- Japan

- /

- Construction

- /

- TSE:1721

Earnings are growing at COMSYS Holdings (TSE:1721) but shareholders still don't like its prospects

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by COMSYS Holdings Corporation (TSE:1721) shareholders over the last year, as the share price declined 17%. That's well below the market decline of 5.9%. Longer term investors have fared much better, since the share price is up 12% in three years. More recently, the share price has dropped a further 9.5% in a month. However, we note the price may have been impacted by the broader market, which is down 9.1% in the same time period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the COMSYS Holdings share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

Revenue was fairly steady year on year, which isn't usually such a bad thing. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

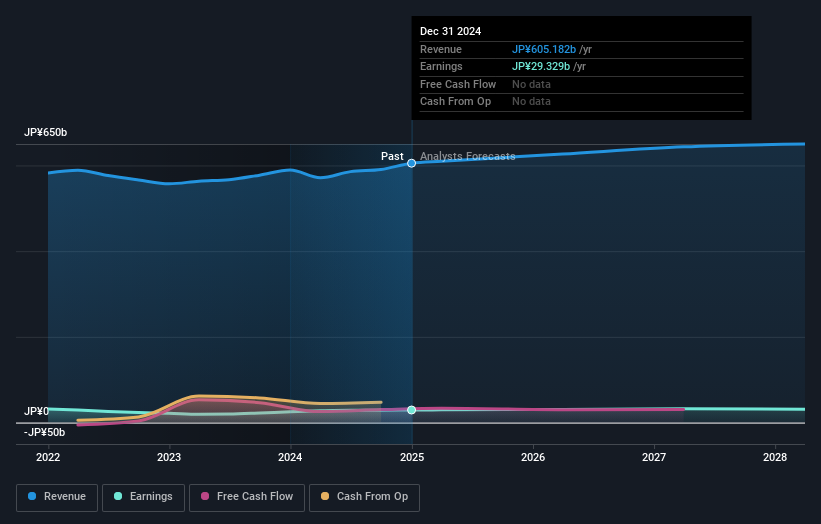

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that COMSYS Holdings has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling COMSYS Holdings stock, you should check out this free report showing analyst profit forecasts .

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of COMSYS Holdings, it has a TSR of -14% for the last 1 year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 5.9% in the twelve months, COMSYS Holdings shareholders did even worse, losing 14% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Keeping this in mind, a solid next step might be to take a look at COMSYS Holdings' dividend track record. This free interactive graph is a great place to start.

Of course COMSYS Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1721

COMSYS Holdings

Engages in information, communications, construction, electrical facilities construction, and information processing-related businesses in Japan.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives