Concordia Financial Group's (TSE:7186) Upcoming Dividend Will Be Larger Than Last Year's

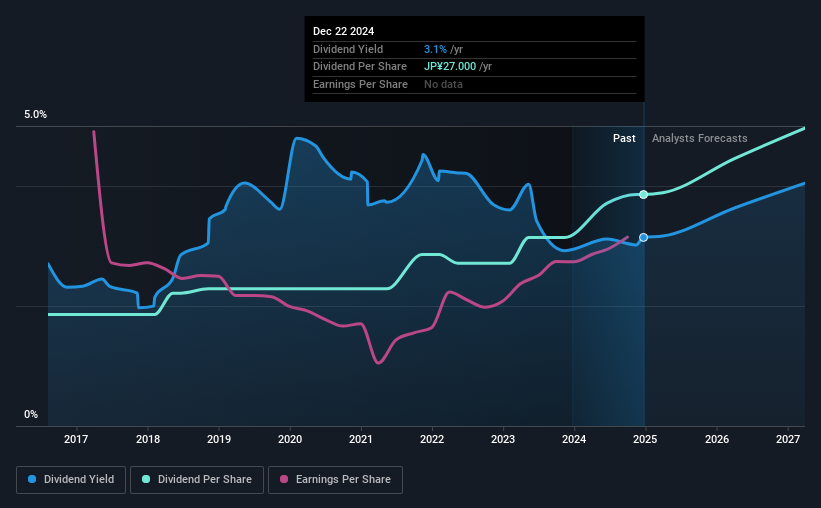

Concordia Financial Group, Ltd.'s (TSE:7186) dividend will be increasing from last year's payment of the same period to ¥14.00 on 29th of May. Based on this payment, the dividend yield for the company will be 3.1%, which is fairly typical for the industry.

Check out our latest analysis for Concordia Financial Group

Concordia Financial Group's Earnings Will Easily Cover The Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue.

Concordia Financial Group has a good history of paying out dividends, with its current track record at 8 years. Using data from its latest earnings report, Concordia Financial Group's payout ratio sits at 19%, an extremely comfortable number that shows that it can pay its dividend.

Over the next year, EPS is forecast to expand by 12.1%. If the dividend continues on this path, the future payout ratio could be 40% by next year, which we think can be pretty sustainable going forward.

Concordia Financial Group Doesn't Have A Long Payment History

The dividend's track record has been pretty solid, but with only 8 years of history we want to see a few more years of history before making any solid conclusions. Since 2016, the annual payment back then was ¥13.00, compared to the most recent full-year payment of ¥27.00. This works out to be a compound annual growth rate (CAGR) of approximately 9.6% a year over that time. Concordia Financial Group has a nice track record of dividend growth but we would wait until we see a longer track record before getting too confident.

We Could See Concordia Financial Group's Dividend Growing

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. It's encouraging to see that Concordia Financial Group has been growing its earnings per share at 8.3% a year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for Concordia Financial Group's prospects of growing its dividend payments in the future.

Concordia Financial Group Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 7 analysts we track are forecasting for Concordia Financial Group for free with public analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7186

Yokohama Financial Group

Provides various banking products and services to small and medium-sized businesses and individuals in Japan and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives