As global markets navigate the complexities of AI-related concerns and fluctuating economic indicators, Asian markets have mirrored these challenges with notable declines in key indices. Despite this backdrop, the search for promising opportunities continues, particularly among small-cap stocks that may offer unique growth potential in a volatile environment. Identifying a good stock often involves looking for companies with strong fundamentals and innovative capabilities that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jetwell Computer | 34.75% | 16.24% | 27.51% | ★★★★★★ |

| Xiamen Jiarong TechnologyLtd | 8.54% | -5.04% | -25.38% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 0.09% | 3.09% | 5.71% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 44.30% | -13.35% | 24.08% | ★★★★★★ |

| Sichuan Haite High-techLtd | 33.85% | 9.98% | -37.61% | ★★★★★★ |

| Qingdao CHOHO IndustrialLtd | 37.31% | 12.33% | 8.72% | ★★★★★☆ |

| House of Investments | 16.98% | 15.00% | 47.47% | ★★★★★☆ |

| Li Ming Development Construction | 183.36% | 8.59% | 19.98% | ★★★★☆☆ |

| Wuhan Huakang Century Clean Technology | 49.07% | 21.27% | 6.99% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 51.85% | 20.80% | -5.94% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Vobile Group (SEHK:3738)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Mainland China, and other international markets, with a market cap of approximately HK$12.42 billion.

Operations: Vobile Group generates revenue primarily from its SaaS offerings, amounting to HK$2.68 billion. The company's market cap stands at approximately HK$12.42 billion.

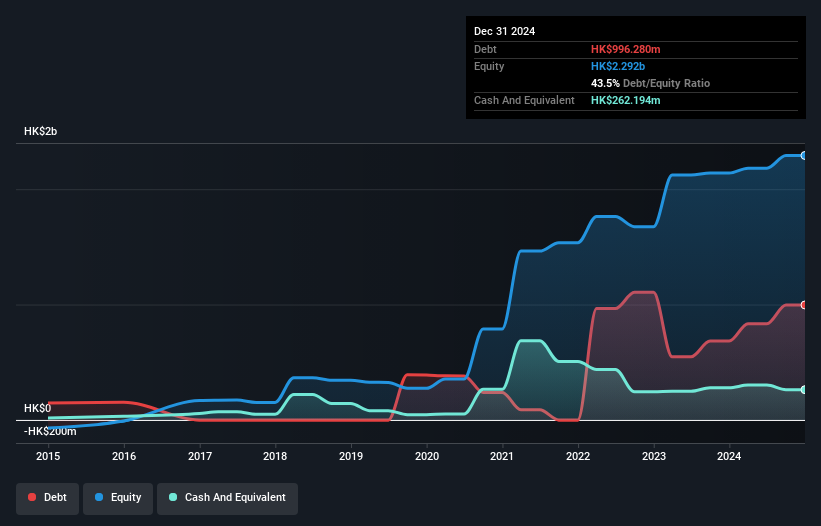

Vobile Group, a dynamic player in the tech space, has shown impressive growth with earnings surging 4431% over the past year, outpacing the software industry. The company's net debt to equity ratio stands at a satisfactory 16%, indicating prudent financial management. Interest payments are well-covered by EBIT at 4.3 times coverage. Recent results highlight a robust performance with Q3 revenue up by about 27% and monthly recurring revenue climbing approximately 28%. Despite no share buybacks in early 2025, Vobile completed repurchasing shares worth HKD 3.42 million under its earlier announced plan.

- Delve into the full analysis health report here for a deeper understanding of Vobile Group.

Gain insights into Vobile Group's past trends and performance with our Past report.

Bellwether Electronic (TPEX:7861)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bellwether Electronic Corp. specializes in designing, manufacturing, and providing after-sale services for electronic connectors and peripheral products related to computers, electronics, and communication products with a market capitalization of NT$24.29 billion.

Operations: Bellwether Electronic generates revenue primarily from electronic components and parts, amounting to NT$3.14 billion. The company's market capitalization stands at NT$24.29 billion.

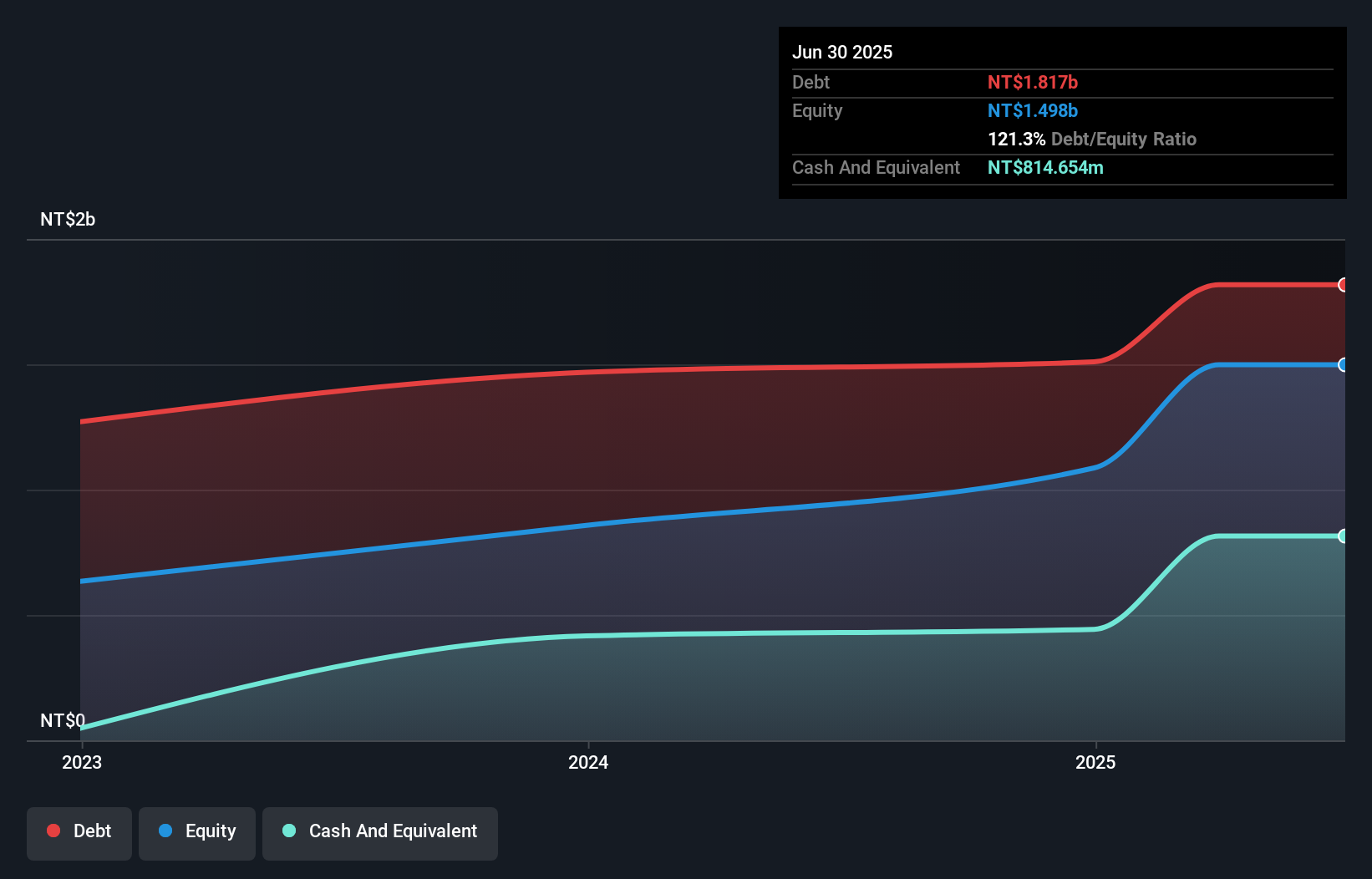

Bellwether Electronic, a smaller player in the electronics sector, has shown impressive earnings growth of 84.4% over the past year, outpacing the industry average of 6.6%. The company's net debt to equity ratio stands at a high 66.9%, indicating significant leverage but with interest payments well-covered by EBIT at 18.7 times coverage, financial stability seems manageable for now. Despite its high-quality earnings and positive free cash flow reaching US$287 million last year, shares remain highly illiquid which could pose challenges for investors seeking liquidity in their portfolios.

North Pacific BankLtd (TSE:8524)

Simply Wall St Value Rating: ★★★★☆☆

Overview: North Pacific Bank, Ltd. offers a range of banking products and services to both individuals and corporations in Japan, with a market cap of ¥289.56 billion.

Operations: Revenue for North Pacific Bank, Ltd. is primarily derived from interest income and fees associated with its banking products and services. The bank's net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

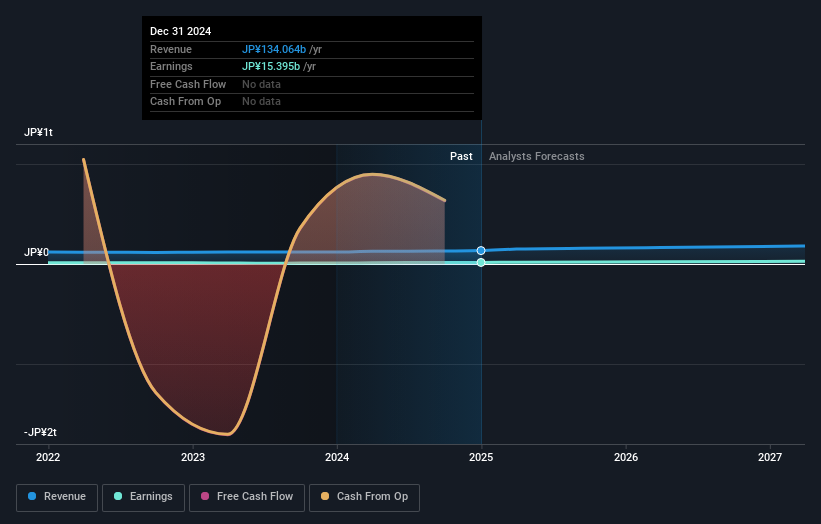

North Pacific Bank, with total assets of ¥13,212.2 billion and equity of ¥406.1 billion, is a notable player in the banking sector. Total deposits stand at ¥10,881.6 billion against loans of ¥8,111.8 billion. The bank's earnings shot up by 69% last year, outpacing the industry’s 25.5% growth rate and reflecting high-quality past earnings despite a net interest margin of 0.6%. An appropriate level of bad loans at 1.2% indicates sound risk management; however, allowance for bad loans is low at 47%. Recent moves include establishing Hokkaido Mother Investment Co., Ltd., aiming to bolster competitiveness and regional growth initiatives.

Next Steps

- Delve into our full catalog of 2492 Asian Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3738

Vobile Group

An investment holding company, provides software as a service for digital content asset protection and transaction in the United States, Mainland China, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success