- Japan

- /

- Construction

- /

- TSE:1812

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election and subsequent economic policies, major indices like the S&P 500 have surged to record highs, buoyed by optimism around growth and tax reforms. Amidst this backdrop of market enthusiasm and evolving fiscal landscapes, dividend stocks continue to offer investors a potential source of steady income, providing a buffer against volatility while capitalizing on favorable economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Innotech (TSE:9880) | 5.06% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.36% | ★★★★☆☆ |

Click here to see the full list of 1930 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

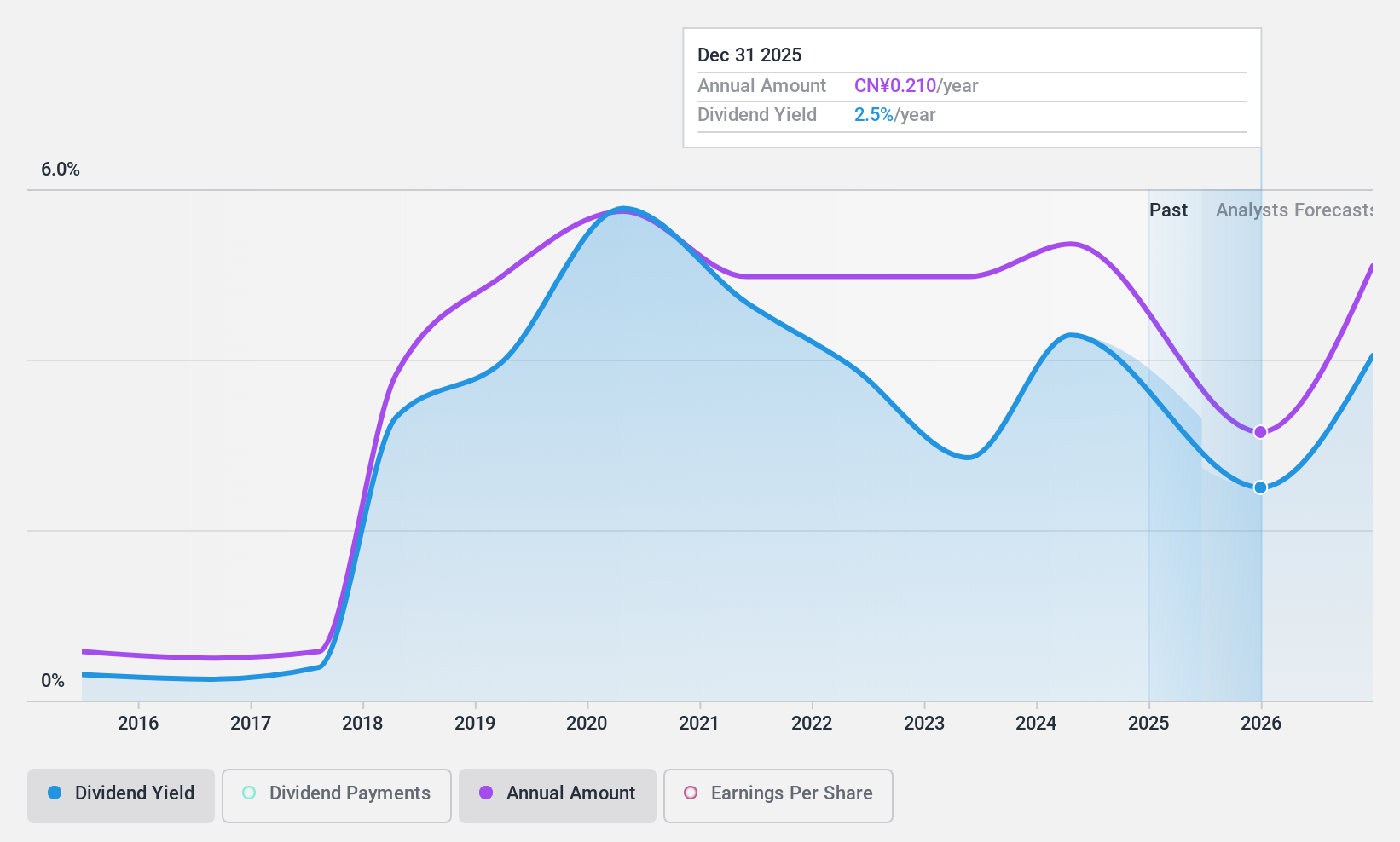

Teyi Pharmaceutical GroupLtd (SZSE:002728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teyi Pharmaceutical Group Co., Ltd operates in the research, development, production, and sale of Chinese patent medicines and pharmaceutical products in China with a market cap of CN¥4.71 billion.

Operations: Teyi Pharmaceutical Group Co., Ltd generates revenue through its activities in the research and development, production, and sale of Chinese patent medicines, pharmaceutical preparations, and raw materials within China.

Dividend Yield: 3.5%

Teyi Pharmaceutical Group Ltd. has a history of stable and reliable dividend payments over the past decade, with dividends growing steadily despite recent financial challenges. However, the company's high payout ratio of 290.2% indicates dividends are not well covered by earnings or cash flow, raising concerns about sustainability. Recent earnings reports show significant declines in revenue and net income, which may impact future dividend reliability despite ongoing share buybacks totaling CNY 93.85 million.

- Get an in-depth perspective on Teyi Pharmaceutical GroupLtd's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Teyi Pharmaceutical GroupLtd shares in the market.

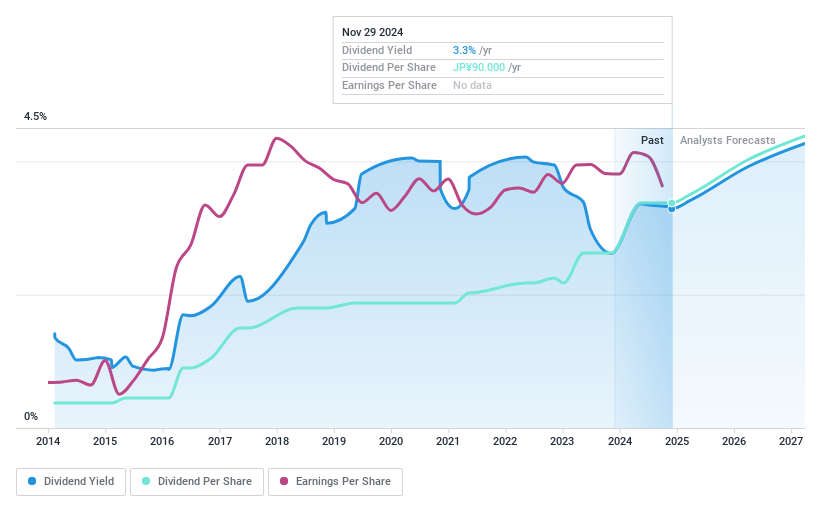

Kajima (TSE:1812)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kajima Corporation operates globally in civil engineering, building construction, real estate development, and architectural design with a market cap of ¥1.29 trillion.

Operations: Kajima Corporation's revenue segments include Construction Business with ¥1.05 billion, Civil Engineering Business at ¥369.31 million, Development Business, Etc. contributing ¥89.69 million, Overseas Affiliates providing ¥936.33 million, and Domestic Affiliated Company adding ¥364.76 million.

Dividend Yield: 3.2%

Kajima offers a stable dividend yield of 3.22%, though it falls short compared to the top dividend payers in Japan. The company's dividends are well-supported by earnings with a payout ratio of 38.2% and cash flows at 53.2%. Over the past decade, Kajima's dividends have been consistent and growing, reflecting reliability despite being undervalued by approximately 48.2% against its estimated fair value, suggesting potential for capital appreciation alongside income stability.

- Navigate through the intricacies of Kajima with our comprehensive dividend report here.

- According our valuation report, there's an indication that Kajima's share price might be on the cheaper side.

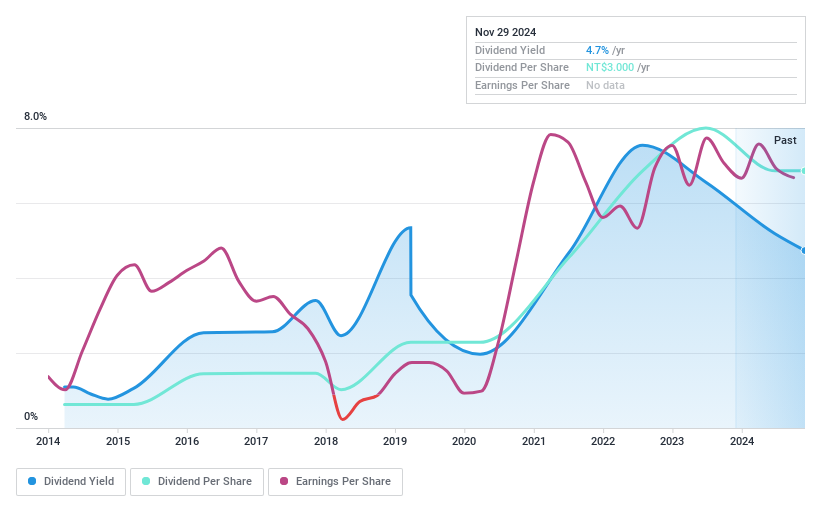

Sunrex Technology (TWSE:2387)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sunrex Technology Corporation manufactures and sells laptop computer keyboards globally, with a market cap of NT$11.26 billion.

Operations: Sunrex Technology Corporation's revenue primarily comes from its operations in the Central Region of Mainland China (NT$19.15 billion), followed by Sunrex Taiwan (NT$12.24 billion) and the Southern Region of Mainland China (NT$1.15 billion).

Dividend Yield: 5%

Sunrex Technology's dividend yield of 5.15% ranks in the top 25% of Taiwan's market, though its history shows volatility and unreliability over the past decade. Despite this, dividends have grown during that period and are well-covered by earnings (payout ratio: 44.2%) and cash flows (cash payout ratio: 29.8%). Trading at a significant discount to estimated fair value, Sunrex presents potential for both income generation and capital appreciation despite its unstable dividend track record.

- Click to explore a detailed breakdown of our findings in Sunrex Technology's dividend report.

- Our expertly prepared valuation report Sunrex Technology implies its share price may be lower than expected.

Taking Advantage

- Delve into our full catalog of 1930 Top Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kajima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1812

Kajima

Engages in civil engineering, building construction, real estate development, architectural design, and other businesses worldwide.

Good value average dividend payer.