- Japan

- /

- Auto Components

- /

- TSE:7282

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks notably outperforming growth shares. This environment has set a promising stage for dividend stocks, which can offer investors potential income stability amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

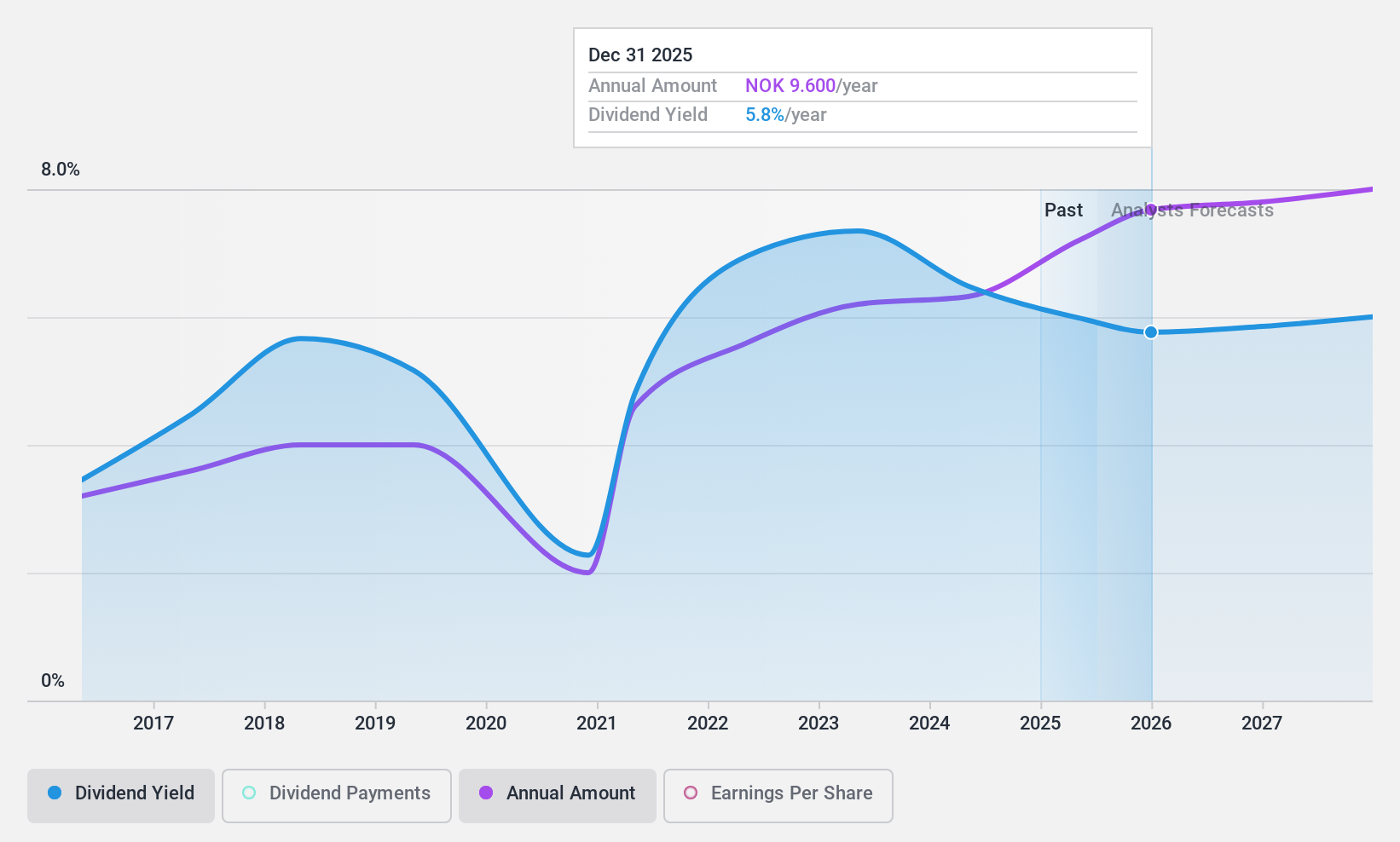

Veidekke (OB:VEI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Veidekke ASA is a construction and property development company operating in Norway, Sweden, and Denmark, with a market cap of NOK19.12 billion.

Operations: Veidekke ASA generates revenue from various segments, including Construction Norway (NOK15.16 billion), Infrastructure Norway (NOK10.02 billion), Construction Sweden excluding Infrastructure Sweden (NOK8.18 billion), Infrastructure Sweden (NOK6.10 billion), and Denmark (NOK3.10 billion).

Dividend Yield: 5.5%

Veidekke's dividend yield of 5.52% is lower than the top quartile of Norwegian dividend payers, and its dividends have been volatile over the past decade with significant annual drops. However, recent increases in earnings and a reasonable cash payout ratio of 49% suggest dividends are well-covered by cash flows. Recent contracts like the NOK 410 million Haslevangen project and other large commissions bolster its order book, potentially supporting future financial stability for dividend payments.

- Get an in-depth perspective on Veidekke's performance by reading our dividend report here.

- According our valuation report, there's an indication that Veidekke's share price might be on the cheaper side.

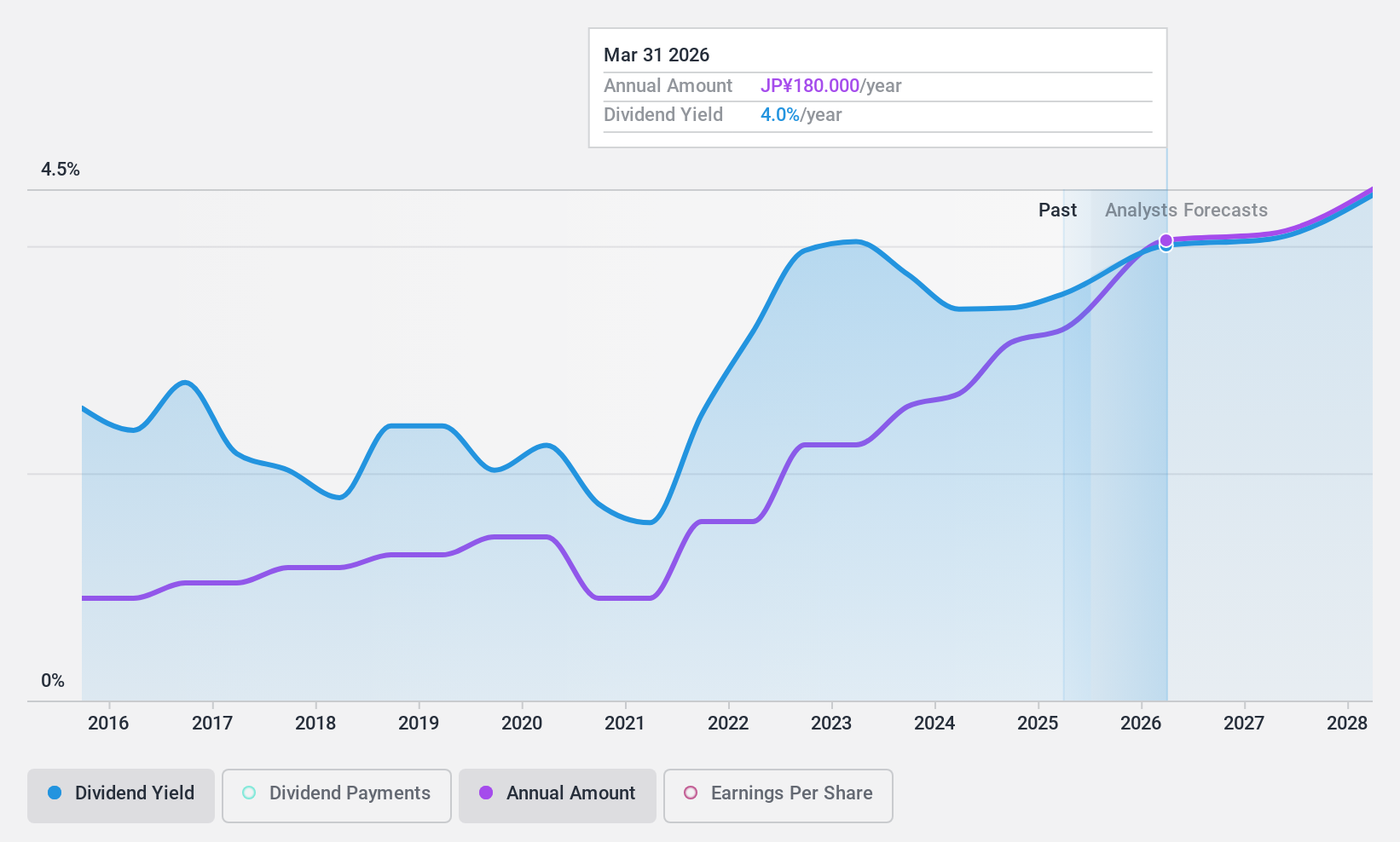

Amano (TSE:6436)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amano Corporation operates in the time information, parking, environmental, and cleaning systems sectors both in Japan and internationally, with a market cap of ¥288.44 billion.

Operations: Amano Corporation's revenue is primarily derived from its Time Information System Business, which accounts for ¥129.36 billion, and its Environment-Related Systems Business, contributing ¥37.57 billion.

Dividend Yield: 3.6%

Amano's dividend yield of 3.58% is below the top tier in Japan, and its dividends have been unstable over the past decade with volatility exceeding 20% annually. Despite this, a payout ratio of 70.4% indicates dividends are well-covered by earnings, and a cash payout ratio of 53.3% suggests coverage by cash flows too. Earnings growth of 12.2% last year supports potential future stability in dividend payments despite past inconsistencies.

- Click here to discover the nuances of Amano with our detailed analytical dividend report.

- The analysis detailed in our Amano valuation report hints at an inflated share price compared to its estimated value.

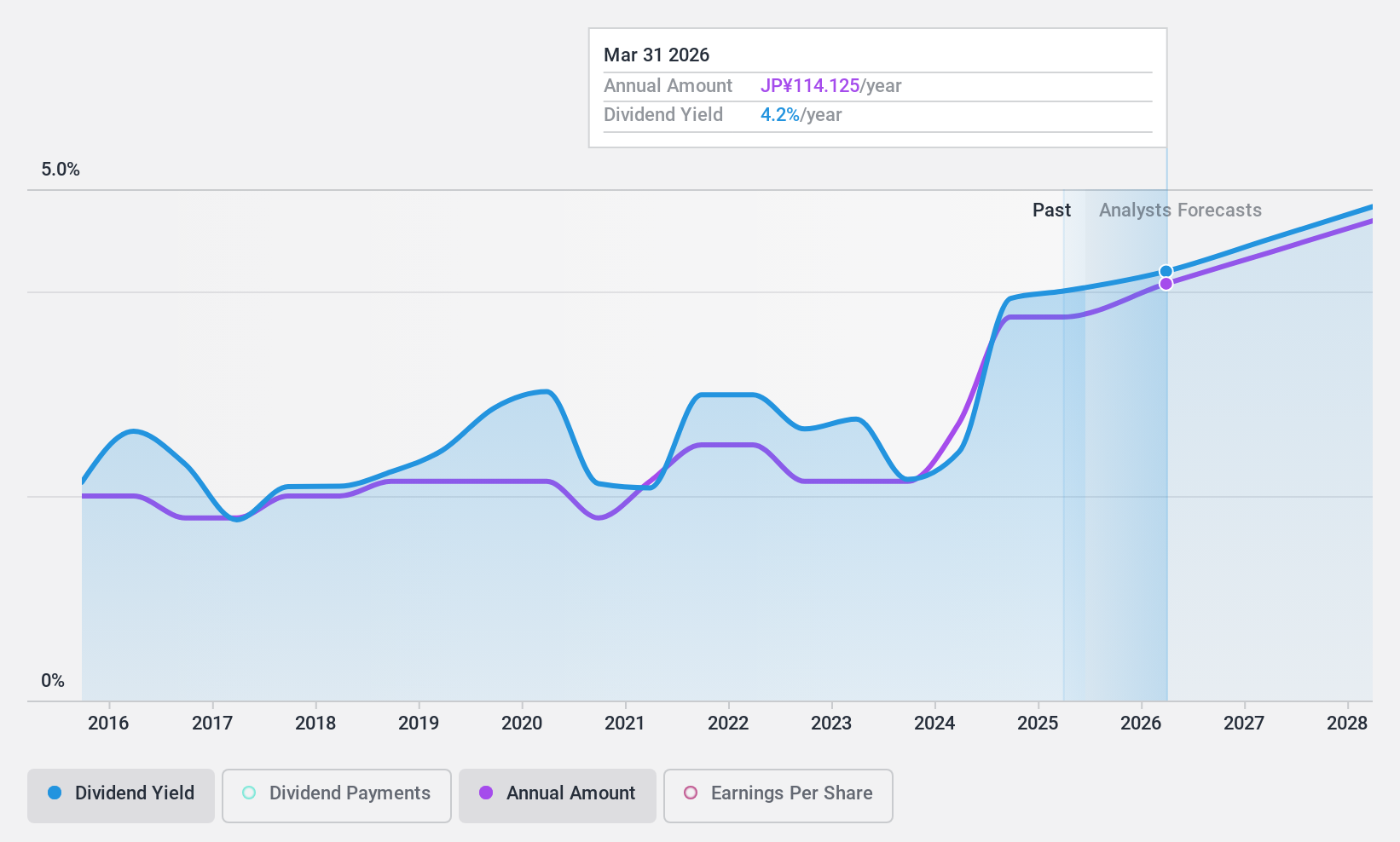

Toyoda Gosei (TSE:7282)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyoda Gosei Co., Ltd. is a company that manufactures and sells automotive parts, optoelectronic products, and general industry products, with a market cap of ¥341.12 billion.

Operations: Toyoda Gosei Co., Ltd.'s revenue is primarily derived from its operations in Japan (¥436.56 billion), followed by the Americas (¥406.53 billion), Asia (¥209.67 billion), and Europe & Africa (¥35.41 billion).

Dividend Yield: 3.9%

Toyoda Gosei's dividend yield of 3.91% ranks in the top 25% among Japanese dividend payers, supported by a low payout ratio of 29.4%, indicating strong earnings coverage. However, dividends have been volatile over the past decade, raising concerns about reliability despite recent increases. The company's ¥10 billion fixed-income offering and strategic investment in DigitalArchi highlight its focus on sustainable growth and innovation, potentially impacting future cash flows and dividend stability positively.

- Click here and access our complete dividend analysis report to understand the dynamics of Toyoda Gosei.

- Insights from our recent valuation report point to the potential undervaluation of Toyoda Gosei shares in the market.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1978 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyoda Gosei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7282

Toyoda Gosei

Manufactures and sells automotive parts, optoelectronic products, and general industry products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives