As global markets navigate a landscape marked by record highs in major indexes and optimism surrounding AI investments, small-cap stocks have lagged behind their larger counterparts. In this environment of cautious optimism and selective growth, identifying promising opportunities requires a keen eye for companies with strong fundamentals and innovative potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

| Primadaya Plastisindo | 10.46% | 15.41% | 23.92% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 34.82% | 2.24% | -22.15% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Haw Par (SGX:H02)

Simply Wall St Value Rating: ★★★★★☆

Overview: Haw Par Corporation Limited is engaged in the manufacturing, marketing, and trading of healthcare products across Singapore, ASEAN countries, other Asian regions, and internationally, with a market capitalization of SGD2.52 billion.

Operations: Haw Par generates revenue primarily from its healthcare products, totaling SGD220.30 million. The company's market capitalization is approximately SGD2.52 billion.

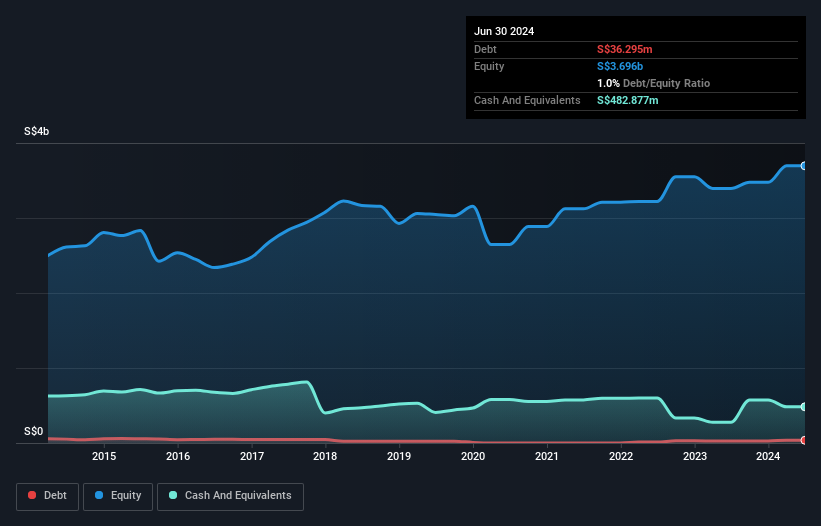

Haw Par's earnings growth of 33.8% over the past year outpaces the Pharmaceuticals industry average of 8.6%, showcasing robust performance. The company holds more cash than its total debt, suggesting a strong financial position, although its debt-to-equity ratio has increased from 0.8 to 1 over five years, indicating higher leverage. With a price-to-earnings ratio of 10.8x below the Singapore market average of 12x, it appears undervalued relative to peers. High-quality earnings and positive free cash flow further highlight Haw Par’s solid footing in its sector, offering potential for continued strength and stability moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Haw Par.

Examine Haw Par's past performance report to understand how it has performed in the past.

Taihei Dengyo Kaisha (TSE:1968)

Simply Wall St Value Rating: ★★★★★★

Overview: Taihei Dengyo Kaisha, Ltd. operates in the plant construction industry both domestically and internationally, with a market capitalization of ¥97.77 billion.

Operations: Taihei Dengyo Kaisha generates revenue primarily from its Construction and Maintenance and Renovation segments, with the latter contributing significantly more at ¥85.49 billion compared to ¥46.15 billion from Construction.

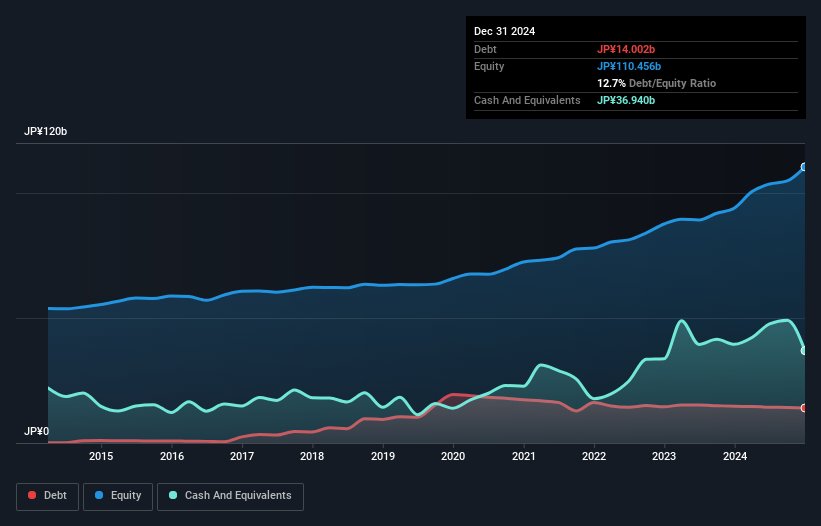

With a price-to-earnings ratio of 10.2x, Taihei Dengyo Kaisha appears attractively valued compared to the JP market's 13.5x. The company's debt-to-equity ratio has impressively decreased from 23.9% to 13.6% over the past five years, indicating solid financial management and reduced leverage. Earnings have grown at an annual rate of 13.2%, though recent growth of 17% slightly lagged behind the construction industry's average of 20.7%. Despite this, Taihei remains profitable with high-quality earnings and more cash than total debt, suggesting a stable financial footing for future operations and potential growth opportunities in its sector.

- Click to explore a detailed breakdown of our findings in Taihei Dengyo Kaisha's health report.

Evaluate Taihei Dengyo Kaisha's historical performance by accessing our past performance report.

Comture (TSE:3844)

Simply Wall St Value Rating: ★★★★★☆

Overview: Comture Corporation offers cloud, digital, business, platform and operation, and digital learning solutions in Japan with a market capitalization of ¥69.36 billion.

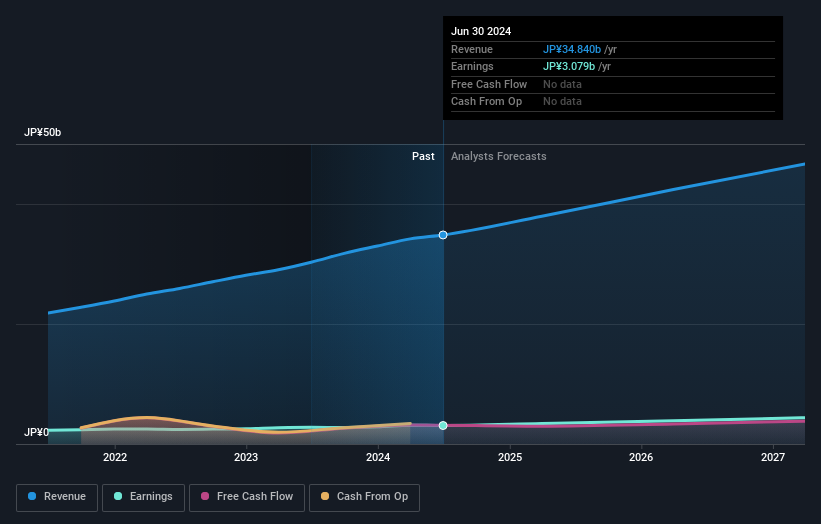

Operations: The company's revenue primarily comes from its Solution Services segment, which generated ¥35.22 billion.

Comture, a player in the tech sector, has shown impressive earnings growth of 14.6% over the past year, outpacing the IT industry average of 11.4%. With a debt to equity ratio reduced from 4.5 to 1.2 over five years and trading at about 24% below its estimated fair value, it seems well-positioned financially. The company recently affirmed a dividend of ¥12 per share for Q2 FY2025, signaling confidence in its cash flow stability despite recent share price volatility. Its robust non-cash earnings suggest high-quality profits that could support future growth prospects in this dynamic industry landscape.

- Get an in-depth perspective on Comture's performance by reading our health report here.

Review our historical performance report to gain insights into Comture's's past performance.

Key Takeaways

- Navigate through the entire inventory of 4671 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haw Par might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H02

Haw Par

Manufactures, markets, and trades in healthcare products in Singapore, ASEAN countries, other Asian countries, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives