As global markets grapple with uncertainties surrounding trade policies and economic growth, Asian markets are capturing attention with their potential for stability and income generation through dividend stocks. In times of market volatility, dividend-paying stocks can provide a reliable stream of income, making them an attractive option for investors seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.71% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.75% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 3.95% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.17% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.17% | ★★★★★★ |

Click here to see the full list of 1123 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Ren Tang Technologies Co. Ltd. manufactures and sells Chinese medicine products both in Mainland China and internationally, with a market cap of HK$6.65 billion.

Operations: Tong Ren Tang Technologies Co. Ltd. generates revenue from its primary segments, with The Company contributing CN¥4.29 billion and Tong Ren Tang Chinese Medicine adding CN¥1.26 billion.

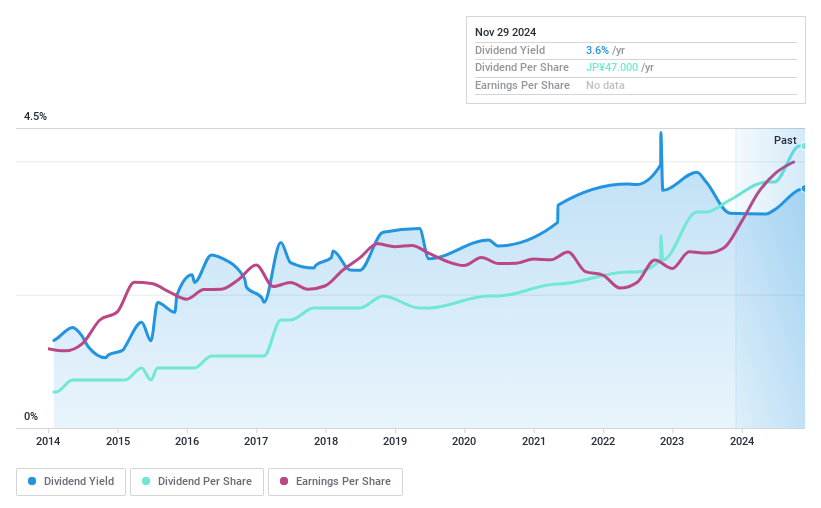

Dividend Yield: 3.7%

Tong Ren Tang Technologies offers a stable dividend profile, with payments reliably growing over the past decade. Despite a low payout ratio of 35.4%, indicating dividends are well covered by earnings, the dividend yield of 3.69% is modest compared to top-tier Hong Kong market payers. Recent developments include a HK$5 million Technical Service Agreement with Beijing Tong Ren Tang Chinese Medicine Company Limited, potentially enhancing technological capabilities but not directly impacting free cash flow coverage for dividends.

- Get an in-depth perspective on Tong Ren Tang Technologies' performance by reading our dividend report here.

- The analysis detailed in our Tong Ren Tang Technologies valuation report hints at an inflated share price compared to its estimated value.

MEISEI INDUSTRIALLtd (TSE:1976)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MEISEI INDUSTRIAL Co., Ltd. is a construction works company operating both in Japan and internationally, with a market cap of ¥63.44 billion.

Operations: MEISEI INDUSTRIAL Co., Ltd. generates revenue primarily from its Construction Work segment, which accounts for ¥58.19 billion, and its Boiler Business segment, contributing ¥7.26 billion.

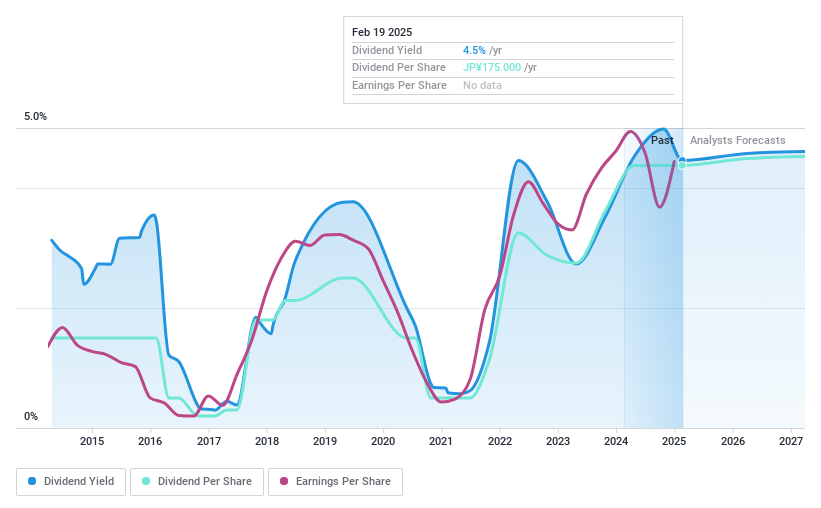

Dividend Yield: 3.5%

MEISEI INDUSTRIAL Ltd. maintains a stable dividend profile with consistent growth over the past decade, supported by a low payout ratio of 38.3%. Despite this, its 3.53% yield is below top-tier Japanese market payers and not covered by free cash flows due to lack thereof. The company's P/E ratio of 9.1x reflects good value compared to the broader market, yet sustainability concerns arise from dividends not being backed by earnings or cash flows.

- Take a closer look at MEISEI INDUSTRIALLtd's potential here in our dividend report.

- The valuation report we've compiled suggests that MEISEI INDUSTRIALLtd's current price could be inflated.

Hitachi Construction Machinery (TSE:6305)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hitachi Construction Machinery Co., Ltd., along with its subsidiaries, is engaged in the global manufacturing and sales of construction machinery, with a market cap of ¥9.18 billion.

Operations: Hitachi Construction Machinery Co., Ltd. generates revenue from its Construction Machinery Business, amounting to ¥1.27 billion, and its Specialized Parts & Service Business, contributing ¥130.86 million.

Dividend Yield: 4.1%

Hitachi Construction Machinery's dividend is well-supported by earnings and cash flow, with a payout ratio of 29.3% and a cash payout ratio of 47.7%. Despite past volatility in dividends, the yield stands at 4.05%, placing it among the top quartile in Japan. However, its unstable dividend history raises concerns about reliability. Trading at 33.6% below estimated fair value suggests good relative value despite high debt levels impacting financial stability.

- Unlock comprehensive insights into our analysis of Hitachi Construction Machinery stock in this dividend report.

- According our valuation report, there's an indication that Hitachi Construction Machinery's share price might be on the cheaper side.

Key Takeaways

- Unlock our comprehensive list of 1123 Top Asian Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tong Ren Tang Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1666

Tong Ren Tang Technologies

Manufactures and sells Chinese medicine products in Mainland China and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives