Asian Value Stocks Estimated To Be Trading Below Intrinsic Worth April 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade uncertainties and monetary policy shifts, Asian indices have shown resilience amidst these challenges. In this environment, identifying stocks that are potentially trading below their intrinsic value can offer investors opportunities to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pegasus (TSE:6262) | ¥462.00 | ¥919.54 | 49.8% |

| Insource (TSE:6200) | ¥847.00 | ¥1673.19 | 49.4% |

| Micro-Star International (TWSE:2377) | NT$135.00 | NT$265.59 | 49.2% |

| Members (TSE:2130) | ¥1133.00 | ¥2245.98 | 49.6% |

| AeroEdge (TSE:7409) | ¥1884.00 | ¥3722.30 | 49.4% |

| Rakus (TSE:3923) | ¥2189.00 | ¥4351.45 | 49.7% |

| BIKE O (TSE:3377) | ¥388.00 | ¥769.71 | 49.6% |

| BalnibarbiLtd (TSE:3418) | ¥1120.00 | ¥2235.42 | 49.9% |

| Aozora Bank (TSE:8304) | ¥1861.00 | ¥3690.63 | 49.6% |

| SAMG Entertainment (KOSDAQ:A419530) | ₩36050.00 | ₩72090.20 | 50% |

We're going to check out a few of the best picks from our screener tool.

Food & Life Companies (TSE:3563)

Overview: Food & Life Companies Ltd. operates a chain of sushi restaurants and has a market cap of ¥557.95 billion.

Operations: The company's revenue is primarily derived from its Domestic Sushiro Business at ¥242.76 billion, followed by the Overseas Sushiro Business at ¥100.83 billion, and the Kyotaru Business contributing ¥23.88 billion, with Other Businesses adding ¥7.42 billion.

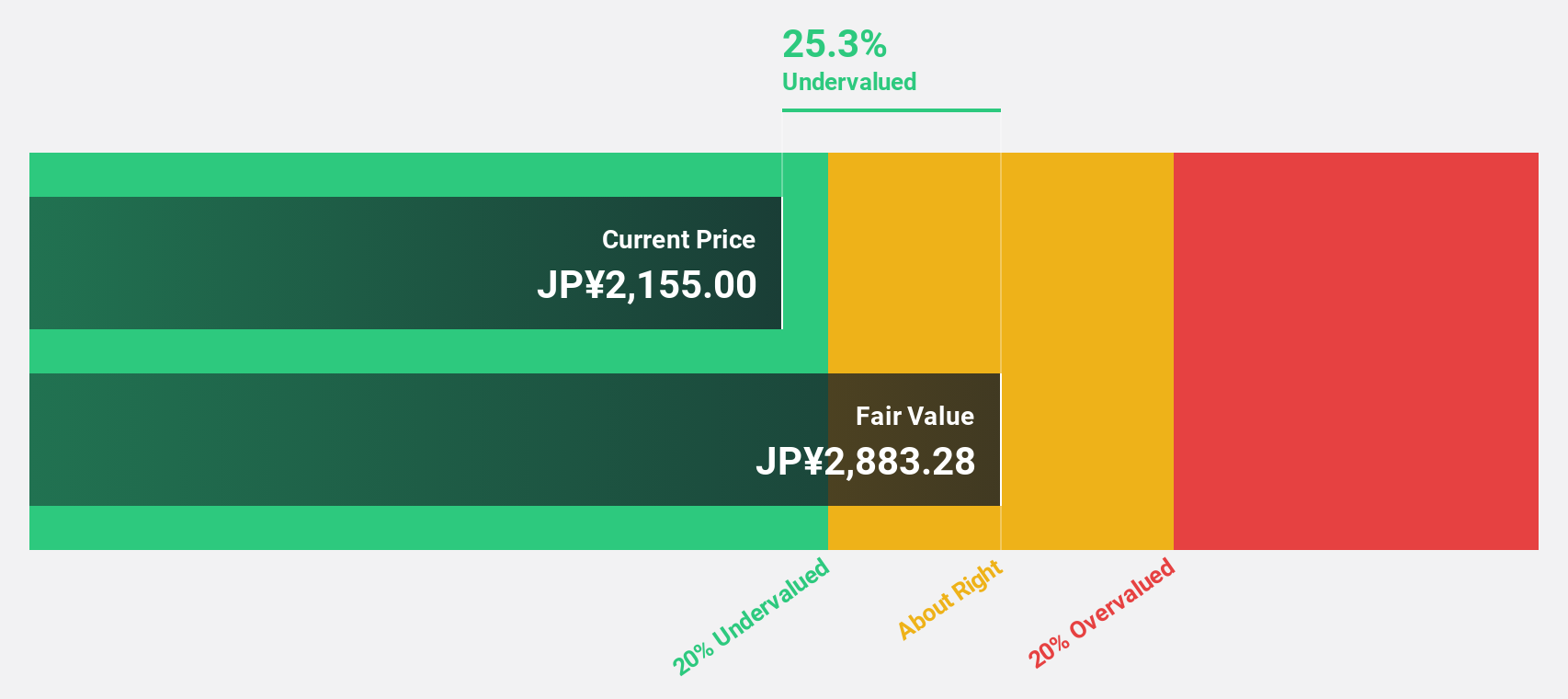

Estimated Discount To Fair Value: 45.9%

Food & Life Companies is trading at ¥4932, significantly below its estimated fair value of ¥9109.62, indicating potential undervaluation based on cash flows. Despite a high debt level and reduced dividends (¥27.50 per share), the company forecasts robust earnings growth of 10.1% annually, outpacing the Japanese market's 7.7%. With projected sales of ¥408 billion and operating profit of ¥26 billion for FY2025, it shows promising financial prospects amidst moderate revenue growth expectations.

- Our expertly prepared growth report on Food & Life Companies implies its future financial outlook may be stronger than recent results.

- Take a closer look at Food & Life Companies' balance sheet health here in our report.

Kyushu Financial Group (TSE:7180)

Overview: Kyushu Financial Group, Inc., with a market cap of ¥280.01 billion, operates through its subsidiaries to offer a range of financial products and services to customers in Japan.

Operations: Kyushu Financial Group's revenue is primarily derived from its subsidiaries offering a variety of financial products and services within Japan.

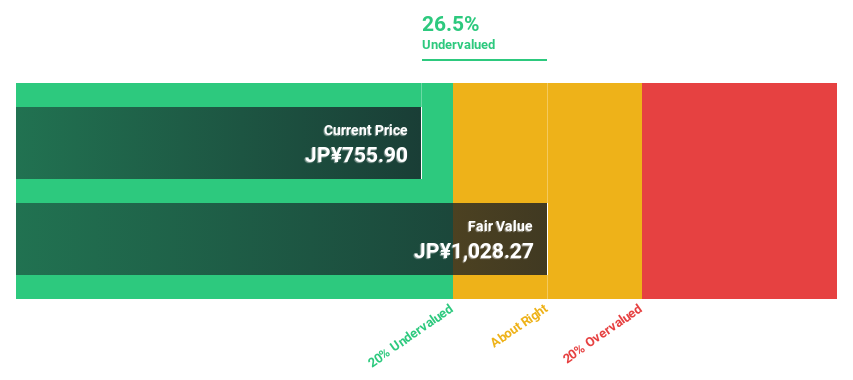

Estimated Discount To Fair Value: 40.7%

Kyushu Financial Group is trading at ¥647.2, well below its estimated fair value of ¥1090.48, highlighting undervaluation based on cash flows. The company anticipates earnings growth of 23.6% annually, surpassing the Japanese market's 7.7%. However, a low return on equity forecast and high share price volatility could pose challenges. Recent guidance projects profits of ¥28.5 billion for FY2025 with dividends increasing to ¥11 per share from the previous year’s ¥9.

- In light of our recent growth report, it seems possible that Kyushu Financial Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Kyushu Financial Group's balance sheet health report.

Nishi-Nippon Financial Holdings (TSE:7189)

Overview: Nishi-Nippon Financial Holdings, Inc. manages and operates banks and companies offering financial and non-financial solutions in Japan, Hong Kong, China, and Singapore with a market cap of ¥268.54 billion.

Operations: Nishi-Nippon Financial Holdings, Inc. generates revenue through its subsidiaries by providing a range of financial and non-financial solutions across Japan, Hong Kong, China, and Singapore.

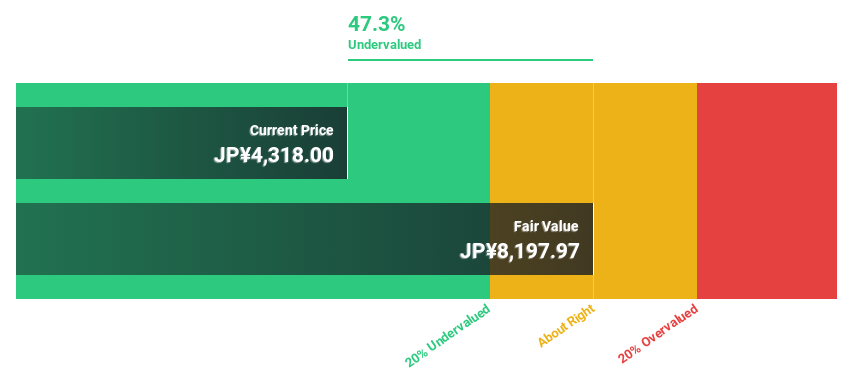

Estimated Discount To Fair Value: 46.9%

Nishi-Nippon Financial Holdings is trading at ¥1942, significantly below its estimated fair value of ¥3655.43, indicating undervaluation based on cash flows. The company forecasts robust earnings growth of 23% annually, outperforming the Japanese market's 7.7% growth rate. Recent guidance projects profits attributable to owners at ¥30 billion for FY2025 with dividends rising to ¥45 per share from last year's ¥30. However, a low return on equity forecast and unstable dividend history present challenges.

- The growth report we've compiled suggests that Nishi-Nippon Financial Holdings' future prospects could be on the up.

- Click here to discover the nuances of Nishi-Nippon Financial Holdings with our detailed financial health report.

Summing It All Up

- Gain an insight into the universe of 271 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishi-Nippon Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7189

Nishi-Nippon Financial Holdings

Through its subsidiaries, manages and operates banks and other companies that provide financial and non-financial solutions in Japan, Hong Kong, China, and Singapore.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives