- Japan

- /

- Construction

- /

- TSE:1407

Three Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are keenly observing how these factors impact their portfolios. In such a dynamic environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

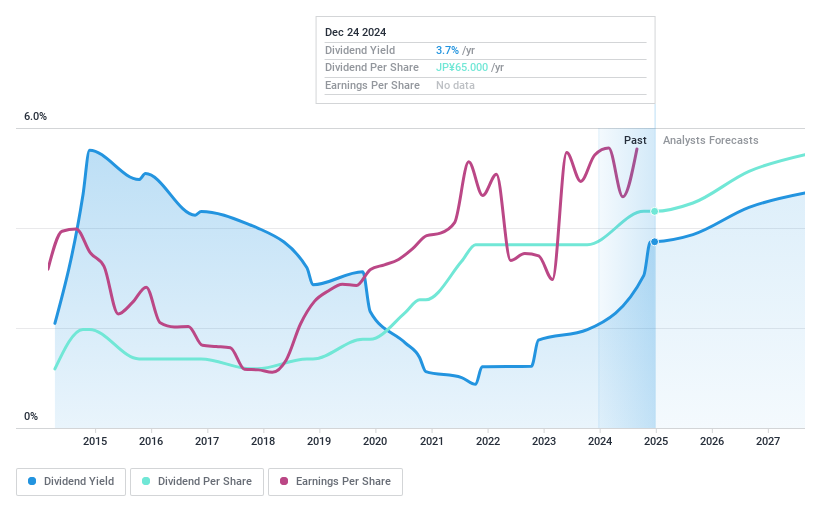

West Holdings (TSE:1407)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: West Holdings Corporation, with a market cap of ¥63.26 billion, operates in the renewable energy sector both in Japan and internationally through its subsidiaries.

Operations: West Holdings Corporation generates revenue primarily from its renewable energy business operations in Japan and abroad.

Dividend Yield: 4.1%

West Holdings offers a dividend yield of 4.08%, placing it in the top 25% of dividend payers in Japan. However, its dividends have been unreliable and volatile over the past decade, with payments not well covered by free cash flows despite a low payout ratio. The company's debt is not adequately covered by operating cash flow, and its share price has been highly volatile recently. It trades at a significant discount to estimated fair value.

- Click to explore a detailed breakdown of our findings in West Holdings' dividend report.

- According our valuation report, there's an indication that West Holdings' share price might be on the cheaper side.

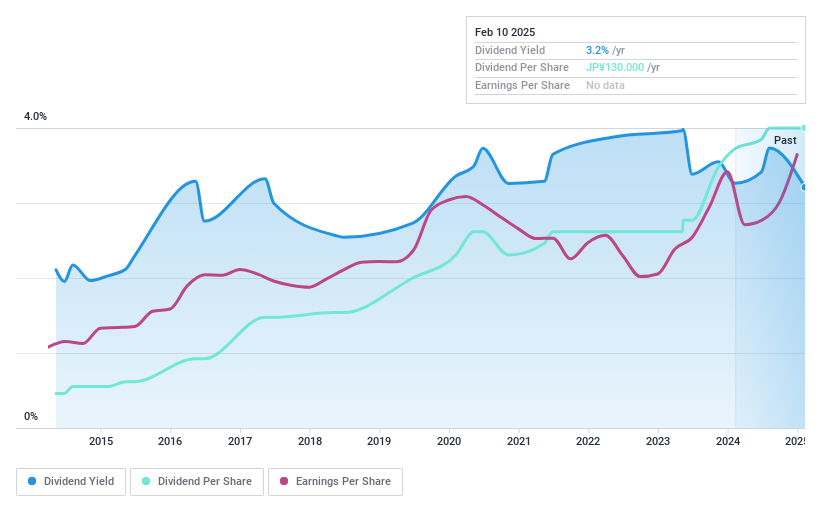

Otec (TSE:1736)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Otec Corporation specializes in trading pipework equipment in Japan and has a market capitalization of ¥19.57 billion.

Operations: Otec Corporation's revenue segments are not specified in the provided text.

Dividend Yield: 3.2%

Otec's dividend payments have been volatile over the past decade, despite being well covered by earnings and cash flows with payout ratios of 34.3% and 37.7%, respectively. The dividend yield of 3.23% is below the top quartile in Japan, but dividends have grown over ten years. Otec trades at a significant discount to its estimated fair value, suggesting potential value for investors seeking growth alongside dividends amidst its unstable track record.

- Delve into the full analysis dividend report here for a deeper understanding of Otec.

- Our valuation report unveils the possibility Otec's shares may be trading at a premium.

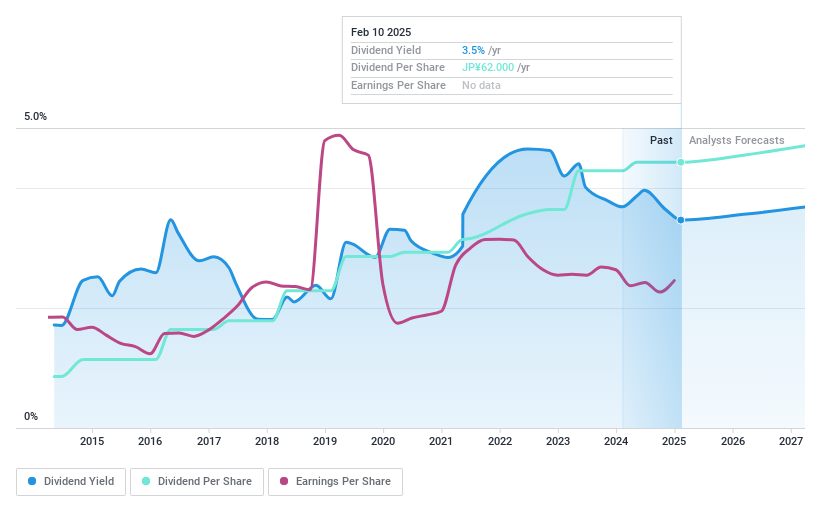

EXEO Group (TSE:1951)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EXEO Group, Inc. operates in telecommunications, civil engineering, construction, electric equipment, system solutions, and renewable energy sectors in Japan with a market cap of ¥350.73 billion.

Operations: EXEO Group, Inc.'s revenue segments include telecommunications, civil engineering, construction, electric equipment, system solutions, and renewable energy businesses in Japan.

Dividend Yield: 3.5%

EXEO Group's dividend stability over the past decade contrasts with its current cash flow challenges, as the 3.45% yield is not well covered by free cash flows, indicated by a high cash payout ratio of 102.6%. Despite trading at a significant discount to its estimated fair value, recent share buybacks aim to enhance shareholder returns and capital efficiency. Earnings growth forecasts and stable dividends suggest potential for investors prioritizing long-term income amidst short-term coverage concerns.

- Dive into the specifics of EXEO Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that EXEO Group is priced higher than what may be justified by its financials.

Summing It All Up

- Explore the 1963 names from our Top Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1407

West Holdings

Engages in the renewable energy business in Japan and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives