As global markets edge towards record highs, with U.S. stock indexes like the Nasdaq Composite and S&P 500 nearing all-time peaks, investors are closely watching inflation trends and interest rate expectations. Amidst this backdrop of economic uncertainty, dividend stocks can offer a reliable income stream and potential stability, making them an appealing option for those looking to navigate these turbulent market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.96% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

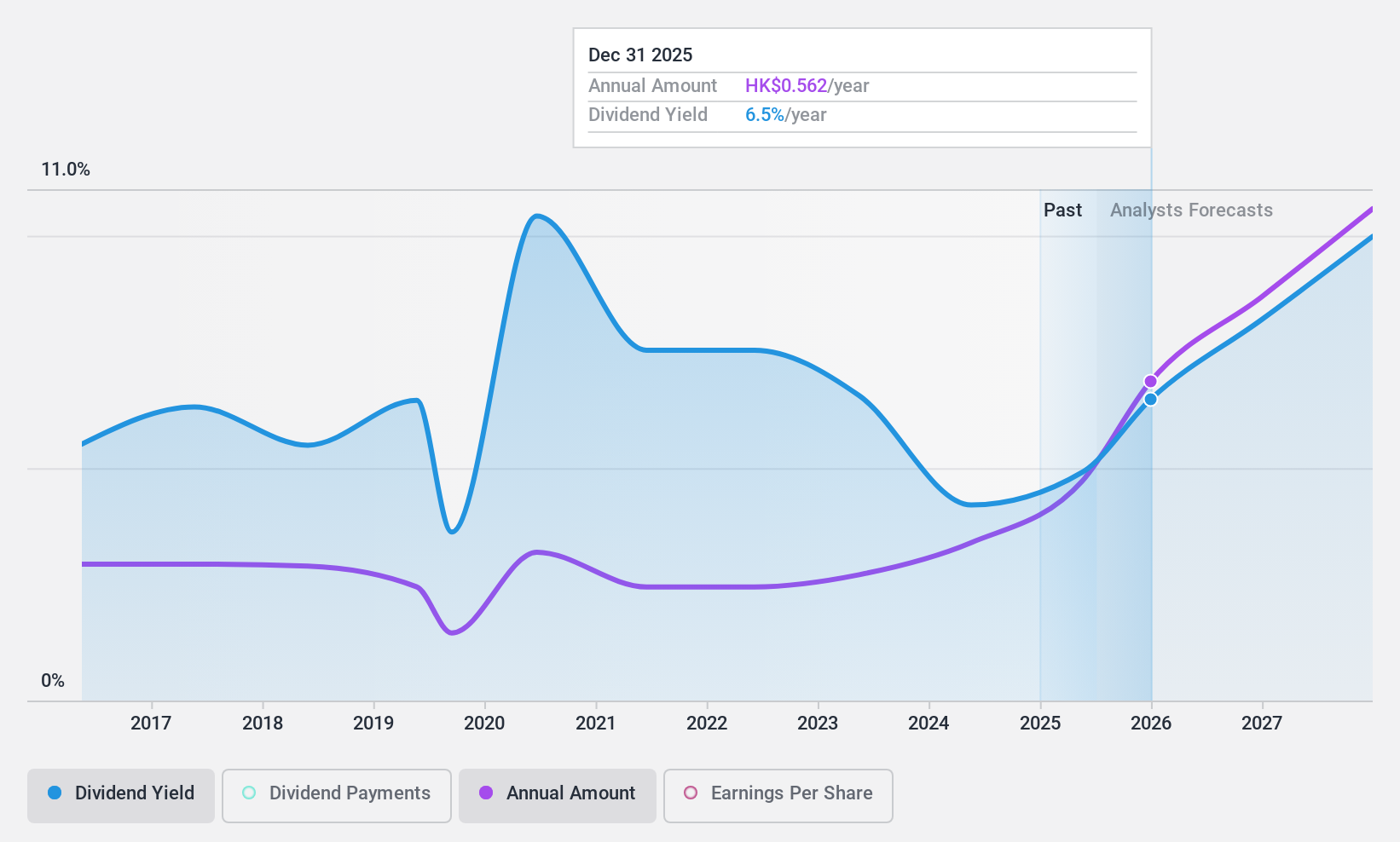

Wasion Holdings (SEHK:3393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia; it has a market cap of approximately HK$8.07 billion.

Operations: Wasion Holdings Limited generates revenue from three main segments: Advanced Distribution Operations (CN¥2.51 billion), Power Advanced Metering Infrastructure (CN¥2.99 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion).

Dividend Yield: 3.4%

Wasion Holdings' dividend payments have been volatile over the past decade, with a relatively low yield of 3.38% compared to top-tier Hong Kong dividend payers. However, dividends are well-covered by earnings and cash flows, with payout ratios at 40% and 39%, respectively. Despite an unstable track record, recent earnings growth of 61.9% suggests potential for future stability. The stock trades at a significant discount to its estimated fair value, enhancing its appeal for value-focused investors.

- Click here to discover the nuances of Wasion Holdings with our detailed analytical dividend report.

- Our expertly prepared valuation report Wasion Holdings implies its share price may be lower than expected.

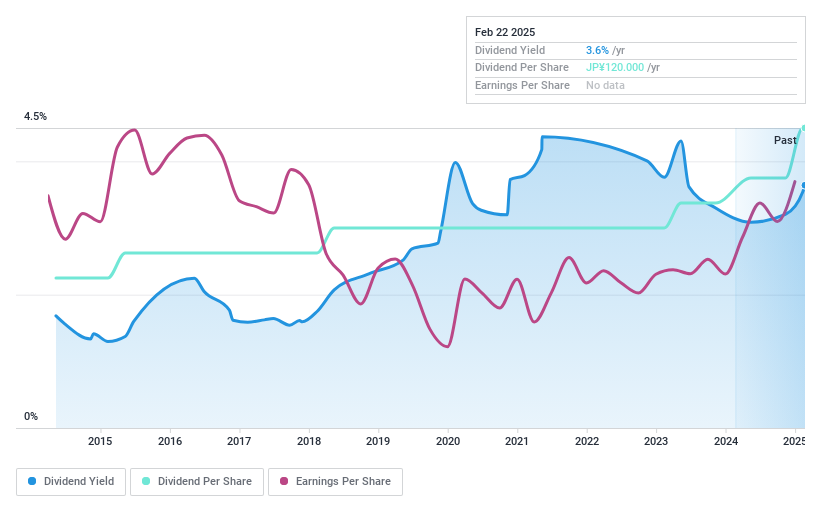

Oita Bank (TSE:8392)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Oita Bank, Ltd. offers a range of banking products and services to individual and corporate clients mainly in Japan, with a market cap of ¥53.44 billion.

Operations: Oita Bank generates revenue through its diverse banking products and services tailored for individual and corporate clients in Japan.

Dividend Yield: 3.5%

Oita Bank offers a reliable dividend yield of 3.46%, though it is below the top tier in Japan. With a low payout ratio of 18.7%, dividends are well-covered by earnings, and payments have been stable and increasing over the past decade. The bank's price-to-earnings ratio of 6.4x suggests good value compared to the broader market (13.2x). Recent share buyback plans aim to enhance shareholder returns and improve capital efficiency, potentially benefiting dividend investors further.

- Click here and access our complete dividend analysis report to understand the dynamics of Oita Bank.

- In light of our recent valuation report, it seems possible that Oita Bank is trading beyond its estimated value.

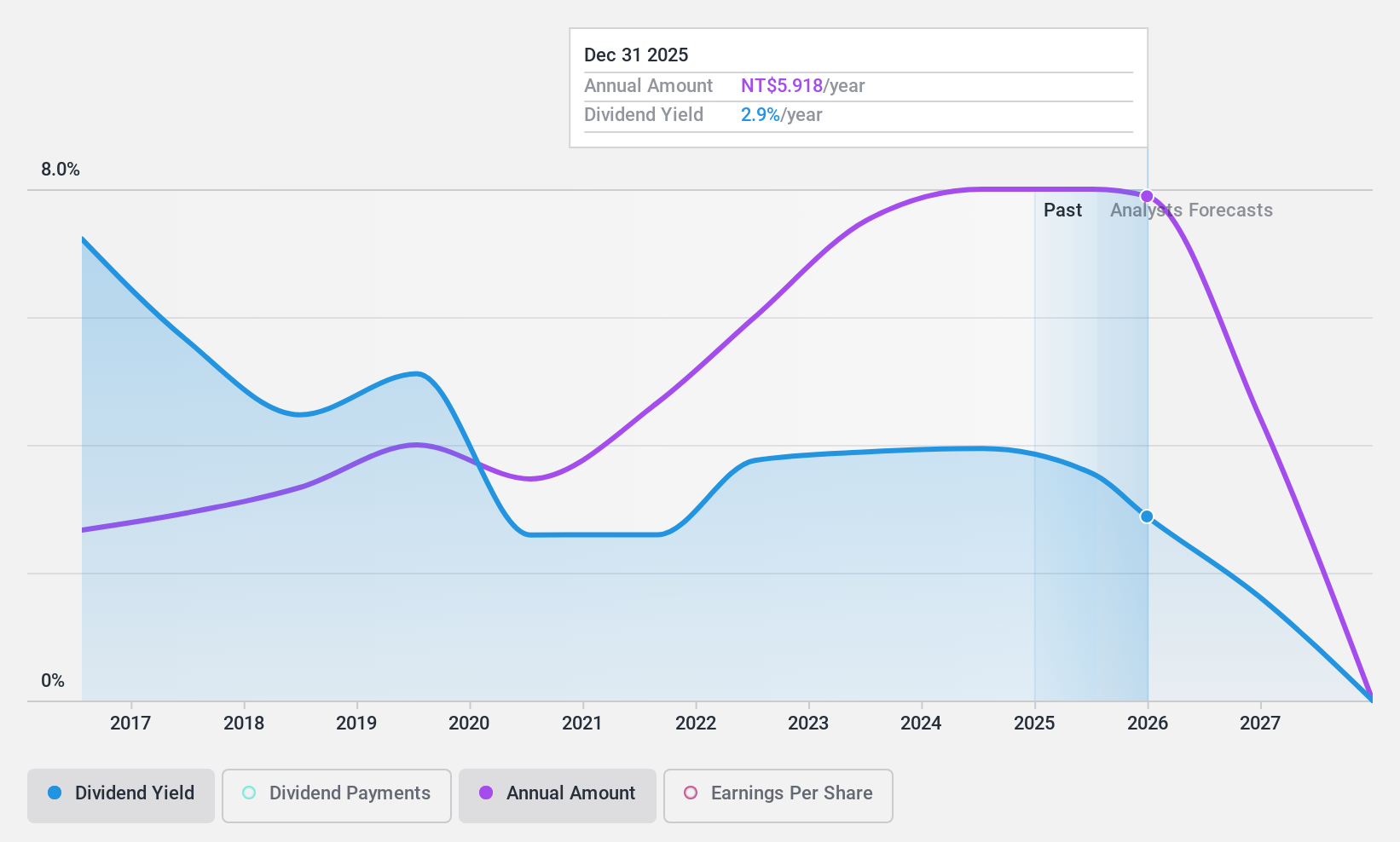

Marketech International (TWSE:6196)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marketech International Corp. manufactures, sells, imports, and trades integrated circuits, semiconductors, electrical and computer equipment and materials, chemicals, gas, and components across Taiwan, China, the United States, and internationally with a market cap of NT$30.40 billion.

Operations: Marketech International Corp.'s revenue is primarily derived from three segments: Factory System and Electromechanical System Service Business (NT$44.83 billion), Customized Equipment Manufacturing (NT$8.98 billion), and Equipment Materials Agent Sales Business (NT$8.06 billion).

Dividend Yield: 3.9%

Marketech International's dividend yield of 3.87% is slightly below the top tier in Taiwan, but dividends have been reliable and growing over the past decade. The payout ratio of 70.6% indicates earnings coverage, while a cash payout ratio of 26.5% ensures dividends are well covered by cash flows. Trading at a price-to-earnings ratio of 18.3x, it offers good value relative to the market average of 21.4x despite recent profit margin declines due to large one-off items impacting results.

- Click to explore a detailed breakdown of our findings in Marketech International's dividend report.

- The valuation report we've compiled suggests that Marketech International's current price could be quite moderate.

Make It Happen

- Dive into all 1985 of the Top Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8392

Oita Bank

Provides various banking products and services to individual and corporate clients primarily in Japan.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives