- Taiwan

- /

- Real Estate

- /

- TWSE:1436

Undiscovered Gems on None Exchange to Explore in November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, small-cap stocks have experienced a mixed performance, with indices like the Russell 2000 reflecting this volatility. Despite these fluctuations, opportunities remain for investors willing to explore lesser-known stocks that demonstrate strong fundamentals and potential resilience amid changing economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.46% | 20.33% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Hailide New Material Co., Ltd is involved in the research, development, production, and marketing of industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors both in China and internationally with a market cap of CN¥5.28 billion.

Operations: Zhejiang Hailide New Material Co., Ltd generates revenue primarily through its production and marketing of industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors. The company has a market cap of CN¥5.28 billion.

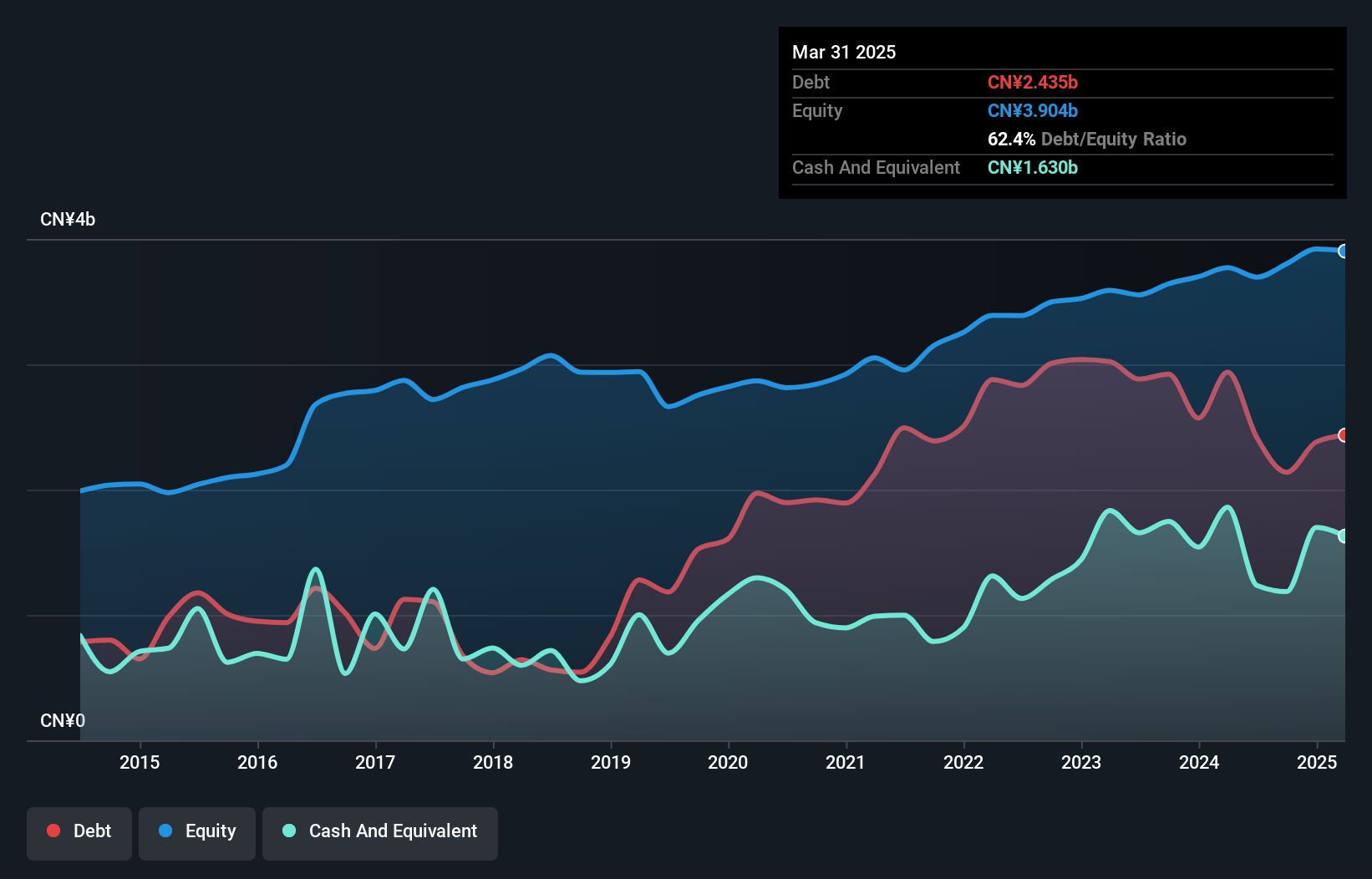

Zhejiang Hailide New Material Co., Ltd, a notable player in the chemicals sector, has shown robust performance with earnings growth of 15.5% over the past year, outpacing the industry average of -5.3%. The company’s net debt to equity ratio stands at a satisfactory 25%, indicating sound financial health. Trading at a price-to-earnings ratio of 14.2x, it offers good value compared to the broader CN market's 35.9x. Recent earnings reports reveal an increase in net income to CNY 296 million for the first nine months of 2024 from CNY 272 million last year, reflecting steady profitability despite shareholder dilution concerns.

Nihon Dengi (TSE:1723)

Simply Wall St Value Rating: ★★★★★★

Overview: Nihon Dengi Co., Ltd. operates in Japan's automatic control system sector and has a market capitalization of ¥50.56 billion.

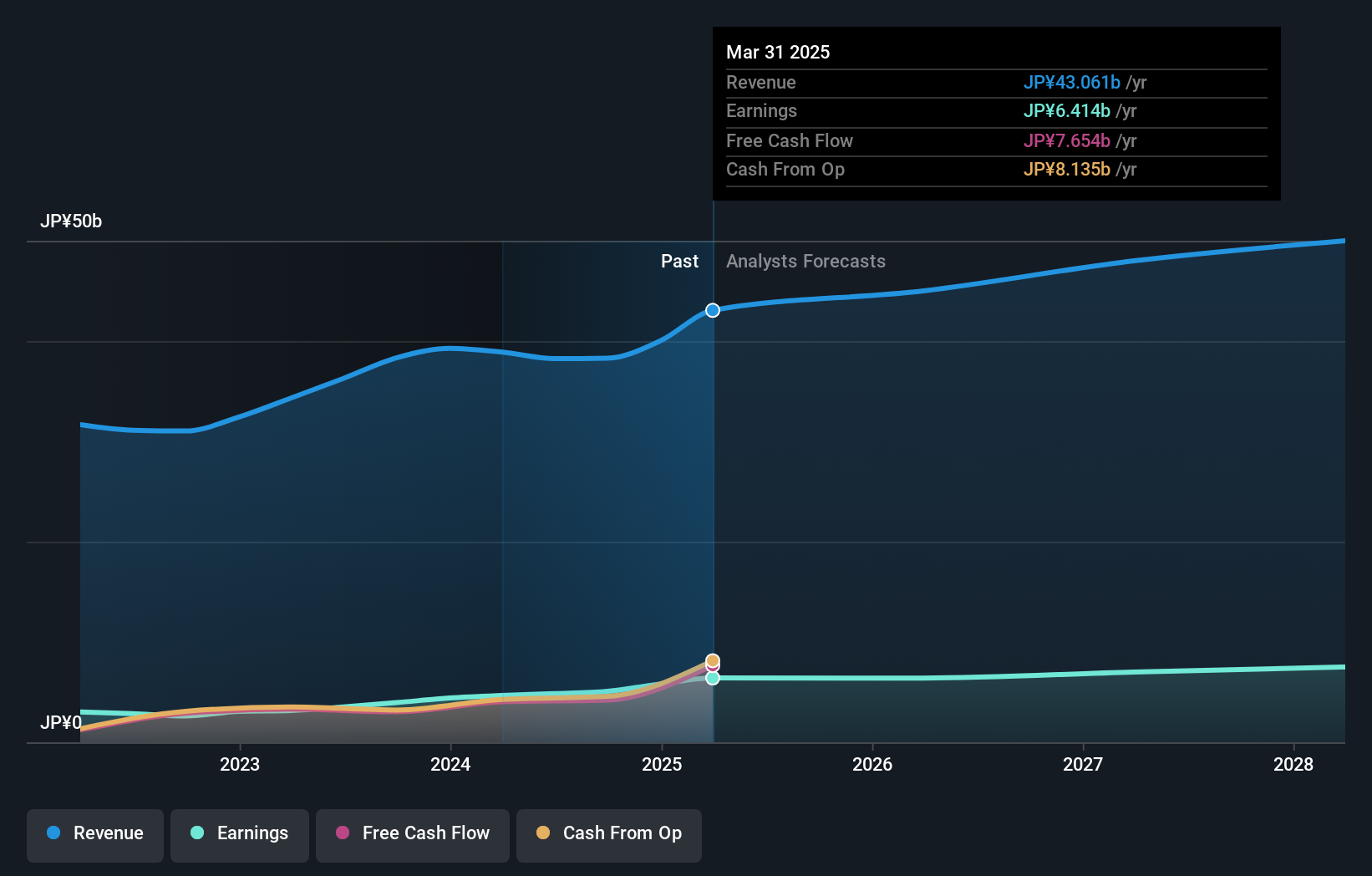

Operations: Nihon Dengi generates revenue primarily from its Air Conditioning Instrumentation Related Business, which accounts for ¥34.42 billion, significantly overshadowing the Industrial System Business at ¥3.88 billion.

Nihon Dengi stands out with its robust financial health, boasting a 28.7% earnings growth over the past year, outperforming the Building industry average of 7.6%. The company has been debt-free for five years, eliminating concerns about interest coverage and enhancing its financial stability. Trading at 34.4% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent guidance projects net sales of ¥42.5 billion and operating profit of ¥7.5 billion by March 2025, while dividends have increased to ¥82 per share from last year's ¥76, reflecting confidence in future profitability and shareholder returns.

- Get an in-depth perspective on Nihon Dengi's performance by reading our health report here.

Understand Nihon Dengi's track record by examining our Past report.

Hua Yu Lien Development (TWSE:1436)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hua Yu Lien Development Co., Ltd. focuses on the development, leasing, and sale of residential projects and buildings in Taiwan, with a market cap of NT$13.90 billion.

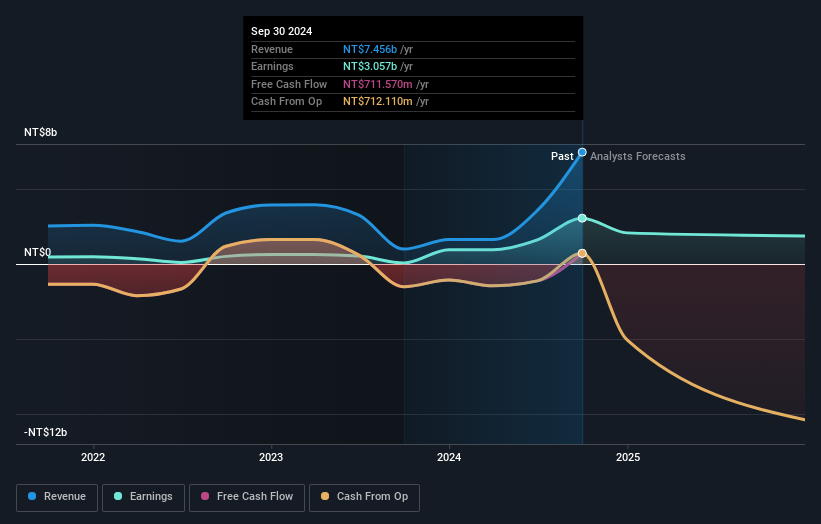

Operations: Hua Yu Lien derives its revenue primarily from the Construction Sector, contributing NT$7.46 billion, while the Engineering Department adds NT$643.99 million. The company has a market cap of NT$13.90 billion and incurs adjustments and write-offs amounting to -NT$643.99 million.

Hua Yu Lien Development has shown remarkable growth, with earnings skyrocketing by 4,480% over the past year, far outpacing the real estate industry's 52% growth. The company reported a net income of TWD 1.48 billion for Q3 2024, a significant jump from TWD 25.66 million the previous year. Despite this impressive performance, the company's debt remains high with a net debt to equity ratio of 145.6%, although interest payments are well covered by EBIT at a coverage of 30.5x. Recent board approvals for establishing two new subsidiaries indicate potential future expansion and strategic investments totaling TWD 3 billion using its capital resources.

- Click here and access our complete health analysis report to understand the dynamics of Hua Yu Lien Development.

Learn about Hua Yu Lien Development's historical performance.

Where To Now?

- Navigate through the entire inventory of 4629 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Yu Lien Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1436

Proven track record with adequate balance sheet and pays a dividend.