Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that EXEO Group, Inc. (TSE:1951) does use debt in its business. But should shareholders be worried about its use of debt?

Our free stock report includes 1 warning sign investors should be aware of before investing in EXEO Group. Read for free now.What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

How Much Debt Does EXEO Group Carry?

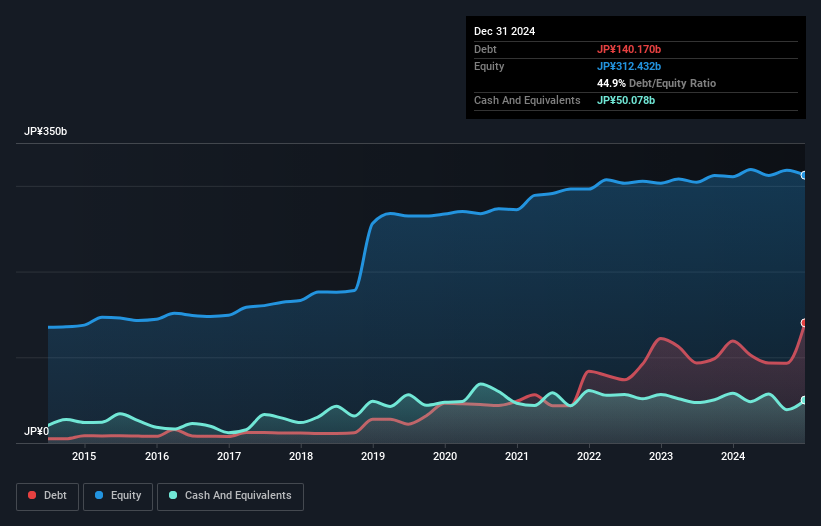

As you can see below, at the end of December 2024, EXEO Group had JP¥140.2b of debt, up from JP¥118.9b a year ago. Click the image for more detail. However, it does have JP¥50.1b in cash offsetting this, leading to net debt of about JP¥90.1b.

How Strong Is EXEO Group's Balance Sheet?

The latest balance sheet data shows that EXEO Group had liabilities of JP¥196.9b due within a year, and liabilities of JP¥88.3b falling due after that. On the other hand, it had cash of JP¥50.1b and JP¥203.3b worth of receivables due within a year. So it has liabilities totalling JP¥31.8b more than its cash and near-term receivables, combined.

Given EXEO Group has a market capitalization of JP¥352.2b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

View our latest analysis for EXEO Group

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

We'd say that EXEO Group's moderate net debt to EBITDA ratio ( being 1.7), indicates prudence when it comes to debt. And its commanding EBIT of 354 times its interest expense, implies the debt load is as light as a peacock feather. One way EXEO Group could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 18%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if EXEO Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, EXEO Group reported free cash flow worth 19% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Happily, EXEO Group's impressive interest cover implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. All these things considered, it appears that EXEO Group can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for EXEO Group that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if EXEO Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1951

EXEO Group

Engages in telecommunications, civil engineering, construction, electric equipment, system solutions, and renewable energy business in Japan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives