- Japan

- /

- Construction

- /

- TSE:1980

Uncovering Undiscovered Gems with Promising Fundamentals in December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of interest rate adjustments and economic shifts, small-cap stocks have faced notable challenges, with the Russell 2000 Index underperforming against larger indices like the S&P 500. Amidst this backdrop, identifying stocks with strong fundamentals becomes crucial, as these qualities can offer resilience and potential growth opportunities even when broader market sentiment is mixed.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shin Nippon Air Technologies (TSE:1952)

Simply Wall St Value Rating: ★★★★★★

Overview: Shin Nippon Air Technologies Co., Ltd. and its subsidiaries offer engineering systems for air, water, heat, and other areas of air conditioning, electrical, and sanitary facilities both in Japan and internationally; the company has a market cap of approximately ¥89.83 billion.

Operations: Shin Nippon Air Technologies generates revenue primarily from engineering systems related to air conditioning, electrical, and sanitary facilities. The company has a market cap of approximately ¥89.83 billion.

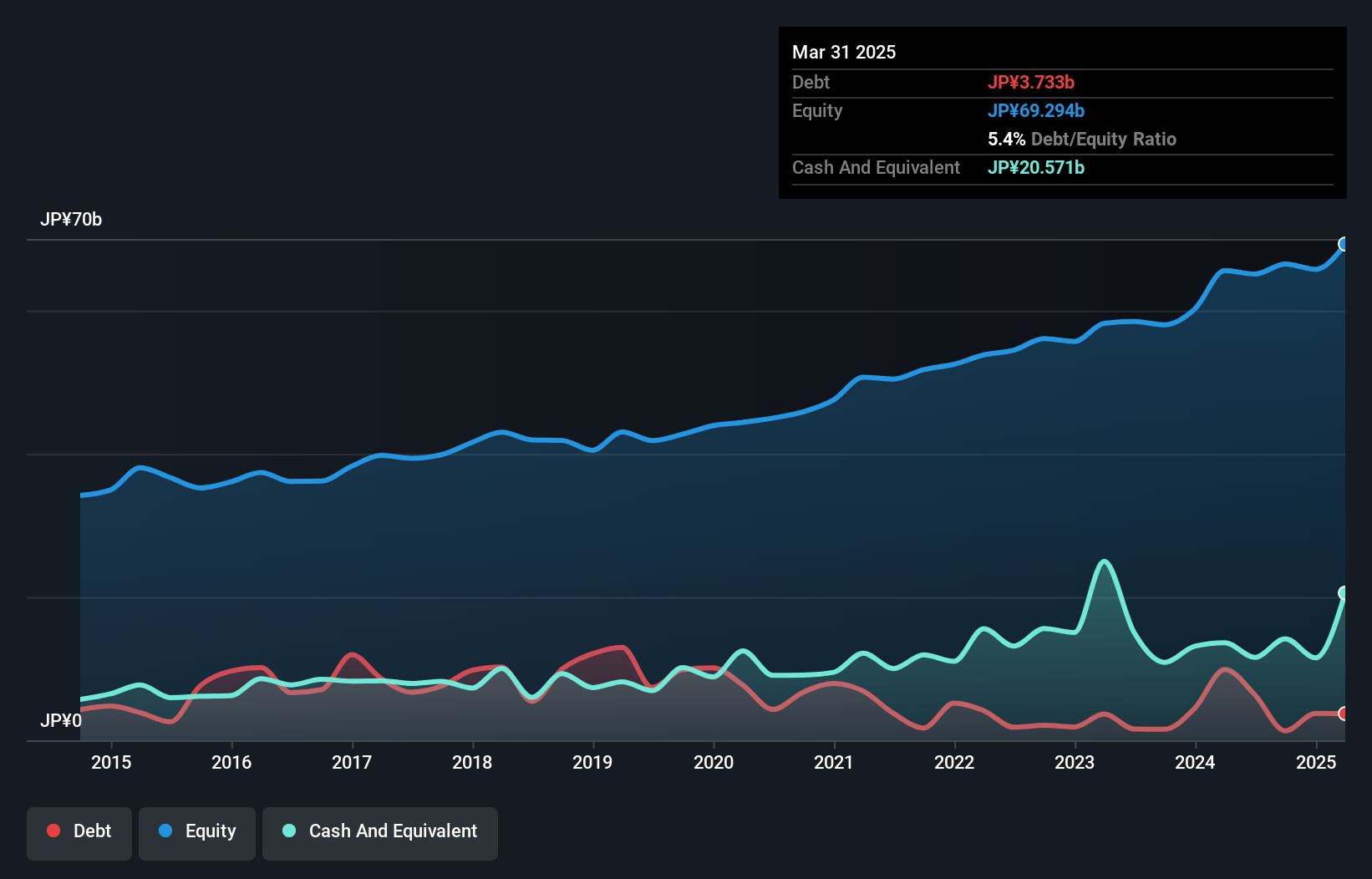

Shin Nippon Air Technologies, a standout in its sector, has seen impressive earnings growth of 63.5% over the past year, outpacing the building industry’s average of 7.6%. This company sports high-quality earnings and maintains a solid financial footing with more cash than total debt, which has improved its debt-to-equity ratio from 23% to just 2% over five years. With a price-to-earnings ratio of 12x below Japan's market average of 13.4x, it offers value potential. Recent moves include a share repurchase program to enhance shareholder returns and improve capital efficiency by buying back up to ¥1 billion worth of shares.

Dai-Dan (TSE:1980)

Simply Wall St Value Rating: ★★★★☆☆

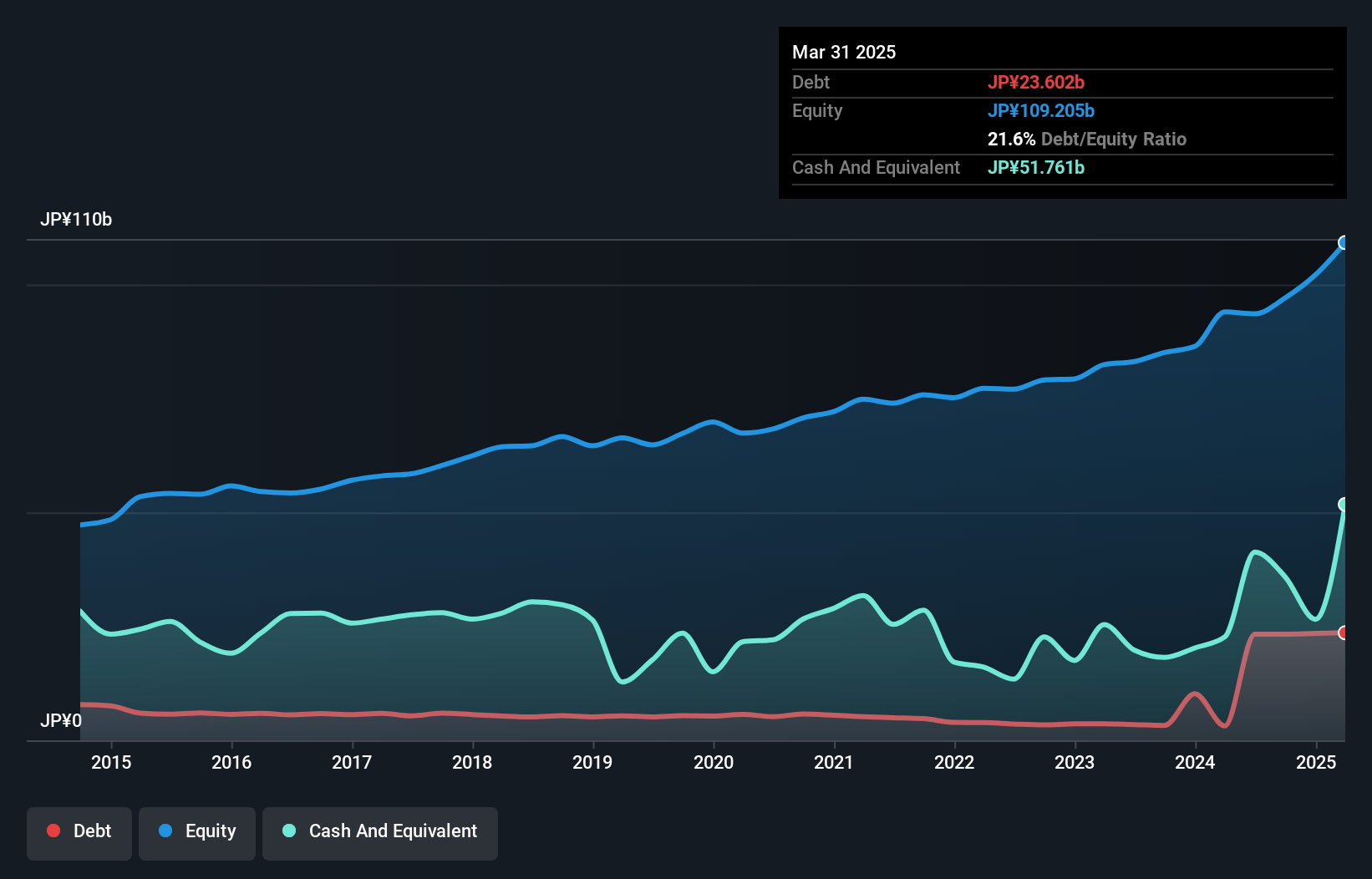

Overview: Dai-Dan Co., Ltd. specializes in the design, supervision, and construction of electrical, air conditioning, plumbing and sanitary, and firefighting facilities works in Japan with a market cap of ¥164.68 billion.

Operations: The company generates revenue primarily from its design, supervision, and construction services in electrical, air conditioning, plumbing and sanitary, and firefighting facilities. It operates with a market cap of ¥164.68 billion.

Dai-Dan, a promising player in the construction industry, has shown remarkable earnings growth of 102% over the past year, outpacing the industry's 20%. With more cash than total debt, its financial footing seems solid despite a rising debt-to-equity ratio from 8% to 24% over five years. The company trades at nearly 36% below estimated fair value, indicating potential undervaluation. Recent guidance projects net sales of ¥250 billion and operating profit of ¥17.5 billion for fiscal year ending March 2025. Additionally, Dai-Dan increased its dividend to ¥52 per share for Q2 from last year's ¥27.50.

- Navigate through the intricacies of Dai-Dan with our comprehensive health report here.

Examine Dai-Dan's past performance report to understand how it has performed in the past.

KYE Systems (TWSE:2365)

Simply Wall St Value Rating: ★★★★★★

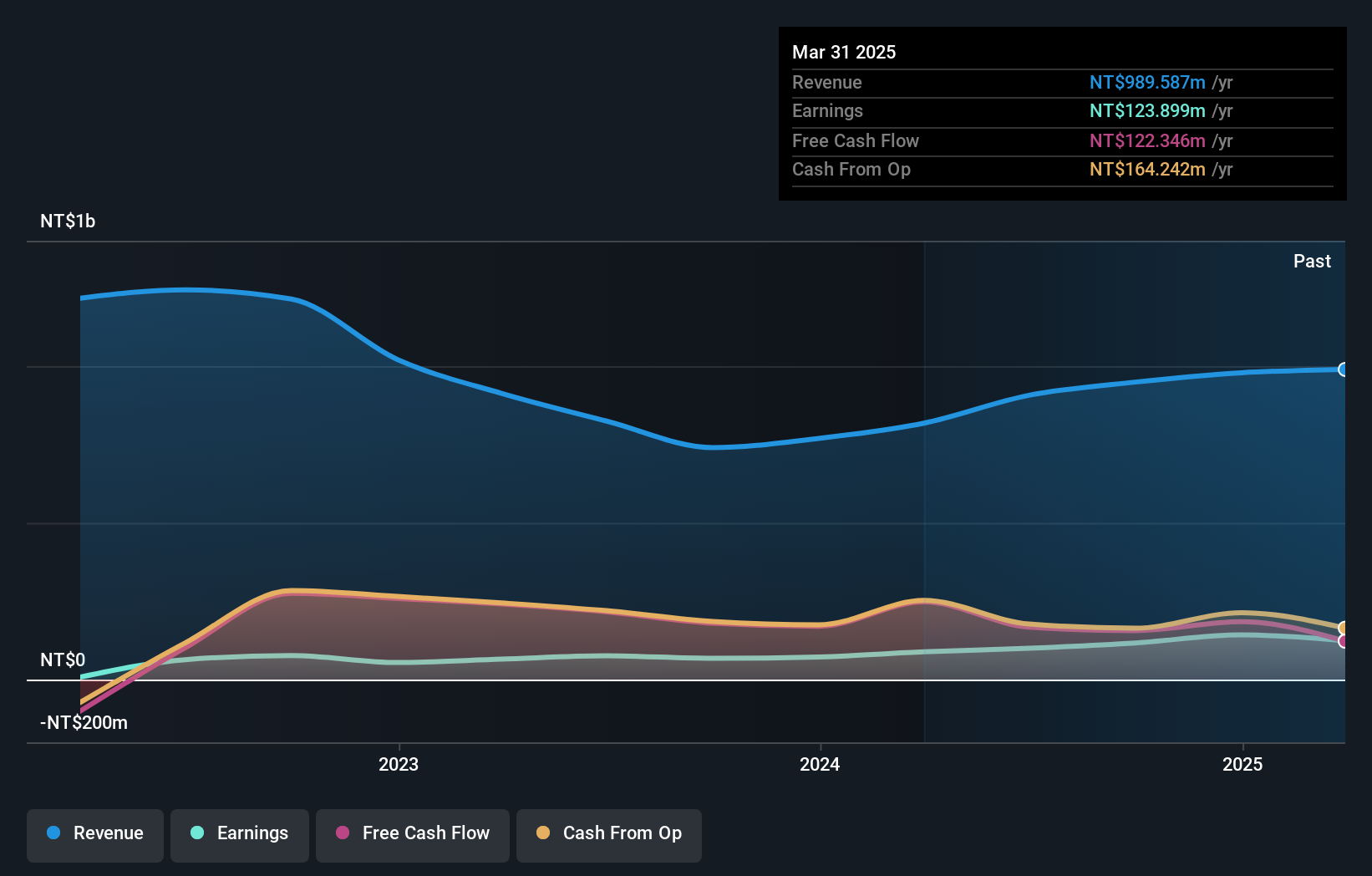

Overview: KYE Systems Corp. specializes in the manufacturing, processing, and trading of computer peripheral products for various sectors including business, lifestyle, mobility, and gaming peripherals with a market cap of NT$9.37 billion.

Operations: KYE Systems Corp. generates its revenue primarily from 3C electronic products, amounting to NT$947.03 million.

KYE Systems, a nimble player in the tech arena, has shown impressive earnings growth of 71.7% over the past year, outpacing the industry average of 11.4%. Despite a yearly decline of 14.3% over five years, recent figures reveal net income for Q3 at TWD 47.72 million from TWD 30.87 million previously and sales climbing to TWD 262.74 million from TWD 219.95 million last year. The company boasts more cash than total debt and reduced its debt-to-equity ratio to just 7.3%, indicating robust financial health as it joins the S&P Global BMI Index, highlighting its growing market presence.

- Take a closer look at KYE Systems' potential here in our health report.

Evaluate KYE Systems' historical performance by accessing our past performance report.

Summing It All Up

- Dive into all 4621 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1980

Dai-Dan

Engages in the design, supervision, and construction of electrical, air conditioning, plumbing and sanitary, and firefighting facilities works in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives