Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% and the broader TOPIX Index down 1.0%. Despite currency headwinds and a hawkish outlook from the Bank of Japan, there are still opportunities to uncover promising investments in this dynamic market. In such an environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to capitalize on market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Toho Bank | 98.27% | 0.43% | 22.80% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sumitomo DensetsuLtd (TSE:1949)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumitomo Densetsu Co., Ltd., along with its subsidiaries, operates as a construction company in several countries including Japan and various Southeast Asian nations, with a market cap of ¥137.02 billion.

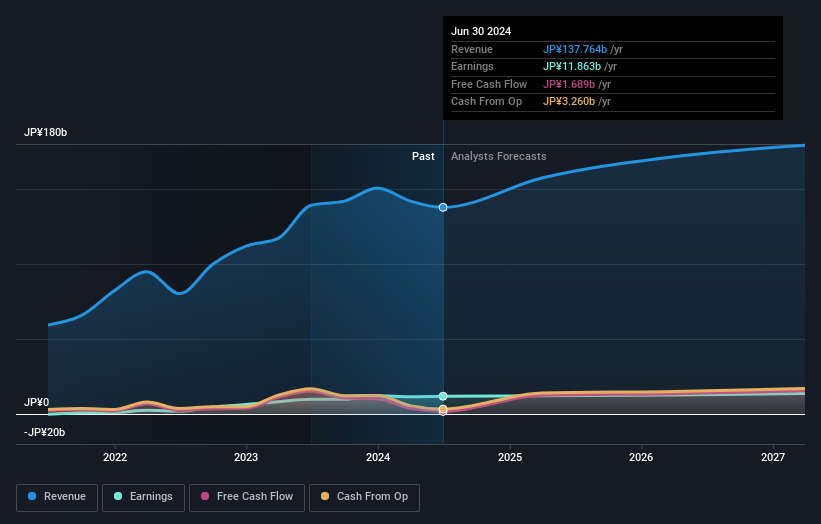

Operations: Sumitomo Densetsu generates revenue primarily from its Utilities Engineering Service segment, which accounted for ¥182.44 billion. The company also reported a minor revenue contribution from other segments totaling ¥7.55 million and a segment adjustment of -¥0.66 million.

Sumitomo Densetsu Ltd. offers a compelling investment case with its strong earnings growth of 33.5% over the past year, outpacing the Construction industry’s 25.5%. The company has reduced its debt to equity ratio from 3.8 to 2 in five years, showcasing prudent financial management. Additionally, with a price-to-earnings ratio of 12.4x below the JP market average of 13.2x, it appears undervalued relative to peers despite recent share price volatility and stable interest coverage ratios.

- Unlock comprehensive insights into our analysis of Sumitomo DensetsuLtd stock in this health report.

Understand Sumitomo DensetsuLtd's track record by examining our Past report.

GNI Group (TSE:2160)

Simply Wall St Value Rating: ★★★★★☆

Overview: GNI Group Ltd. engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally with a market cap of ¥124.90 billion.

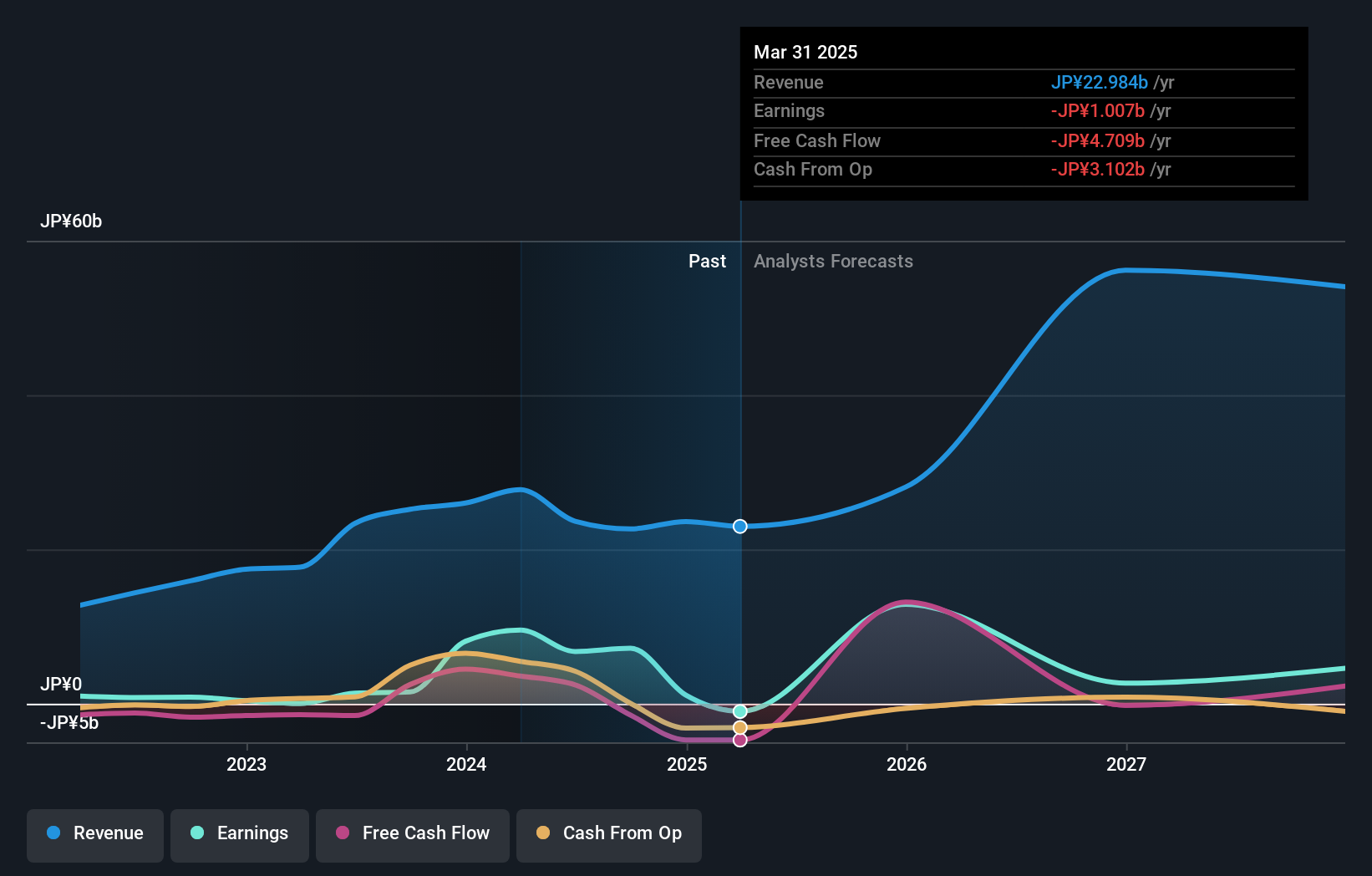

Operations: GNI Group Ltd. generates revenue primarily from its pharmaceutical segment, which brought in ¥19.35 billion, and its medical device segment, which contributed ¥4.30 billion. The company’s net profit margin is not discussed here but can be inferred from the provided financial data for a deeper analysis elsewhere.

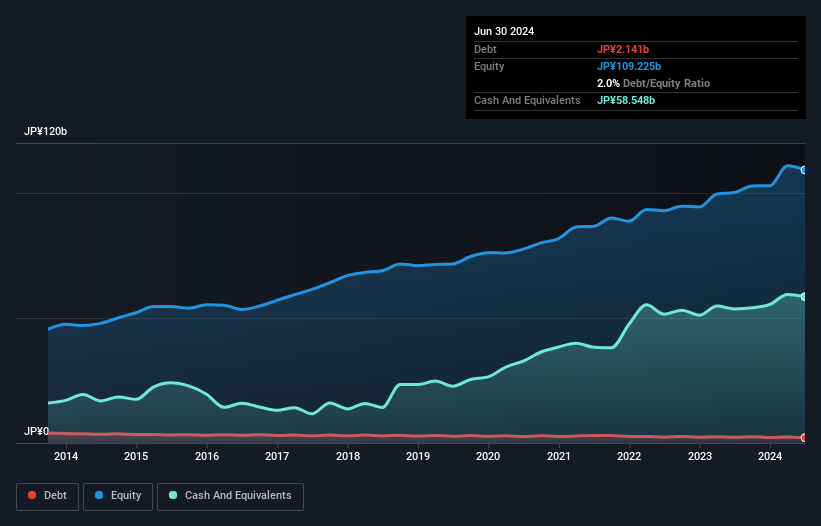

GNI Group, a biotech player, has shown remarkable earnings growth of 393.9% over the past year, outpacing the Biotechs industry average of 172.6%. Their debt to equity ratio improved from 16.8% to 13.8% over five years, reflecting better financial health. Despite high volatility in share price recently, GNI remains profitable with positive free cash flow and forecasts an annual earnings growth rate of nearly 19%. The recent approval for Avatrombopag Maleate Tablets in China adds another product to their lineup and underscores their commitment to treating rare diseases.

- Click here and access our complete health analysis report to understand the dynamics of GNI Group.

Review our historical performance report to gain insights into GNI Group's's past performance.

Tsuburaya Fields Holdings (TSE:2767)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsuburaya Fields Holdings Inc. operates in content-related businesses in Japan with a market cap of ¥132.65 billion.

Operations: The company generates revenue primarily from its PS Business Segment (¥120.91 billion) and Content & Digital Business Segment (¥15.80 billion).

Tsuburaya Fields Holdings, a small-cap stock in Japan's leisure industry, has shown impressive performance with earnings growth of 20.9% over the past year, outpacing the industry average of 5.4%. The company’s debt-to-equity ratio improved from 40.4% to 24.5% over five years, indicating better financial management. Trading at a significant discount of 63.7% below its estimated fair value, it also boasts strong non-cash earnings and positive free cash flow, making it an attractive prospect for investors seeking undervalued opportunities in Japan's market.

Summing It All Up

- Embark on your investment journey to our 754 Japanese Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2160

GNI Group

Engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally.

Undervalued with high growth potential.