- Turkey

- /

- Auto Components

- /

- IBSE:BRISA

3 Reliable Dividend Stocks Yielding Up To 4.7%

Reviewed by Simply Wall St

Amid a backdrop of cautious Federal Reserve commentary and political uncertainty, global markets have experienced fluctuations, with U.S. stocks recently declining despite some recovery by week's end. As investors navigate these choppy waters, dividend stocks offering reliable yields can provide a measure of stability and income, making them an attractive consideration for those looking to balance risk in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.71% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1933 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

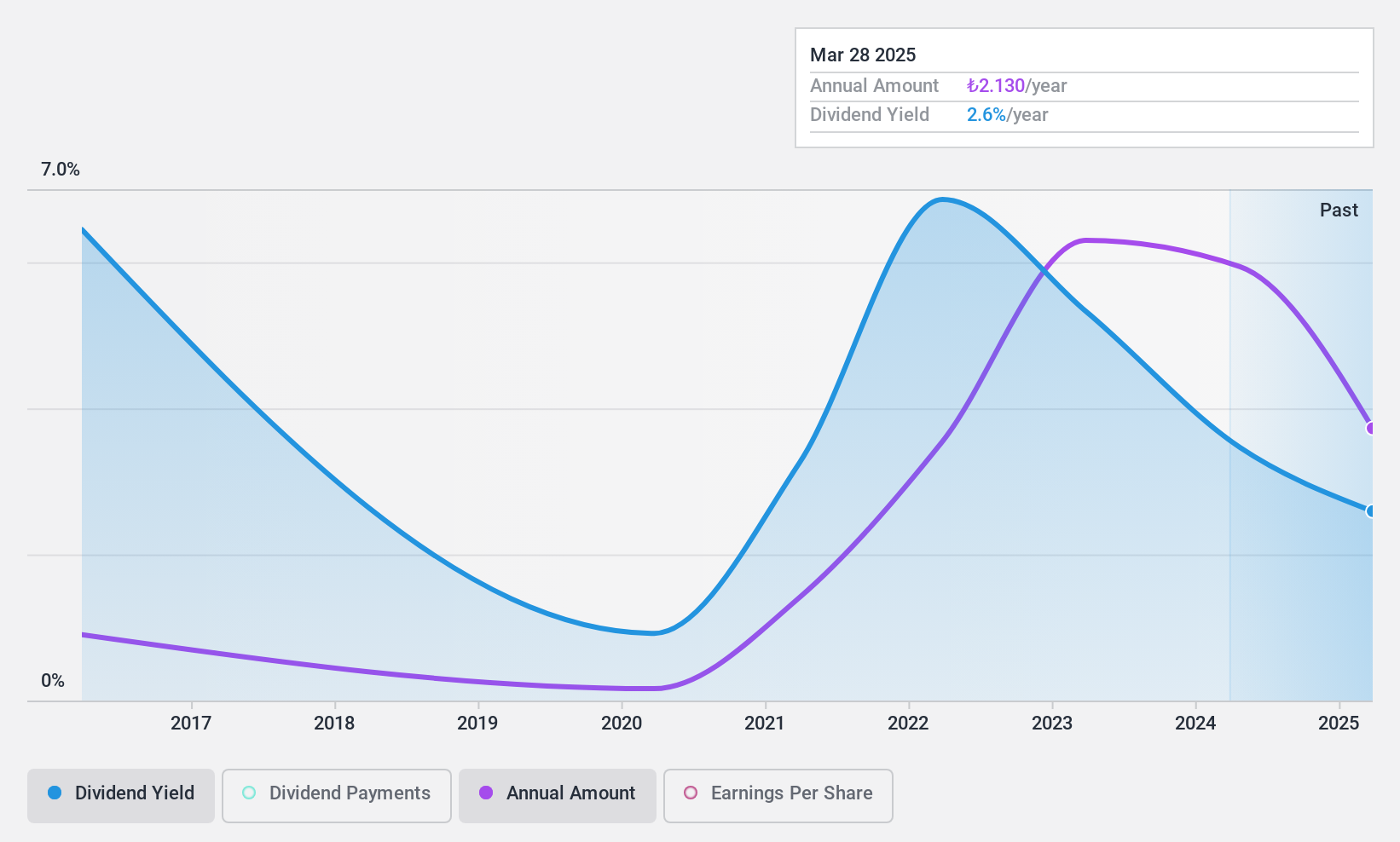

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret (IBSE:BRISA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S. operates in the tire manufacturing industry and has a market capitalization of TRY26.78 billion.

Operations: Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S. generates revenue primarily from its Vehicle Tires segment, amounting to TRY24.87 billion.

Dividend Yield: 3.7%

BRISA's dividend yield of 3.71% ranks in the top 25% of Turkish dividend payers, supported by a low payout ratio of 32.6%. However, its dividend history is unstable with significant volatility over the past decade. Despite recent earnings challenges—reporting a net loss in Q3 and decreased nine-month income—the dividends remain covered by cash flows and earnings, suggesting sustainability amidst fluctuating financial performance. The stock trades at an attractive price-to-earnings ratio of 8.8x.

- Click here to discover the nuances of Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret is trading behind its estimated value.

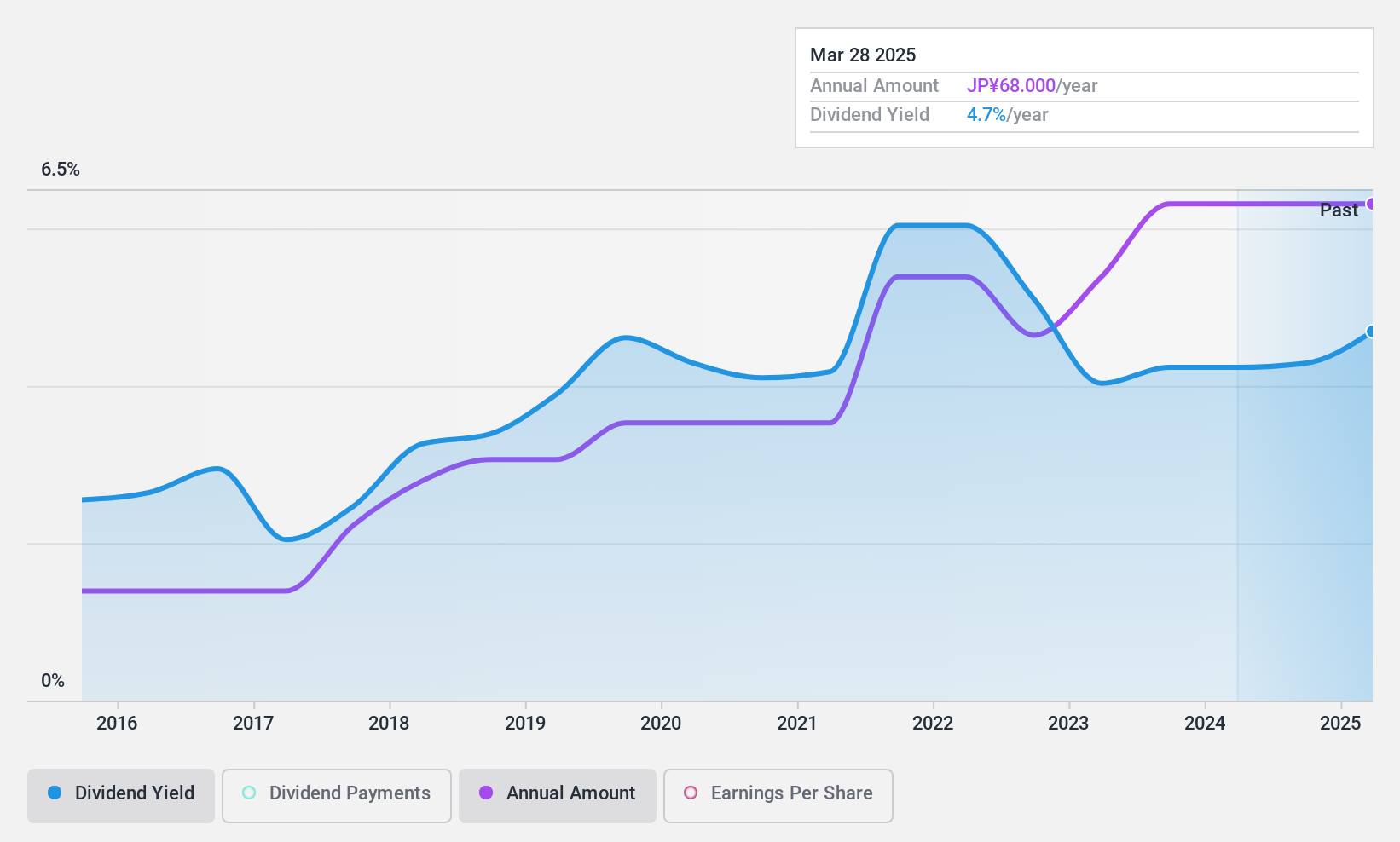

Rasa (TSE:3023)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rasa Corporation is a trading company that provides resources, metallic materials, industrial machinery, and construction equipment across Japan, China, Korea, Taiwan, and Australia with a market cap of ¥15.80 billion.

Operations: Rasa Corporation's revenue segments include Industrial Machinery/Construction Machinery Related at ¥10.25 billion, Chemical Products Connection at ¥5.90 billion, Resources/Metal Materials Related at ¥5.75 billion, Plant/Equipment Construction Related at ¥2.62 billion, Environmental Equipment Related at ¥1.84 billion, and Real Estate Leasing Related at ¥375 million.

Dividend Yield: 4.7%

Rasa offers a compelling dividend profile with a yield of 4.71%, placing it in the top 25% of Japanese dividend payers. The company's dividends have been stable and growing over the past decade, supported by a low payout ratio of 39%, indicating strong earnings coverage. Additionally, Rasa's price-to-earnings ratio of 8.1x suggests good value compared to the broader JP market average. Cash flow coverage is adequate, with a cash payout ratio at 77.9%.

- Click here and access our complete dividend analysis report to understand the dynamics of Rasa.

- Our expertly prepared valuation report Rasa implies its share price may be too high.

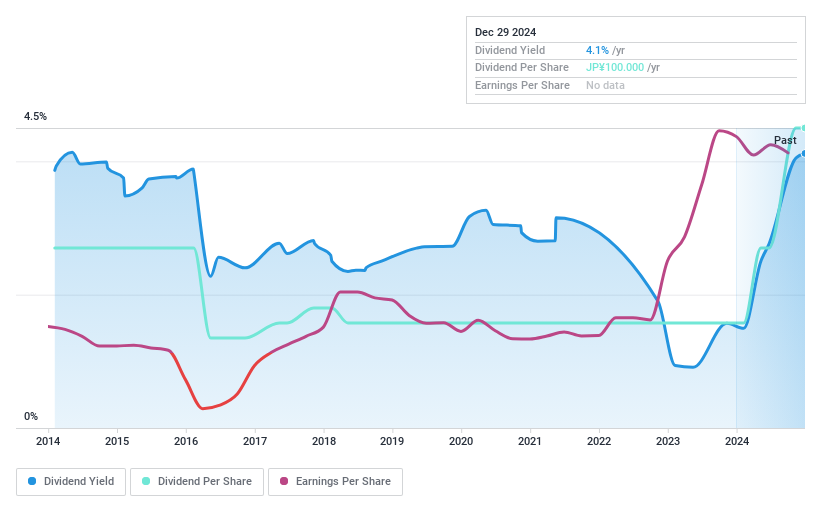

Gamecard-Joyco HoldingsInc (TSE:6249)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gamecard-Joyco Holdings, Inc. operates in the gaming business and has a market cap of ¥35.59 billion.

Operations: Gamecard-Joyco Holdings, Inc. generates its revenue from the gaming business segment.

Dividend Yield: 4.1%

Gamecard-Joyco Holdings Inc. recently completed a share buyback, enhancing shareholder returns and capital efficiency. Despite trading significantly below its estimated fair value, the stock's dividend yield of 4.12% ranks in the top 25% of Japanese payers. However, dividends have been unreliable and volatile over the past decade despite being well-covered by earnings (payout ratio: 7%) and cash flows (cash payout ratio: 14%). The company's share price has been highly volatile recently.

- Delve into the full analysis dividend report here for a deeper understanding of Gamecard-Joyco HoldingsInc.

- Insights from our recent valuation report point to the potential undervaluation of Gamecard-Joyco HoldingsInc shares in the market.

Summing It All Up

- Click through to start exploring the rest of the 1930 Top Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BRISA

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives