- Japan

- /

- Construction

- /

- TSE:1844

Weak Statutory Earnings May Not Tell The Whole Story For OhmoriLtd (TSE:1844)

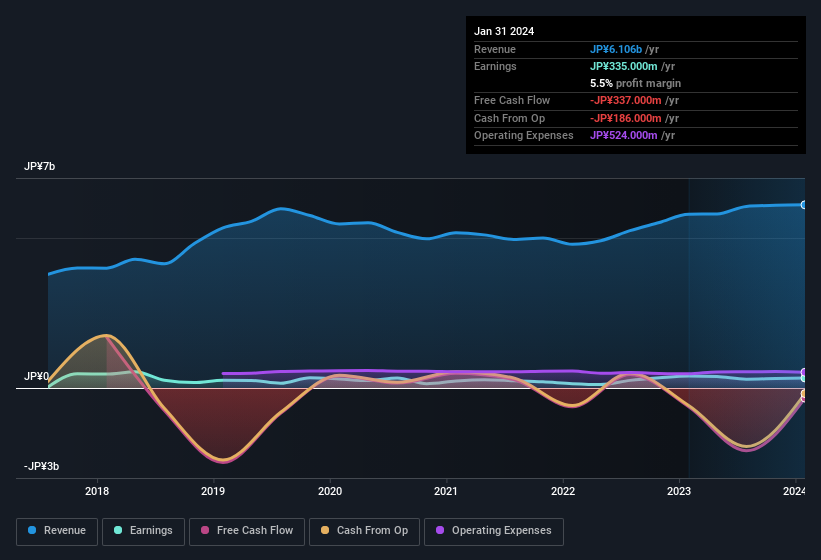

The market rallied behind Ohmori Co.,Ltd.'s (TSE:1844) stock, leading do a rise in the share price after its recent weak earnings report. While shareholders may be willing to overlook soft profit numbers, we believe that they should also be taking into account some other factors which may be cause for concern.

View our latest analysis for OhmoriLtd

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. OhmoriLtd expanded the number of shares on issue by 22% over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out OhmoriLtd's historical EPS growth by clicking on this link.

A Look At The Impact Of OhmoriLtd's Dilution On Its Earnings Per Share (EPS)

As you can see above, OhmoriLtd has been growing its net income over the last few years, with an annualized gain of 43% over three years. In comparison, earnings per share only gained 26% over the same period. Net profit actually dropped by 17% in the last year. But the EPS result was even worse, with the company recording a decline of 26%. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if OhmoriLtd's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of OhmoriLtd.

The Power Of Non-Operating Revenue

At most companies, some revenue streams, such as government grants, are accounted for as non-operating revenue, while the core business is said to produce operating revenue. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. Alongside the dilution mentioned above, we think shareholders should note that OhmoriLtd had a significant increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from JP¥320.0m to JP¥726.0m. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Our Take On OhmoriLtd's Profit Performance

In the last year OhmoriLtd's non-operating revenue really gave it a boost, but not in a way that is necessarily going to be sustained. And the fact that it issued more shares means that its results look weaker from a per-share perspective. Considering all this we'd argue OhmoriLtd's profits probably give an overly generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Our analysis shows 4 warning signs for OhmoriLtd (1 makes us a bit uncomfortable!) and we strongly recommend you look at these bad boys before investing.

Our examination of OhmoriLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1844

Flawless balance sheet with solid track record and pays a dividend.