- Taiwan

- /

- Tech Hardware

- /

- TWSE:6117

Discovering Hidden Gems With Promising Potential In November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains, with smaller-cap indexes outperforming their larger counterparts and economic indicators like U.S. jobless claims reaching new lows, investors are keenly observing the potential within small-cap stocks. In this environment of cautious optimism, identifying a good stock often involves looking for companies that demonstrate resilience and growth potential amidst geopolitical uncertainties and shifting economic policies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Youcare Pharmaceutical Group (SHSE:688658)

Simply Wall St Value Rating: ★★★★★★

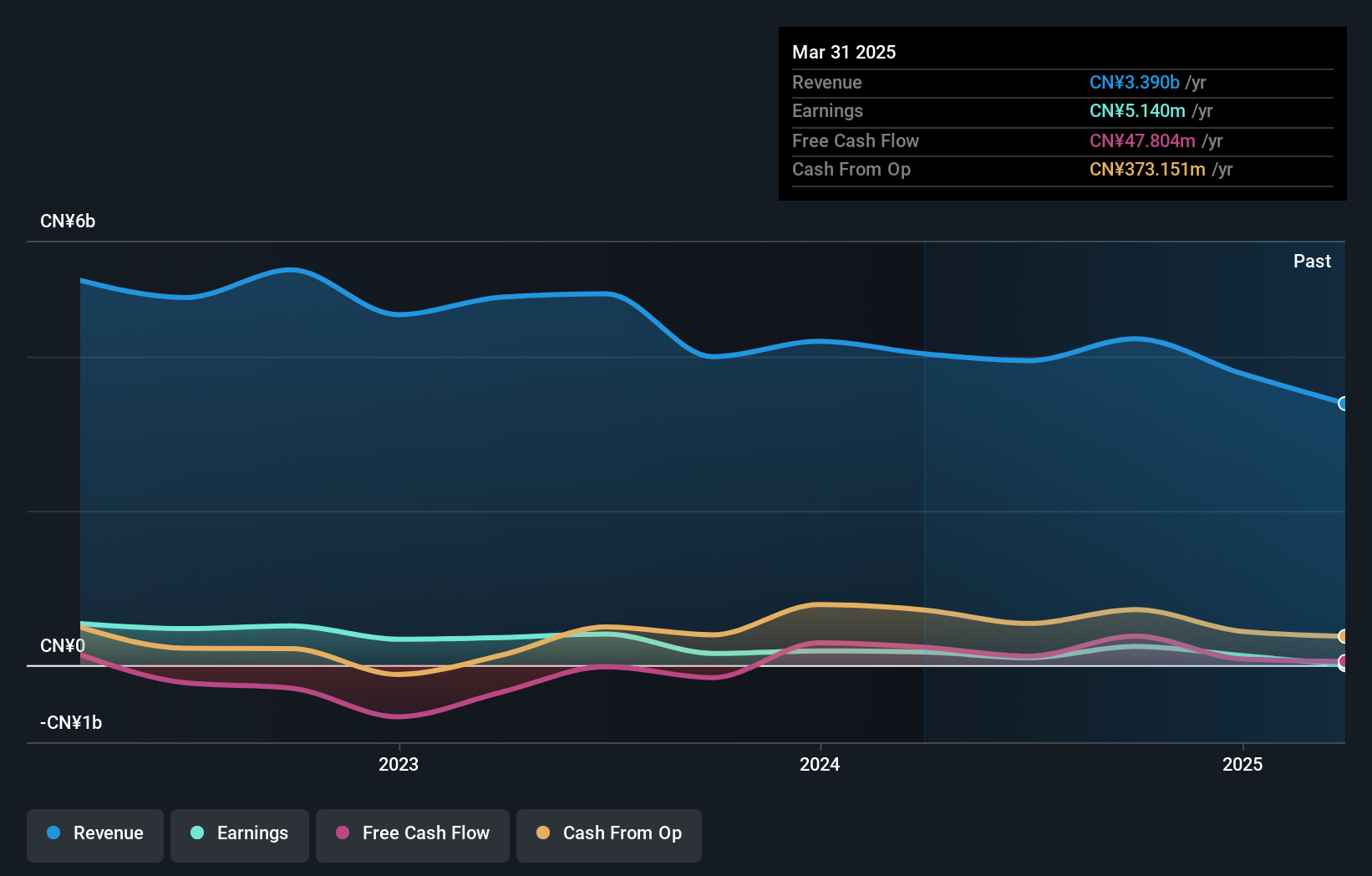

Overview: Youcare Pharmaceutical Group Co., Ltd. focuses on the research, development, manufacture, distribution, and sale of pharmaceutical products with a market capitalization of CN¥9.03 billion.

Operations: Youcare Pharmaceutical Group generates revenue primarily from the sale of pharmaceutical products. The company has a market capitalization of approximately CN¥9.03 billion, reflecting its financial standing in the industry.

Youcare Pharmaceutical Group, a promising player in the pharmaceutical industry, has shown remarkable financial resilience. Over the past year, earnings surged by 59.4%, outpacing the industry's -2.5% growth rate. The company's debt-to-equity ratio improved significantly from 40.8% to 19% over five years, indicating prudent financial management. Its interest payments are well covered with an impressive EBIT coverage of 262 times, suggesting strong operational performance. Recent earnings reports highlight a net income increase to CNY 209 million from CNY 152 million last year, reflecting solid profitability and potential for future growth in this dynamic sector.

- Click here and access our complete health analysis report to understand the dynamics of Youcare Pharmaceutical Group.

Gain insights into Youcare Pharmaceutical Group's past trends and performance with our Past report.

Nippon Densetsu Kogyo (TSE:1950)

Simply Wall St Value Rating: ★★★★★★

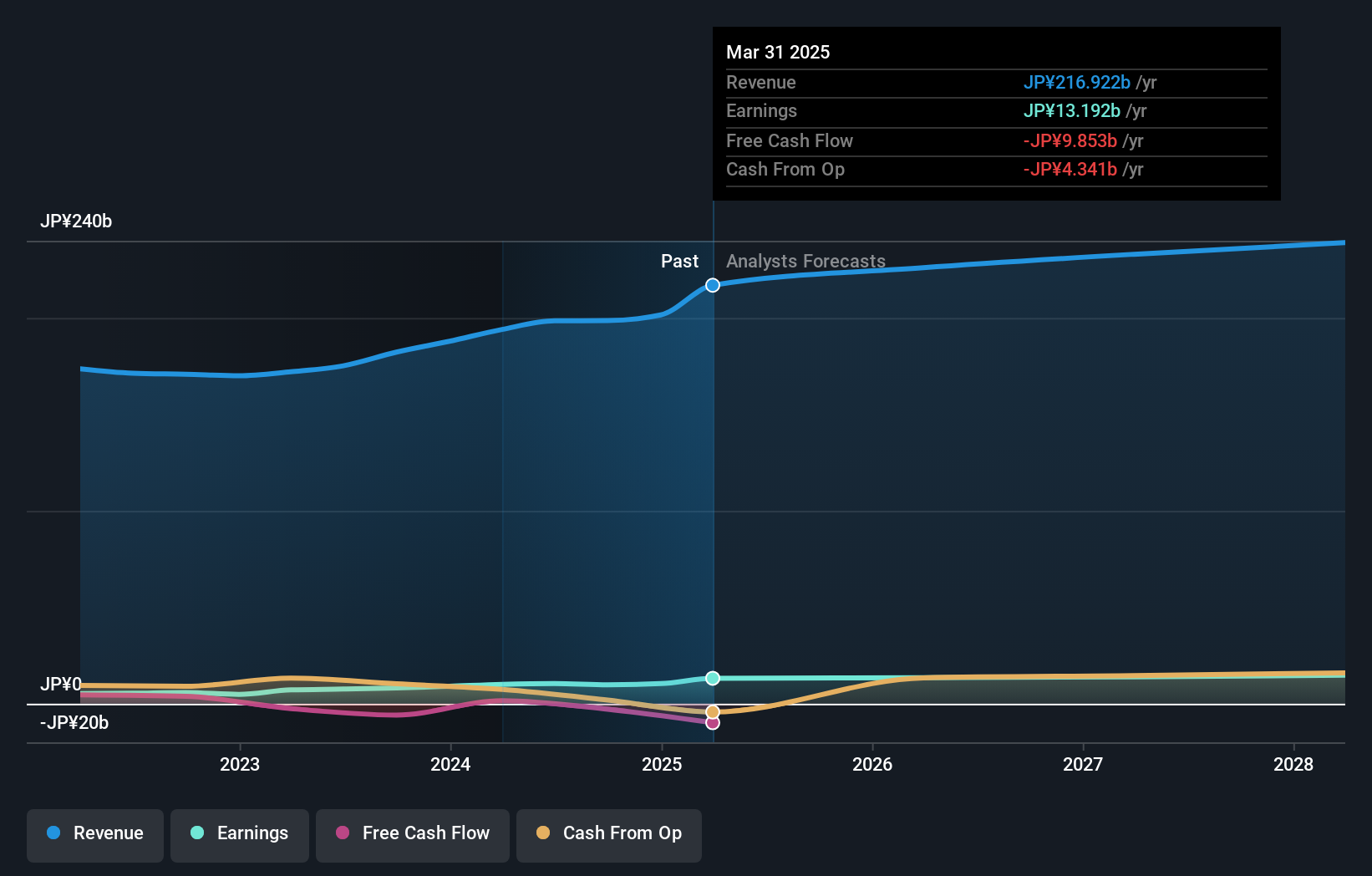

Overview: Nippon Densetsu Kogyo Co., Ltd. is a Japanese company specializing in railway electronics equipment construction, with a market capitalization of approximately ¥110.04 billion.

Operations: Nippon Densetsu Kogyo generates revenue primarily from its facility installation work, totaling ¥198.62 billion. The company's net profit margin reflects its financial efficiency in managing costs related to this core business segment.

Nippon Densetsu Kogyo, a promising player in the construction sector, has shown notable financial resilience. With earnings growth of 20.9% over the past year, it outpaced the industry's 19.2% increase. The company boasts a favorable price-to-earnings ratio of 11x compared to Japan's market average of 13x, suggesting potential undervaluation. Despite not being free cash flow positive recently, its debt-to-equity ratio decreased from 0.06% to 0.05% over five years, indicating prudent financial management. Future earnings are expected to grow by about 4%, hinting at steady progress in this niche market segment.

In Win Development (TWSE:6117)

Simply Wall St Value Rating: ★★★★☆☆

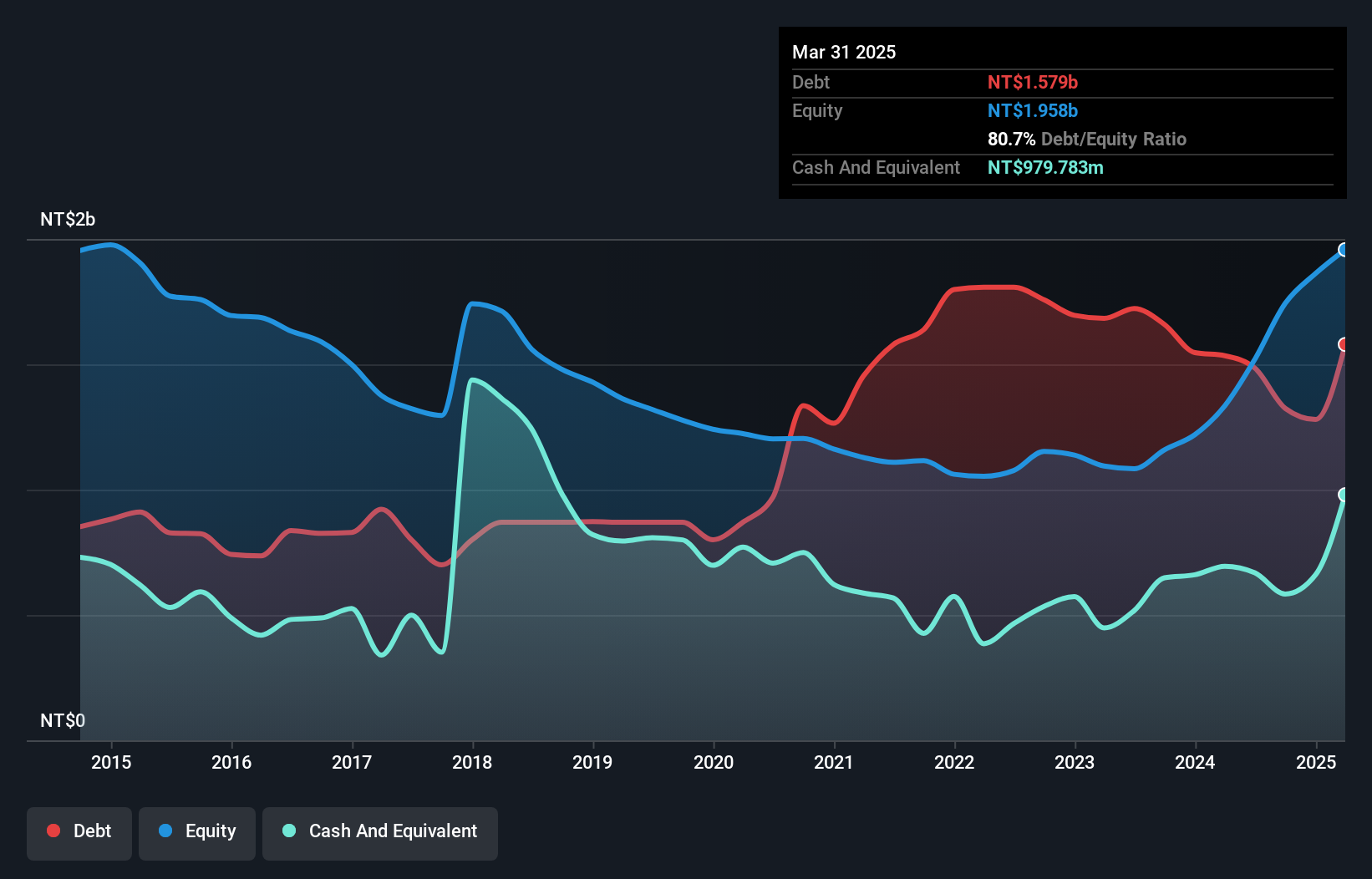

Overview: In Win Development Inc. engages in the processing, manufacturing, and trading of computer and peripheral equipment across Russia, the United States, Japan, Taiwan, and other international markets with a market cap of NT$8.47 billion.

Operations: In Win Development generates revenue primarily from the processing, manufacturing, and trading of computer and peripheral equipment across various international markets. The company has a market capitalization of NT$8.47 billion.

In Win Development, a notable player in its sector, recently reported impressive earnings growth of 6738.6% over the past year, significantly outpacing the Tech industry's 10%. The company's net income for Q3 rose to TWD 74.37 million from TWD 62.96 million a year ago, with sales climbing to TWD 678.58 million from TWD 652.99 million previously. Despite this robust performance and high-quality earnings, In Win's debt-to-equity ratio has increased from 68.1% to 76% over five years, indicating higher leverage; however, interest payments remain well-covered by EBIT at an impressive multiple of 11.6x.

Summing It All Up

- Gain an insight into the universe of 4639 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6117

In Win Development

Engages in processing, manufacturing, and trading of computer and peripheral equipment, and plastic products in Europe, the United States, Japan, Taiwan, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives