Amidst ongoing global market volatility, characterized by U.S. inflation easing and recession concerns weighing heavily on stocks, investors are increasingly turning their attention to dividend stocks as a potential source of stable income. In such uncertain times, selecting dividend stocks with solid yields can provide a measure of stability and income generation, making them an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.11% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.01% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.08% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.78% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 3.94% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.80% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.62% | ★★★★★★ |

Click here to see the full list of 1411 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Chugin Financial GroupInc (TSE:5832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chugin Financial Group, Inc., with a market cap of ¥299.50 billion, operates through its subsidiary The Chugoku Bank, Limited to offer a range of financial services to both corporate and individual clients in Japan.

Operations: Chugin Financial Group, Inc., primarily generates revenue through its subsidiary The Chugoku Bank, Limited by offering a variety of financial services to corporate and individual customers in Japan.

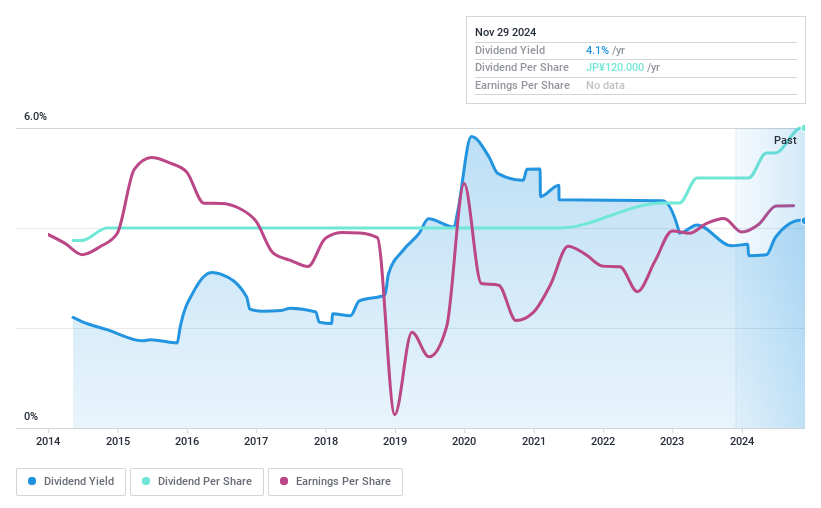

Dividend Yield: 3.2%

Chugin Financial Group Inc. offers a reliable dividend yield of 3.23%, with stable and growing payments over the past decade, supported by a low payout ratio of 45.1%. The company trades at 16.8% below its estimated fair value, suggesting potential for capital appreciation alongside dividends. Recent guidance indicates expected revenues of ¥212 billion and profits of ¥25 billion for the year ending March 31, 2025, which could support future dividend sustainability.

- Get an in-depth perspective on Chugin Financial GroupInc's performance by reading our dividend report here.

- Our valuation report here indicates Chugin Financial GroupInc may be overvalued.

Nishi-Nippon Financial Holdings (TSE:7189)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nishi-Nippon Financial Holdings, Inc. manages and operates banks and companies offering financial and non-financial solutions in Japan, Hong Kong, China, and Singapore with a market cap of ¥287.35 billion.

Operations: Nishi-Nippon Financial Holdings, Inc. generates revenue through its banking operations and financial services across Japan, Hong Kong, China, and Singapore.

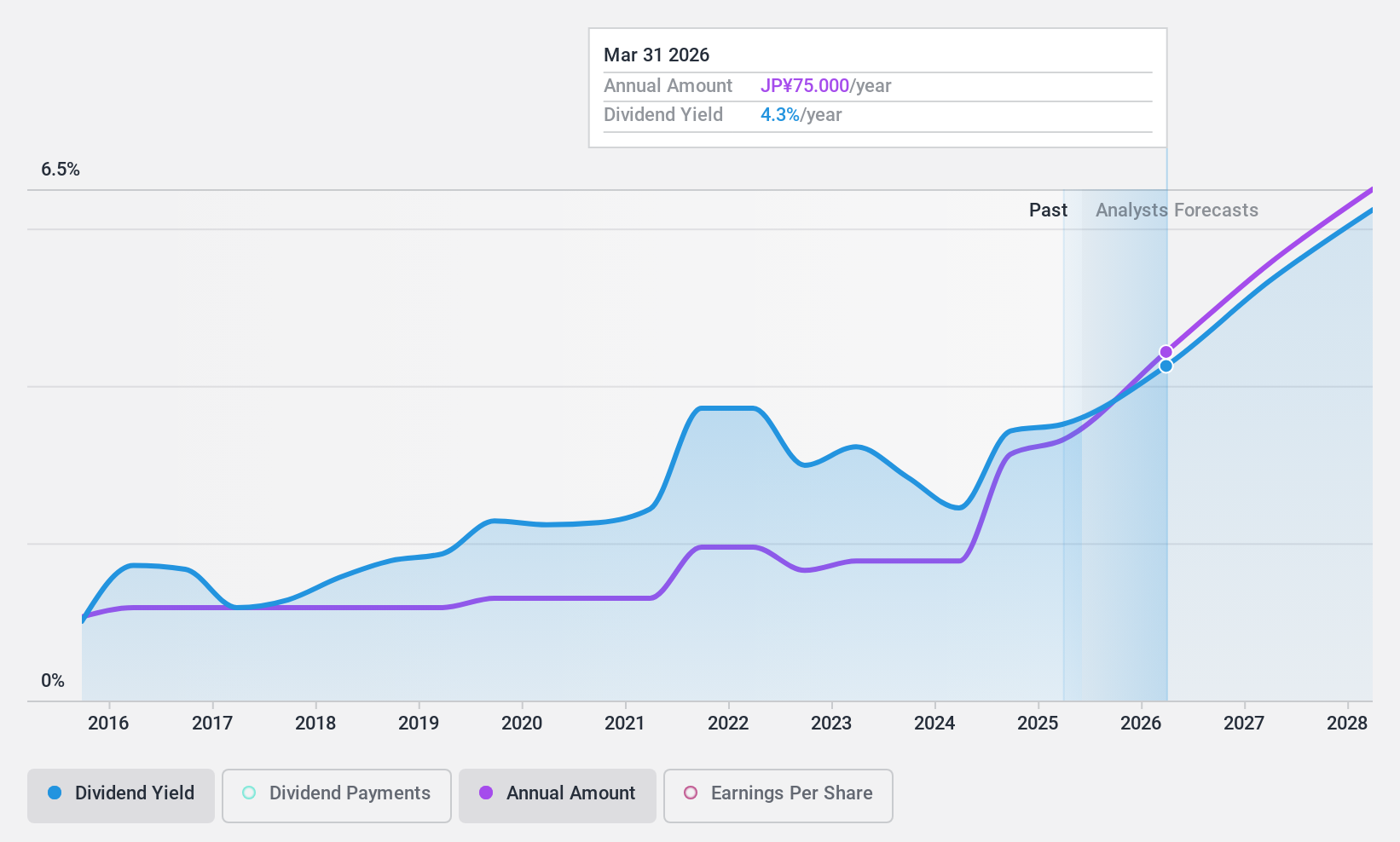

Dividend Yield: 4.3%

Nishi-Nippon Financial Holdings has increased its year-end dividend guidance to ¥45.00 per share, up from ¥30.00 last year, reflecting a positive shift despite a historically volatile dividend track record. The company maintains a low payout ratio of 30.5%, suggesting dividends are well-covered by earnings. Trading at 37.5% below estimated fair value, it offers potential for capital appreciation alongside its top-tier dividend yield in the JP market, though long-term reliability remains uncertain.

- Unlock comprehensive insights into our analysis of Nishi-Nippon Financial Holdings stock in this dividend report.

- Our valuation report here indicates Nishi-Nippon Financial Holdings may be undervalued.

Musashino Bank (TSE:8336)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Musashino Bank, Ltd., along with its subsidiaries, offers banking products and financial services in Japan and has a market capitalization of ¥106.52 billion.

Operations: Musashino Bank generates revenue primarily from its Banking segment, which accounts for ¥65.01 billion, followed by the Leasing Business at ¥10.93 billion and the Credit Guarantee Business contributing ¥1.53 billion.

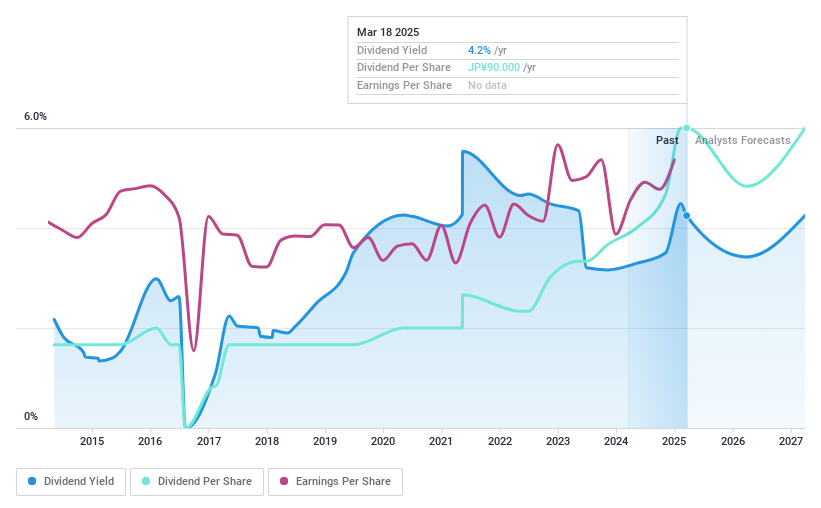

Dividend Yield: 3.6%

Musashino Bank pays a reliable dividend of 3.6%, with stable and growing payments over the past decade, although it falls slightly short of the top-tier yields in Japan. The bank's low payout ratio of 29.2% indicates dividends are well-supported by earnings, despite limited data on future sustainability. Earnings have grown at 8.3% annually over five years, and shares trade at a significant discount to estimated fair value, suggesting potential for capital appreciation.

- Click here to discover the nuances of Musashino Bank with our detailed analytical dividend report.

- Our valuation report unveils the possibility Musashino Bank's shares may be trading at a discount.

Taking Advantage

- Click this link to deep-dive into the 1411 companies within our Top Global Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nishi-Nippon Financial Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nishi-Nippon Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7189

Nishi-Nippon Financial Holdings

Through its subsidiaries, manages and operates banks and other companies that provide financial and non-financial solutions in Japan, Hong Kong, China, and Singapore.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives