As global markets navigate through a period of uncertainty marked by U.S. tariff announcements and mixed economic signals, investors are closely monitoring the impact on equities, with major indices experiencing slight declines amid these developments. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to weather market volatility while benefiting from regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.35% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Okura Industrial (TSE:4221)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Okura Industrial Co., Ltd. manufactures and sells polyethylene and polypropylene products in Japan, with a market cap of ¥35.27 billion.

Operations: Okura Industrial Co., Ltd. generates revenue through its Synthetic Resin Business, which accounts for ¥51.11 billion, Building Materials Business at ¥12.60 billion, and New Materials segment contributing ¥14.03 billion.

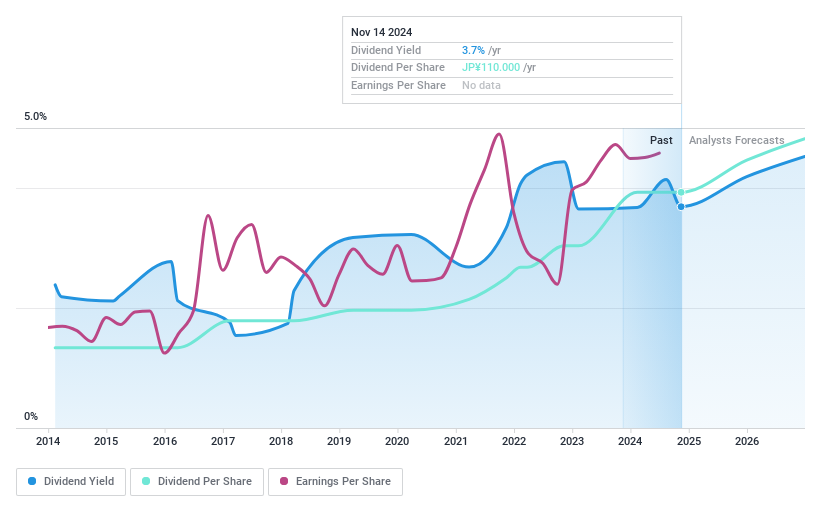

Dividend Yield: 4.8%

Okura Industrial's dividend yield of 4.84% is among the top 25% in the Japanese market, but its sustainability is questionable due to insufficient free cash flows and a recent dividend cut from ¥110.00 to ¥100.00 per share. Despite a low payout ratio of 44%, indicating coverage by earnings, lack of free cash flow raises concerns. The company has also engaged in significant share buybacks totaling ¥1.27 billion, which may impact future dividend stability and growth prospects.

- Navigate through the intricacies of Okura Industrial with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Okura Industrial's share price might be too pessimistic.

CAC Holdings (TSE:4725)

Simply Wall St Dividend Rating: ★★★★★★

Overview: CAC Holdings Corporation, with a market cap of ¥29.94 billion, operates through its subsidiaries to provide information technology services both in Japan and internationally.

Operations: CAC Holdings Corporation generates revenue from its Domestic IT segment amounting to ¥38.63 billion and its Overseas IT segment totaling ¥15.59 billion.

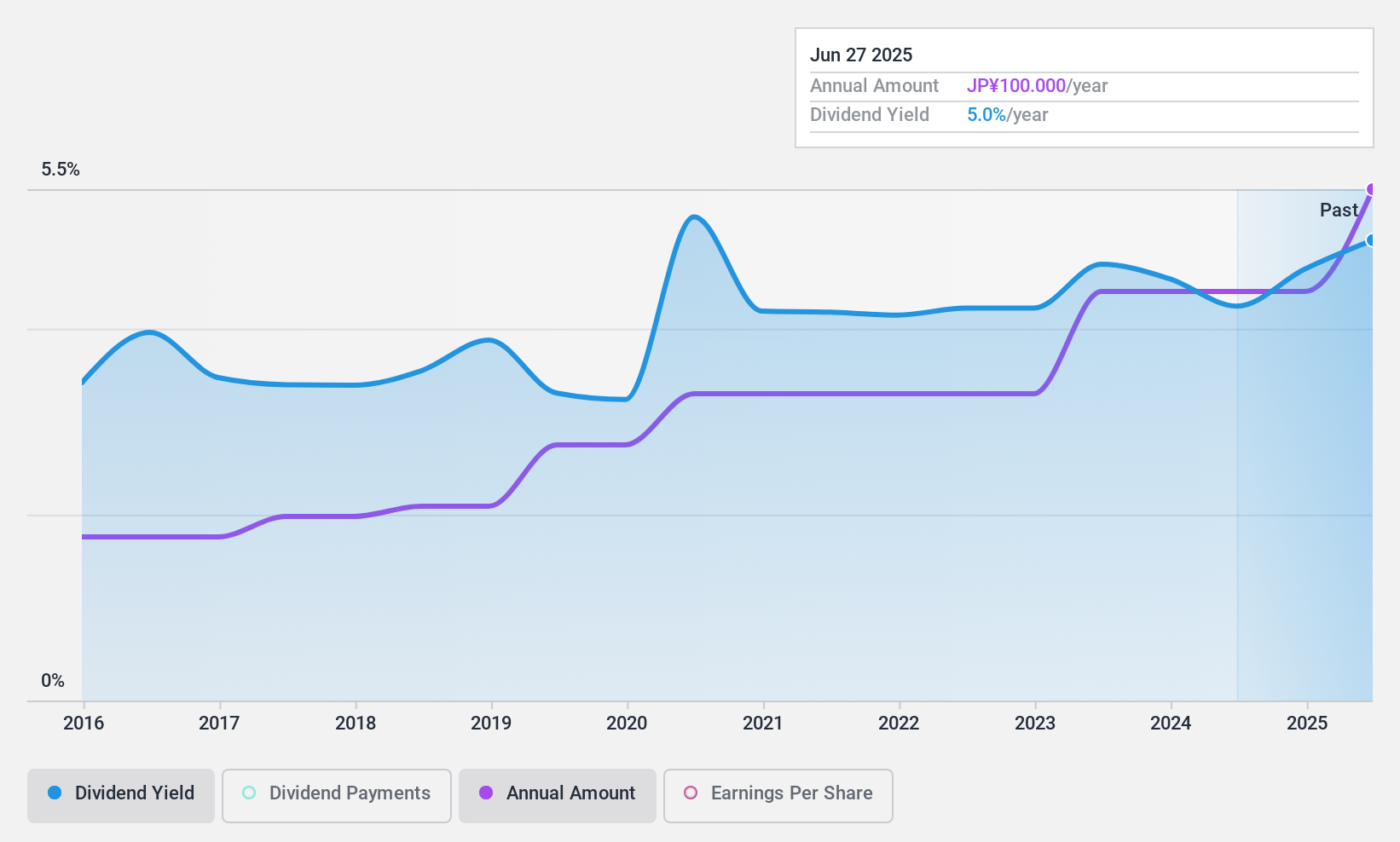

Dividend Yield: 4.1%

CAC Holdings offers a reliable dividend yield of 4.12%, placing it in the top quartile of Japanese dividend payers. The company's dividends have been stable and growing over the past decade, supported by a payout ratio of 54.4% and a cash payout ratio of 68.3%. Trading at 12% below its estimated fair value, CAC Holdings presents an attractive option for income-focused investors, with earnings growth at 32.6% over the past year further bolstering its dividend sustainability.

- Dive into the specifics of CAC Holdings here with our thorough dividend report.

- Our expertly prepared valuation report CAC Holdings implies its share price may be lower than expected.

Shizuoka Financial GroupInc (TSE:5831)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shizuoka Financial Group, Inc., along with its subsidiaries, offers a range of banking products and services and has a market capitalization of approximately ¥755.55 billion.

Operations: Shizuoka Financial Group, Inc. generates revenue from its main segments, with ¥199.86 billion from banking and ¥33.37 billion from leasing activities.

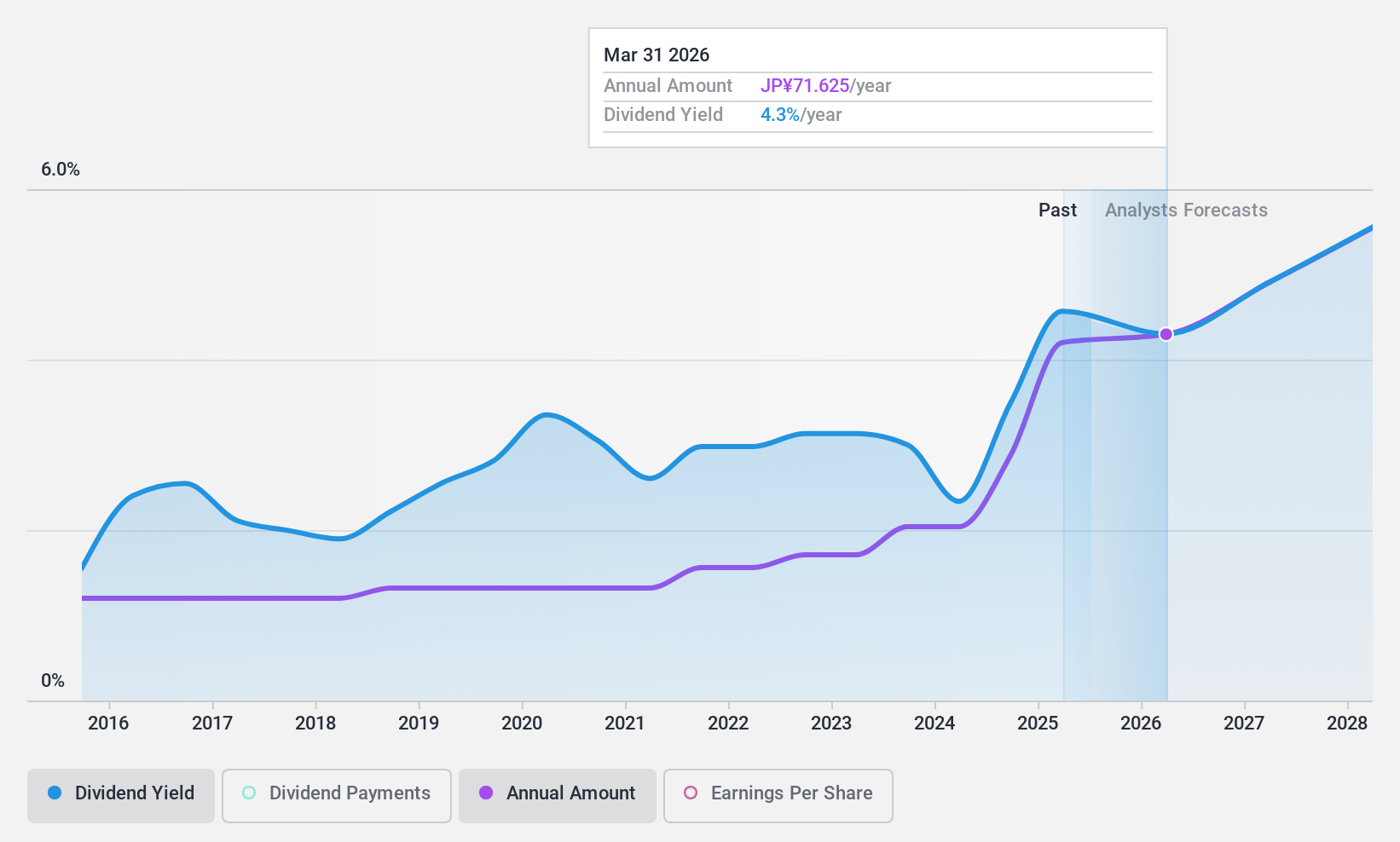

Dividend Yield: 3.4%

Shizuoka Financial Group has increased its dividend forecast to ¥35.00 per share for the year ending March 31, 2025, up from ¥25.00 a year ago. The company's dividends have been stable and growing over the past decade, supported by a low payout ratio of 38.2%. Recent earnings guidance was revised upward due to higher net interest income and equity gains, enhancing dividend coverage. Trading at a discount to fair value adds potential appeal for investors seeking income stability.

- Click here to discover the nuances of Shizuoka Financial GroupInc with our detailed analytical dividend report.

- Our valuation report unveils the possibility Shizuoka Financial GroupInc's shares may be trading at a discount.

Next Steps

- Investigate our full lineup of 1967 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5831

Shizuoka Financial GroupInc

Provides various banking products and services.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives