Nitto Boseki Co., Ltd. (TSE:3110) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

Nitto Boseki Co., Ltd. (TSE:3110) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. The last 30 days bring the annual gain to a very sharp 67%.

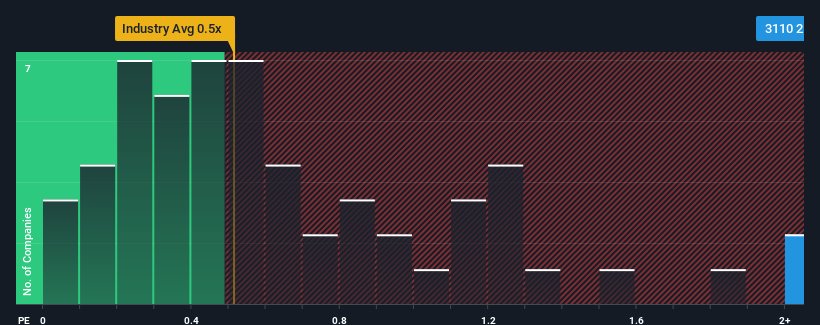

After such a large jump in price, you could be forgiven for thinking Nitto Boseki is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in Japan's Building industry have P/S ratios below 0.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Nitto Boseki

What Does Nitto Boseki's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Nitto Boseki has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nitto Boseki.How Is Nitto Boseki's Revenue Growth Trending?

Nitto Boseki's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. Revenue has also lifted 24% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the nine analysts following the company. That's shaping up to be materially higher than the 4.0% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Nitto Boseki's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Nitto Boseki's P/S

Nitto Boseki's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Nitto Boseki shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Nitto Boseki you should be aware of.

If these risks are making you reconsider your opinion on Nitto Boseki, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Boseki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3110

Nitto Boseki

Engages in the manufacture, processing, and sale of textile products and textile-related industrial goods, rock wool and building materials, glass fiber products, and specialty chemicals and medical products in Japan.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives