A Look at Chiba Bank's (TSE:8331) Valuation Following Share Buyback Announcement

Reviewed by Kshitija Bhandaru

Chiba Bank (TSE:8331) has just unveiled plans to launch a substantial share repurchase program, targeting up to 12 million shares, which represents about 1.7% of its total issued share capital by December 2025.

See our latest analysis for Chiba Bank.

Chiba Bank’s latest buyback announcement comes following a strong run for shareholders, with a 33.7% total return over the past year and an impressive 204% over five years. This suggests growing market confidence in its long-term potential. Despite some short-term pullback, momentum remains robust as the company works to boost capital efficiency and shareholder value.

If this kind of shareholder-focused action has you thinking bigger, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

While Chiba Bank trades at a notable discount to analyst price targets and its intrinsic value, long-term gains have already outpaced market averages. Investors may need to consider whether there is still value left to unlock or if future growth is already reflected in the price.

Price-to-Earnings of 13.8x: Is it justified?

Chiba Bank currently trades at a price-to-earnings (P/E) ratio of 13.8x, putting it above the average P/E for the JP banks industry. With a last close of ¥1,487.5, the valuation appears elevated against sector peers.

The price-to-earnings ratio measures what the market is willing to pay for a company’s earnings. For banks, this metric is widely used as a yardstick for comparing future growth prospects, profitability, and risk. When a bank’s P/E is above industry averages, it usually means investors are expecting stronger earnings or growth relative to competitors.

Chiba Bank’s P/E of 13.8x sits above the JP banks industry average of 11.1x. This suggests the stock is priced at a premium. However, it is still below the peer group’s average of 16.7x, which indicates some restraint in the market’s optimism. Compared to the company’s estimated fair P/E ratio of 14.6x, the current multiple also hints there may be upside if the market re-rates the stock closer to its fair valuation level.

Explore the SWS fair ratio for Chiba Bank

Result: Price-to-Earnings of 13.8x (ABOUT RIGHT)

However, a recent dip in annual revenue and the stock's premium valuation could pose headwinds if investor sentiment shifts or growth slows.

Find out about the key risks to this Chiba Bank narrative.

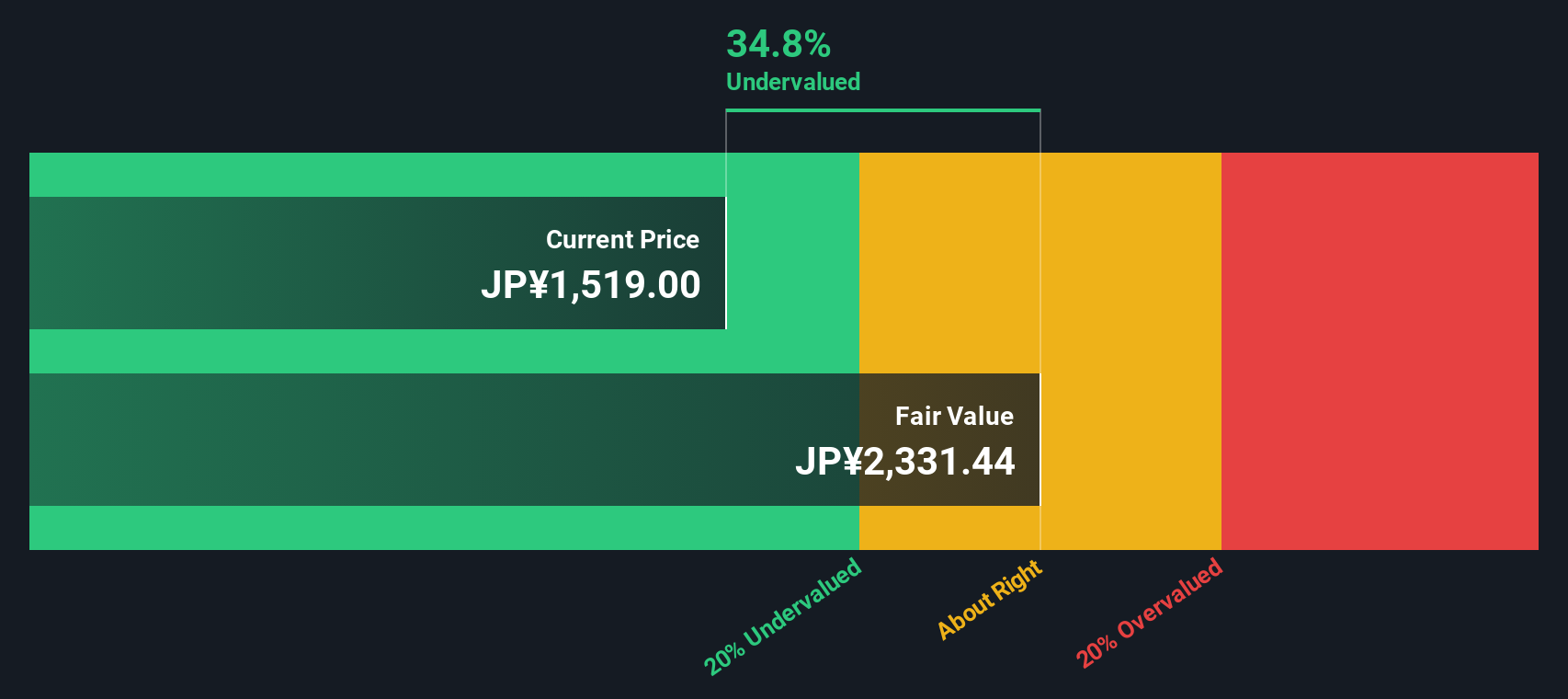

Another View: What Does the SWS DCF Model Say?

While the price-to-earnings ratio paints a picture of relative value in the market, our SWS DCF model offers a different perspective. It suggests Chiba Bank shares are trading at a sizable discount to their fair value, which could indicate considerable potential upside. Is the market missing something, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Chiba Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Chiba Bank Narrative

If you see things differently or want to dive into the numbers your own way, you can shape a personal view in just a few minutes. Do it your way

A great starting point for your Chiba Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t watch from the sidelines while others spot tomorrow’s winners. Make your next move with powerful tools that spotlight opportunities often missed by the crowd.

- Unlock income potential by checking out these 19 dividend stocks with yields > 3%, which offers high yields for dependable returns in any market climate.

- Capture growth in healthcare breakthroughs when you tap into these 33 healthcare AI stocks, delivering innovation at the intersection of medicine and technology.

- Seize undervalued opportunities others may overlook by leveraging these 898 undervalued stocks based on cash flows, which is grounded in rigorous cash flow analysis and built for smart investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8331

Chiba Bank

Provides banking products and services in Japan and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives