- Japan

- /

- Construction

- /

- TSE:1968

There May Be Underlying Issues With The Quality Of Taihei Dengyo Kaisha's (TSE:1968) Earnings

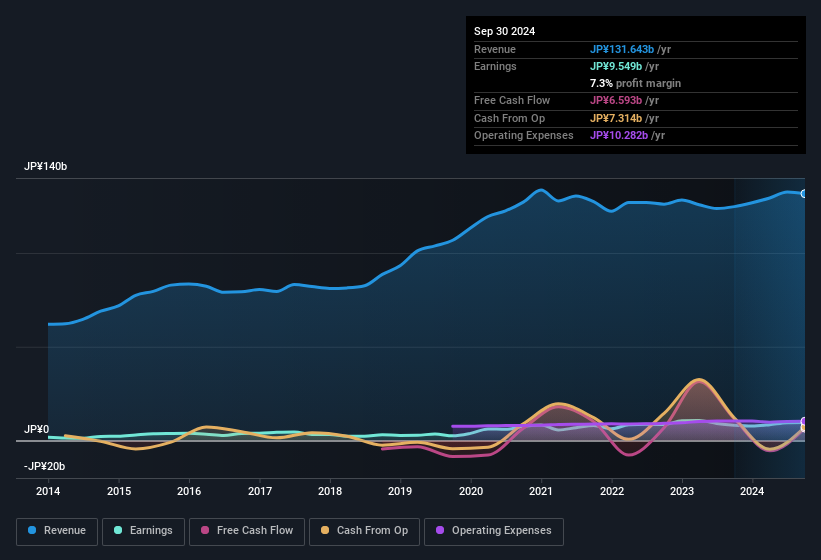

Taihei Dengyo Kaisha, Ltd. (TSE:1968) announced strong profits, but the stock was stagnant. Our analysis suggests that shareholders have noticed something concerning in the numbers.

View our latest analysis for Taihei Dengyo Kaisha

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Taihei Dengyo Kaisha expanded the number of shares on issue by 5.7% over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Taihei Dengyo Kaisha's historical EPS growth by clicking on this link.

A Look At The Impact Of Taihei Dengyo Kaisha's Dilution On Its Earnings Per Share (EPS)

As you can see above, Taihei Dengyo Kaisha has been growing its net income over the last few years, with an annualized gain of 19% over three years. And over the last 12 months, the company grew its profit by 17%. On the other hand, earnings per share are only up 14% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So Taihei Dengyo Kaisha shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Taihei Dengyo Kaisha's Profit Performance

Each Taihei Dengyo Kaisha share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Therefore, it seems possible to us that Taihei Dengyo Kaisha's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 16% per annum growth in EPS for the last three. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. At Simply Wall St, we found 2 warning signs for Taihei Dengyo Kaisha and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of Taihei Dengyo Kaisha's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Taihei Dengyo Kaisha, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taihei Dengyo Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1968

Taihei Dengyo Kaisha

Engages in the plant construction business in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives