As global markets navigate the complexities of policy changes and economic signals, investors are keenly observing sectors that may benefit from regulatory shifts and interest rate adjustments. In this environment, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$279.00 | NT$554.65 | 49.7% |

| Lindab International (OM:LIAB) | SEK226.60 | SEK450.18 | 49.7% |

| SeSa (BIT:SES) | €76.00 | €150.71 | 49.6% |

| S-Pool (TSE:2471) | ¥344.00 | ¥681.84 | 49.5% |

| Solum (KOSE:A248070) | ₩17280.00 | ₩34265.45 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥16.20 | CN¥32.31 | 49.9% |

| XD (SEHK:2400) | HK$22.40 | HK$44.60 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.25 | CA$8.45 | 49.7% |

| Intellian Technologies (KOSDAQ:A189300) | ₩44600.00 | ₩88907.79 | 49.8% |

| iFLYTEKLTD (SZSE:002230) | CN¥53.07 | CN¥105.85 | 49.9% |

Let's review some notable picks from our screened stocks.

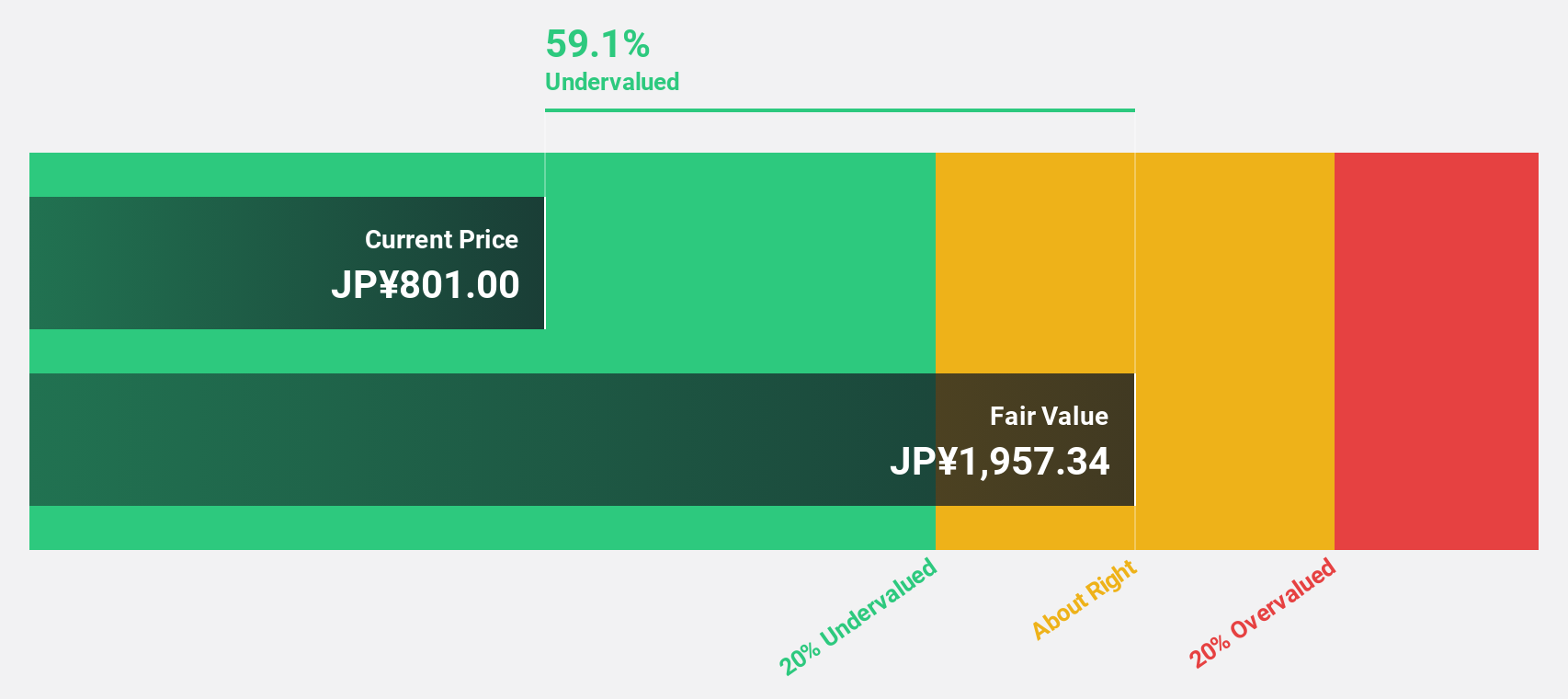

Takara Bio (TSE:4974)

Overview: Takara Bio Inc. operates in the bioindustry, CDMO, and gene therapy sectors across Japan, China, the rest of Asia, the United States, Europe, and internationally with a market cap of approximately ¥129.33 billion.

Operations: Takara Bio Inc.'s revenue is derived from its operations in the bioindustry, contract development and manufacturing organization (CDMO), and gene therapy sectors across various regions including Japan, China, Asia, the United States, and Europe.

Estimated Discount To Fair Value: 39.5%

Takara Bio's stock, trading at ¥1074, is significantly undervalued relative to its estimated fair value of ¥1774.38. Despite a decline in profit margins from 13.2% to 2.1%, the company's earnings are projected to grow substantially at 25.22% annually, outpacing the broader Japanese market's growth rate of 8%. However, future return on equity remains modest at an anticipated 4.8%, and recent financials were affected by large one-off items.

- In light of our recent growth report, it seems possible that Takara Bio's financial performance will exceed current levels.

- Navigate through the intricacies of Takara Bio with our comprehensive financial health report here.

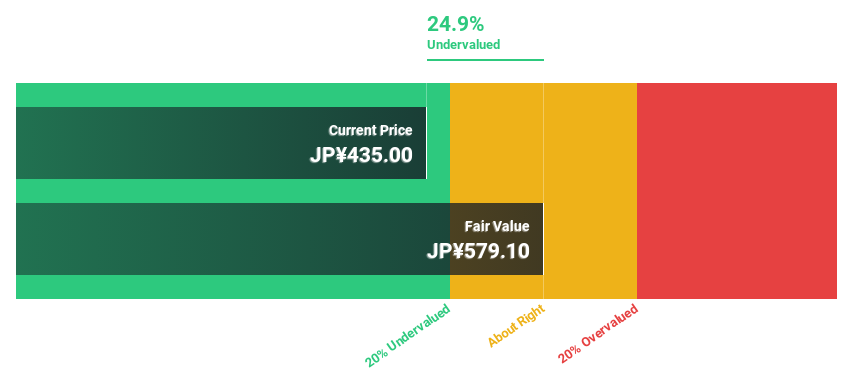

North Pacific BankLtd (TSE:8524)

Overview: North Pacific Bank, Ltd. offers a range of banking products and services to individuals and corporations in Japan, with a market cap of ¥168.29 billion.

Operations: The company generates revenue through its diverse banking products and services tailored for both individual and corporate clients within Japan.

Estimated Discount To Fair Value: 24%

North Pacific Bank Ltd. is trading at ¥440, notably below its estimated fair value of ¥579.09, indicating it is undervalued based on cash flow analysis. The bank's earnings are projected to grow significantly at 20.8% annually, surpassing the Japanese market average of 8%. However, its return on equity is forecasted to remain low at 5.8% in three years. Recently, the bank increased its dividend from ¥5 to ¥6.50 per share for the fiscal year ending March 2025.

- Insights from our recent growth report point to a promising forecast for North Pacific BankLtd's business outlook.

- Dive into the specifics of North Pacific BankLtd here with our thorough financial health report.

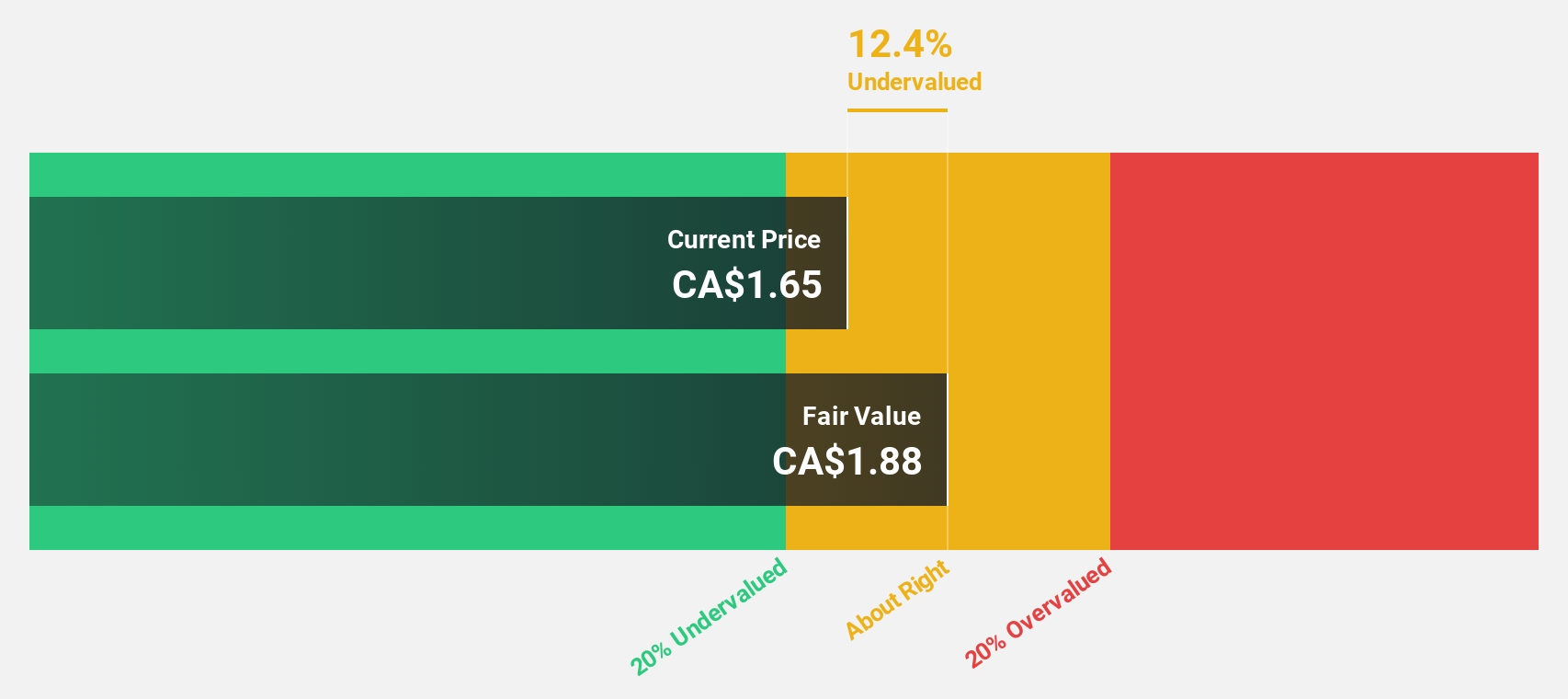

Africa Oil (TSX:AOI)

Overview: Africa Oil Corp., along with its subsidiaries, is engaged in oil and gas exploration and production activities in Kenya, Nigeria, and South Africa, with a market cap of CA$837.30 million.

Operations: Africa Oil Corp. focuses on oil and gas exploration and production operations across Kenya, Nigeria, and South Africa.

Estimated Discount To Fair Value: 47.5%

Africa Oil is trading at CA$1.89, significantly below its estimated fair value of CA$3.6, highlighting its undervaluation based on cash flows. Despite recent financial setbacks with a net loss of US$289.2 million in Q3 2024, revenue and earnings are forecasted to grow substantially over the next three years, outpacing the Canadian market average growth rate. However, the sustainability of its 3.73% dividend remains questionable due to insufficient earnings coverage.

- Our earnings growth report unveils the potential for significant increases in Africa Oil's future results.

- Take a closer look at Africa Oil's balance sheet health here in our report.

Next Steps

- Delve into our full catalog of 935 Undervalued Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takara Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4974

Takara Bio

Engages in bioindustry, contract development and manufacturing organization (CDMO), and gene therapy businesses in Japan, China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.