- Japan

- /

- Construction

- /

- TSE:1882

Dongkuk HoldingsLtd And 2 Other Top Dividend Stocks For Income

Reviewed by Simply Wall St

In a week marked by U.S. indexes approaching record highs and broad-based gains, the global markets have shown resilience amidst geopolitical tensions and economic uncertainties. As investors navigate these dynamic conditions, dividend stocks like Dongkuk Holdings Ltd offer potential stability and income through regular payouts, making them an attractive option for those seeking to balance growth with consistent returns in today's market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

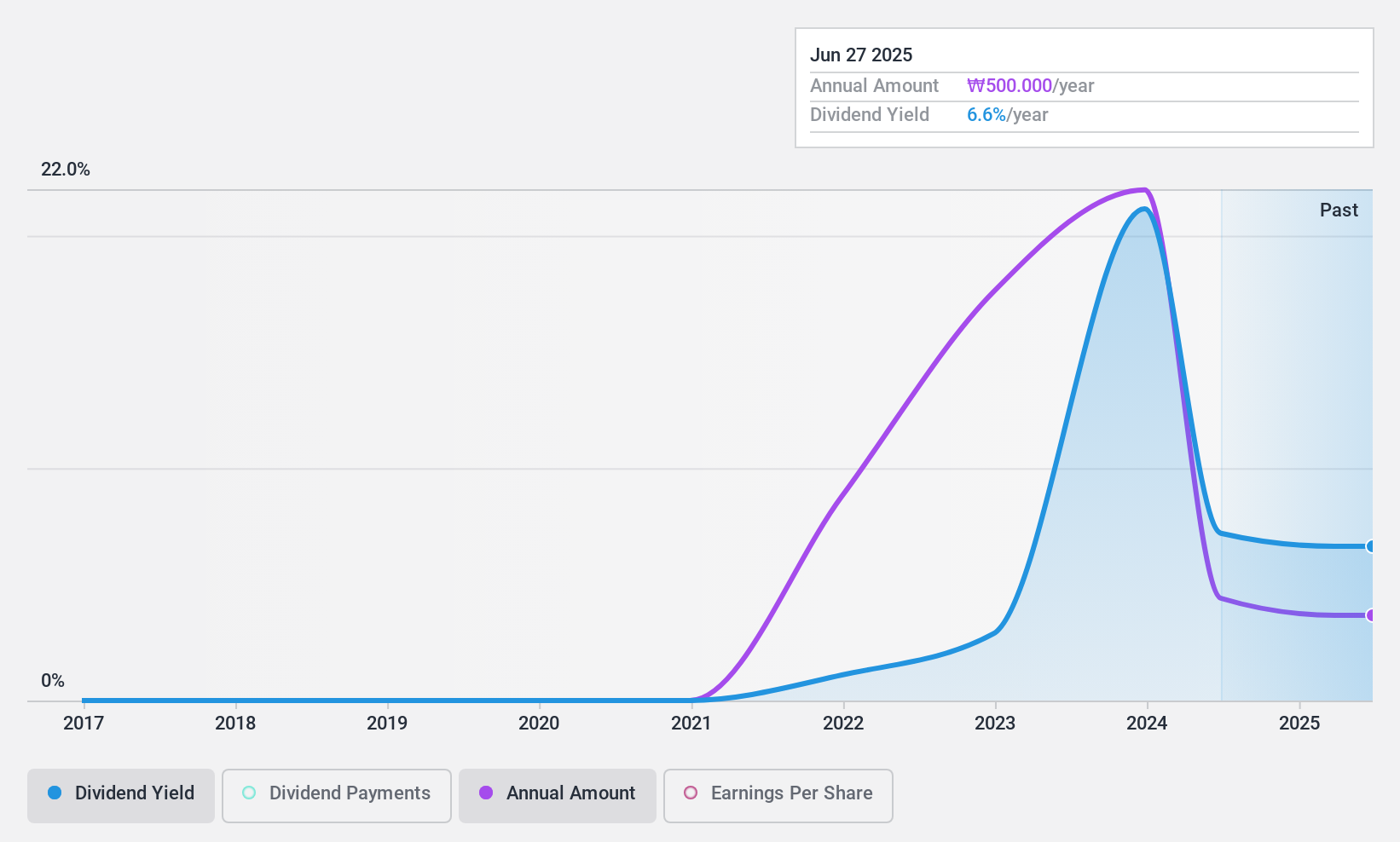

Dongkuk HoldingsLtd (KOSE:A001230)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dongkuk Holdings Co., Ltd. manufactures and sells steel products both in South Korea and internationally, with a market cap of ₩232.95 billion.

Operations: Dongkuk Holdings Co., Ltd. generates revenue from several segments, including Steel (₩412.85 million), Transit (₩707.87 million), and Trade, including IT (₩766.77 million).

Dividend Yield: 8%

Dongkuk Holdings Ltd. offers a high dividend yield of 8.01%, placing it in the top 25% of Korean dividend payers, with dividends well-covered by earnings and cash flows due to low payout ratios (2.8% and 12.1%, respectively). However, its dividend history is unstable and has been volatile over the past four years, with recent financial performance showing a significant decline in sales and net loss for Q3 2024 compared to the previous year.

- Click to explore a detailed breakdown of our findings in Dongkuk HoldingsLtd's dividend report.

- The analysis detailed in our Dongkuk HoldingsLtd valuation report hints at an inflated share price compared to its estimated value.

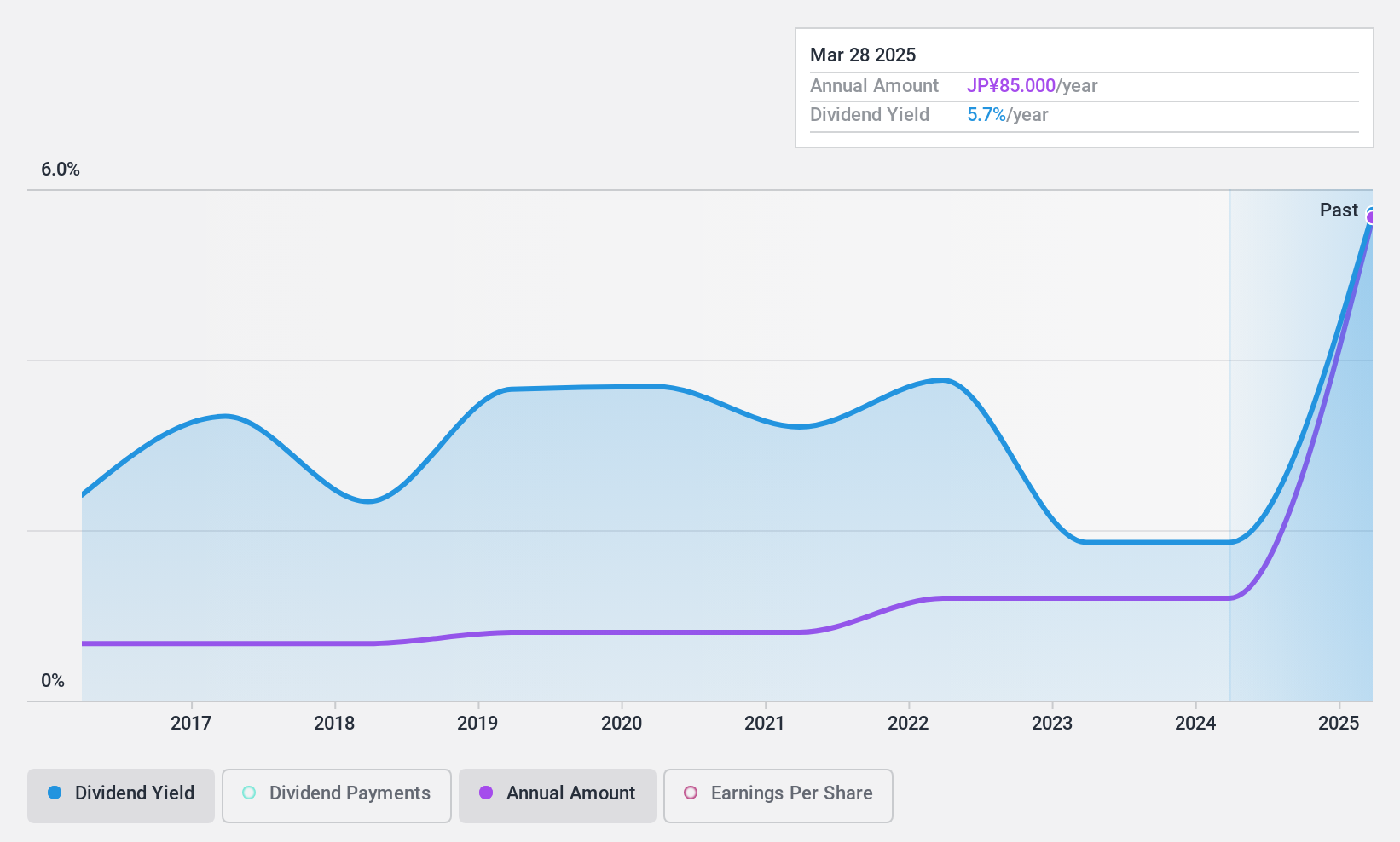

Toa Road (TSE:1882)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toa Road Corporation operates in the civil engineering sector in Japan with a market capitalization of ¥58.78 billion.

Operations: Toa Road Corporation generates its revenue primarily from its civil engineering operations in Japan.

Dividend Yield: 4.1%

Toa Road Corporation's dividend yield of 4.09% ranks in the top 25% among Japanese dividend payers, though it is not supported by free cash flows. Despite a stable and growing dividend history over the past decade, concerns arise from high non-cash earnings and lack of free cash flow coverage. While dividends are covered by a reasonable payout ratio of 50.3%, sustainability issues remain due to insufficient earnings or cash flow support.

- Take a closer look at Toa Road's potential here in our dividend report.

- Our expertly prepared valuation report Toa Road implies its share price may be too high.

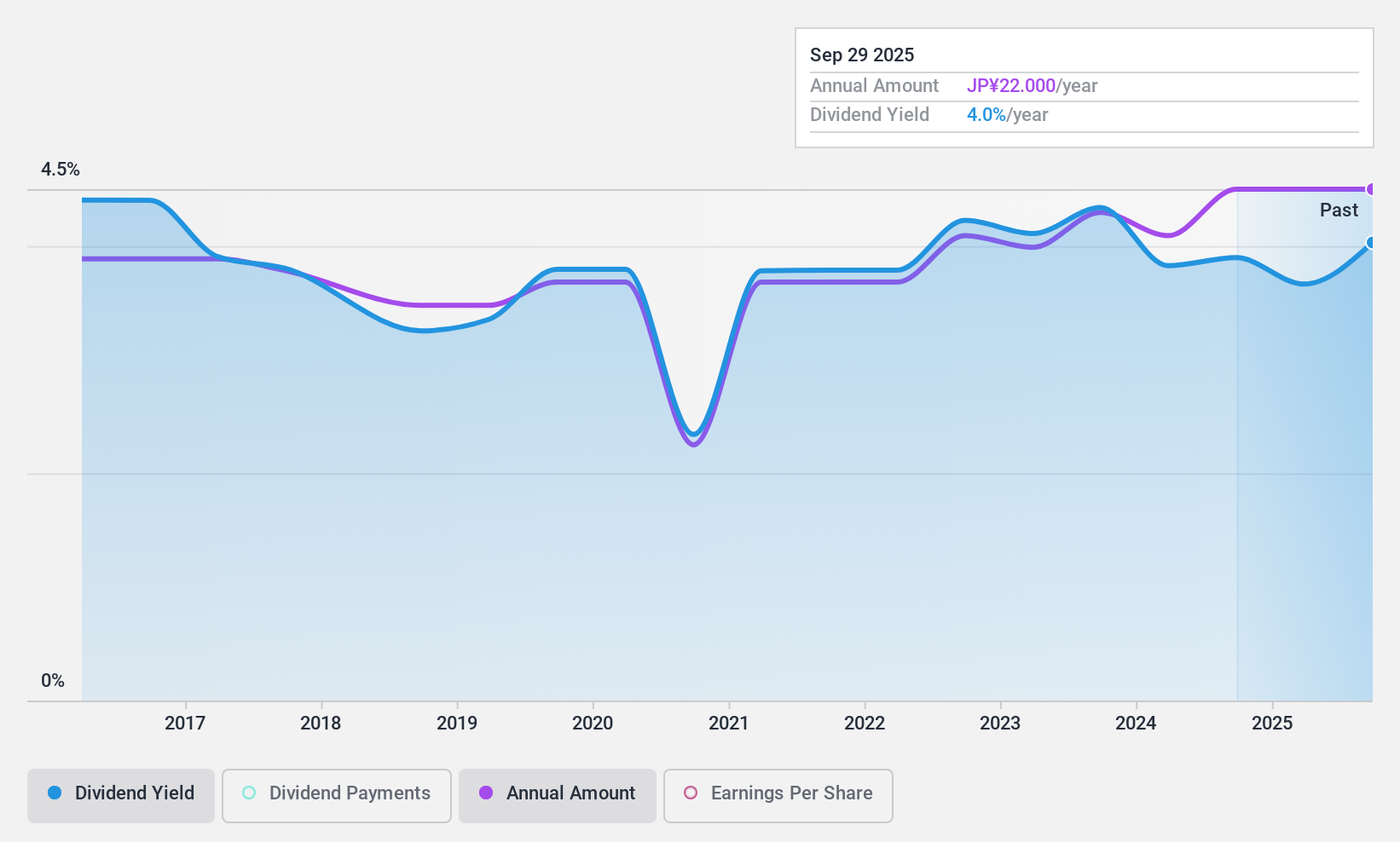

Nac (TSE:9788)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nac Co., Ltd. operates in Japan, focusing on the renting and sale of dust control and cleaning products and equipment, with a market cap of ¥24.74 billion.

Operations: Nac Co., Ltd.'s revenue segments include Housing at ¥11.30 billion, Rental Business at ¥17.62 billion, Kurikura Business at ¥15.28 billion, Beauty and Health Business at ¥6.98 billion, and Architectural Consulting Business at ¥5.37 billion.

Dividend Yield: 3.7%

Nac Co., Ltd. trades at 42% below its estimated fair value, offering potential for capital appreciation. Its dividend payments have grown over the past decade and are covered by earnings (54.5% payout ratio) and cash flows (47.7% cash payout ratio). However, the dividend yield of 3.65% is below top-tier levels in Japan, and the company's dividend track record has been unstable with volatility over the last ten years.

- Click here to discover the nuances of Nac with our detailed analytical dividend report.

- Our valuation report unveils the possibility Nac's shares may be trading at a premium.

Key Takeaways

- Explore the 1970 names from our Top Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toa Road might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1882

Excellent balance sheet established dividend payer.