Shizuoka Financial Group (TSE:5831): Assessing Valuation After New Share Buyback Activity

Reviewed by Simply Wall St

Shizuoka Financial GroupInc (TSE:5831) just confirmed it bought 2.4 million of its own shares on the Tokyo Stock Exchange, the latest step in a larger 10 million share buyback program aimed at tightening its capital base.

See our latest analysis for Shizuoka Financial GroupInc.

The buyback comes after a strong run, with the share price returning 76 percent year to date and a 1 year total shareholder return of roughly 79 percent, suggesting momentum is still firmly on the upside.

If this capital return story has you thinking more broadly about opportunity, it could be worth exploring fast growing stocks with high insider ownership as a next stop for ideas.

Yet with the stock already beating analyst targets while still trading at a discount to some intrinsic estimates, the real question now is whether Shizuoka Financial GroupInc is a buy or if the market has already priced in its future growth.

Price-to-Earnings of 14.5x, Is it justified?

On a price-to-earnings basis, Shizuoka Financial GroupInc trades at 14.5 times earnings, putting it at a premium to both its own fair ratio and banking peers.

The price-to-earnings multiple compares what investors pay for each unit of current earnings. This is a key yardstick for banks where profits and return on equity drive valuations.

In this case, the market is assigning Shizuoka Financial GroupInc a richer earnings multiple than suggested by its estimated fair price-to-earnings ratio of 13.6 times. This implies investors may be paying up for recent profit momentum and future growth that consensus expects to be only moderate.

Relative to the wider JP Banks industry average of 11.5 times earnings and a peer average of 13.7 times, the stock stands out as clearly more expensive. This suggests the market believes its earnings quality and growth prospects justify a sustained valuation premium.

Explore the SWS fair ratio for Shizuoka Financial GroupInc

Result: Price-to-Earnings of 14.5x (OVERVALUED)

However, slowing revenue and the shares already trading above analyst targets could quickly unwind momentum if earnings or credit quality disappoint from here.

Find out about the key risks to this Shizuoka Financial GroupInc narrative.

Another View: What Does DCF Say?

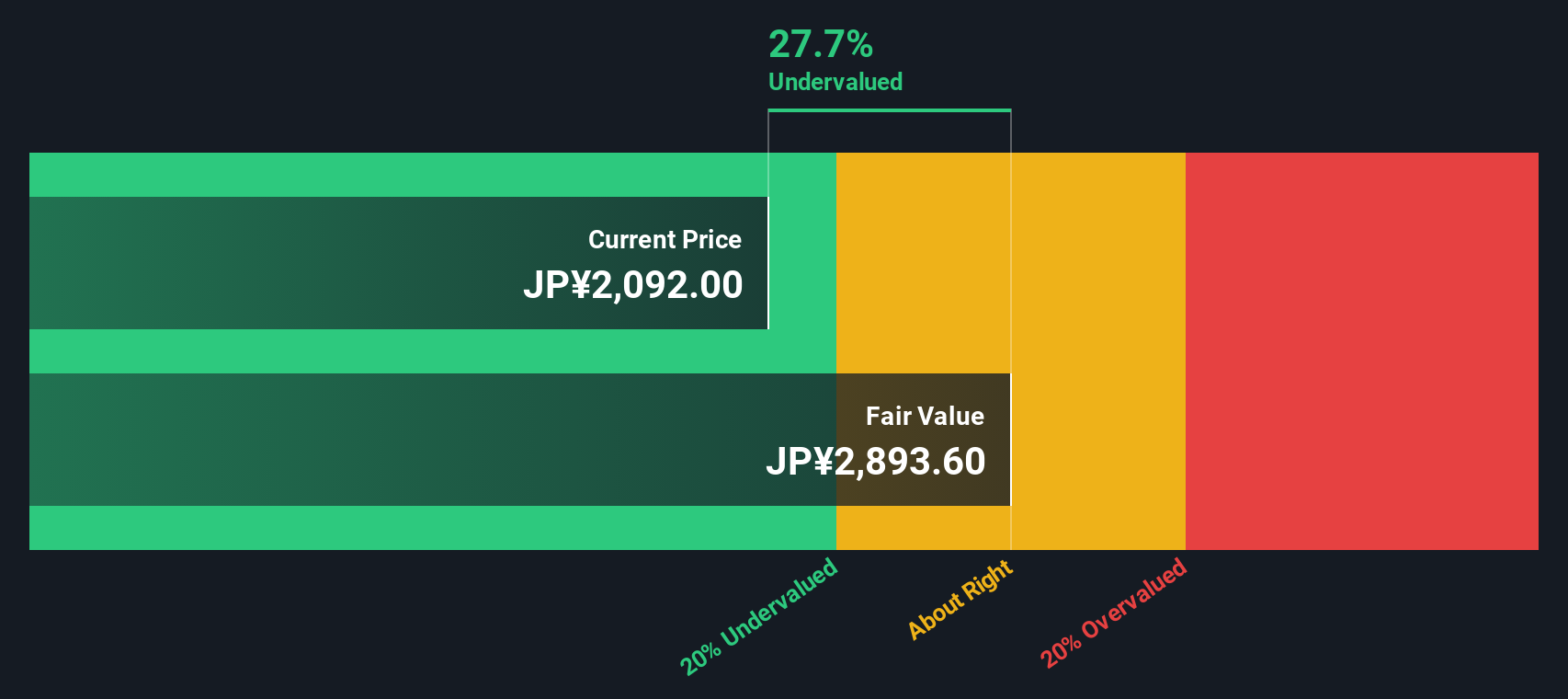

While earnings multiples make Shizuoka Financial GroupInc look expensive, our DCF model points the other way. With shares around ¥2,310 versus an estimated fair value of about ¥2,889, the stock screens as roughly 20 percent undervalued, raising the question of which signal deserves more weight.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shizuoka Financial GroupInc for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shizuoka Financial GroupInc Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes, Do it your way.

A great starting point for your Shizuoka Financial GroupInc research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for the next opportunity by putting Simply Wall Street's powerful Screener to work, or risk watching standout stocks run without you.

- Capture potential bargains early by targeting companies trading below their projected cash flows with these 925 undervalued stocks based on cash flows before the market catches on.

- Position your portfolio at the forefront of technological change by zeroing in on these 24 AI penny stocks shaping the next wave of intelligent innovation.

- Strengthen your income stream by focusing on reliable payers through these 14 dividend stocks with yields > 3% and avoid missing stocks that combine yield with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5831

Shizuoka Financial GroupInc

Provides various banking products and services.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026