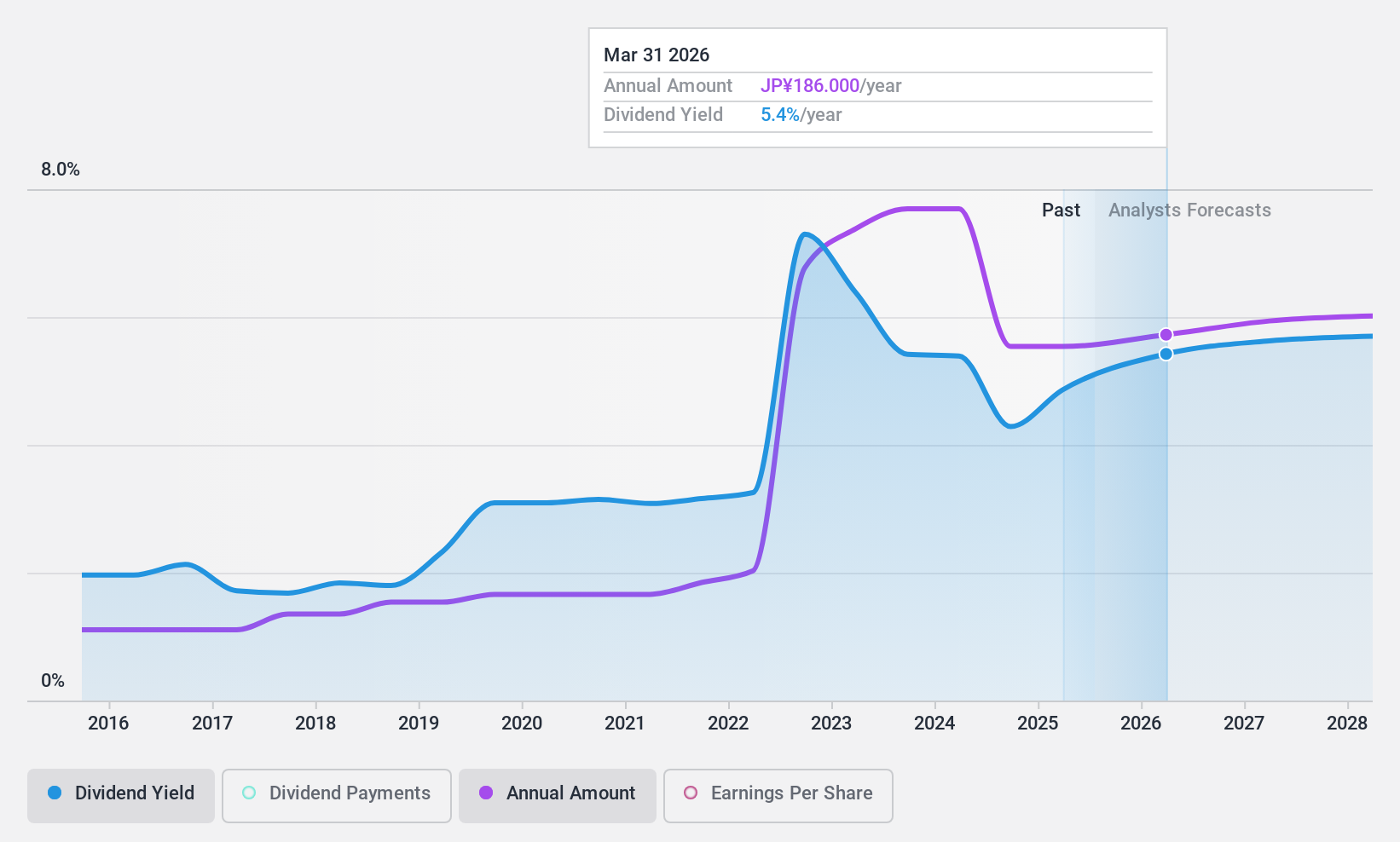

Mitsuboshi Belting (TSE:5192)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsuboshi Belting Ltd. manufactures and sells power transmission belts, waterproofing and water shielding sheets, as well as engineering plastics and structural foams in Japan and internationally, with a market cap of ¥113.55 billion.

Operations: Mitsuboshi Belting Ltd.'s revenue segments include ¥48.20 billion from abroad belt sales, ¥41.42 billion from domestic belt sales, and ¥7.94 billion from construction materials.

Dividend Yield: 4.5%

Mitsuboshi Belting's dividend yield of 4.5% ranks in the top 25% of Japanese dividend payers, yet it faces sustainability issues with a high cash payout ratio of 197%. Despite a reasonable earnings payout ratio of 63.5%, dividends are not well-covered by free cash flows and have been volatile over the past decade. Recent share buybacks totaling ¥999.7 million reflect efforts to enhance shareholder returns, although earnings growth is expected to decline by an average of 9.3% annually over the next three years.

- Click to explore a detailed breakdown of our findings in Mitsuboshi Belting's dividend report.

- According our valuation report, there's an indication that Mitsuboshi Belting's share price might be on the expensive side.

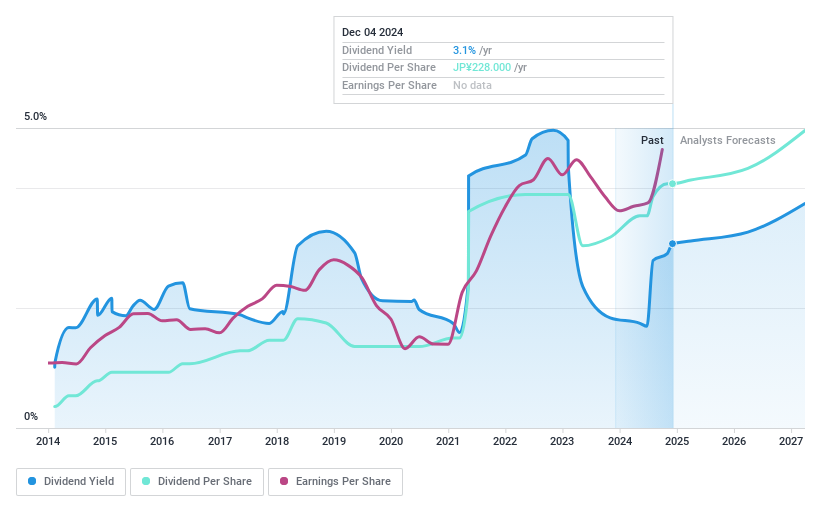

Tokyo Seimitsu (TSE:7729)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokyo Seimitsu Co., Ltd. is a Japanese company that manufactures and sells semiconductor production equipment and measuring instruments, with a market cap of ¥297.64 billion.

Operations: Tokyo Seimitsu Co., Ltd.'s revenue is derived from two main segments: Measuring Equipment, contributing ¥35.16 billion, and Semiconductor Manufacturing Equipment, accounting for ¥107.42 billion.

Dividend Yield: 3.1%

Tokyo Seimitsu's dividend yield of 3.1% falls short of the top quartile in Japan, but recent increases to JPY 114 per share indicate growth. Despite a history of volatility, dividends are well-covered by earnings (36%) and cash flows (63.6%). The company raised its earnings guidance for fiscal year ending March 2025, with expected net sales and profits showing improvement. However, past dividend reliability remains a concern for investors seeking stable income streams.

- Dive into the specifics of Tokyo Seimitsu here with our thorough dividend report.

- According our valuation report, there's an indication that Tokyo Seimitsu's share price might be on the cheaper side.

Turning Ideas Into Actions

- Dive into all 1942 of the Top Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4570

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives