- South Korea

- /

- Electrical

- /

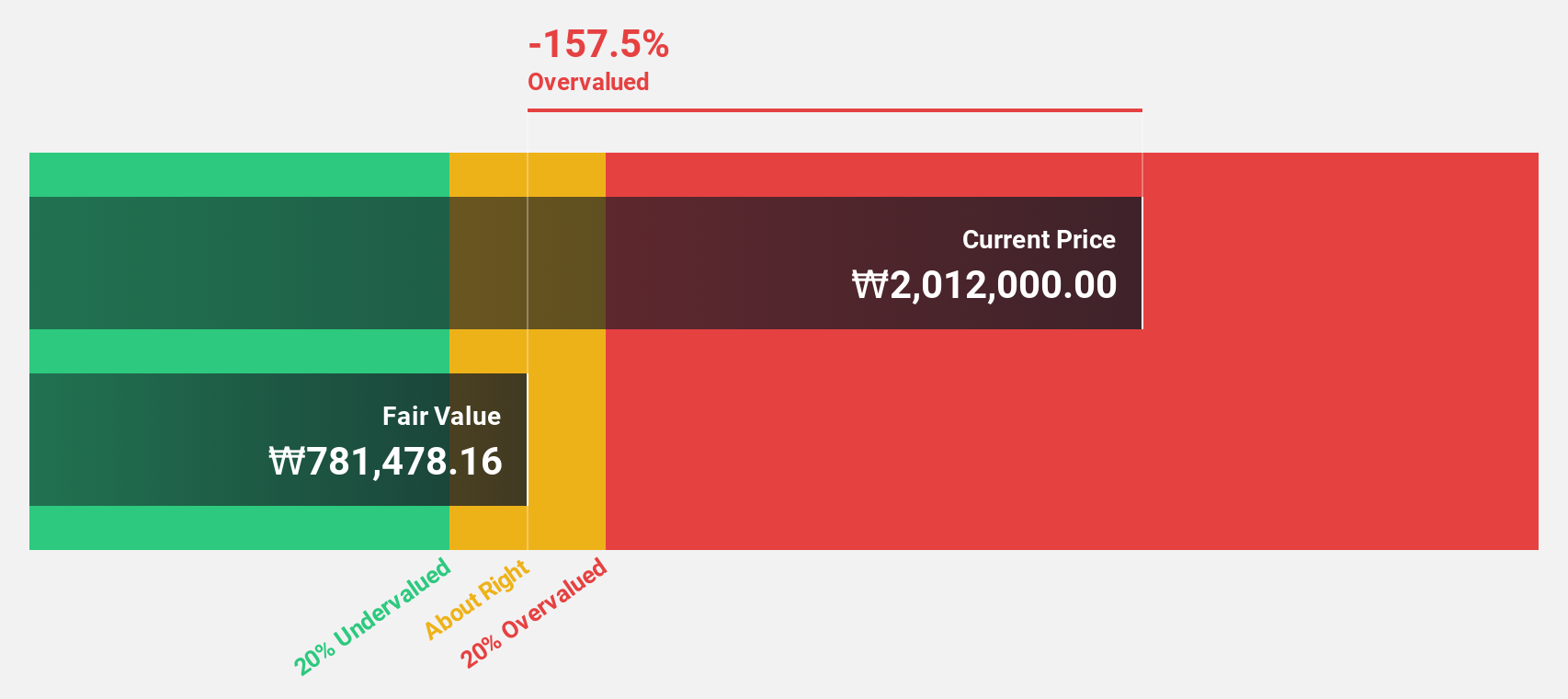

- KOSE:A298040

Asian Markets: 3 Companies That Could Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade uncertainties and inflation concerns, Asian stock markets have demonstrated resilience, with some indices showing modest gains despite broader economic challenges. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that align with potential growth and stability; these stocks often exhibit strong fundamentals and are positioned to benefit from regional economic trends.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| STI (KOSDAQ:A039440) | ₩22050.00 | ₩44090.10 | 50% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.30 | CN¥30.32 | 49.5% |

| S Foods (TSE:2292) | ¥2547.00 | ¥5084.09 | 49.9% |

| JSHLtd (TSE:150A) | ¥555.00 | ¥1103.38 | 49.7% |

| Takara Bio (TSE:4974) | ¥856.00 | ¥1693.07 | 49.4% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.675 | SGD1.33 | 49.2% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.62 | CN¥16.93 | 49.1% |

| Ryman Healthcare (NZSE:RYM) | NZ$2.80 | NZ$5.59 | 49.9% |

| Shenzhen Anche Technologies (SZSE:300572) | CN¥18.87 | CN¥37.24 | 49.3% |

| Doosan Fuel Cell (KOSE:A336260) | ₩16020.00 | ₩31553.22 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

Hyosung Heavy Industries (KOSE:A298040)

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment in South Korea and internationally, with a market cap of ₩4.42 trillion.

Operations: Hyosung Heavy Industries generates revenue primarily from the manufacturing and sale of heavy electrical equipment both domestically and internationally.

Estimated Discount To Fair Value: 33.6%

Hyosung Heavy Industries is trading at ₩474,500, significantly below its estimated fair value of ₩714,270.56, indicating it might be undervalued based on cash flows. Despite a volatile share price recently, the company’s earnings are forecast to grow significantly at 29.55% annually over the next three years, outpacing the Korean market's growth rate. Revenue is expected to increase by 10.1% per year, surpassing market expectations of 8.8%.

- Insights from our recent growth report point to a promising forecast for Hyosung Heavy Industries' business outlook.

- Take a closer look at Hyosung Heavy Industries' balance sheet health here in our report.

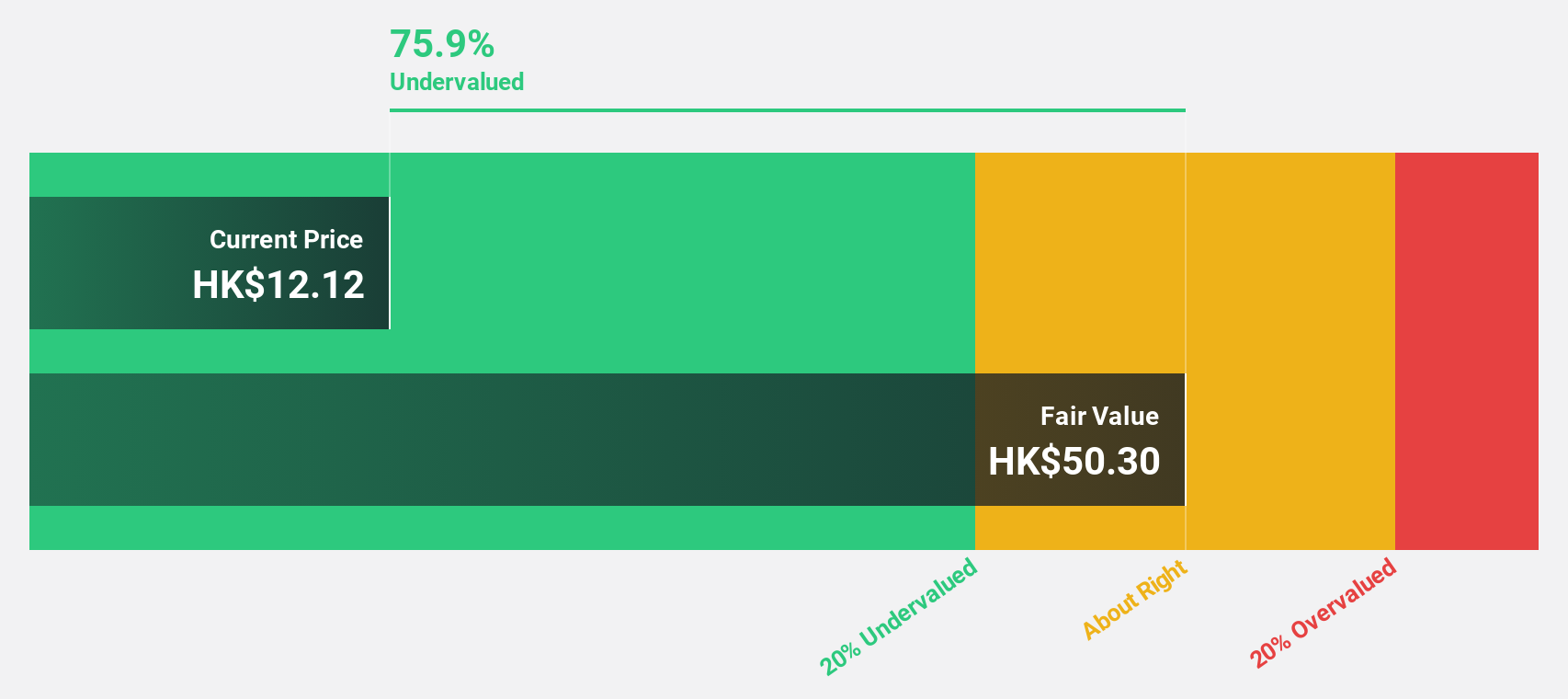

Yadea Group Holdings (SEHK:1585)

Overview: Yadea Group Holdings Ltd. is an investment holding company that focuses on the development, manufacture, and sale of electric two-wheeled vehicles and related accessories in the People’s Republic of China, with a market cap of HK$47.88 billion.

Operations: The company's revenue primarily comes from electric two-wheeled vehicles and related accessories, amounting to CN¥31.76 billion, followed by batteries and electric drive components at CN¥5.23 billion.

Estimated Discount To Fair Value: 15.7%

Yadea Group Holdings is trading at HK$15.74, below its estimated fair value of HK$18.68, suggesting potential undervaluation based on cash flows. Despite a forecasted decrease in net profit for 2024 due to inventory destocking and price reductions, earnings are expected to grow 18.6% annually—faster than the Hong Kong market's rate of 11.5%. Revenue growth is projected at 13.6% per year, outpacing the market's 7.7%, though dividend coverage by free cash flows remains weak.

- Our earnings growth report unveils the potential for significant increases in Yadea Group Holdings' future results.

- Delve into the full analysis health report here for a deeper understanding of Yadea Group Holdings.

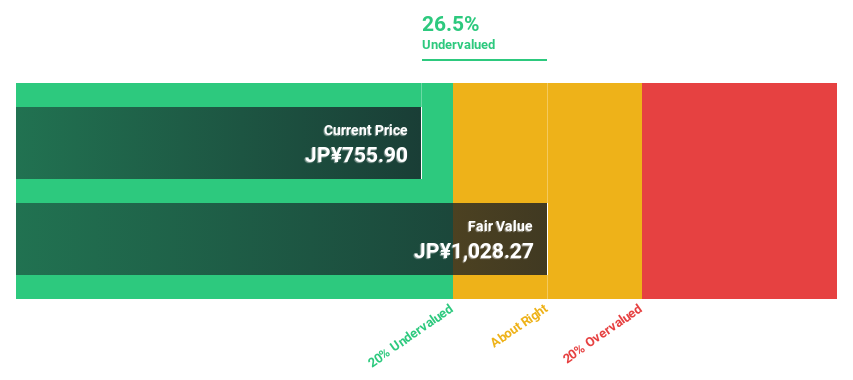

Kyushu Financial Group (TSE:7180)

Overview: Kyushu Financial Group, Inc. operates through its subsidiaries to offer a range of financial products and services in Japan, with a market cap of ¥331.41 billion.

Operations: Kyushu Financial Group's revenue is primarily derived from its subsidiaries offering diverse financial products and services across Japan.

Estimated Discount To Fair Value: 26.5%

Kyushu Financial Group is trading at ¥766, significantly below its estimated fair value of ¥1,042.56, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 23.63% annually, outpacing the Japanese market's growth rate of 8.1%. Despite a highly volatile share price recently and a low return on equity forecasted at 5.2%, the company anticipates profit attributable to owners of parent to reach ¥28.5 billion this fiscal year with increased dividends.

- Upon reviewing our latest growth report, Kyushu Financial Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Kyushu Financial Group with our comprehensive financial health report here.

Next Steps

- Get an in-depth perspective on all 277 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyosung Heavy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A298040

Hyosung Heavy Industries

Manufactures and sells heavy electrical equipment in South Korea and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives