As global markets navigate a period of volatility marked by cautious Federal Reserve commentary and political uncertainties, small-cap stocks have faced notable challenges, with indices like the S&P 600 experiencing declines. Amidst this backdrop, identifying hidden stock opportunities requires a keen eye for companies that demonstrate resilience and potential growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

SP Group (CPSE:SPG)

Simply Wall St Value Rating: ★★★★★★

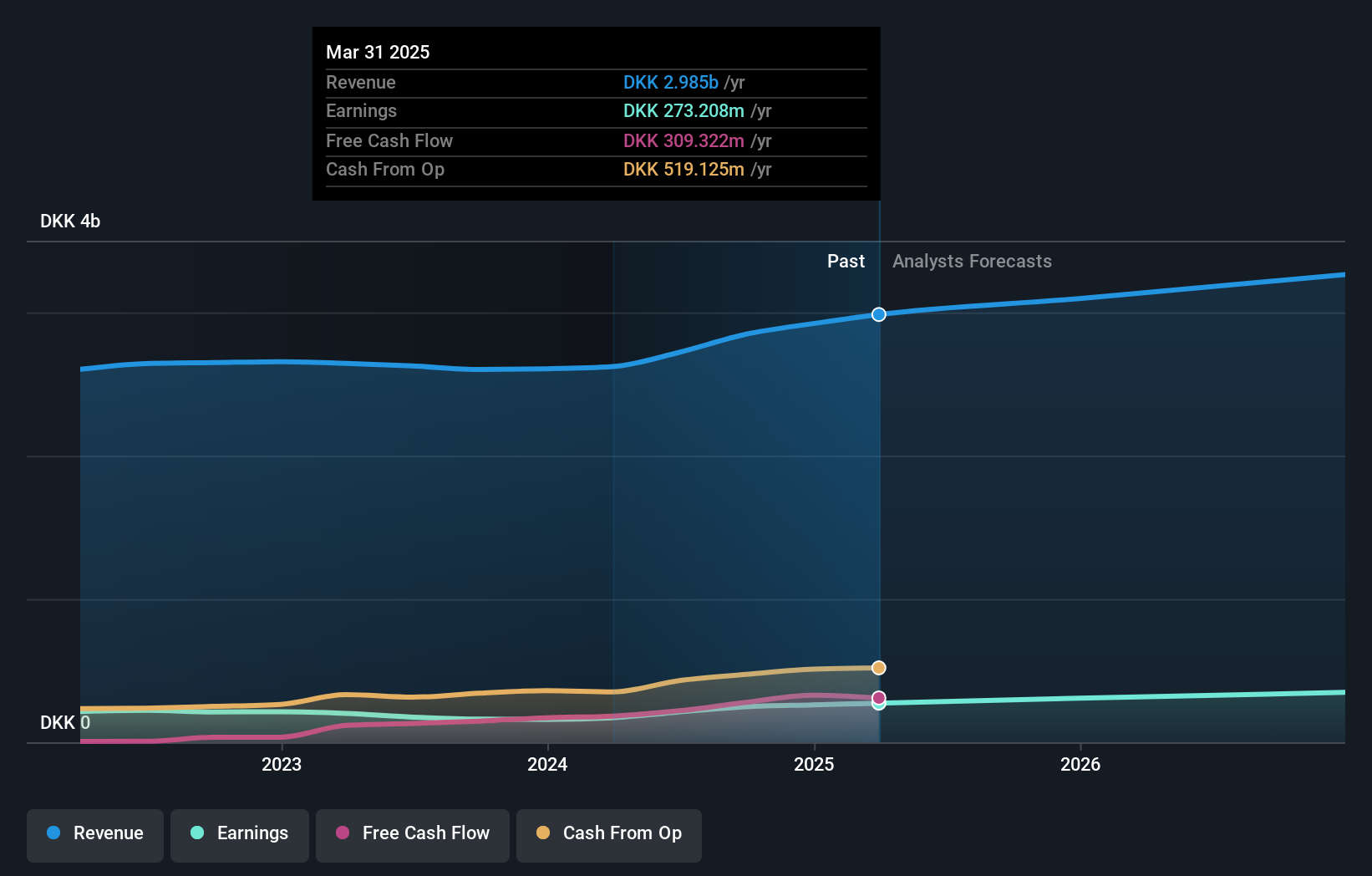

Overview: SP Group A/S, with a market cap of DKK3.61 billion, manufactures and sells molded plastic and composite components across Denmark, Europe, the Americas, Asia, the Middle East, Australia, and Africa.

Operations: SP Group generates revenue primarily from its Plastics & Rubber segment, amounting to DKK2.85 billion.

SP Group's financial health appears robust, with a notable reduction in its debt to equity ratio from 67.6% to 41.4% over five years, indicating improved financial stability. The company has demonstrated high-quality earnings and maintains a satisfactory net debt to equity ratio of 36.4%. Recent performance shows impressive earnings growth of 53.8%, significantly outpacing the Chemicals industry's -4.7%. For the third quarter of 2024, SPG reported sales of DKK 709 million and net income of DKK 60 million, both up from the previous year, suggesting strong operational momentum in its niche market segment.

- Click here to discover the nuances of SP Group with our detailed analytical health report.

Gain insights into SP Group's past trends and performance with our Past report.

Sea1 Offshore (OB:SEA1)

Simply Wall St Value Rating: ★★★★☆☆

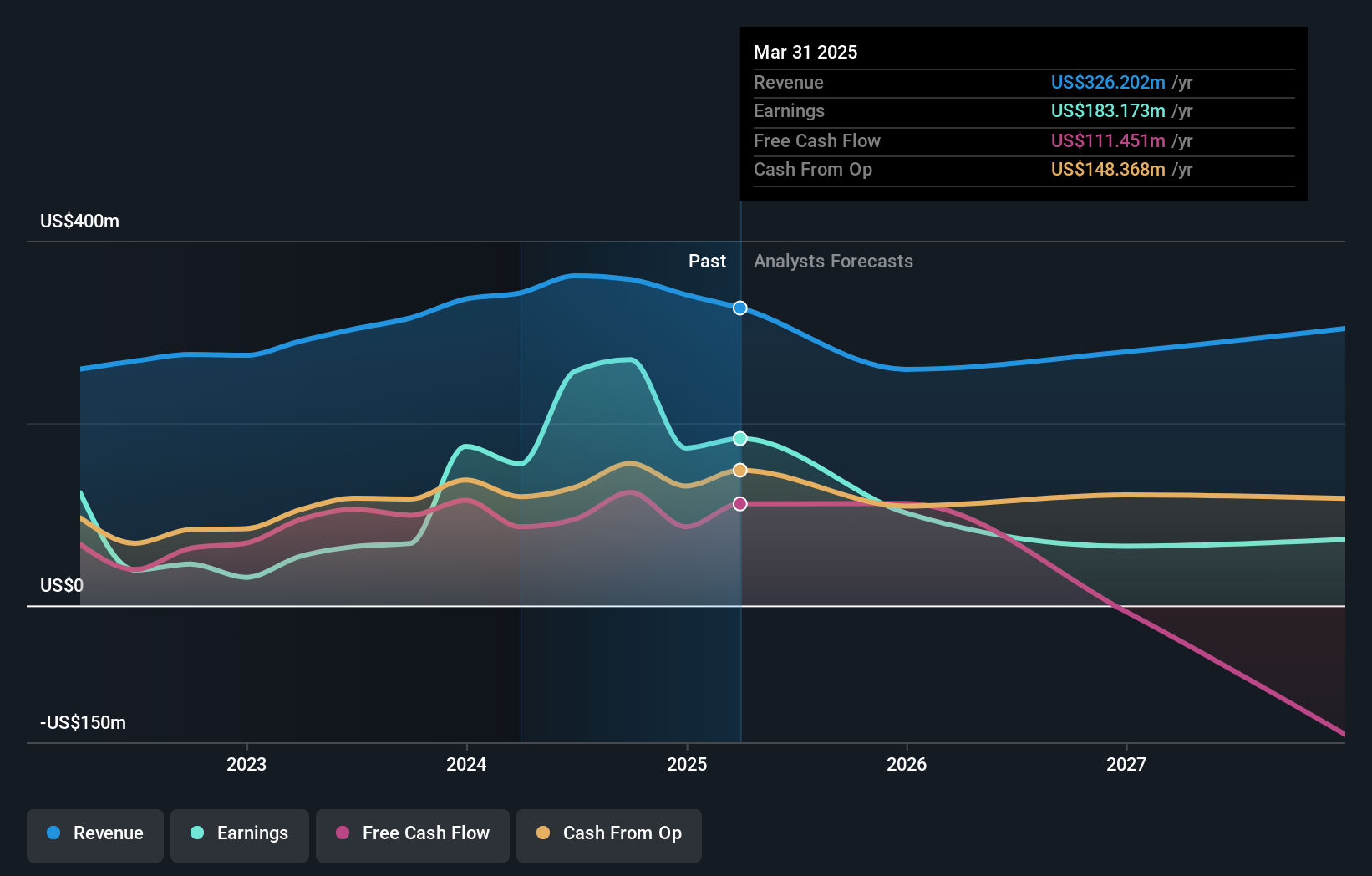

Overview: Sea1 Offshore Inc. owns and operates offshore support vessels for the offshore energy service industry and offshore renewables market, with a market capitalization of NOK 3.74 billion.

Operations: Sea1 Offshore's primary revenue streams are derived from its Subsea Vessels and Anchor Handling Tug Supply Vessels, generating $192.55 million and $114.40 million respectively. The company also earns income from Platform Supply Vessels at $51.17 million and Fast Crew & Oil Spill Recovery Vessels at $12.41 million.

Sea1 Offshore, a promising player in the energy services sector, has shown remarkable earnings growth of 296.1% over the past year, far surpassing the industry average of 17.8%. Despite its high net debt to equity ratio of 58.7%, which is considered elevated, SEA1's interest payments are well-covered by EBIT at 5.2 times coverage. The company has been trading at a significant discount of 82.6% below its estimated fair value and recently announced a share repurchase program worth NOK 15 million for up to 400,000 shares to bolster its long-term incentive plan.

- Unlock comprehensive insights into our analysis of Sea1 Offshore stock in this health report.

Examine Sea1 Offshore's past performance report to understand how it has performed in the past.

TOMONY Holdings (TSE:8600)

Simply Wall St Value Rating: ★★★★★☆

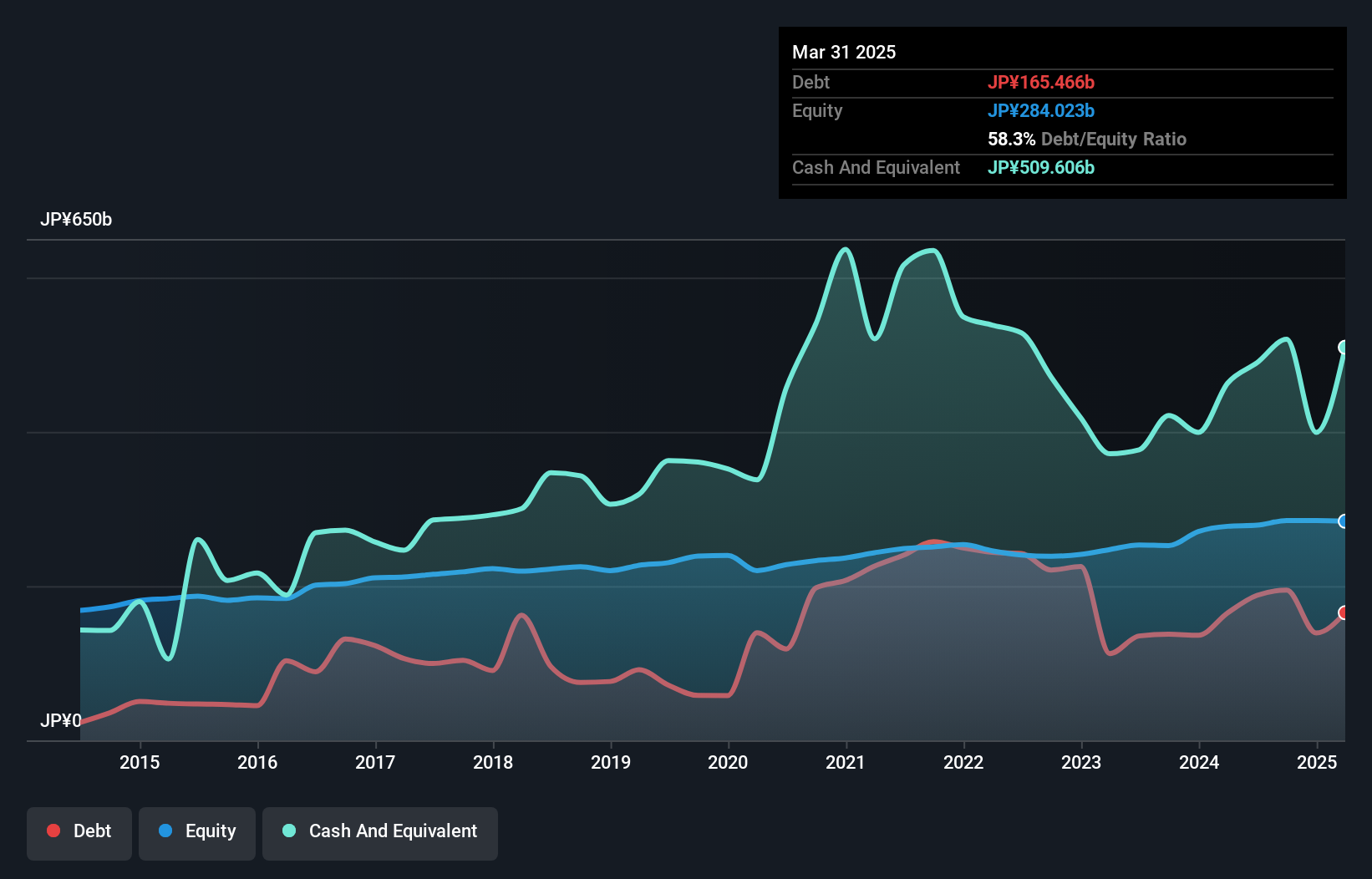

Overview: TOMONY Holdings, Inc. operates through its subsidiaries to offer a range of banking and financial products and services with a market cap of ¥87.15 billion.

Operations: TOMONY Holdings generates revenue primarily from its banking segment, amounting to ¥86.12 billion.

TOMONY Holdings, a financial player with total assets of ¥4,967.5 billion and equity of ¥285.0 billion, has been navigating the market with a focus on stability through customer deposits making up 95% of its liabilities. The company’s allowance for bad loans is low at 32%, which might be concerning given non-performing loans stand at 1.9%. Despite trading significantly below estimated fair value by 68.5%, earnings growth over five years has averaged 13.8% annually but lagged behind the industry last year with just a 9.4% increase compared to the sector's robust performance.

- Click to explore a detailed breakdown of our findings in TOMONY Holdings' health report.

Assess TOMONY Holdings' past performance with our detailed historical performance reports.

Next Steps

- Click this link to deep-dive into the 4633 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:SPG

SP Group

Manufactures and sells moulded plastic and composite components in Denmark, rest of Europe, the Americas, Asia, the Middle East, Australia, and Africa.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives