Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Mitsuboshi Co., Ltd. (TYO:5820) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Mitsuboshi

What Is Mitsuboshi's Debt?

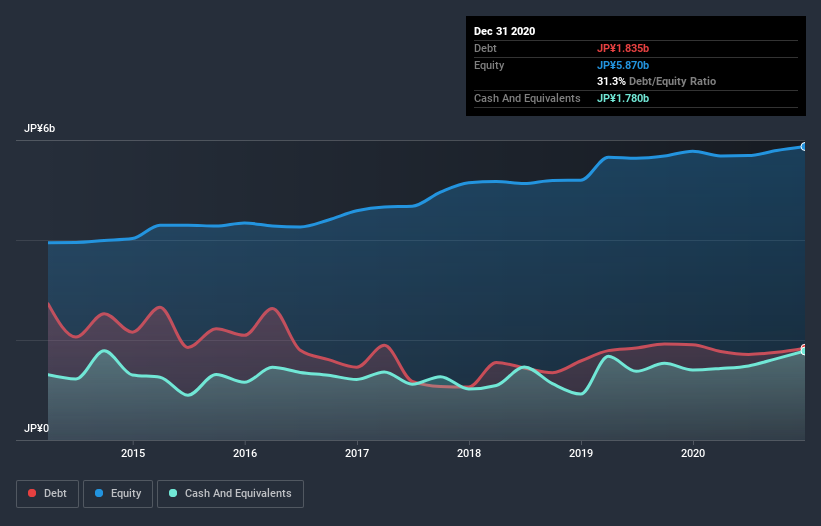

As you can see below, Mitsuboshi had JP¥1.84b of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have JP¥1.78b in cash offsetting this, leading to net debt of about JP¥55.0m.

How Strong Is Mitsuboshi's Balance Sheet?

We can see from the most recent balance sheet that Mitsuboshi had liabilities of JP¥2.25b falling due within a year, and liabilities of JP¥1.71b due beyond that. On the other hand, it had cash of JP¥1.78b and JP¥2.87b worth of receivables due within a year. So it can boast JP¥699.0m more liquid assets than total liabilities.

This luscious liquidity implies that Mitsuboshi's balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet means the company is able to handle some adversity.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Mitsuboshi has a low debt to EBITDA ratio of only 0.14. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. Mitsuboshi's EBIT was pretty flat over the last year, but that shouldn't be an issue given the it doesn't have a lot of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Mitsuboshi will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Mitsuboshi burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Happily, Mitsuboshi's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Taking all this data into account, it seems to us that Mitsuboshi takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Mitsuboshi is showing 3 warning signs in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Mitsuboshi, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:5820

Mitsuboshi

Manufactures and sells electric wires and synthetic resin products in Japan.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives