- Japan

- /

- Construction

- /

- TSE:1802

Does Recent Infrastructure Push Signal More Growth Ahead for Obayashi in 2025?

Reviewed by Simply Wall St

Thinking about what to do with Obayashi stock right now? You are not alone. This construction and engineering powerhouse has been turning heads lately, and for good reason. Obayashi has delivered impressive returns: up 2.5% in just the last week, 6.4% over the past month, and a striking 17.5% year to date. If you have held on for the longer term, the stock’s 43.1% leap over the past year is remarkable, and the growth stretches back even further, with gains of 191.7% across three years and 201.9% in five. These results are more than numbers to brag about; they signal that investors are seeing something special in Obayashi.

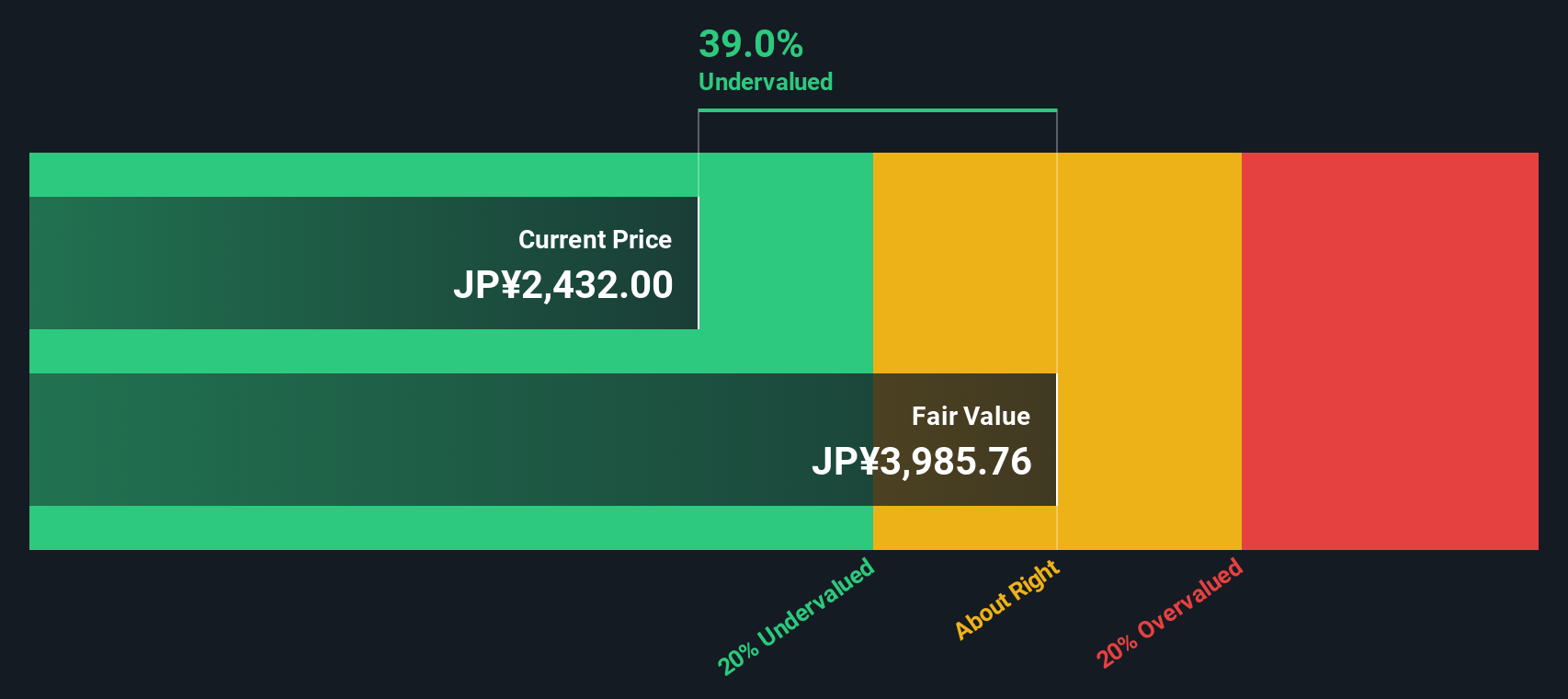

Some of this renewed optimism can be tied to broader market momentum in the construction sector, with infrastructure and urban development themes gaining traction. As investors rethink risk and potential in these areas, Obayashi seems to capture plenty of their confidence. At the same time, there is a growing perception that the company may still be undervalued. According to a proprietary value score, Obayashi checks 5 out of 6 essential undervaluation boxes. That is not just good; it is rare territory for a stock with such multi-year momentum.

But how do these valuation figures really hold up under scrutiny? In the next section, we will break down the main valuation methods and see exactly how Obayashi fares. Plus, stay tuned for what could be the most insightful way yet to understand its true value.

Why Obayashi is lagging behind its peersApproach 1: Obayashi Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a business’s value by projecting its future cash flows and then discounting those amounts back to the present using a required rate of return. This approach gives investors an idea of what the company is really worth based on its ability to generate cash in the years ahead.

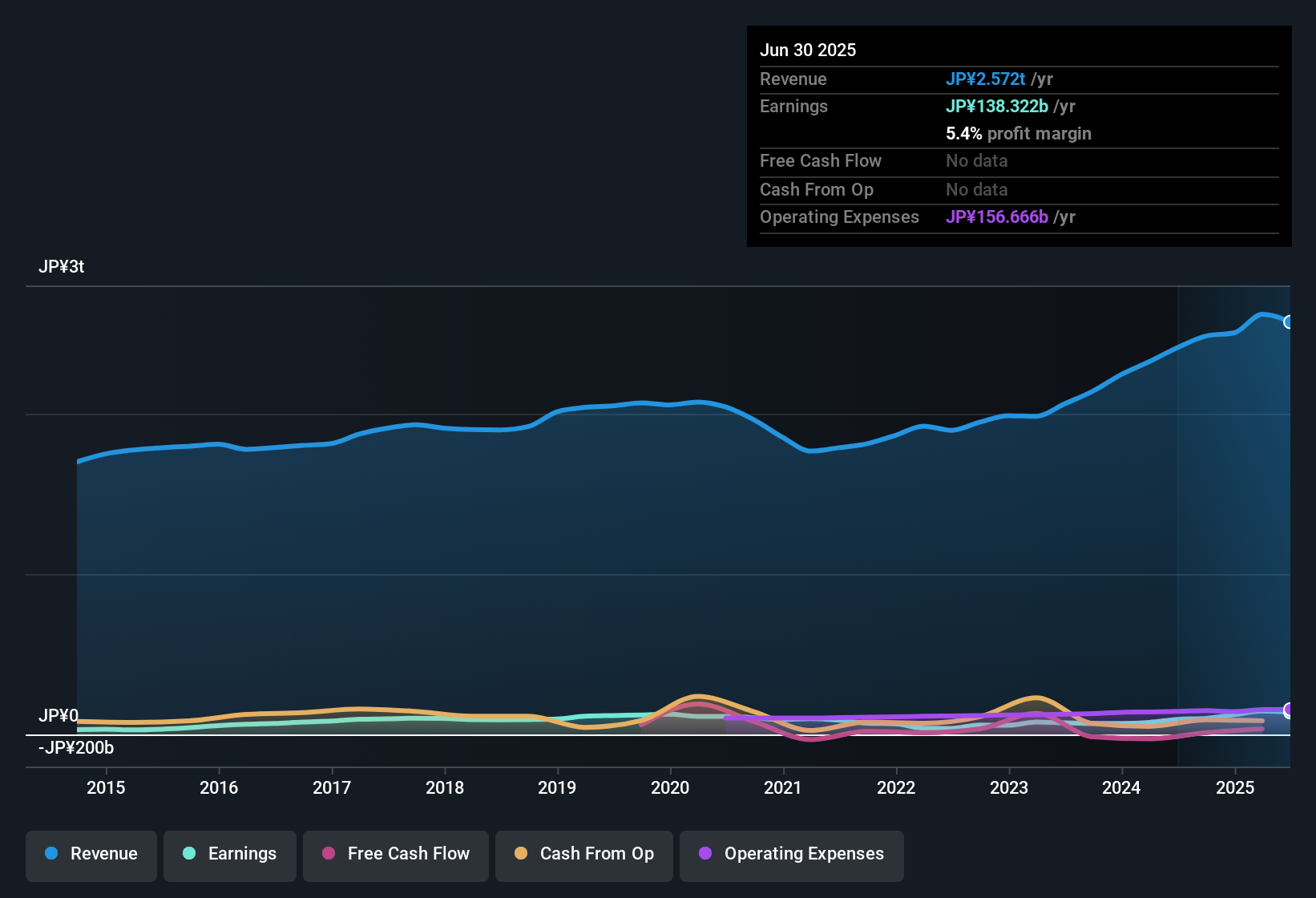

For Obayashi, the current Free Cash Flow stands at ¥1.89 billion. Analysts forecast that, over the next five years, Free Cash Flow will rise significantly and reach around ¥154.5 billion by the fiscal year ending March 2030. Beyond these analyst estimates, further growth is extrapolated, resulting in continued increases through to 2035. All figures are reported in yen, Obayashi’s listing and reporting currency.

Using this two-stage Free Cash Flow to Equity model, Obayashi’s estimated intrinsic value is ¥4,107.74 per share. With this approach, the DCF model suggests the stock is trading at a 39.1% intrinsic discount. This means the current share price is well below what these cash flow projections justify, implying meaningful upside for investors who buy at these levels.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Obayashi.

Approach 2: Obayashi Price vs Earnings

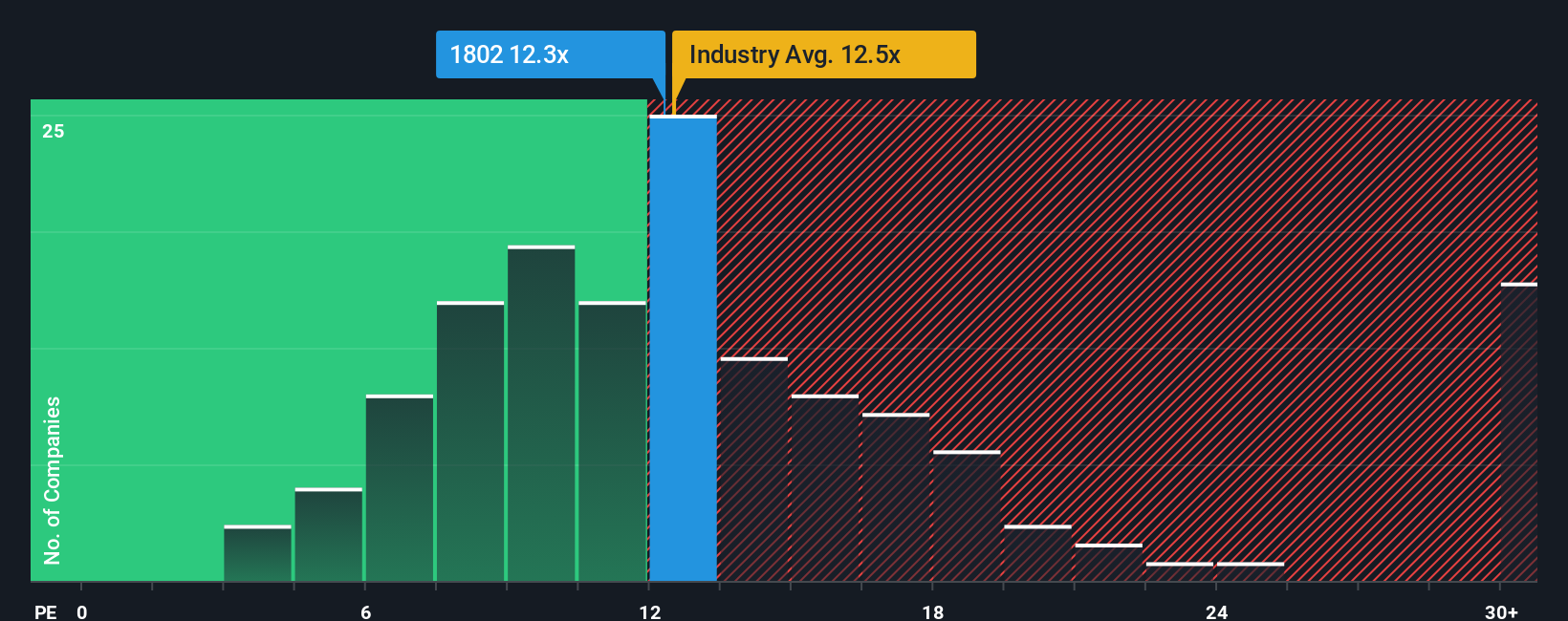

For profitable companies like Obayashi, the Price-to-Earnings (PE) ratio stands out as a reliable way to assess valuation. The PE ratio tells investors how much they are paying today for each yen of earnings the company delivers. It is especially useful because it connects a company's current performance with expectations about future growth and the risks investors might face.

Growth prospects and risk play big roles in setting a "normal" or "fair" PE ratio. Companies with faster expected earnings growth or lower risk typically command higher PE ratios, since investors are willing to pay more for that potential. Conversely, slow-growing firms or those with riskier outlooks tend to trade at lower multiples.

Obayashi currently trades at a PE ratio of 12.6x, just below the Construction industry average of 12.7x, and noticeably lower than the peer group average of 17.4x. While industry averages and peer comparisons provide meaningful context, Simply Wall St’s proprietary “Fair Ratio” goes a step further by factoring in variables like Obayashi’s growth profile, profit margins, market capitalization, and risk. In this case, Obayashi’s Fair Ratio is calculated at 15.5x. This suggests investors might typically expect to pay a bit more than the current multiple for the company’s earnings. Because the Fair Ratio takes into account a broader set of company-specific factors, it delivers a more tailored benchmark than industry or peer comparisons alone.

Since Obayashi’s actual PE of 12.6x is meaningfully below its Fair Ratio of 15.5x, it suggests the stock is undervalued at these levels.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Obayashi Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective on a company, connecting your story about its potential to personal forecasts for its future revenue, profits, and fair value. Instead of focusing only on traditional numbers, Narratives allow you to link Obayashi’s business outlook to your own financial assumptions, giving real meaning to whether a stock looks cheap or expensive.

On Simply Wall St’s Community page, Narratives are an easy and accessible tool used by millions of investors to help guide buy or sell decisions. By comparing your Narrative’s Fair Value to today’s share price, you can decide if now is the right time to act. Narratives automatically update in real time as new earnings or news is released, keeping your insights fresh and relevant.

For example, some investors project Obayashi will outperform with aggressive growth, while others see more modest progress ahead. Each Narrative leads to a different fair value and decision. With Narratives, you can invest confidently, always grounded in a story and outlook you truly believe in.

Do you think there's more to the story for Obayashi? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1802

Obayashi

Engages in the construction business in Japan, North America, Asia and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives