- Japan

- /

- Construction

- /

- TSE:1968

Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate through a period of broad-based gains and geopolitical uncertainties, U.S. indexes are approaching record highs, buoyed by positive labor market data and stabilizing economic indicators. In this context, dividend stocks present an attractive option for investors seeking steady income streams amid fluctuating market conditions. A good dividend stock typically combines a strong financial foundation with consistent payout histories, providing potential stability in uncertain times like these.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.31% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

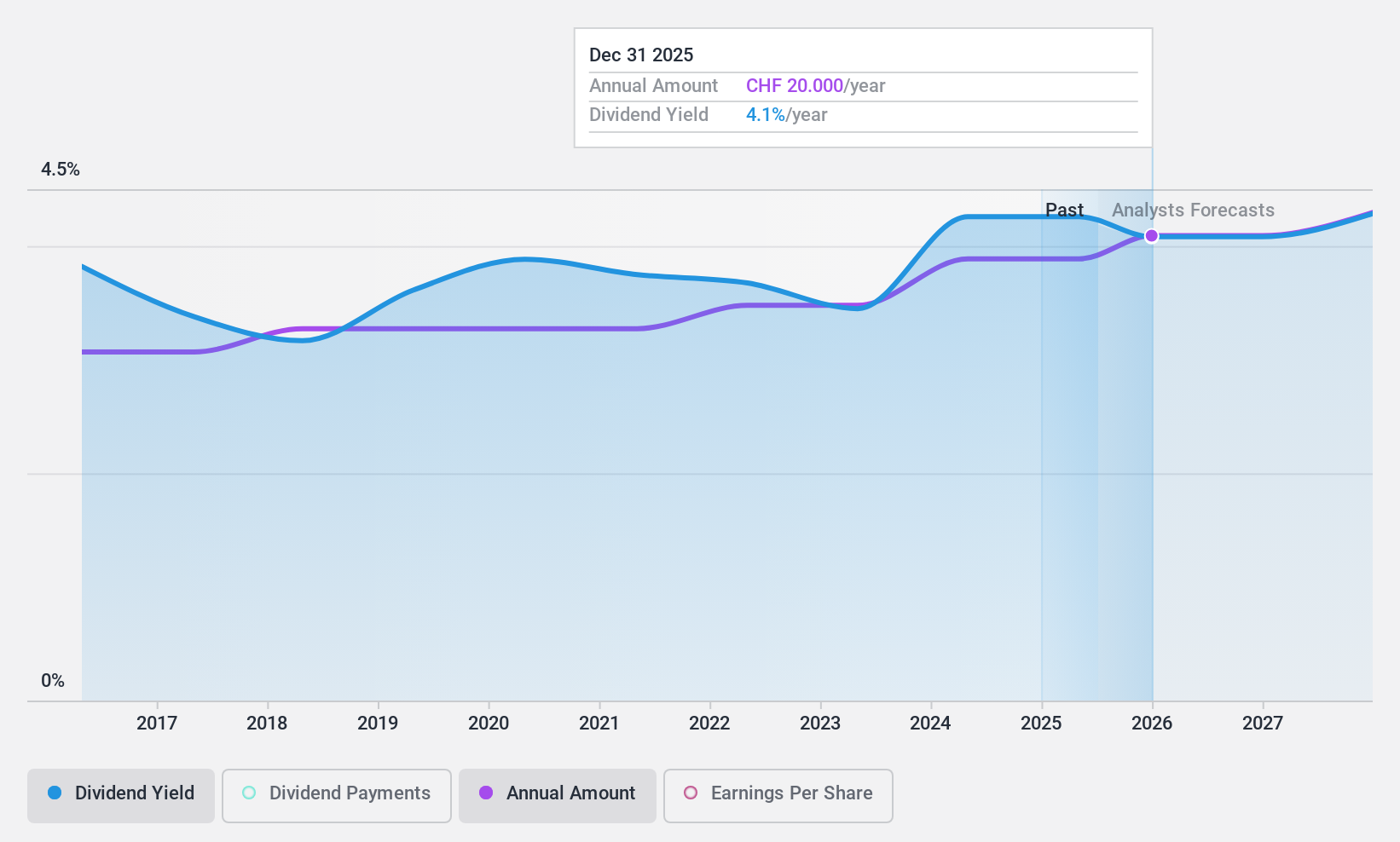

St. Galler Kantonalbank (SWX:SGKN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: St. Galler Kantonalbank AG is a cantonal bank offering banking products and services to the local population and small to medium-sized enterprises in the Cantons of St. Gallen, with a market cap of CHF2.54 billion.

Operations: St. Galler Kantonalbank AG's revenue segments focus on providing comprehensive banking products and services to individuals and SMEs in the St. Gallen region.

Dividend Yield: 4.5%

St. Galler Kantonalbank offers a high and reliable dividend yield of 4.47%, placing it in the top 25% of Swiss dividend payers. The bank's dividends are well-covered by earnings with a current payout ratio of 57.1%, forecasted to improve to 52.1% in three years, indicating sustainability. Over the past decade, dividends have been stable and growing, enhancing their attractiveness for income-focused investors while trading at a significant discount to its estimated fair value.

- Take a closer look at St. Galler Kantonalbank's potential here in our dividend report.

- The valuation report we've compiled suggests that St. Galler Kantonalbank's current price could be quite moderate.

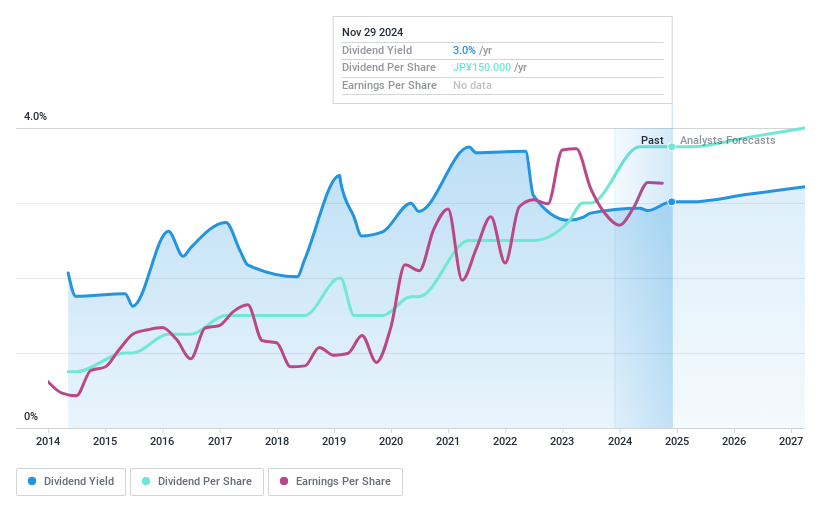

Taihei Dengyo Kaisha (TSE:1968)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taihei Dengyo Kaisha, Ltd. operates in the plant construction industry both in Japan and internationally, with a market capitalization of ¥100.95 billion.

Operations: Taihei Dengyo Kaisha, Ltd.'s revenue primarily comes from its plant construction business in Japan and abroad.

Dividend Yield: 3%

Taihei Dengyo Kaisha's dividend yield of 2.99% is below the top 25% in Japan, but its payout ratio of 27.6% indicates dividends are well-covered by earnings and cash flows (45.8%). Despite a volatile dividend history, payments have increased over the past decade. The company is expanding into biomass power projects, which may impact future financials and dividend stability. Trading at a favorable P/E ratio of 10.6x compared to the market average enhances its value proposition.

- Navigate through the intricacies of Taihei Dengyo Kaisha with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Taihei Dengyo Kaisha is trading behind its estimated value.

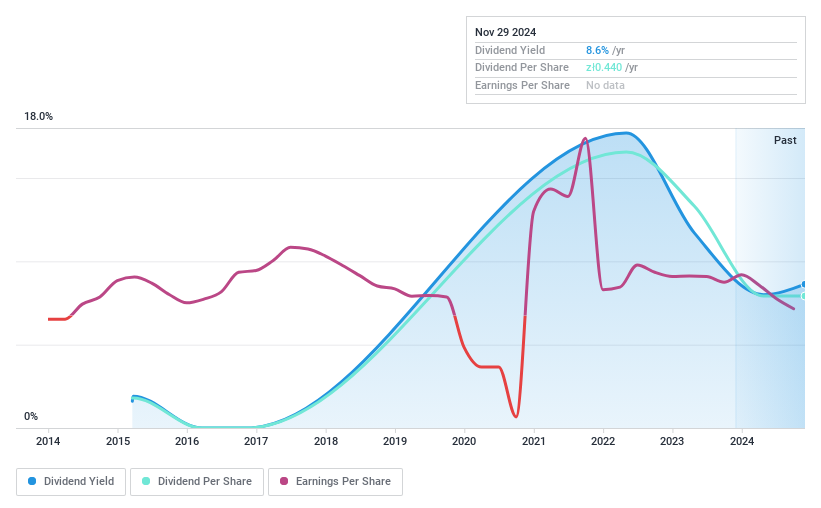

Boryszew (WSE:BRS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boryszew S.A. operates in the automotive, metals, and chemical products sectors both in Poland and internationally, with a market capitalization of PLN1.04 billion.

Operations: Boryszew S.A.'s revenue is primarily derived from its motorization segment, contributing PLN1.66 billion, and its chemistry segment, which accounts for PLN161.59 million.

Dividend Yield: 8.7%

Boryszew's dividend yield of 8.66% ranks in the top 25% of Polish payers, but its high payout ratio (486.5%) suggests dividends are not covered by earnings or cash flows despite a reasonable cash payout ratio (54.6%). The company's dividend history is volatile and unreliable, with past payments experiencing significant fluctuations. Recent financial results show a net loss for Q3 2024 and declining sales, raising concerns about future dividend sustainability amidst shrinking profit margins.

- Click to explore a detailed breakdown of our findings in Boryszew's dividend report.

- In light of our recent valuation report, it seems possible that Boryszew is trading beyond its estimated value.

Taking Advantage

- Delve into our full catalog of 1970 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taihei Dengyo Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1968

Taihei Dengyo Kaisha

Engages in the plant construction business in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.