- Japan

- /

- Food and Staples Retail

- /

- TSE:9869

Discovering Three Asian Small Caps with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape of trade negotiations and economic uncertainties, small-cap indexes have shown resilience, posting gains for the fifth consecutive week. In this promising environment, identifying potential opportunities in Asian small caps can be particularly rewarding as these companies often offer unique growth potential amid broader market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Chemical Equipment | NA | 13.24% | -0.17% | ★★★★★★ |

| Ascentech K.K | NA | 134.28% | 78.96% | ★★★★★★ |

| Neosem | 2.26% | 26.11% | 25.59% | ★★★★★★ |

| Triocean Industrial Corporation | 15.32% | 47.09% | 77.47% | ★★★★★★ |

| Toyo Kanetsu K.K | 33.97% | 3.33% | 18.20% | ★★★★★☆ |

| Kangping Technology (Suzhou) | 23.90% | 1.60% | 16.23% | ★★★★★☆ |

| Techshine ElectronicsLtd | 8.66% | 23.58% | 16.34% | ★★★★★☆ |

| Suzhou Chunqiu Electronic Technology | 46.46% | 3.33% | -19.72% | ★★★★★☆ |

| Hangzhou Zhengqiang | 26.03% | 2.95% | 16.75% | ★★★★★☆ |

| Kinpo Electronics | 99.44% | 5.80% | 41.38% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

China Nerin Engineering (SHSE:603257)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Nerin Engineering Co., Ltd is an engineering technology company that operates both in China and internationally, with a market capitalization of CN¥6.40 billion.

Operations: The company generates revenue primarily through its engineering technology services both domestically and internationally.

China Nerin Engineering, a smaller player in the construction industry, has demonstrated notable financial resilience and growth. The company's earnings rose by 5.5% over the past year, outpacing the industry's -4.8%. Recent IPO proceeds of CNY 615.6 million likely bolster its financial position further. Despite a slight increase in debt-to-equity from 0% to 0.5% over five years, it maintains more cash than total debt and positive free cash flow of CNY 243.58 million as of March 2025. The successful launch of the Mariana Project in Argentina underscores its technical prowess in lithium extraction engineering on an international scale.

Suruga Bank (TSE:8358)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Suruga Bank Ltd. offers a range of banking and financial services to both individual and corporate clients throughout Japan, with a market capitalization of ¥237.41 billion.

Operations: Suruga Bank generates revenue primarily from its banking segment, which accounts for ¥83.80 billion. The bank's market capitalization stands at ¥237.41 billion.

Suruga Bank, a notable player in Japan's banking sector, boasts total assets of ¥3.45 trillion with equity standing at ¥301.5 billion. Its deposits amount to ¥3.12 trillion and loans reach ¥2.30 trillion, while the net interest margin sits at 1.9%. Despite having high-quality past earnings and a significant 534% earnings growth last year, the bank faces challenges with bad loans comprising 7.7% of total loans and an insufficient allowance for these non-performing assets at just 55%. Recently, Suruga repurchased shares worth ¥5.81 billion, signaling confidence in its market value amidst ongoing strategic adjustments.

- Unlock comprehensive insights into our analysis of Suruga Bank stock in this health report.

Gain insights into Suruga Bank's historical performance by reviewing our past performance report.

Kato Sangyo (TSE:9869)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kato Sangyo Co., Ltd. operates in the general food wholesaling industry both within Japan and internationally, with a market cap of ¥171.66 billion.

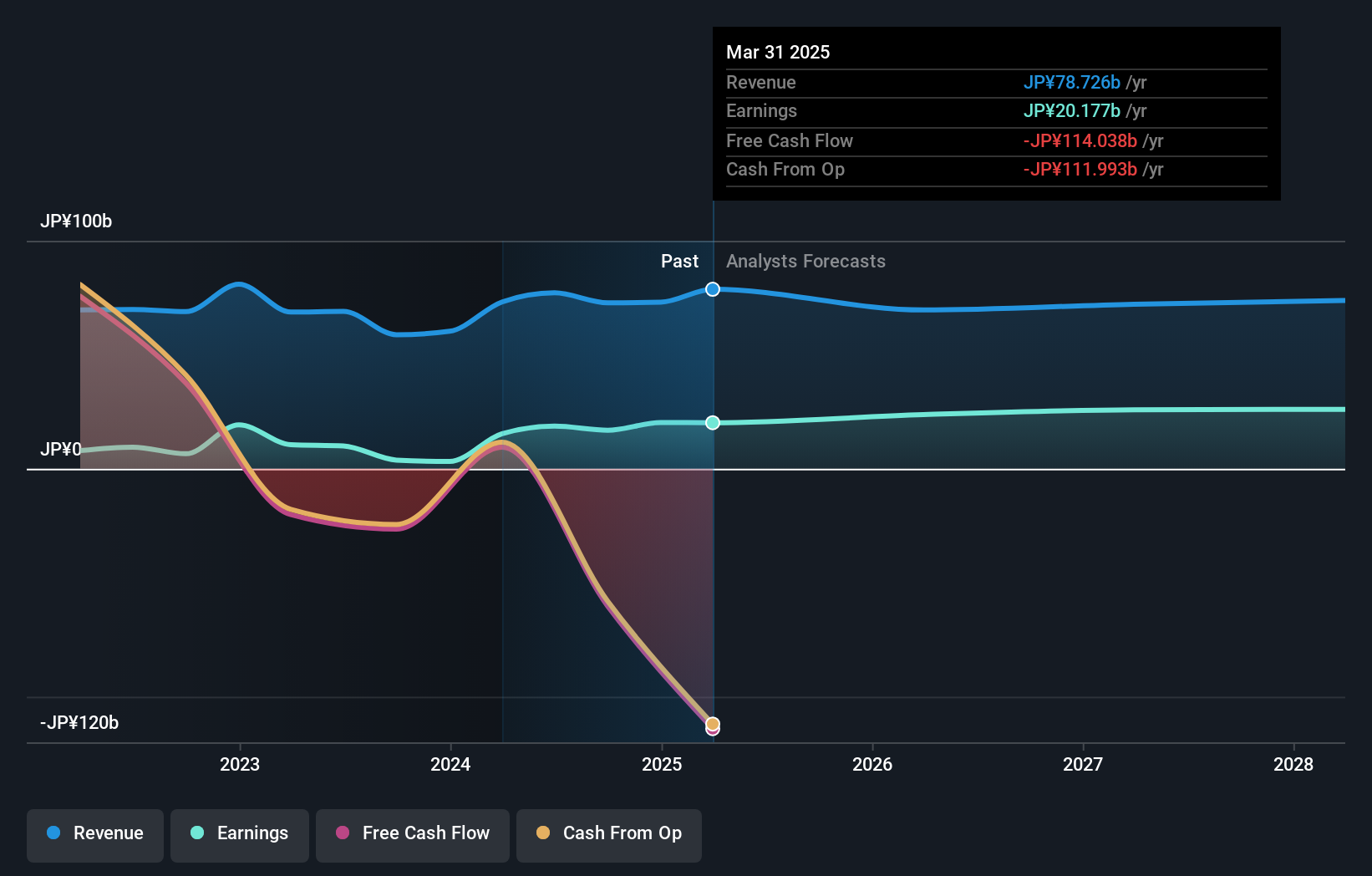

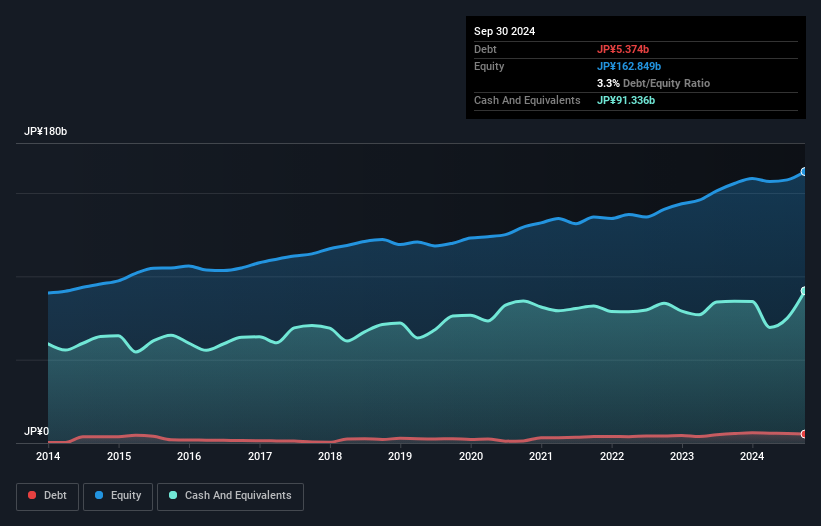

Operations: Kato Sangyo generates revenue primarily from its food wholesaling operations. The company's net profit margin is 1.37%.

Kato Sangyo, a notable player in the consumer retailing sector, has shown consistent earnings growth of 12.6% annually over the past five years. The company is trading at 19.3% below its estimated fair value, suggesting potential upside for investors. Despite an increase in its debt-to-equity ratio from 2% to 3.8%, Kato Sangyo holds more cash than total debt, indicating sound financial health. Recently announced plans to repurchase up to ¥10 billion worth of shares aim to enhance capital efficiency and shareholder returns, reflecting a proactive approach in adapting to market conditions and boosting investor confidence.

- Click here and access our complete health analysis report to understand the dynamics of Kato Sangyo.

Next Steps

- Investigate our full lineup of 2670 Asian Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kato Sangyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9869

Kato Sangyo

Engages in the general food wholesaling business in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives