- Japan

- /

- Construction

- /

- TSE:1721

COMSYS Holdings Corporation (TSE:1721) Investors Are Less Pessimistic Than Expected

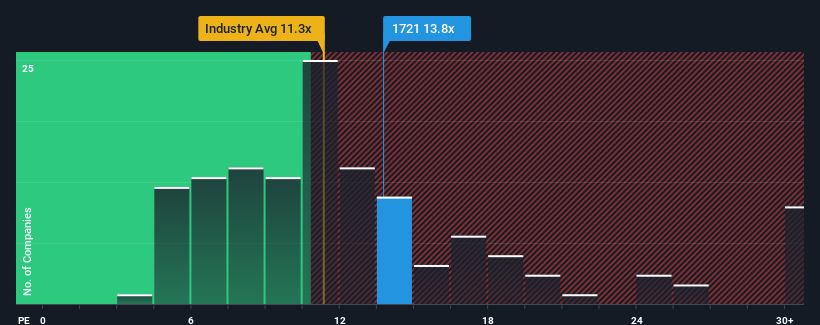

With a median price-to-earnings (or "P/E") ratio of close to 14x in Japan, you could be forgiven for feeling indifferent about COMSYS Holdings Corporation's (TSE:1721) P/E ratio of 13.8x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

COMSYS Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for COMSYS Holdings

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like COMSYS Holdings' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 30% last year. Still, incredibly EPS has fallen 7.3% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 2.9% per annum over the next three years. That's shaping up to be materially lower than the 10% each year growth forecast for the broader market.

With this information, we find it interesting that COMSYS Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From COMSYS Holdings' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that COMSYS Holdings currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for COMSYS Holdings with six simple checks.

If you're unsure about the strength of COMSYS Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1721

COMSYS Holdings

Engages in information and communication construction, electrical equipment construction, and information processing-related businesses.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives