A Look at Mitsubishi UFJ (TSE:8306) Valuation as It Enters Japan’s Stablecoin Market With Big Bank Partners

Reviewed by Simply Wall St

Mitsubishi UFJ Financial Group (TSE:8306) is teaming up with major Japanese banks to launch yen-backed stablecoins, with plans for dollar-backed versions as well. This strategic step strengthens their presence in regulated digital assets.

See our latest analysis for Mitsubishi UFJ Financial Group.

Mitsubishi UFJ’s foray into yen-backed stablecoins is generating fresh buzz just as the group delivers solid momentum. Its one-year total shareholder return has soared 49.8 percent, and longer-term holders have seen even more dramatic gains. Even with occasional pullbacks, this mix of innovation and robust performance reflects resilient investor confidence and hints at ongoing growth potential.

If Mitsubishi UFJ’s bold move has you watching the financial sector, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing and new digital asset ventures in play, the key question for investors is whether Mitsubishi UFJ remains undervalued, or if the recent rally means the market is already pricing in its next stage of growth.

Most Popular Narrative: 5.9% Undervalued

Mitsubishi UFJ’s fair value is set at ¥2,452.73, a modest premium to its recent close of ¥2,307.5. This provides an opportunity to examine why the narrative anticipates more near-term upside.

The bank's efforts to reduce low-profitability assets and transform into a more profitable entity through strategic asset replacement could enhance their net margins by optimizing the risk-reward ratio. The focus on customer segments and expanded contributions from deposit loan income and fee income indicate enhanced earnings power, potentially leading to robust revenue growth.

Curious about the hidden math behind that price target? One key variable fueling this fair value is a bold projection on future profit margins and revenue acceleration. Find out exactly how analysts expect this banking giant to hit those numbers. See what could propel the shares even higher.

Result: Fair Value of ¥2,452.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as declining bond portfolio income or sustained market volatility could quickly shift the outlook and test investors' confidence.

Find out about the key risks to this Mitsubishi UFJ Financial Group narrative.

Another View: Multiples Signal a Steeper Price

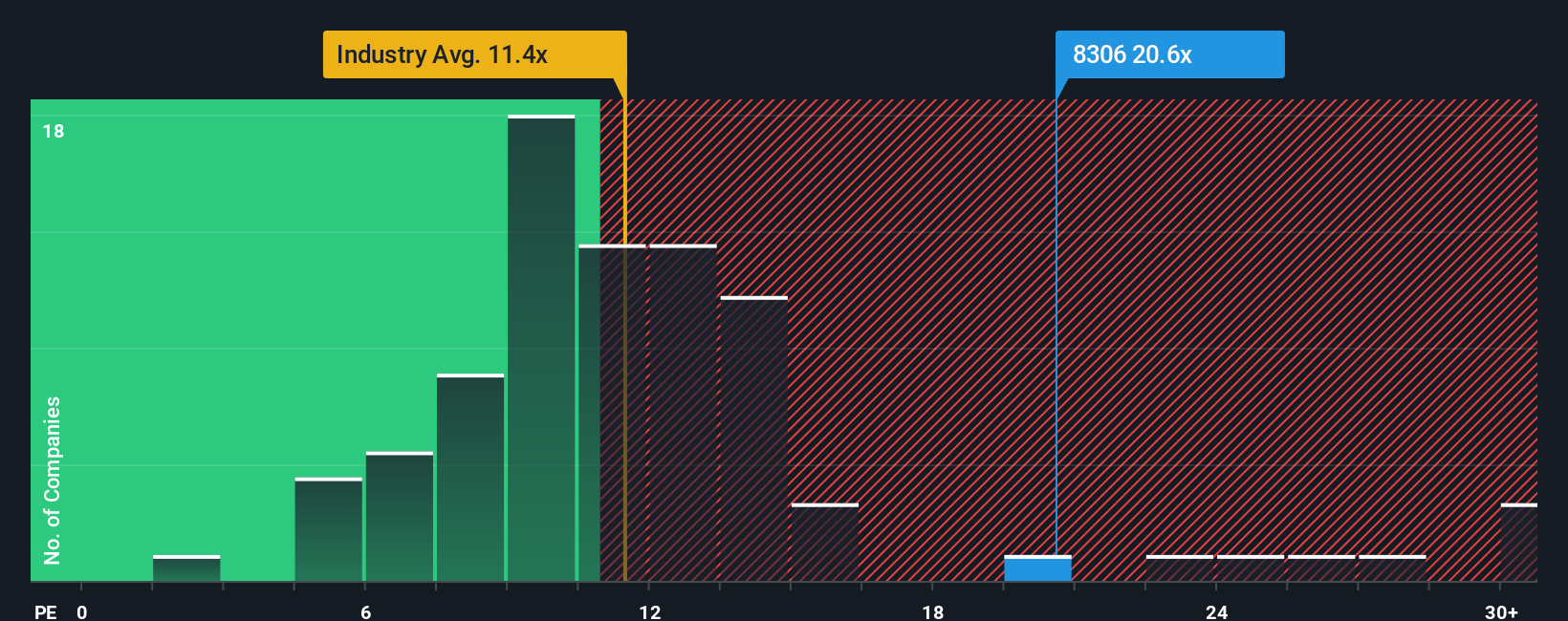

Looking through a traditional price-to-earnings lens, Mitsubishi UFJ’s 20.9x multiple appears high compared to the Japanese banks average of 11.1x and a peer average of 17.8x. The fair ratio for the company is estimated at 18.2x, which means the stock could be at risk of getting re-rated downward if market sentiment shifts. Are investors paying too much for recent momentum or is there justification for this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi UFJ Financial Group Narrative

If you see the numbers differently, or want to dive deeper with your own analysis, it only takes minutes to shape your perspective, so why not Do it your way

A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let today’s momentum pass you by. Seize the chance to get ahead of the curve with hand-picked ideas designed to help you build a winning portfolio.

- Unlock income potential and steady returns by evaluating these 17 dividend stocks with yields > 3%, which features high yields and reliable payers.

- Target fast-moving innovations in medicine and health by reviewing these 33 healthcare AI stocks, which is transforming the industry with AI breakthroughs.

- Spot undervalued gems positioned for growth by examining these 877 undervalued stocks based on cash flows, which analysts believe are priced below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives