- United Arab Emirates

- /

- Banks

- /

- ADX:BOS

Undiscovered Gems And 2 Other Hidden Opportunities To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by mixed signals from global markets, small-cap stocks have shown resilience despite broader indices finishing mostly lower. As economic indicators send varied messages, investors are increasingly looking towards undiscovered gems that can provide stability and growth in uncertain times. Identifying such opportunities often involves seeking out companies with strong fundamentals and potential for growth that may be overlooked amidst the market's current volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C., along with its subsidiaries, offers a range of commercial and investment banking services in the United Arab Emirates, with a market capitalization of AED2.63 billion.

Operations: Bank Of Sharjah generates revenue primarily from commercial banking (AED328.96 million) and investment banking (AED406.73 million) services.

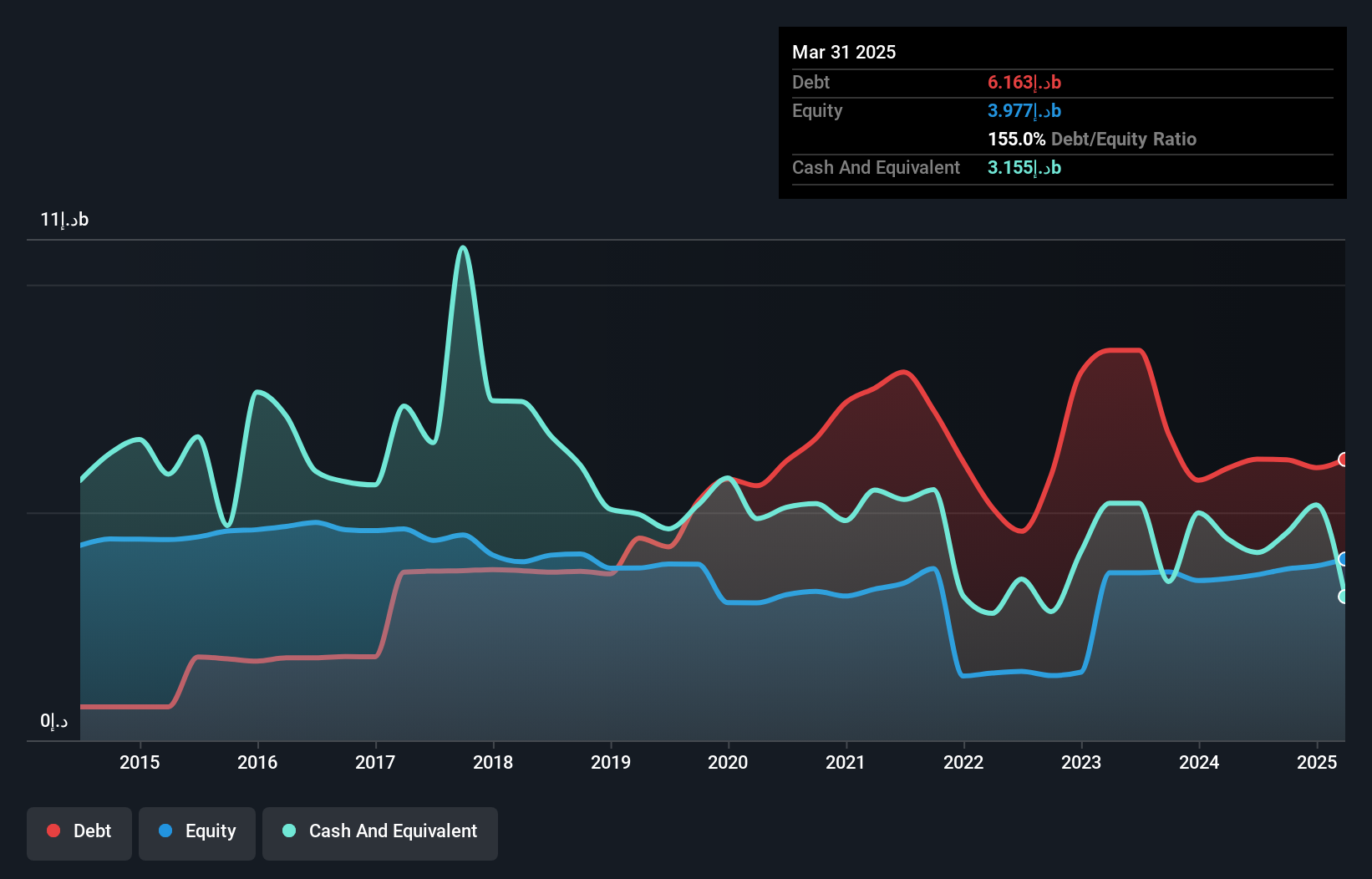

Bank of Sharjah, a smaller player in the banking sector, recently showcased a remarkable earnings growth of 2546.7%, far surpassing the industry average. With assets totaling AED40.7 billion and equity at AED3.8 billion, it holds AED29.5 billion in deposits against AED23.4 billion in loans, indicating solid financial footing despite an 8.3% bad loan ratio and a low allowance for bad loans at 83%. The bank's reliance on customer deposits as its primary funding source reduces risk exposure significantly, while recent inclusion in the S&P Global BMI Index highlights its growing recognition within global financial markets.

Fuji Furukawa Engineering & ConstructionLtd (TSE:1775)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fuji Furukawa Engineering & Construction Co., Ltd. operates in the construction industry, focusing on electrical and air conditioning equipment construction, with a market capitalization of approximately ¥58.54 billion.

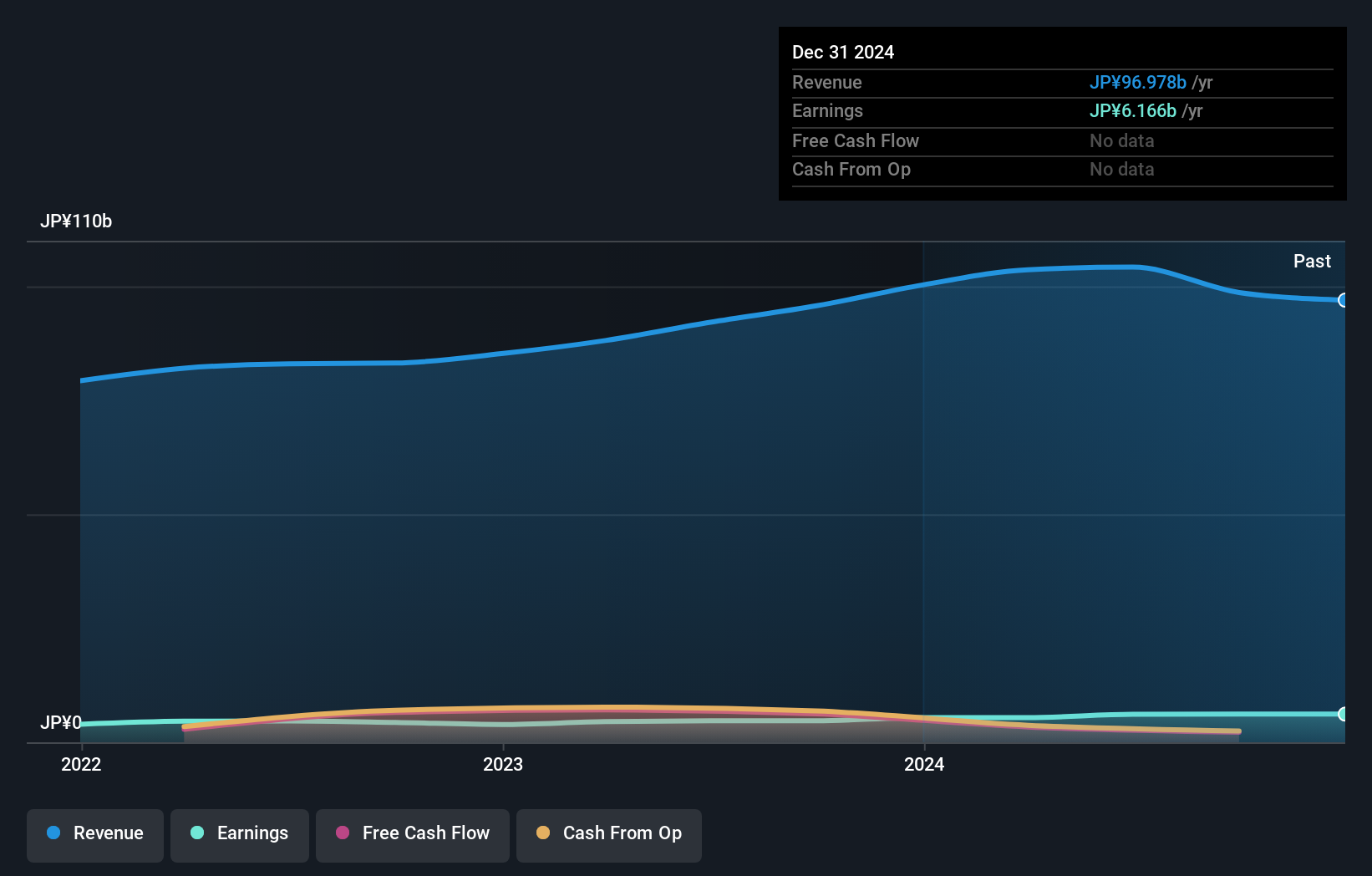

Operations: Fuji Furukawa Engineering & Construction generates revenue primarily from its Electrical Equipment Construction Business, contributing ¥66.52 billion, and its Air Conditioning Equipment Construction Business, adding ¥30.41 billion.

Fuji Furukawa Engineering & Construction, a nimble player in the construction sector, has shown robust earnings growth of 30.5% over the past year, outpacing its industry peers at 26.5%. The company enjoys high-quality earnings with substantial non-cash components and maintains a favorable price-to-earnings ratio of 9.5x compared to Japan's market average of 13.2x, suggesting it offers good value. Additionally, its debt level is manageable with interest payments well covered by EBIT at an impressive 987 times coverage. Recently, Fuji Electric announced plans to acquire a majority stake in Fuji Furukawa Engineering & Construction by early February next year.

FuSheng Precision (TWSE:6670)

Simply Wall St Value Rating: ★★★★★★

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and internationally, with a market capitalization of NT$40.99 billion.

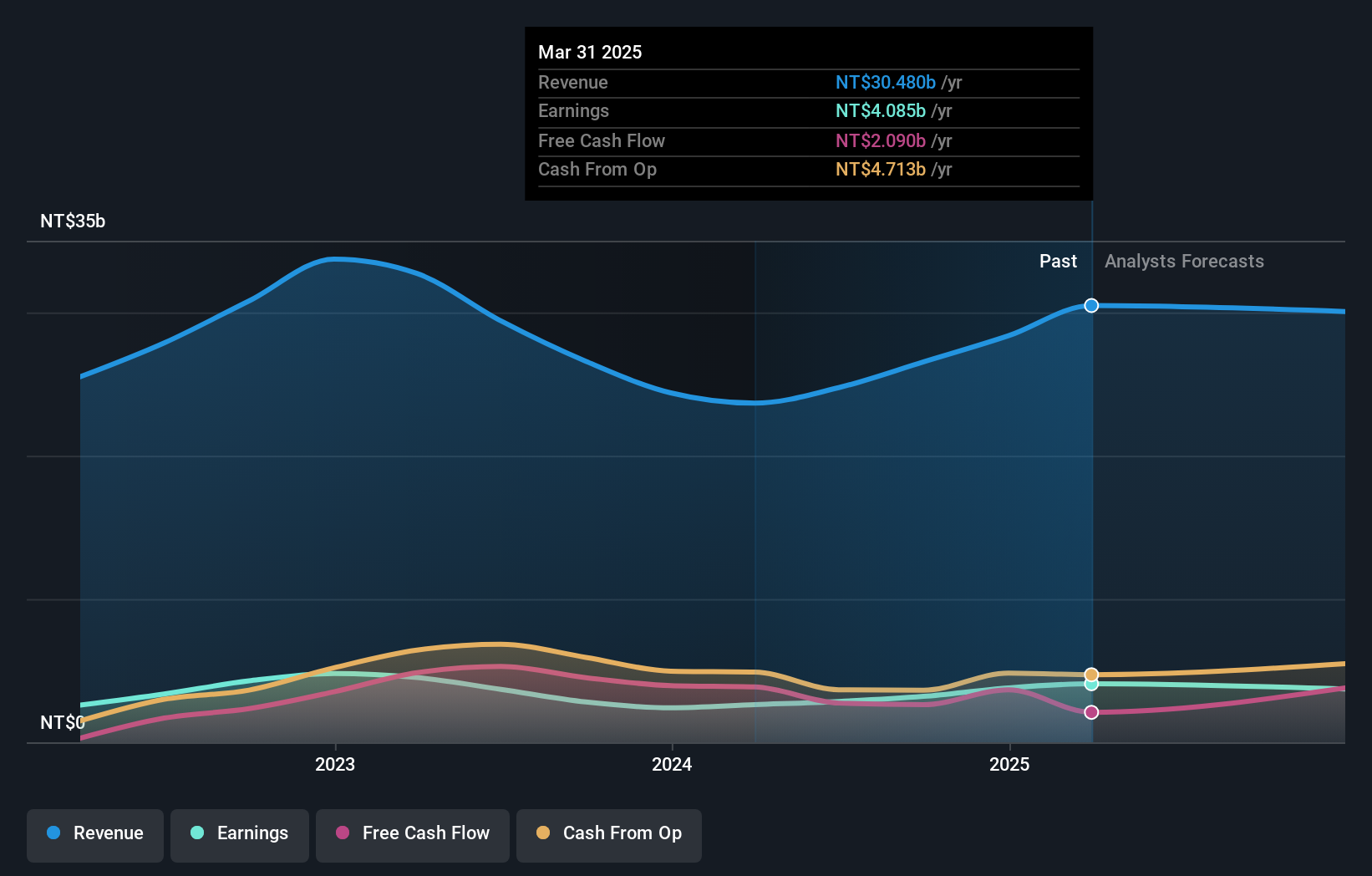

Operations: FuSheng Precision generates revenue primarily from its Golf Business, contributing NT$21.53 billion, and Sports Equipment segment, adding NT$2.24 billion. The company's net profit margin reflects its profitability dynamics over recent periods.

FuSheng Precision, a smaller player in the market, recently reported impressive Q2 2024 earnings with sales hitting TWD 6.14 billion, up from TWD 5.06 billion the previous year. Net income rose to TWD 744.63 million from TWD 522.89 million, reflecting strong operational performance and boosting basic EPS to TWD 5.57 from last year's TWD 3.94. The company also launched a follow-on equity offering worth TWD 480 million, indicating strategic growth plans despite recent negative earnings growth of -22.9%. Trading at a P/E ratio of just 14x against the TW market's average of over 21x suggests attractive valuation potential for investors seeking value opportunities in emerging sectors.

Key Takeaways

- Explore the 4743 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Of Sharjah P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:BOS

Bank Of Sharjah P.J.S.C

Provides commercial and investment banking products and services in the United Arab Emirates.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives