Why Aozora Bank (TSE:8304) Is Up 8.7% After Boosting Its Dividend and Earnings Outlook

Reviewed by Sasha Jovanovic

- Aozora Bank has announced a second-quarter dividend of ¥22 per share, up from ¥19 last year, payable in March 2026 with an ex-date set for December 29, 2025.

- This dividend increase, alongside a strong first-half profit rise in FY2025, highlights the bank's focus on rewarding shareholders amid financial momentum.

- We’ll explore how Aozora Bank’s emphasis on higher shareholder returns shapes its ongoing investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Aozora Bank's Investment Narrative?

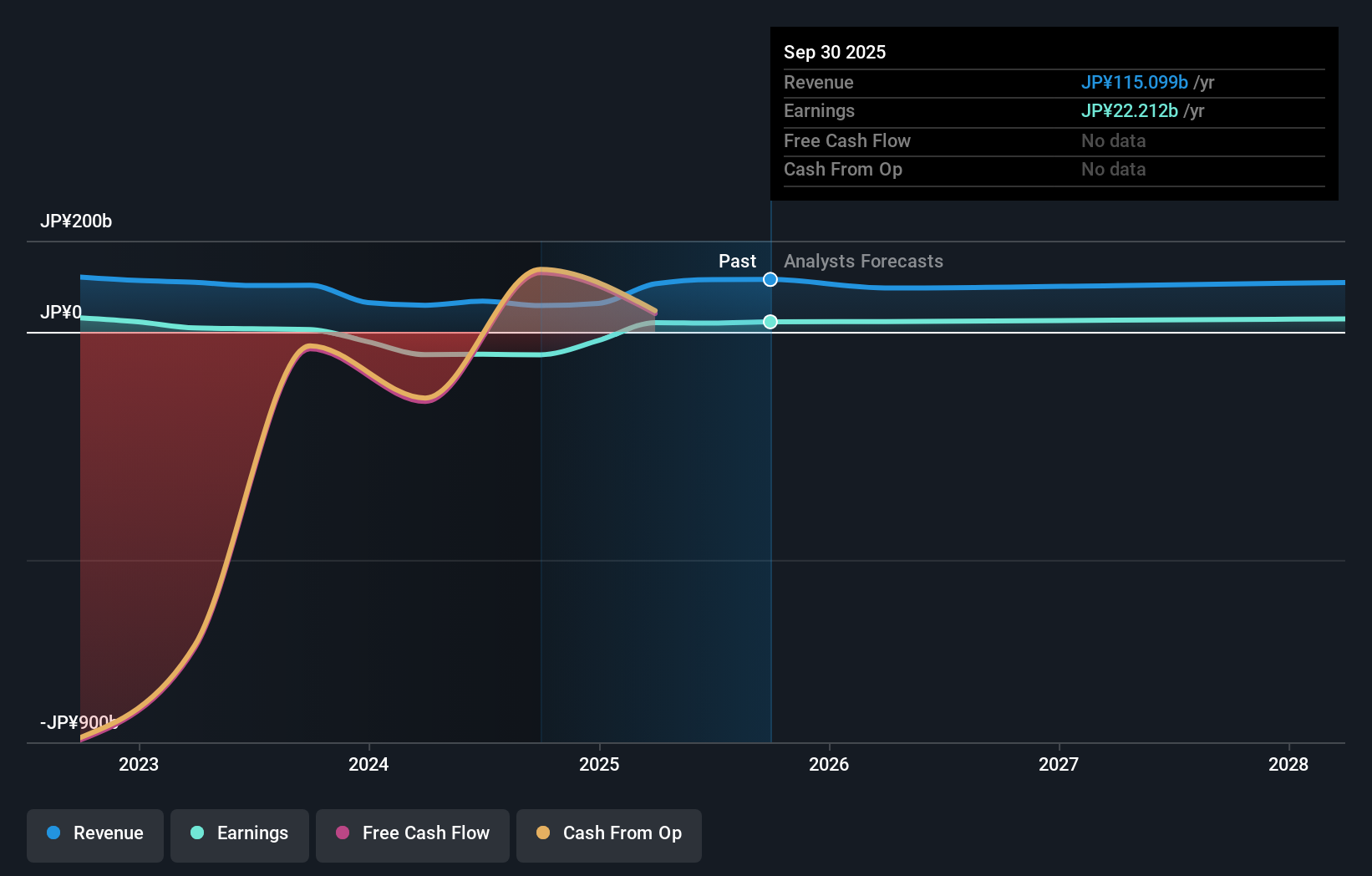

To be an Aozora Bank shareholder right now, the big-picture belief centers on the bank’s transformation efforts delivering real, sustainable growth, despite some clear obstacles. The bank’s decision to hike its Q2 dividend after a strong first-half profit provides a visible sign of management’s confidence and a push to reinforce shareholder value, which may lift sentiment in the short term. However, this payout bump does not fundamentally alter key catalysts or operational risks identified pre-announcement, such as the new and relatively inexperienced management team and board, a low allowance for bad loans, and muted revenue growth forecasts. The announcement fits into a thesis of shareholder-friendly policies, but the underlying business challenges, like recent earnings volatility and a low return on equity, remain crucial factors for investors considering how much to weigh the dividend signal in light of broader business fundamentals.

But investors should also look closely at how the low bad loan allowance could affect stability. Aozora Bank's shares are on the way up, but they could be overextended by 18%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Aozora Bank - why the stock might be worth 13% less than the current price!

Build Your Own Aozora Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aozora Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aozora Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aozora Bank's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8304

Aozora Bank

Provides various banking products and services in Japan and internationally.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives