- Japan

- /

- Trade Distributors

- /

- TSE:3166

3 Reliable Dividend Stocks Yielding Up To 6.5%

Reviewed by Simply Wall St

As global markets grapple with the uncertainty surrounding policy shifts from the incoming Trump administration, investors are keenly observing sector-specific impacts, such as deregulation hopes boosting financials and energy stocks while healthcare faces potential challenges. In this climate of fluctuating returns and economic signals, dividend stocks offer a reliable option for income-focused investors seeking stability amid volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

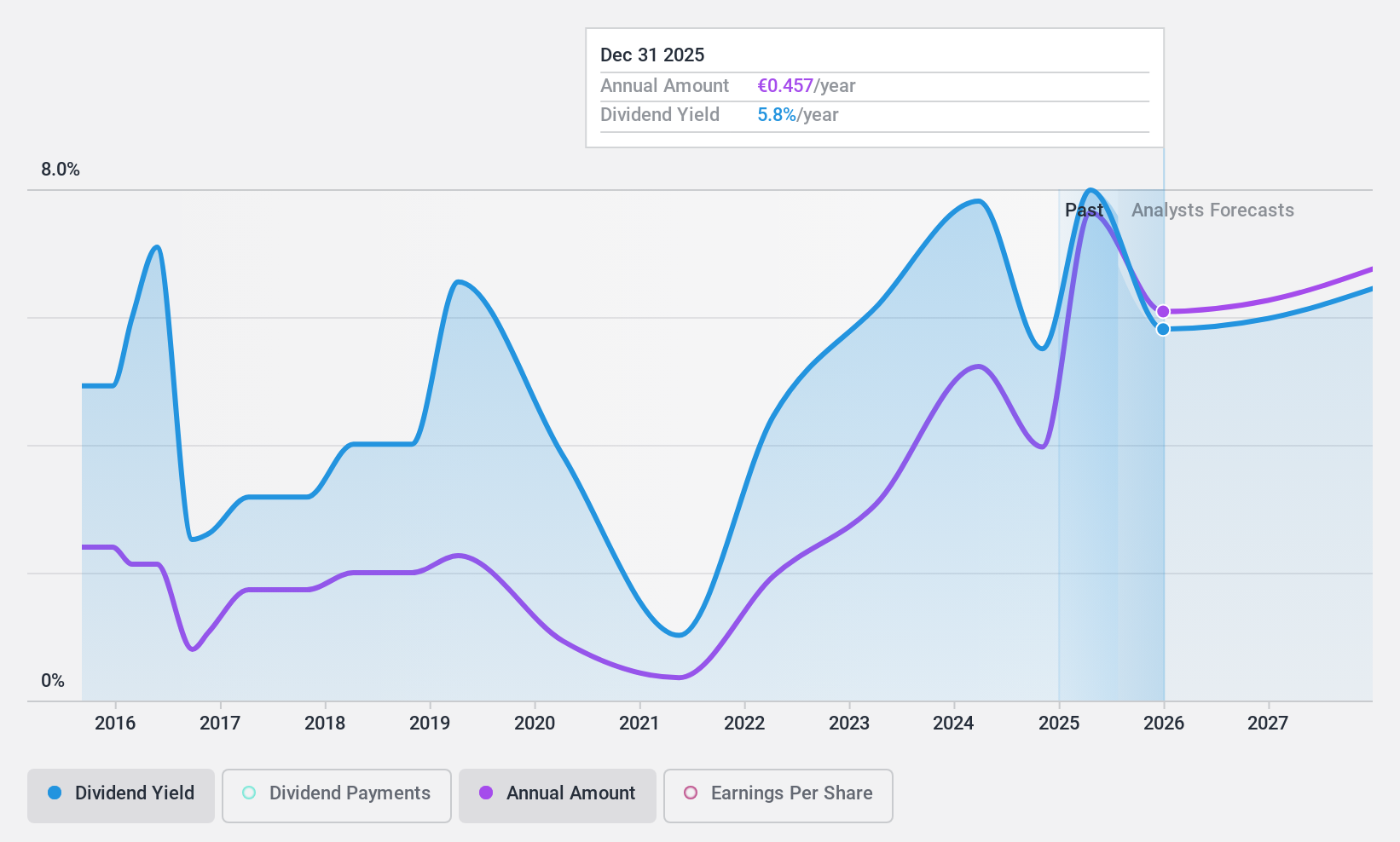

CaixaBank (BME:CABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CaixaBank, S.A. offers a range of banking products and financial services both in Spain and internationally, with a market cap of €40.50 billion.

Operations: CaixaBank's revenue is primarily derived from its Banking segment (€10.67 billion), followed by Insurance (€1.83 billion), and the Portuguese Investment Bank (BPI) (€1.21 billion), with additional contributions from its Corporate Center (€153 million).

Dividend Yield: 5.3%

CaixaBank's dividend is currently covered by earnings with a payout ratio of 76.2%, expected to improve to 67.7% in three years, indicating a sustainable approach despite past volatility and unreliability in payments. The bank's recent earnings growth supports its dividend capacity, although the yield of 5.31% is below top-tier Spanish payers. Notably, CaixaBank has a high level of bad loans at 2.6%, which may affect future stability.

- Get an in-depth perspective on CaixaBank's performance by reading our dividend report here.

- The valuation report we've compiled suggests that CaixaBank's current price could be inflated.

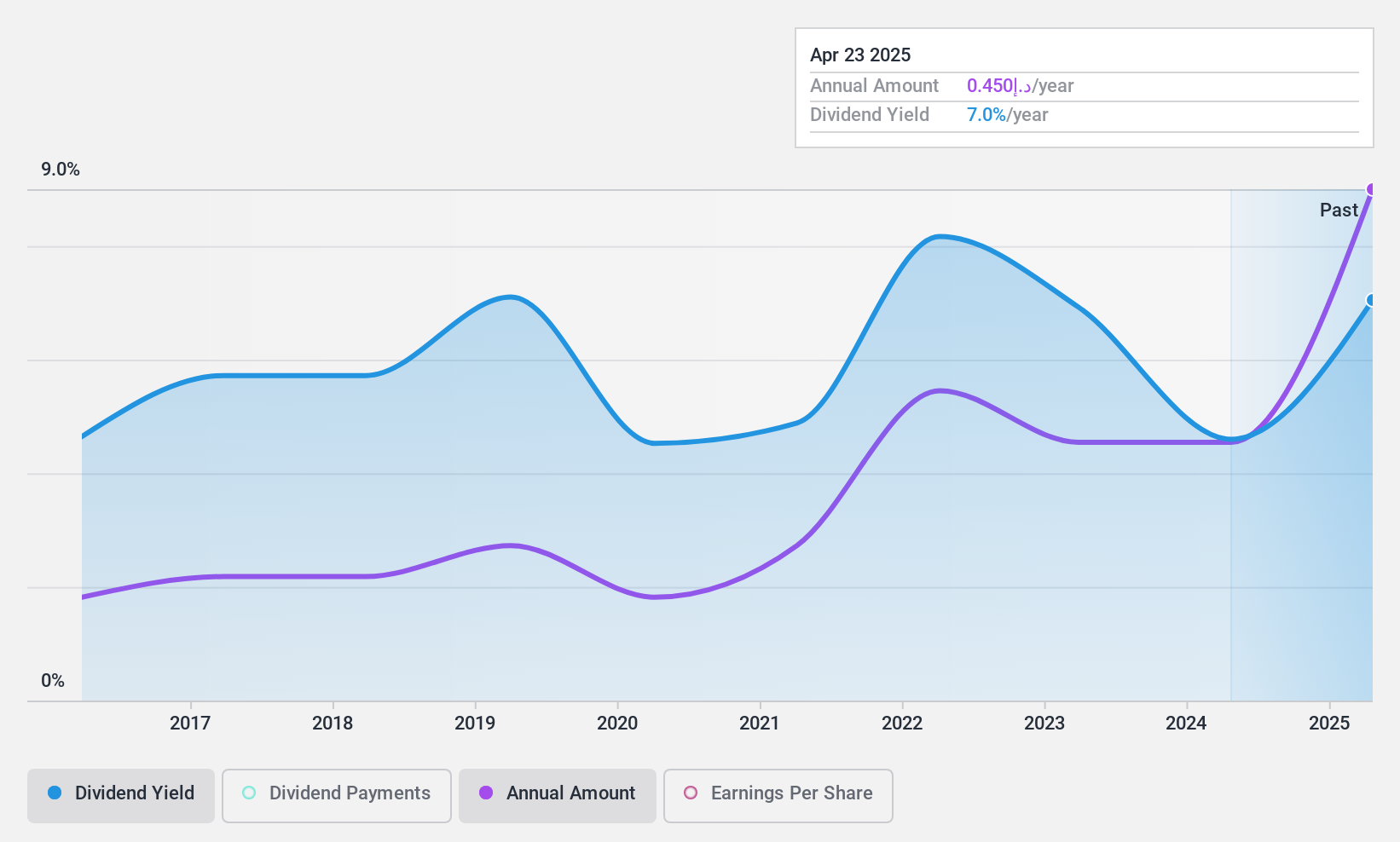

National General Insurance (P.J.S.C.) (DFM:NGI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National General Insurance Co. (P.J.S.C.) operates in the United Arab Emirates, providing underwriting services for life, general insurance, and reinsurance products with a market cap of AED806.60 million.

Operations: National General Insurance Co. (P.J.S.C.) generates revenue through its diverse portfolio of life insurance, general insurance, and reinsurance services in the UAE.

Dividend Yield: 6.5%

National General Insurance's recent earnings growth of 73.7% suggests potential for dividend capacity, yet its dividends remain unreliable and volatile over the past decade, with a history of annual drops exceeding 20%. The current payout ratio of 30.9% indicates coverage by earnings, but dividends are not supported by free cash flows. Despite a high dividend yield of 6.51%, placing it in the top tier within the AE market, sustainability concerns persist due to weak cash flow coverage.

- Dive into the specifics of National General Insurance (P.J.S.C.) here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that National General Insurance (P.J.S.C.) is priced higher than what may be justified by its financials.

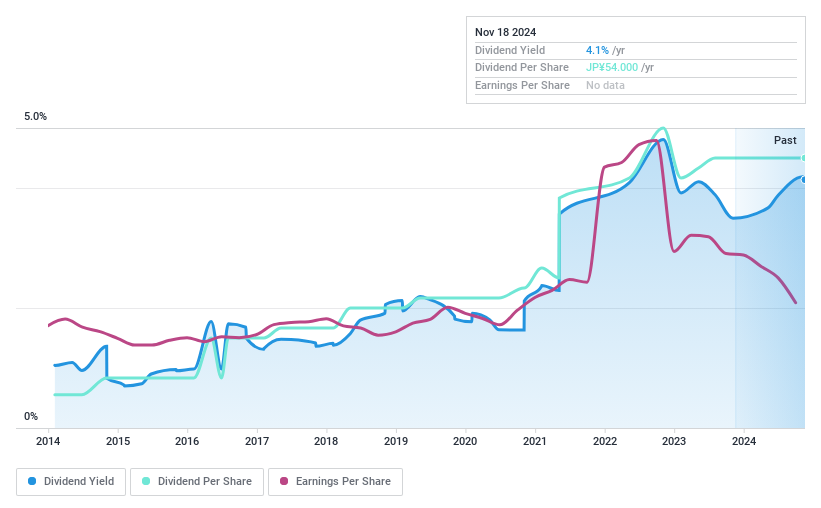

Ochi Holdings (TSE:3166)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ochi Holdings Co., Ltd., with a market cap of ¥16.92 billion, operates through its subsidiaries to trade in building materials in Japan.

Operations: Ochi Holdings Co., Ltd. generates revenue through its subsidiaries by engaging in the trade of building materials within Japan.

Dividend Yield: 4.1%

Ochi Holdings' dividend yield of 4.14% ranks in the top 25% of the JP market, yet sustainability is questionable due to high cash payout ratios (99.5%) and inadequate free cash flow coverage. Although dividends are well covered by earnings with a low payout ratio (43.1%), past payments have been volatile and unreliable, showing annual drops over 20%. The stock trades at a significant discount, 26.5% below estimated fair value, offering potential value for investors despite these concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of Ochi Holdings.

- Our valuation report unveils the possibility Ochi Holdings' shares may be trading at a premium.

Key Takeaways

- Click through to start exploring the rest of the 1948 Top Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3166

Ochi Holdings

Through its subsidiaries, trades in building materials in Japan.

Flawless balance sheet average dividend payer.