Is There Still Value in Fukuoka Financial Group After Strong 2025 Performance?

Reviewed by Simply Wall St

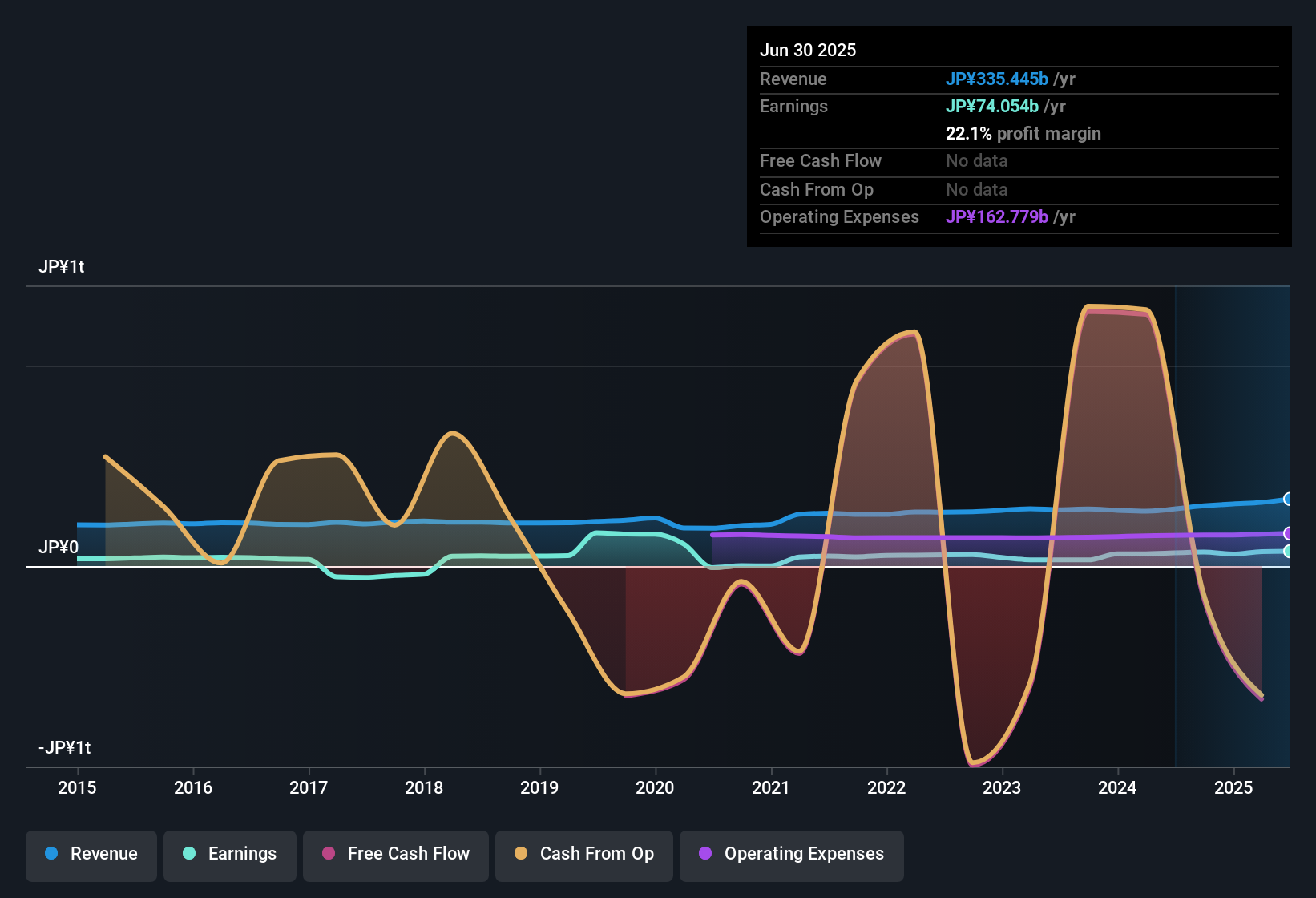

Thinking about your next move with Fukuoka Financial Group? You are not alone. Investors tracking Japanese bank stocks have seen plenty of action lately, but Fukuoka stands out for more than just market noise. Despite some recent choppiness, with shares slipping by 1.4% over the last week and by 1.9% in the past month, the long-term picture is seriously impressive. The stock is up 11.8% year-to-date, and over the past five years, it has soared by 179.0%.

Most of this momentum can be traced back to broader shifts in the Japanese financial sector as well as renewed confidence in domestic lending growth. Improved risk appetite and sector-wide optimism have definitely fed into Fukuoka's returns, especially over the last three years, during which the stock delivered a remarkable 93.7% gain. It is clear that this is a company capturing investor attention for good reasons, not just because of macro trends, but also because of what its numbers are showing under the surface.

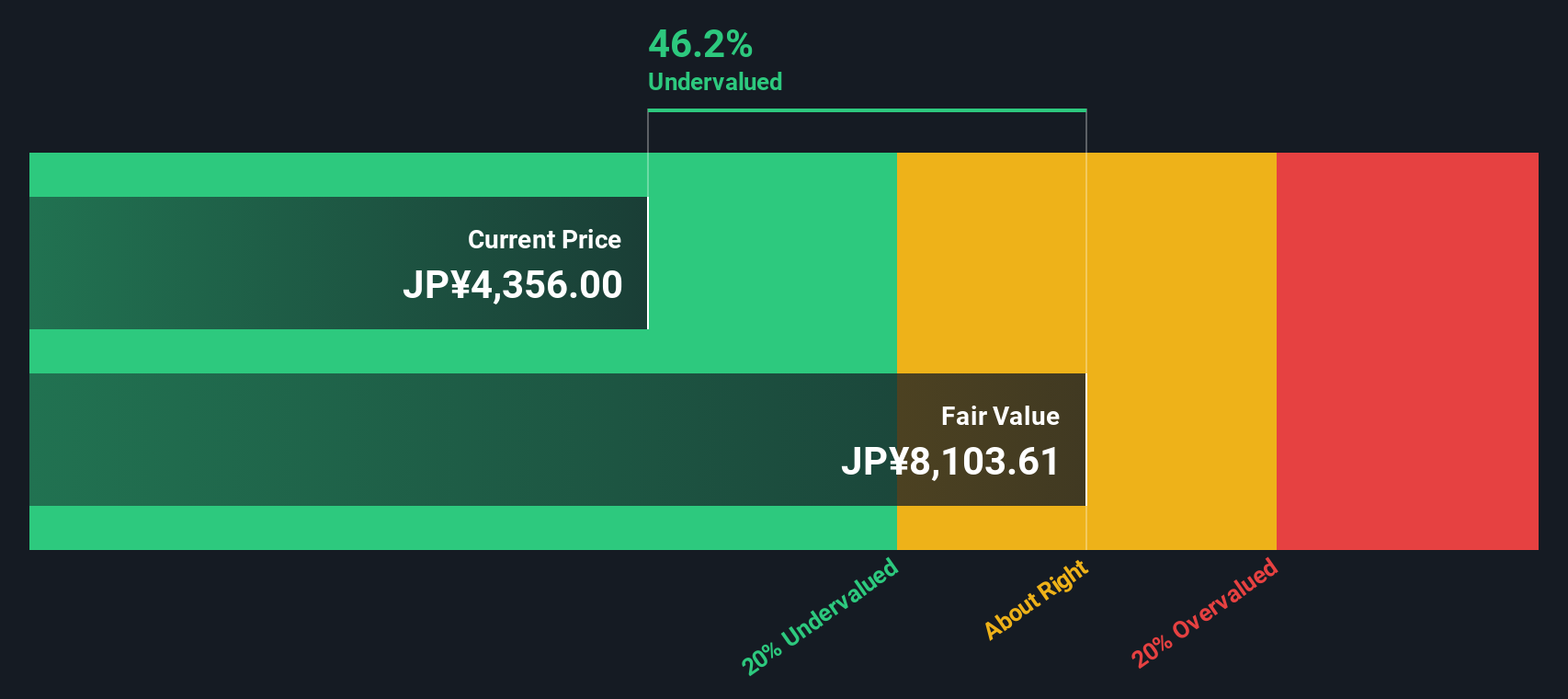

Now, let us get to the heart of the matter: is Fukuoka Financial Group still undervalued, or has it already run its course? According to a recent value assessment that checks for six key measures, the company scores a 4 out of 6, meaning it is undervalued in four important ways. In the next section, we will look closely at these valuation methods and what they mean for investors like you, but keep an eye out, because there just might be an even smarter approach to understanding this stock's true value coming up at the end.

Why Fukuoka Financial Group is lagging behind its peersApproach 1: Fukuoka Financial Group Excess Returns Analysis

The Excess Returns model evaluates a company's value by examining how much profit it generates over and above its cost of equity. Essentially, it focuses on whether Fukuoka Financial Group is delivering returns that consistently outpace what shareholders require as compensation for risk. This method works best for financial companies like banks, where return on equity and growth in book value are critical.

For Fukuoka Financial Group, analysts estimate a Book Value of ¥5,128.83 per share, with stable Earnings Per Share (EPS) of ¥508.04. The cost of equity is calculated at ¥375.83 per share, resulting in annual excess returns of ¥132.20 per share. Over time, the company is expected to maintain an average Return on Equity of 8.67 percent. The stable Book Value projection rises to ¥5,860.27 per share, giving confidence in ongoing profitability.

Based on these inputs, the model calculates an intrinsic value of ¥8,104 per share. This figure points to a significant intrinsic discount of 45.4 percent compared to the current trading price, implying that Fukuoka Financial Group is notably undervalued using this sophisticated return-based methodology.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Fukuoka Financial Group.

Approach 2: Fukuoka Financial Group Price vs Earnings

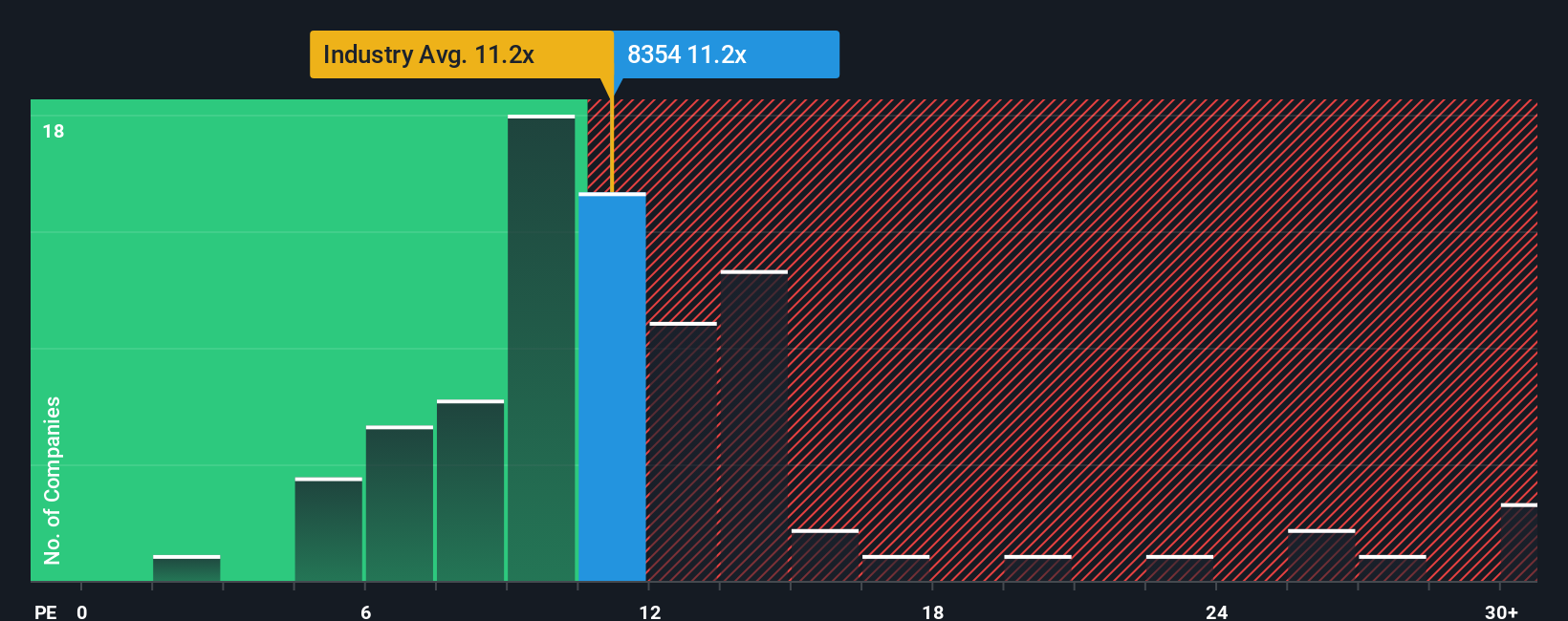

The Price-to-Earnings (PE) ratio is one of the most reliable valuation metrics for profitable companies, as it directly compares a company’s market value to its earnings. Since banks like Fukuoka Financial Group produce steady profits and have transparent earnings, the PE ratio provides a clear gauge for determining whether the stock price fairly reflects its earnings potential.

Growth expectations and risk play a critical role in what constitutes a “normal” or fair PE ratio. Companies with higher expected earnings growth, stronger profitability, or lower risk are usually rewarded with a higher PE. Conversely, if risks are higher or growth is limited, the market typically assigns a lower PE multiple as a discount.

Currently, Fukuoka Financial Group trades at an 11.3x PE ratio. This is slightly above the average for the Japanese banking industry, which sits at 11.0x. However, it is well below the peer average of 17.1x. Simply Wall St’s proprietary “Fair Ratio” offers an even sharper perspective. Unlike a simple peer or industry comparison, the Fair Ratio (13.6x) is tailored for Fukuoka by factoring in its own growth profile, risk characteristics, profit margins, industry context, and market capitalization. This holistic approach allows for a more accurate assessment of value.

With Fukuoka’s current PE ratio below the Fair Ratio, there is a strong case that the stock remains undervalued on an earnings basis despite its strong run.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Fukuoka Financial Group Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story about a company, combining your own view of Fukuoka Financial Group’s future with clear forecasts for revenue, profits, and a fair value estimate. Narratives connect the company’s unique story to its financials and then to a specific fair value, helping you see how your perspective compares to the market.

This approach is both powerful and easy to use, thanks to the Narratives feature on Simply Wall St’s Community page. Here, millions of investors share and refine their outlooks. Narratives make it easier to decide when to buy or sell, guiding you by comparing your calculated Fair Value to Fukuoka’s current price. Additionally, as fresh news or quarterly results become available, Narratives are updated dynamically, so your insights always remain relevant.

For example, while some investors see Fukuoka’s fair value as high as ¥10,200, others may estimate it closer to ¥7,100, each based on their own Narrative about future prospects and risks.

Do you think there's more to the story for Fukuoka Financial Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8354

Fukuoka Financial Group

Provides various banking services to individual and corporate customers.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives