3 Stocks Estimated To Be Trading At Discounts Ranging From 34.3% To 43.3%

Reviewed by Simply Wall St

As global markets show signs of resilience, with U.S. indexes approaching record highs and a notable drop in initial jobless claims, investors are increasingly optimistic despite ongoing geopolitical uncertainties. In this environment of broad-based gains and positive economic indicators, identifying stocks that are potentially undervalued can be a strategic move for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| Truecaller (OM:TRUE B) | SEK47.98 | SEK95.84 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.25 | 49.9% |

| CS Wind (KOSE:A112610) | ₩42350.00 | ₩83358.96 | 49.2% |

| Kitron (OB:KIT) | NOK31.18 | NOK62.32 | 50% |

| PLAIDInc (TSE:4165) | ¥1341.00 | ¥3201.44 | 58.1% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| Neosperience (BIT:NSP) | €0.57 | €1.14 | 50% |

| BATM Advanced Communications (LSE:BVC) | £0.188 | £0.38 | 50% |

| SBI Sumishin Net Bank (TSE:7163) | ¥3405.00 | ¥5793.91 | 41.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

TORIDOLL Holdings (TSE:3397)

Overview: TORIDOLL Holdings Corporation operates and manages restaurants both in Japan and internationally, with a market cap of ¥306.79 billion.

Operations: The company's revenue segments include Marugame Seimen with ¥121.61 billion, Overseas Business generating ¥99.74 billion, and Other Domestic contributing ¥31.72 billion.

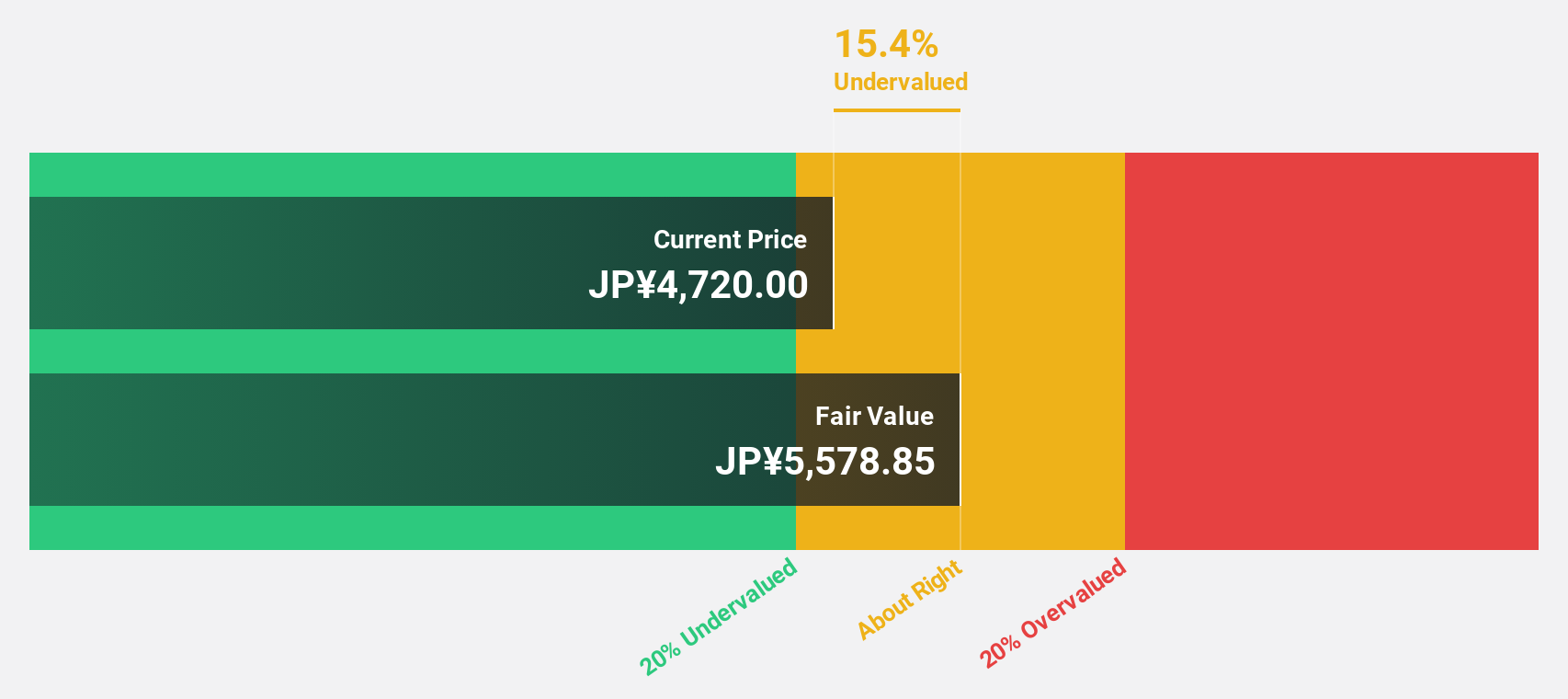

Estimated Discount To Fair Value: 34.3%

TORIDOLL Holdings is trading 34.3% below its estimated fair value of ¥5480.51, with earnings expected to grow significantly at 43.5% annually, surpassing the JP market's growth rate. Despite recent guidance revisions lowering profit expectations due to overseas segment underperformance, domestic operations like Marugame Seimen have shown record interim results in sales and profit margins. The company remains undervalued based on discounted cash flow analysis despite these challenges and lowered forecasts for fiscal year ending March 2025.

- Our earnings growth report unveils the potential for significant increases in TORIDOLL Holdings' future results.

- Take a closer look at TORIDOLL Holdings' balance sheet health here in our report.

SBI Sumishin Net Bank (TSE:7163)

Overview: SBI Sumishin Net Bank, Ltd. offers a range of banking products and services to individual and corporate clients in Japan, with a market cap of ¥438.03 billion.

Operations: The company generates revenue primarily from its Digital Bank Business, which accounts for ¥69.21 billion, and THEMIX Business, contributing ¥266 million.

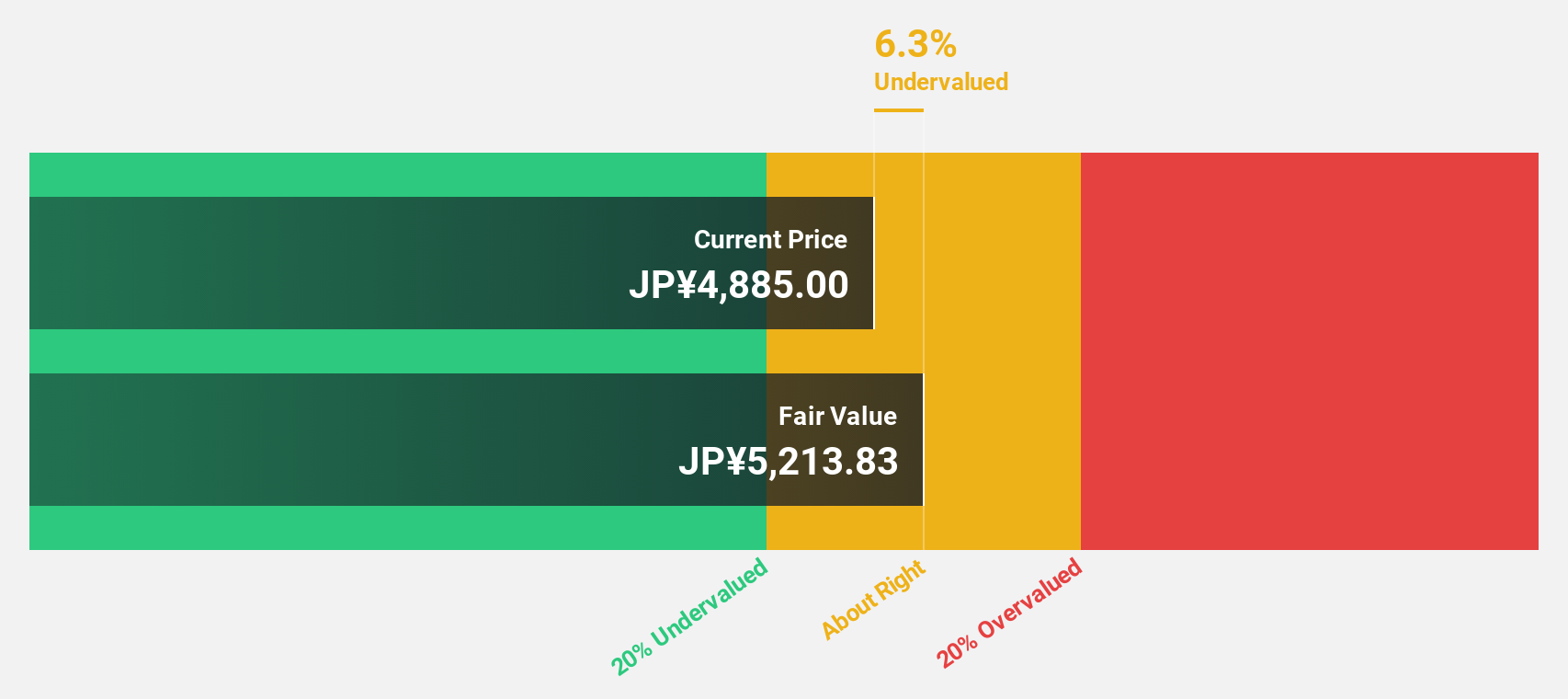

Estimated Discount To Fair Value: 41.2%

SBI Sumishin Net Bank's stock, trading at ¥3405, is undervalued based on discounted cash flow analysis with an estimated fair value of ¥5793.91. Earnings are projected to grow significantly at 25.71% annually, outpacing the JP market's growth rate of 7.9%. Despite a highly volatile share price recently and a low allowance for bad loans (71%), it remains attractive due to its strong earnings forecast and substantial undervaluation by over 20%.

- Insights from our recent growth report point to a promising forecast for SBI Sumishin Net Bank's business outlook.

- Delve into the full analysis health report here for a deeper understanding of SBI Sumishin Net Bank.

Stratec (XTRA:SBS)

Overview: Stratec SE, along with its subsidiaries, designs and manufactures automation and instrumentation solutions for in-vitro diagnostics and life sciences across Germany, the European Union, and internationally, with a market cap of €382.30 million.

Operations: The company's revenue is primarily derived from its Automation Solutions for Highly Regulated Laboratory segment, amounting to €250.54 million.

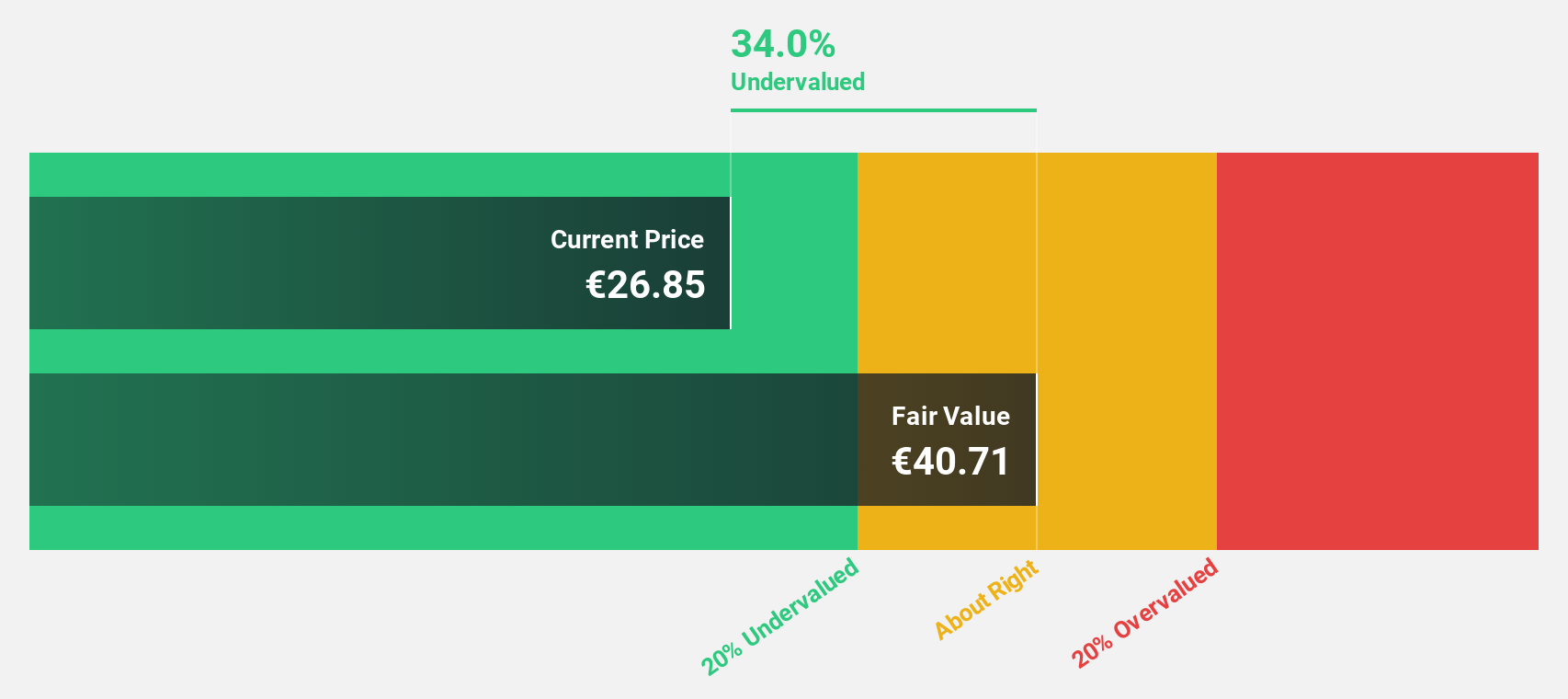

Estimated Discount To Fair Value: 43.3%

Stratec SE, trading at €31.45, is significantly undervalued with a fair value estimate of €55.46 based on discounted cash flow analysis. Despite recent declines in sales and net income, earnings are forecasted to grow 25.38% annually over the next three years, surpassing the German market's growth rate of 20.9%. However, it carries a high level of debt and offers a modest dividend yield of 1.75%, which may impact its overall financial flexibility.

- Our growth report here indicates Stratec may be poised for an improving outlook.

- Dive into the specifics of Stratec here with our thorough financial health report.

Next Steps

- Investigate our full lineup of 914 Undervalued Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7163

SBI Sumishin Net Bank

Provides various banking products and services to individuals and corporate customers in Japan.

High growth potential with adequate balance sheet.