- Taiwan

- /

- Construction

- /

- TWSE:2546

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate through a period of broad-based gains and geopolitical uncertainties, U.S. indexes are approaching record highs, bolstered by strong labor market reports and stabilizing economic conditions. In this context, dividend stocks present an appealing option for investors seeking steady income amidst fluctuating market dynamics. A good dividend stock typically offers consistent payouts and potential for growth, making it a valuable consideration in today's investment landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

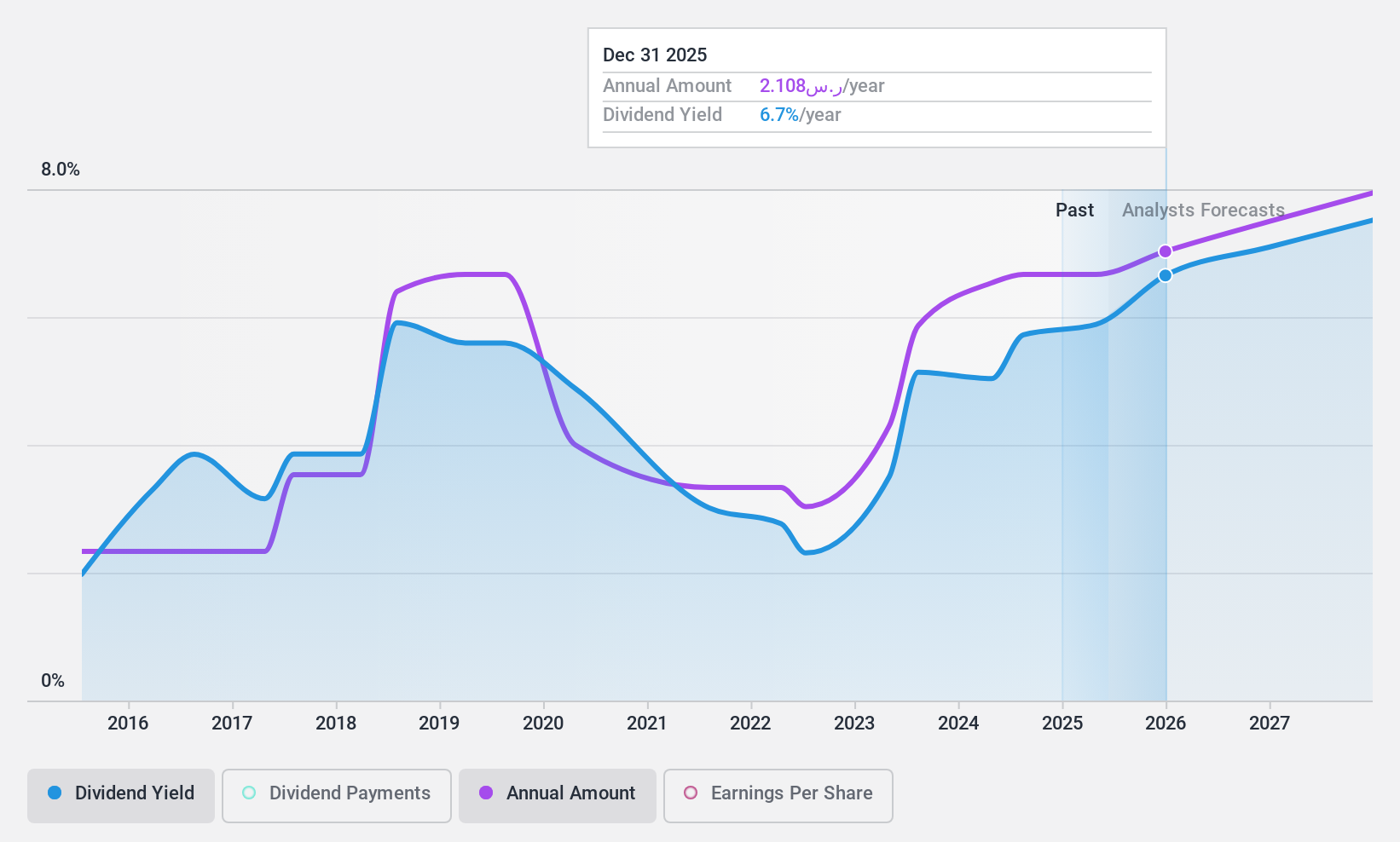

Saudi Awwal Bank (SASE:1060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Awwal Bank, along with its subsidiaries, offers banking and financial services in the Kingdom of Saudi Arabia, with a market cap of SAR67.09 billion.

Operations: Saudi Awwal Bank generates revenue from several segments, including Treasury (SAR1.91 billion), Capital Markets (SAR445.65 million), Wealth & Personal Banking (SAR3.70 billion), and Corporate and Institutional Banking (SAR7.02 billion).

Dividend Yield: 6.1%

Saudi Awwal Bank's dividend yield is among the top 25% in the Saudi Arabian market, supported by a reasonable payout ratio of 53.7%, ensuring current and future coverage by earnings. However, its dividend history shows volatility with unreliable growth over the past decade. Despite this, recent earnings growth of 18.3% and a low price-to-earnings ratio of 8.9x compared to the market suggest potential value for investors seeking high-yield opportunities amidst fluctuating dividends.

- Click to explore a detailed breakdown of our findings in Saudi Awwal Bank's dividend report.

- Our expertly prepared valuation report Saudi Awwal Bank implies its share price may be lower than expected.

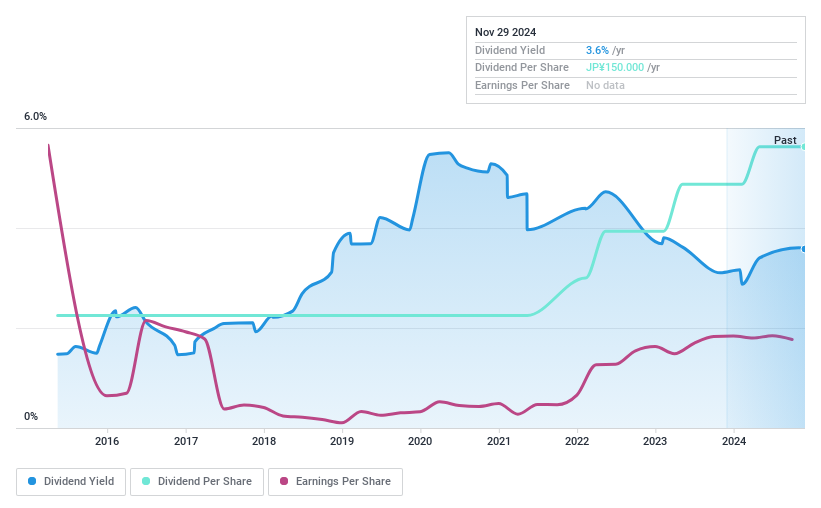

Tokyo Kiraboshi Financial Group (TSE:7173)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokyo Kiraboshi Financial Group, Inc. offers financial services to small and medium-sized enterprises in Japan with a market cap of ¥130.15 billion.

Operations: Tokyo Kiraboshi Financial Group, Inc. generates revenue through its provision of financial services tailored to the needs of small and medium-sized enterprises in Japan.

Dividend Yield: 3.5%

Tokyo Kiraboshi Financial Group offers a stable dividend profile with consistent payments over the past decade and a low payout ratio of 9.7%, indicating strong coverage by earnings. However, the dividend yield of 3.48% is below the top quartile in Japan, possibly limiting its appeal to yield-focused investors. Despite trading at 65.2% below estimated fair value, concerns about high bad loans (2.1%) may affect long-term sustainability and investor confidence in future dividends.

- Unlock comprehensive insights into our analysis of Tokyo Kiraboshi Financial Group stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Tokyo Kiraboshi Financial Group shares in the market.

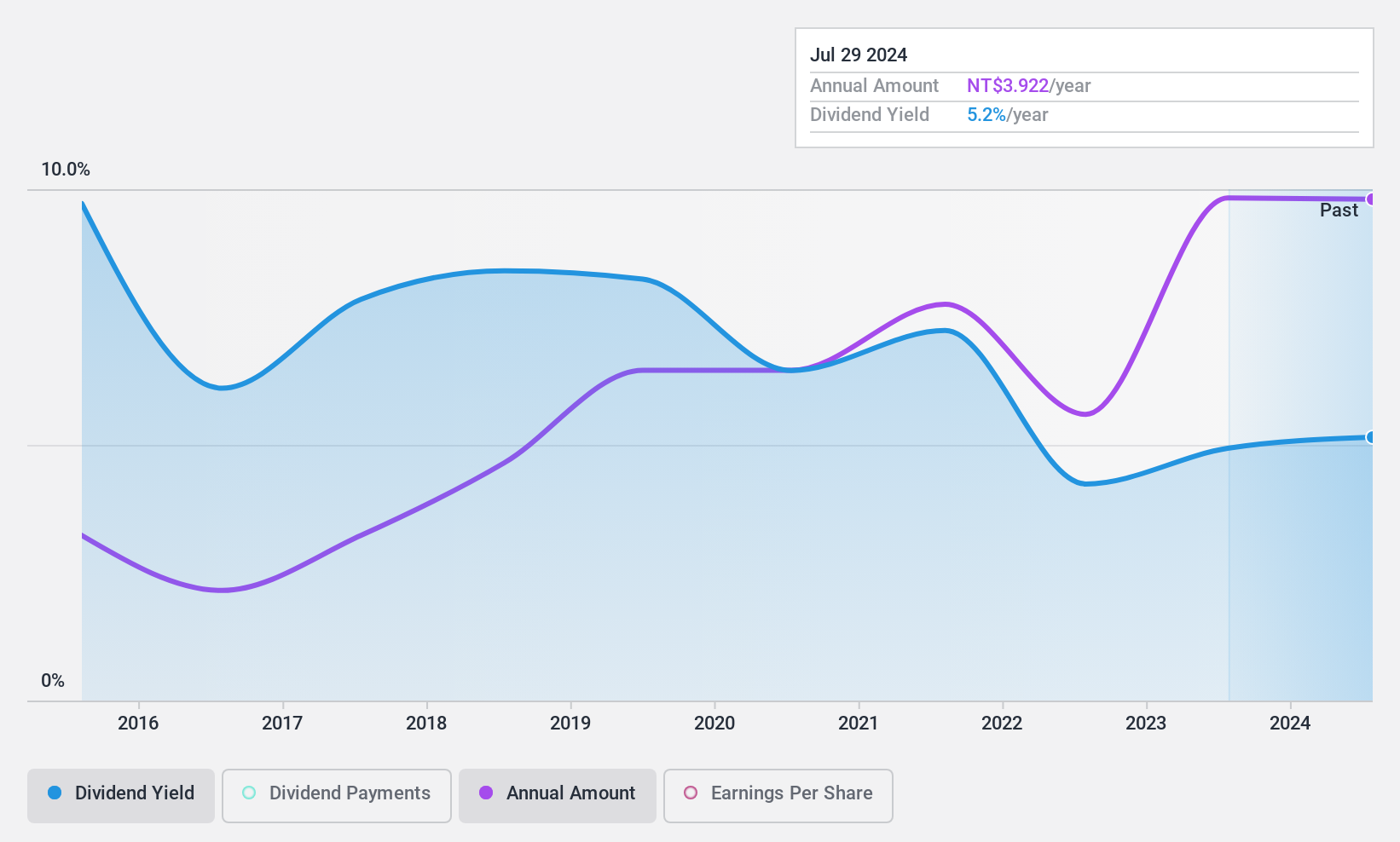

Kedge Construction (TWSE:2546)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kedge Construction Co., Ltd. is involved in constructing, developing, leasing, and selling housing and building properties in Taiwan with a market cap of NT$9.48 billion.

Operations: Kedge Construction Co., Ltd. generates revenue primarily from its construction segment, amounting to NT$13.98 billion.

Dividend Yield: 5.1%

Kedge Construction's recent earnings report shows improved quarterly net income, but a decline over nine months, indicating potential volatility. Despite a dividend yield of 5.09%, placing it among the top 25% in Taiwan, its dividend history is unstable with past volatility and unreliable growth. The payout ratio of 60.6% suggests dividends are covered by earnings, though the high cash payout ratio of 88.5% raises sustainability concerns amidst fluctuating financial performance.

- Click here to discover the nuances of Kedge Construction with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Kedge Construction's current price could be inflated.

Next Steps

- Take a closer look at our Top Dividend Stocks list of 1947 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kedge Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2546

Kedge Construction

Kedge Construction Co., Ltd. constructs, develops, leases, and sells housing and building properties in Taiwan.

Flawless balance sheet established dividend payer.