- Japan

- /

- Construction

- /

- TSE:1961

How Incremental Share Buybacks At Sanki Engineering (TSE:1961) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Sanki Engineering Co., Ltd. recently repurchased 218,000 of its own shares on the Tokyo Stock Exchange as part of a previously authorized program to buy back up to 1,000,000 shares, aiming to refine its capital structure.

- This incremental execution of the buyback plan underlines management’s willingness to return capital to shareholders while adjusting the company’s equity base over time.

- We’ll now explore how this ongoing share repurchase activity could shape Sanki Engineering’s investment narrative and perceived capital discipline.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Sanki Engineering's Investment Narrative?

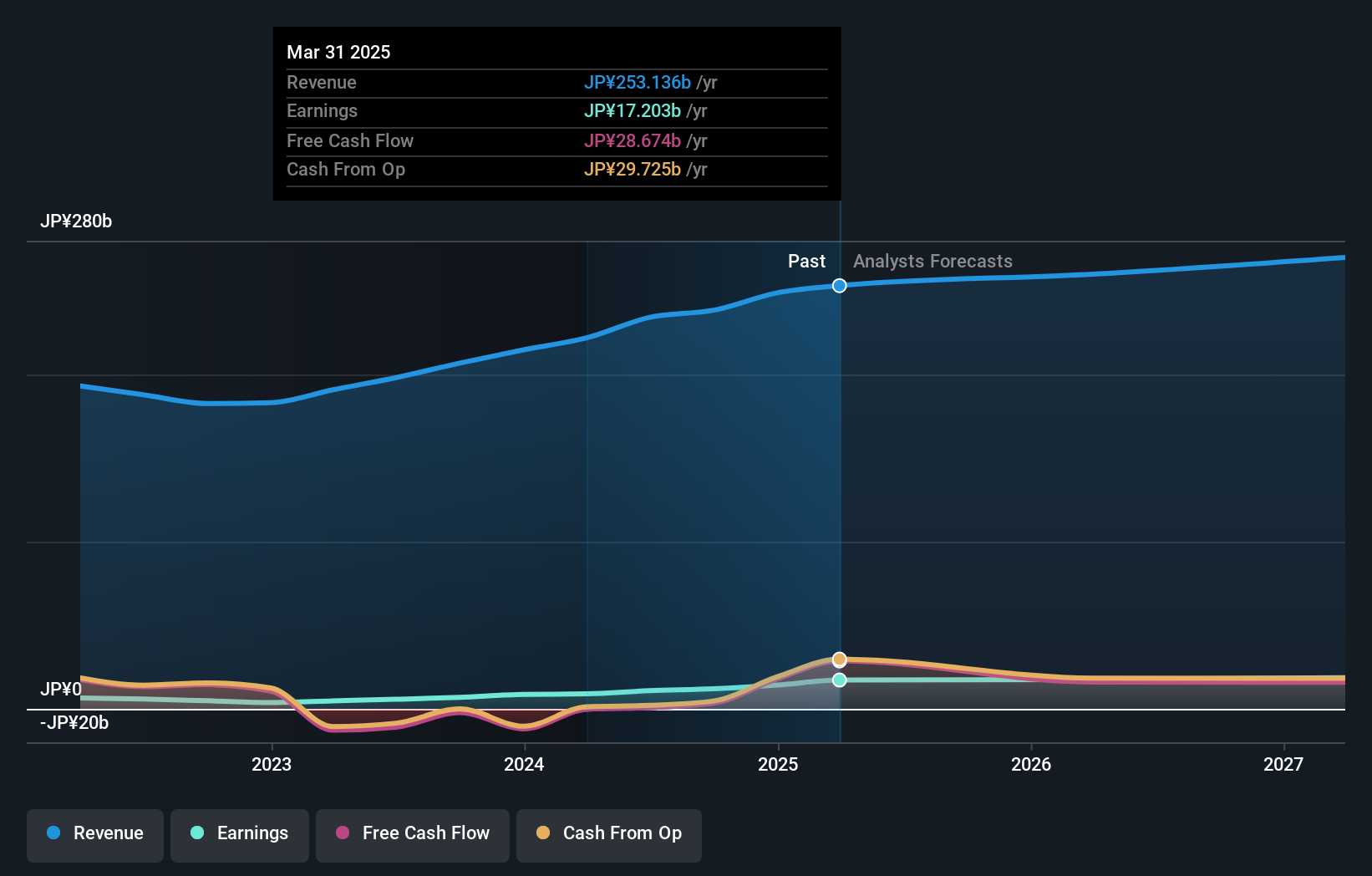

To own Sanki Engineering, you have to believe in a steady, execution-led story: incremental revenue and earnings growth, decent but not spectacular returns on equity, and management focused on both reinvestment and shareholder payouts. The raised guidance for the year ending March 2026 and higher dividend signals confidence around margins and order visibility, while earnings growth has been solid rather than explosive. Against that backdrop, the latest share repurchase of 218,000 shares looks more like a steady reinforcement of capital discipline than a game‑changing catalyst, especially given the modest size relative to market value and recent strong share price performance. It modestly enhances per-share metrics and supports the case for disciplined capital allocation, but it does not materially alter key short term drivers or the core risk profile.

However, investors should also recognise how an unstable dividend track record could complicate this story. Despite retreating, Sanki Engineering's shares might still be trading 41% above their fair value. Discover the potential downside here.Exploring Other Perspectives

The Simply Wall St Community’s fair value views cluster around about ¥8,915 per share, offering one concentrated but independent reference point. Set against Sanki Engineering’s healthy recent earnings momentum and active capital returns, this highlights how even similar numbers can lead to very different judgments about how durable today’s profitability and payout policies will prove. Readers can compare these community estimates with their own assessment of execution risk and capital allocation choices to decide where they stand.

Explore another fair value estimate on Sanki Engineering - why the stock might be worth as much as 68% more than the current price!

Build Your Own Sanki Engineering Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sanki Engineering research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sanki Engineering research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sanki Engineering's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1961

Sanki Engineering

Provides various social infrastructure services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026