The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Kozo Keikaku Engineering Inc. (TYO:4748) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Kozo Keikaku Engineering

How Much Debt Does Kozo Keikaku Engineering Carry?

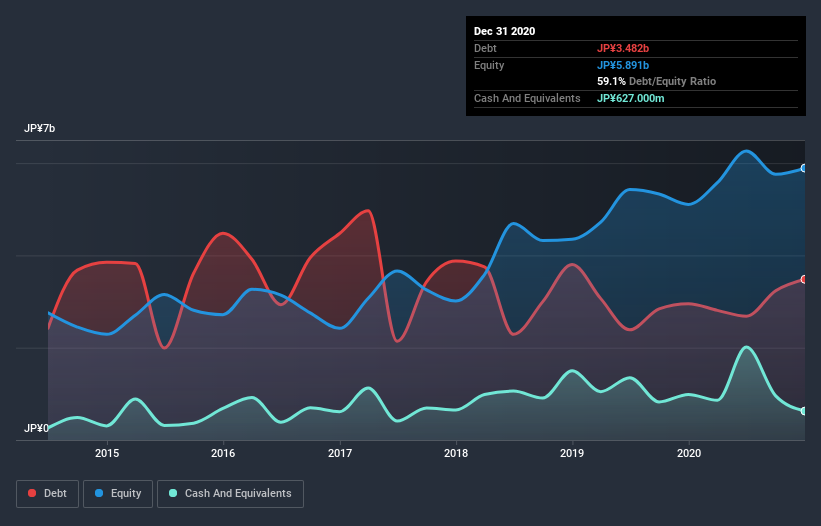

As you can see below, at the end of December 2020, Kozo Keikaku Engineering had JP¥3.44b of debt, up from JP¥2.95b a year ago. Click the image for more detail. However, it also had JP¥627.0m in cash, and so its net debt is JP¥2.82b.

How Healthy Is Kozo Keikaku Engineering's Balance Sheet?

The latest balance sheet data shows that Kozo Keikaku Engineering had liabilities of JP¥3.40b due within a year, and liabilities of JP¥4.87b falling due after that. Offsetting this, it had JP¥627.0m in cash and JP¥1.55b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥6.09b.

Kozo Keikaku Engineering has a market capitalization of JP¥14.8b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Kozo Keikaku Engineering's net debt is only 1.2 times its EBITDA. And its EBIT easily covers its interest expense, being 208 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that Kozo Keikaku Engineering has boosted its EBIT by 88%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Kozo Keikaku Engineering will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Kozo Keikaku Engineering recorded free cash flow worth 53% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Kozo Keikaku Engineering's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! Taking all this data into account, it seems to us that Kozo Keikaku Engineering takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Kozo Keikaku Engineering that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Kozo Keikaku Engineering or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade KOZO KEIKAKU ENGINEERING HOLDINGS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KOZO KEIKAKU ENGINEERING HOLDINGS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:208A

KOZO KEIKAKU ENGINEERING HOLDINGS

A professional design and engineering company, provides solutions in the fields of safety and security, information transmission, manufacturing, and scientific decision-making support in Japan.

Flawless balance sheet with proven track record.