- Japan

- /

- Auto Components

- /

- TSE:7276

Potential Upside For Koito Manufacturing Co., Ltd. (TSE:7276) Not Without Risk

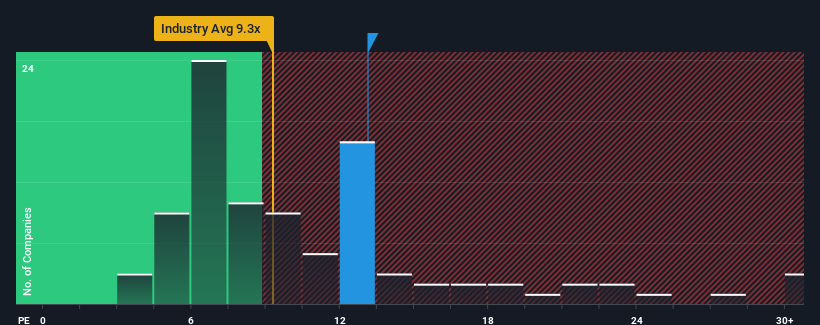

It's not a stretch to say that Koito Manufacturing Co., Ltd.'s (TSE:7276) price-to-earnings (or "P/E") ratio of 13.1x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Koito Manufacturing certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Koito Manufacturing

How Is Koito Manufacturing's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Koito Manufacturing's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 40% gain to the company's bottom line. As a result, it also grew EPS by 29% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the ten analysts watching the company. With the market only predicted to deliver 9.9% per year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Koito Manufacturing's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Koito Manufacturing's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Koito Manufacturing's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Koito Manufacturing that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Koito Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7276

Koito Manufacturing

Manufactures and markets automotive lighting equipment, aircraft parts, electrical equipment, and other products in Japan.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives